BTCUSDT: Bitcoin Hits Record High in Daily Transactions

The Bitcoin transactions are soaring to record high of 927000 after the halving method implemented this month. Bitcoin transactions are done by tokenised system using Runes token for fast and immediate in the halving method.Runes token are more reliable and secured transactions across Businessess and will be helpful for future success of Bitcoin transactions.

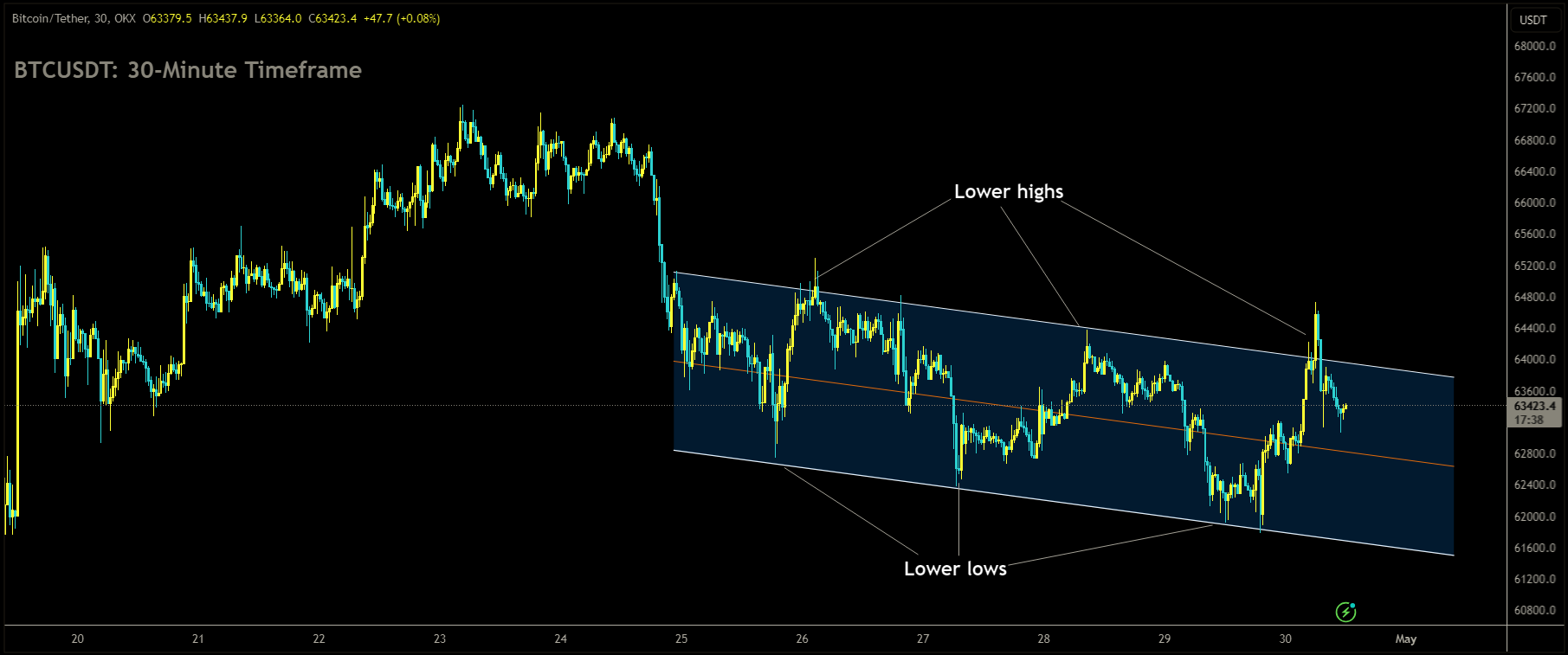

BTCUSDT is moving in Descending channel and market has fallen from the lower high area of the channel

Following the recent Bitcoin halving event, the subsequent days unveiled a remarkable surge in trading activity within the network. While the halving itself sparked considerable attention and interest in Bitcoin, the heightened trading volume appears to be driven by various other factors.

A mere three days post the halving on April 20, 2024, the daily count of Bitcoin transactions soared to an unprecedented peak of 926,842. Notably, this groundbreaking achievement coincided with the launch of Bitcoin Runes on the same day—a novel protocol facilitating the issuance of fungible tokens on the Bitcoin network. Currently, Rune-based transactions, totaling more than 2.38 million, constitute a significant majority of 68% of all Bitcoin activity on the blockchain.

The Runes protocol aims to provide a more efficient and user-friendly alternative to existing token standards such as BRC-20, addressing concerns like network congestion and UTXO proliferation. However, the surge in transactions has prompted discussions regarding the sustainability of Runes for Bitcoin miners. While Runes present a revenue opportunity through transaction fees, their potential impact on traditional Bitcoin transaction costs remains uncertain.

Despite the initial enthusiasm surrounding the Runes token standard, recent data suggests a rapid decline in activity. Runes-related Bitcoin transactions have dwindled to 104,800 over the last 24 hours, comprising only 26% of the total transaction volume.

The substantial drop in Runes transactions observed on April 24, halving from the previous day, contributes to the prevailing uncertainty regarding the protocol’s long-term viability. Experts hold divergent opinions on whether Runes can establish a dependable revenue stream for miners moving forward.

BTCUSDT: Bitcoin Runes Fees Exceed 1,200 BTC After Post-Halving Miner Rewards

The Greg Beard, CEO of Strong hold Digital mining said Rune has helped to retrieving the fees of Bitcoin mining after the halving method implemented. Rune based Bitcoin transactions surpassed 927K so far, Rune based transaction fees are higher in the market due to simple, fast and secured across Digital crypto transactions.

BTCUSDT is moving in box pattern and market has rebounded from the support area of the pattern

In the wake of the Bitcoin halving event, miners have found relief from the expected supply shock resulting from reduced block rewards, thanks to the introduction of Runes, which has propelled transaction fees to unprecedented levels.

Major mining firms operating in the United States, including Stronghold Digital Mining and Marathon, have attested to the positive impact of Runes both financially and operationally, according to communications with Cointelegraph.

Greg Beard, CEO of Stronghold Digital Mining, noted that the initial week post-halving witnessed a projected decline in mining revenue due to the decrease in Bitcoin rewards. However, Beard highlighted that Runes have mitigated this decline, compensating for the reduction in BTC rewards with a substantial surge in transaction fees.

Marathon’s chief growth officer, Adam Swick, echoed Beard’s sentiments, emphasizing the sharp rise in fees post-halving, driven by the introduction of Runes and heightened network activity. Swick indicated that this surge in fees has effectively offset the impact of the halving, if not delayed its consequences.

According to Swick, Rune transactions have contributed over 1,200 BTC in transaction fees to miners since the halving came into effect. This significant influx of fees underscores the immediate impact of Runes on mining revenue.

While Runes, a novel token standard on the Bitcoin blockchain enabling the creation of more efficient fungible tokens, have elicited mixed reactions within the Bitcoin community, mining firms are increasingly optimistic about their potential.

Beard and Swick emphasized a positive outlook regarding the influence of Runes just two weeks post-halving. Beard suggested a speculative element surrounding the impact of Runes and blockchain inscriptions on transaction fees, noting increased interest in BTC post-halving.

Both mining executives believe that innovations like Runes are beneficial for the Bitcoin ecosystem, as they enhance blockchain functionality and attract more transactions. This, in turn, leads to increased fees per block and greater overall mining profitability.

Jag Kooner, head of derivatives at Bitfinex, concurred, stating that miners typically welcome innovations like Runes that enhance blockchain functionality and drive transaction volumes, ultimately bolstering mining profitability and supporting the growth of the Bitcoin ecosystem.

Amidst ongoing debates, the new record for Bitcoin transactions underscores the network’s capacity for growth and adaptability. The introduction of Runes reflects Bitcoin’s ongoing evolution as it navigates the delicate balance between its fundamental purpose and the potential of tokenization.

The surge in Bitcoin transactions, propelled by the Runes protocol, presents an intriguing test scenario. Can Bitcoin seamlessly integrate tokenization without compromising its core function as a swift, peer-to-peer payment system? The resolution of this dynamic will hold significant implications for Bitcoin’s future utility and scalability, thereby influencing the broader cryptocurrency ecosystem.

BTCUSDT: Runes Protocol Boosts Bitcoin Miners, but How Long Will the Excitement Last?

Following the implementation of the halving method earlier this month, Bitcoin transactions have surged to a record high of 927,000. This notable increase in Bitcoin transactions can be attributed to the utilization of a tokenized system, specifically employing Runes tokens. Runes tokens have emerged as a reliable and secure means of conducting transactions across various businesses. The adoption of Runes tokens is anticipated to contribute significantly to the future success of Bitcoin transactions, offering enhanced speed and immediacy within the halving method framework.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

In its inaugural week, the Runes protocol, enabling the creation of fungible tokens on the Bitcoin network, debuted with remarkable success, boasting an impressive $346 million market capitalization. However, amidst this triumph, a pivotal question looms: Can this momentum be sustained?

The quadrennial Bitcoin halving event on April 19, 2024, witnessed Bitcoin miners accruing $81 million in transaction fees, partially attributed to the introduction of the Runes protocol. This launch also catalyzed a surge in transaction fees for the network, reaching unprecedented highs earlier this month, averaging $127.97 in the immediate aftermath of the halving.

While the initial transaction fervor has abated, the impact of the halving persists, reshaping Bitcoin’s inflation dynamics and positioning it in contrast to traditional assets like gold. With the halving, Bitcoin’s supply issuance rate has become more constrained than that of gold, potentially enhancing its role as a store of value over the long term, safeguarding against inflation erosion. Some analysts argue that the reduced supply issuance rate enhances Bitcoin’s functionality as a medium of exchange.

Nevertheless, the enduring implications of Runes transactions have sparked apprehension within the Bitcoin mining sphere. Presently, the Runes protocol dominates over two-thirds of recorded Bitcoin transactions, prompting concerns that the Bitcoin network may no longer be operating as the peer-to-peer electronic cash system originally intended. Nikita Zhavoronkov, the lead developer at Blockchair, a blockchain search engine, has remarked that the electronic cash system has completely ceased.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/