BTCUSDT: Bitcoin Dips Below $60K, Heightening Risk of Further Decline amid Crypto Market’s Worst Month Since FTX Crash

The BTCUSDT market tumbled below $60K after the weak launch of Hong Kong Bitcoin ETFs today. Hong Kong ETFs volume only $10 million during debut day and China Bitcoin ETFs shows $120 million it is the biggest debut volume in the past three years. The Bitcoin prices are plunged 16% in the April month it is the worst decline since FTX collapse happened in the November 2022.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

Due to Stronger pace of interest rates maintaining in the US, Bitcoin prices slowly erased its gains in the market, War in the middle east is calming down is the another factor for Bitcoin price slowdown.

It seems the cryptocurrency correction has transitioned into a bear market phase, as bitcoin (BTC) experienced a significant drop below $60,000 amidst lackluster performances of spot ETFs in Hong Kong and concerns regarding interest rates. On Tuesday, BTC plummeted to a low of $59,100, marking its weakest price level since late February and reflecting a decline of over 5% within the past 24 hours. The broader-market CoinDesk 20 Index (CD20) fared even worse during the same period, registering a 6% decrease, while other major cryptocurrencies like ether (ETH) and solana (SOL) faced losses ranging from 7% to 8%.

Bitcoin is now approximately 20% lower from its all-time high above $73,000, which was reached in mid-March. Traditional markets also faced challenges, with the Nasdaq dropping by 2% and the S&P 500 declining by 1.6% following the release of U.S. economic reports indicating slowing growth and increasing price pressures.

Recent reports highlighting robust U.S. economic data and heightened inflation have significantly reduced expectations of U.S. Federal Reserve interest rate cuts. Joel Kruger, market strategist at LMAX Group, noted that this shift in sentiment is impacting the digital asset market, as investors anticipate a higher interest rate outlook, which is favoring the U.S. dollar and consequently influencing cryptocurrencies.

The cryptocurrency market is on track to experience its worst monthly decline since November 2022, coinciding with the collapse of the crypto exchange FTX. With bitcoin and ether down over 16% and 18% respectively in April, smaller cryptocurrencies have faced even more substantial corrections, with altcoins like solana (SOL), dogecoin (DOGE), and avalanche (AVAX) plummeting by 35% to 40%.

Looking ahead, some analysts anticipate further declines in bitcoin’s price, with expectations of a sell-off to the mid-to-low $50,000 range, which could present a buying opportunity. Seasonal trends also suggest lower prices during the summer months, according to K33 Research.

Despite a somewhat tepid debut, the launch of spot bitcoin and ether ETFs in Hong Kong garnered notable attention. While the trading volume was modest at just over $10 million, considering the comparatively smaller size of the Hong Kong ETF market, the debut was deemed relatively successful. ChinaAMC’s bitcoin ETF alone accumulated over $123 million in assets during its first trading session, positioning it among the top ETF launches in recent years and potentially offsetting outflows from U.S. products.

BTCUSDT: Bitcoin’s Worst Month Since FTX Crash Amid Cooling ETF Demand

The BTCUSDT market experienced a significant downturn, dropping below the $60,000 mark following the lackluster debut of Hong Kong Bitcoin ETFs today. Despite high expectations, the trading volume for these ETFs amounted to only $10 million on their first day. In contrast, China’s Bitcoin ETFs saw a staggering $120 million in trading volume, marking the largest debut volume in the past three years. This disparity underscores the subdued market response to the Hong Kong ETF launch.

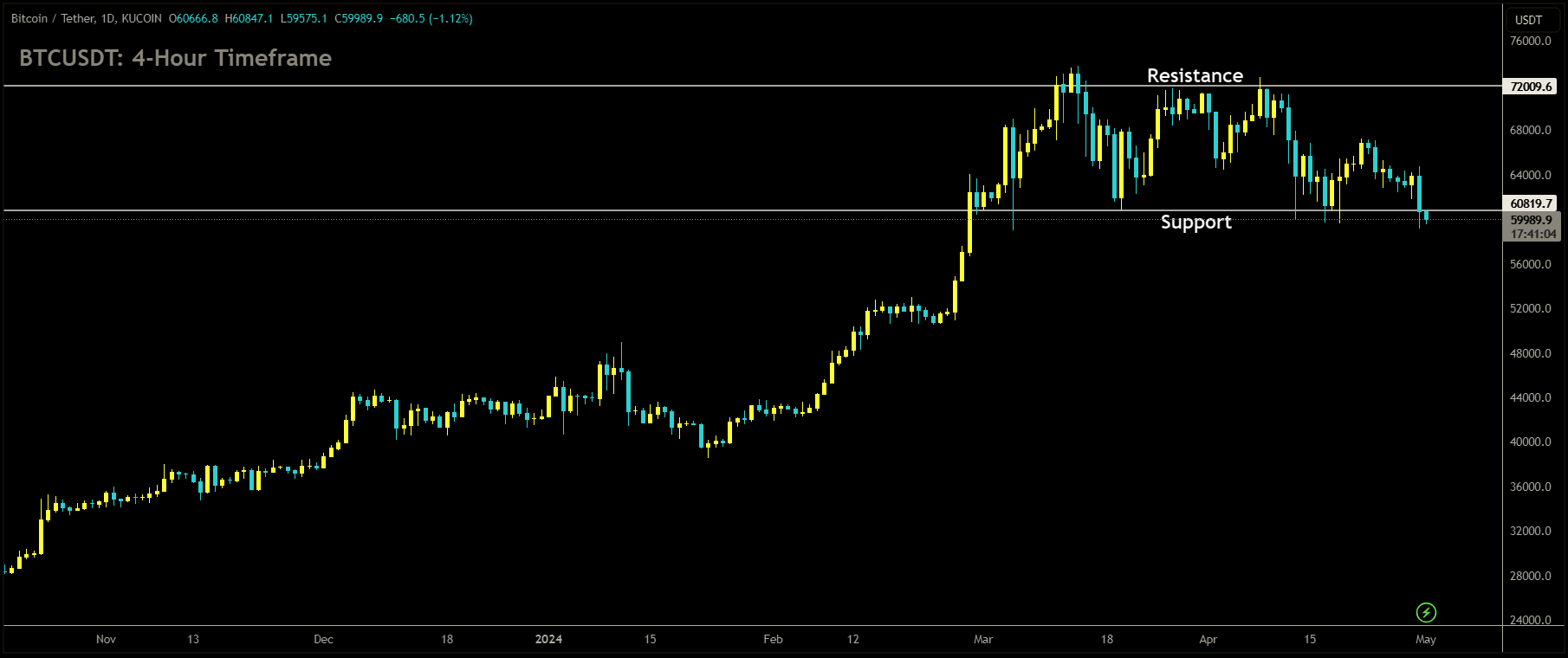

BTCUSDT is moving in box pattern and market has reached support area of the pattern

Bitcoin prices have been on a downward trajectory, plummeting by 16% in April alone. This decline represents the most significant drop since the collapse of the FTX empire in November 2022. One of the contributing factors to this decline is the stronger pace of interest rate hikes in the United States. The prospect of higher interest rates has dampened investor sentiment and led to a gradual erosion of Bitcoin’s gains in the market.

Additionally, the easing tensions in the Middle East have contributed to the slowdown in Bitcoin prices. As geopolitical uncertainties subside, investors may be reallocating their assets away from cryptocurrencies and towards more traditional investment avenues. This shift in investor behavior has further exacerbated the downward pressure on Bitcoin prices in recent weeks.

Bitcoin is facing its most challenging month since the collapse of Sam Bankman-Fried’s FTX empire, as the initial excitement surrounding US exchange-traded funds (ETFs) for the leading digital asset wanes. In April, the original cryptocurrency has experienced a decline of 14%, marking its largest drop since November 2022 when it slumped by 16%. The fervor sparked by the US ETFs propelled Bitcoin to an all-time high of nearly $74,000 in March. However, as optimism for Federal Reserve interest-rate cuts diminishes, inflows into these products have notably decreased.

Throughout April, there have been net outflows totaling $182 million from the 11 US spot ETFs, contrasting sharply with the $4.6 billion in net inflows recorded in March. These ETFs were approved by the US Securities and Exchange Commission in January. Despite the much-anticipated Bitcoin halving on April 19, which historically acted as a price catalyst by reducing the supply of new coins, its impact was minimal this time. Although the halving did not directly affect transaction processing, it halved the number of new Bitcoins awarded to miners.

The downturn in Bitcoin’s price also affected stocks of crypto mining companies, with Marathon Digital Holdings Inc., Riot Platforms Inc., Cleanspark Inc., and Cipher Mining Inc. experiencing significant declines. MicroStrategy Inc., renowned for its corporate Bitcoin strategy, saw a 15% tumble after posting a first-quarter loss of $53 million, even as the value of its Bitcoin holdings surged during the period.

Market observers turned their attention to Asia for potential market momentum, particularly with the listing of Bitcoin and Ether spot ETFs in Hong Kong. However, the lackluster debut of these ETFs on Tuesday failed to instill confidence among investors. The combined trading volume for the six new ETFs in their first session amounted to just $11 million, significantly lower than the $4.6 billion total volume recorded by the 10 US spot-Bitcoin products during their debut.

In response to the tepid demand from Hong Kong, both Bitcoin and Ether experienced accelerated declines, with Bitcoin dropping by as much as 3.8% and Ether by 6.6% on Tuesday. Bitcoin was trading at $60,720, while Ether hovered around $2,985 as of 12:10 p.m. New York time. Ether, the second-largest cryptocurrency, has seen a decline of about 17% in April, marking its largest monthly drop since June 2022.

The US Securities and Exchange Commission’s scrutiny of Ether added to market uncertainties. In March, the SEC requested information from various companies as part of its review of Ether. Last week, crypto software company Consensys filed a lawsuit challenging the SEC’s authority to regulate the Ethereum blockchain and Ether, highlighting the ongoing legal battles between the crypto industry and the regulatory agency.

Vetle Lunde, an analyst at K33 Research, noted that the decline in demand suggests heightened volatility ahead. Despite expectations surrounding the Hong Kong ETFs, Lunde emphasized that their impact is limited, estimating inflows equivalent to only two days’ worth of inflows into BlackRock’s Bitcoin spot ETF in February.

BTCUSDT: Bitcoin Dips Below $60K, Threatening Further Retreat as Crypto Markets Face Worst Month Since FTX Crash

The BTCUSDT market underwent a pronounced downturn, breaching the pivotal $60,000 threshold in response to the lackluster performance of Hong Kong Bitcoin ETFs on the current day. Despite anticipations running high, these ETFs garnered a mere $10 million in trading volume during their inaugural session. In stark contrast, Chinese Bitcoin ETFs exhibited a remarkable $120 million in trading activity, marking an unprecedented surge in debut volume over the past triennium. This glaring incongruity underscores the subdued market reception to the Hong Kong ETF launch.

BTCUSDT is moving in Descending channel and market has reached lower low area of the channel

Bitcoin prices have witnessed a precipitous decline, nosediving by 16% over the course of April alone. Such a descent delineates the most notable downturn since the demise of the FTX empire in November 2022. A confluence of factors has contributed to this descent, foremost among them being the accelerated pace of interest rate hikes in the United States. The specter of heightened interest rates has instilled a sense of trepidation among investors, catalyzing a gradual erosion of Bitcoin’s market gains.

Furthermore, the amelioration of tensions in the Middle East has compounded the deceleration in Bitcoin prices. As geopolitical uncertainties abate, investors may be reallocating their portfolios away from cryptocurrencies and towards more orthodox investment avenues. This shift in investor sentiment has further exacerbated the downward trajectory of Bitcoin prices in recent weeks.

Bitcoin, the flagship cryptocurrency, has experienced a significant downturn in April, marking its most substantial monthly decline since November 2022. The price of Bitcoin has plummeted by over 16% this month, signaling potential challenges for investors. John Glover, the Chief Investment Officer of Ledn, anticipates further declines, projecting a possible drop to the mid-to-low $50,000 range, which he views as a potential buying opportunity.

The debut of spot Bitcoin and Ether exchange-traded funds (ETFs) in Hong Kong, while initially perceived as lackluster, garnered more attention upon closer examination. Despite modest trading volumes of just over $10 million on the debut day, Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, highlighted the significance of this launch, especially considering the relatively smaller size of the Hong Kong ETF market compared to the United States.

ChinaAMC’s Bitcoin ETF alone accumulated over $123 million in assets during its inaugural trading session, positioning it as one of the most successful ETF launches in recent years. Balchunas emphasized that these Hong Kong-listed ETFs arrived at an opportune moment and could potentially offset the slowdown in outflows from U.S. products. This development underscores the growing interest in cryptocurrencies, despite the recent challenges faced by the market.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/