USD: Fed Rate Decision Today: Odds of a Cut

The FOMC Meeting is begins tonight, most anticipated rate cut is not happen in this meeting, rates are remain hold as per economists view. Strong Labour data, wage increased, inflation is above 2% target. FED Members are continuously mentioned rate cuts are necessary in this year and inflation is not reached our 2% target. US Dollar remained higher against counter pairs and no losses is seen in the past one month.

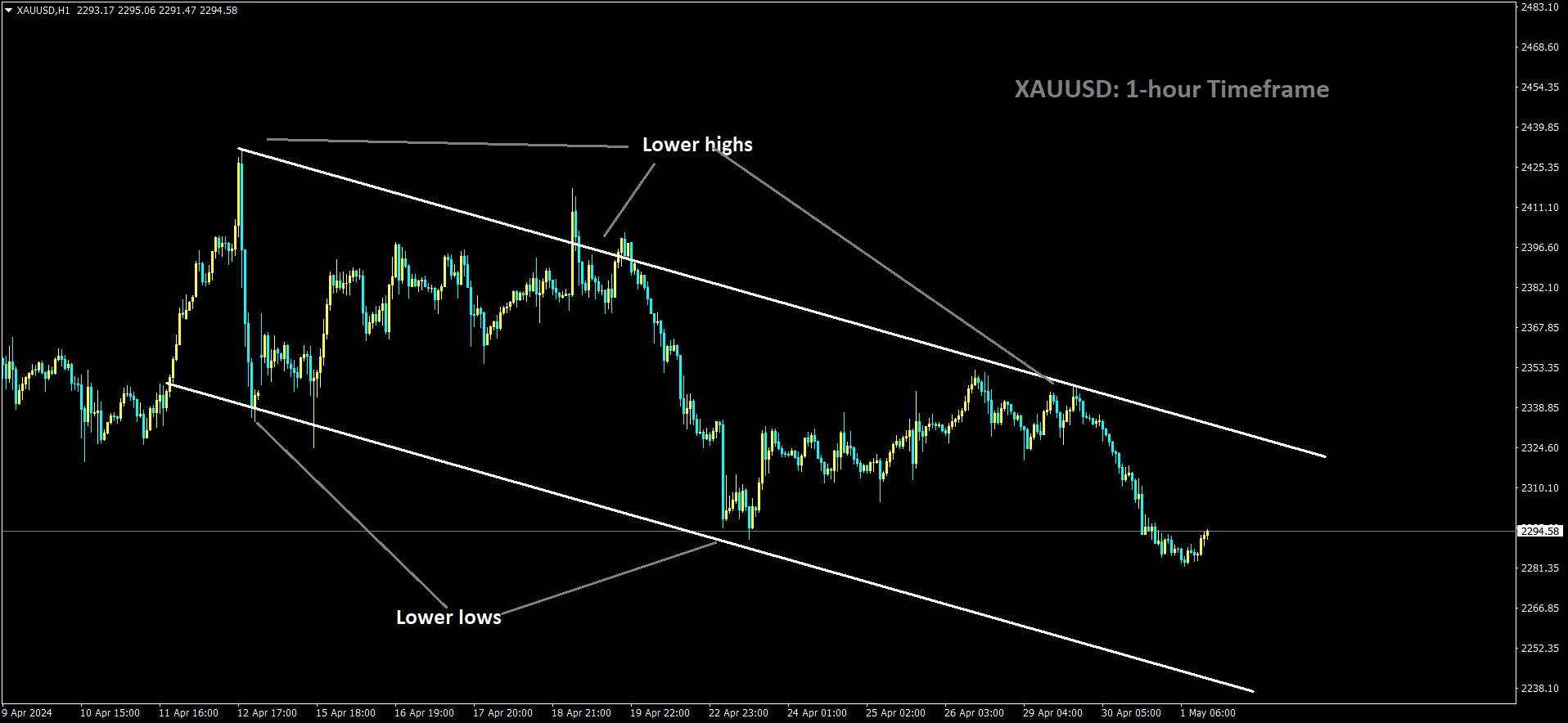

XAUUSD is moving in Descending channel and market has fallen from the lower high area of the channel.

On Wednesday afternoon, the Federal Reserve is slated to announce its third interest rate decision of 2024, a pivotal moment that economists anticipated could bring relief from high borrowing costs. However, recent economic shifts and persistent inflation have complicated policymakers’ plans, leading Wall Street to expect the Fed to maintain its current rates for the time being, according to a survey by financial data firm FactSet.

At the year’s outset, around 90% of economists predicted a rate cut at the May 1 meeting. But evolving economic conditions have shifted expectations, with most experts now projecting the first rate reduction to occur in the Fed’s September or November meetings. This means consumers will likely continue facing elevated loan costs across various sectors, including credit cards and mortgages, amidst sustained high prices for goods and services.

“The Fed has repeatedly emphasized the challenge of taming inflation and their readiness to keep rates high until inflation becomes more manageable,” explained Jacob Channel, a senior economist at LendingTree. “While people might be concerned or disappointed by the Fed’s reluctance to cut rates, premature rate cuts could exacerbate economic challenges for both consumers and businesses.”

The Federal Reserve’s Open Market Committee is scheduled to unveil its rate decision at 2 p.m. Eastern time on Wednesday, followed by a press conference by Fed Chair Jerome Powell at 2:30 p.m., providing insights into the central bank’s economic outlook and its decision-making rationale.

Despite earlier expectations for multiple rate cuts in 2024, current forecasts indicate a single cut, given the persistence of inflationary pressures. The uptick in inflation, fueled by rising housing and gasoline costs, has defied the Fed’s efforts to rein it in. Consumer prices climbed 3.5% annually in March, up from 3.2% in February and 3.1% in January.

While nearly half of economists anticipate a rate cut in September, the majority foresee one in November, likely amounting to a quarter-point reduction rather than a larger half-point cut. This adjustment could have implications for borrowing costs, as indicated by Stephen J. Rich, CEO of Mutual of America Capital Management.

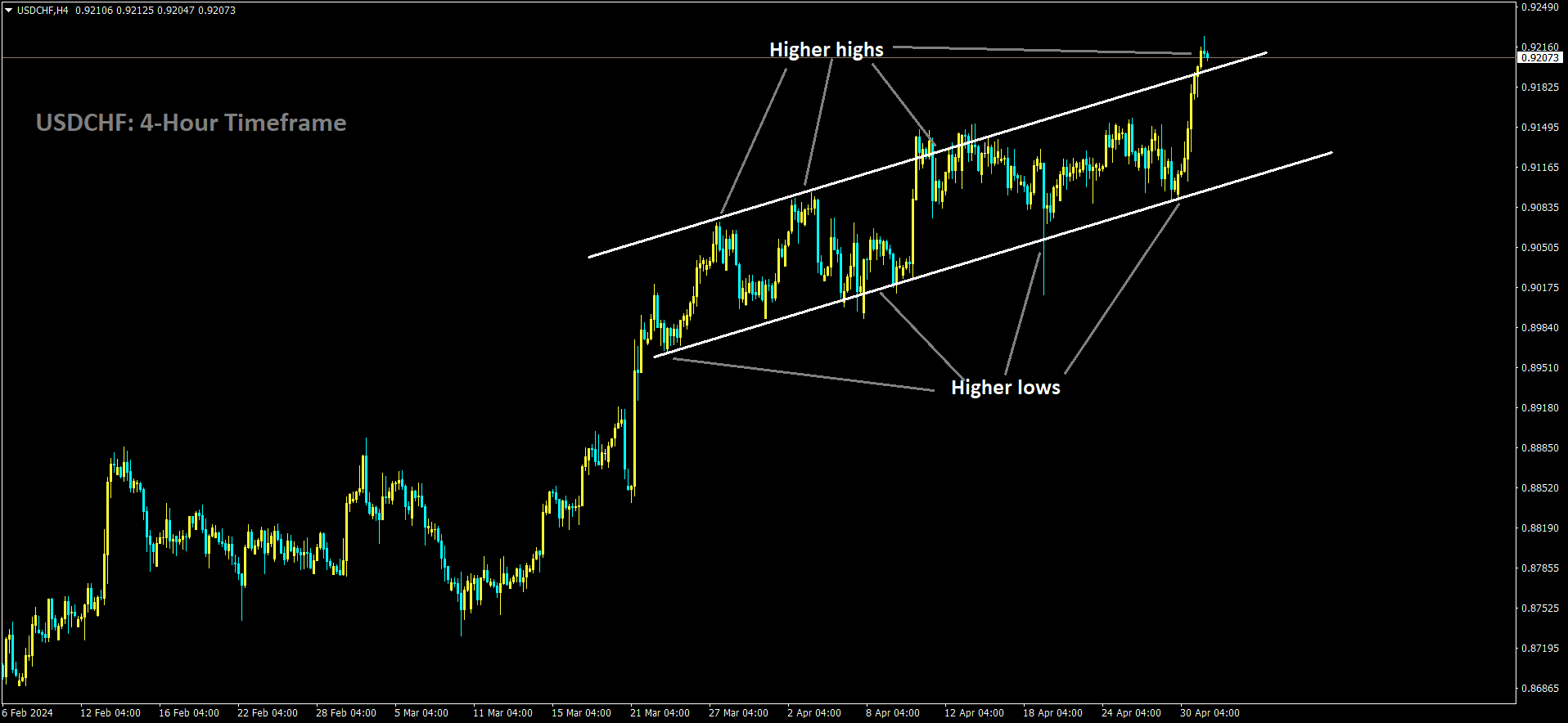

USDCHF is moving in Ascending channel and market has reached higher high area of the channel

“Borrowing money will remain relatively expensive for quite some time,” remarked Channel. “We aren’t going to wake up come August, and rates will be back to zero.”

However, savers may find some solace, with higher-yield savings accounts offering returns above 5%, according to Ken Tumin, a banking expert at DepositAccounts.com. Similarly, certificates of deposit can provide attractive rates for those seeking to bolster their savings.

USD: Stocks on Wall Street decline amid wage data strength and Fed meeting anticipation.

The highly anticipated Federal Open Market Committee (FOMC) meeting commences tonight, with economists largely expecting that a rate cut will not materialize during this session. Instead, interest rates are anticipated to remain unchanged. This expectation is influenced by various factors, including robust labor data indicating an increase in wages and inflation persistently surpassing the 2% target set by the Federal Reserve.

Despite calls from some FOMC members for rate cuts, citing the necessity of such actions to address current economic conditions and the failure of inflation to reach the 2% target, the prevailing sentiment within the committee seems inclined towards maintaining the status quo for the time being.

The U.S. Dollar has demonstrated resilience against its counterpart currencies, maintaining its strength over the past month without significant losses. This strength reflects market expectations and investor sentiment regarding the Federal Reserve’s monetary policy stance and the broader economic landscape.

U.S. equities closed lower on Tuesday, grappling with economic indicators revealing a surge in labor costs and a dip in consumer confidence, all while anticipating the Federal Reserve’s pivotal policy meeting to decide on interest rates.

Labor data unveiled on Tuesday depicted a stronger-than-expected 1.2% rise in U.S. labor costs during the last quarter, signaling a notable uptick in wage pressures. Concurrently, a survey highlighted a deterioration in U.S. consumer confidence for April, hitting its lowest level in over 18 months.

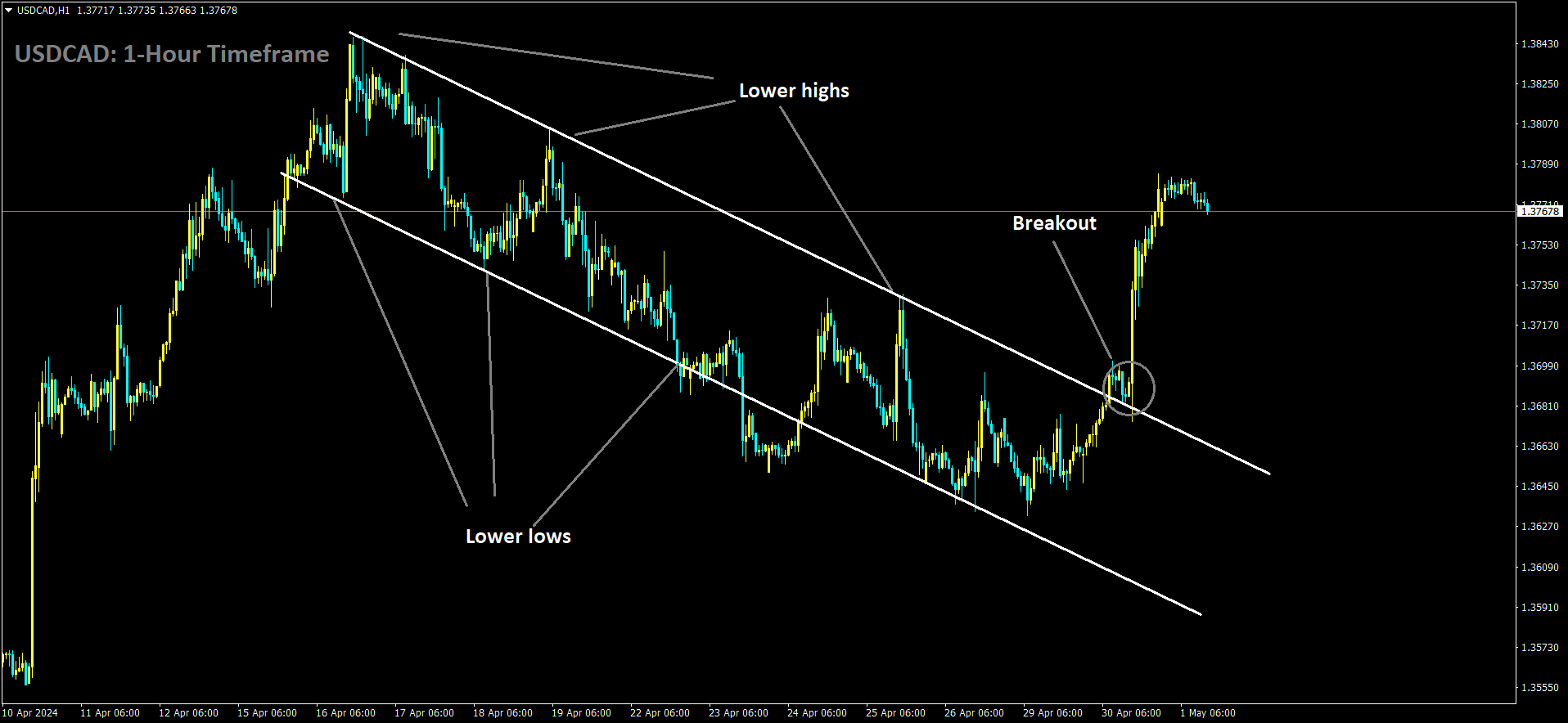

USDCAD has broken Descending channel in Upside

These reports emerged just ahead of the Federal Reserve Open Market Committee (FOMC) concluding its two-day session, with market participants widely anticipating the central bank to maintain the current interest rate levels.

The majority of the major stocks, including Tesla (TSLA.O), Alphabet (GOOGL.O), Nvidia (NVDA.O), Microsoft (MSFT.O), and Amazon (AMZN.O), experienced declines, reflecting the market’s cautious sentiment.

Garrett Melson, portfolio strategist at Natixis Investment Managers in Boston, remarked, “We’re still in an environment where the knee-jerk reaction is to extrapolate any warmer data into firmer inflation and more hawkish reaction from the Fed. But nothing has changed: growth is still strong, labor markets are holding up, and ultimately we’re taking a little bit of breather in the disinflation process.”

USD: US Fed meeting today: Expert views on persistent inflation

The impending Federal Open Market Committee (FOMC) rendezvous commences imminently, with a prevailing consensus among economists leaning towards the likelihood of a rate stasis rather than a cut. This forecast is underpinned by multifarious considerations, notably the robust labor metrics showcasing wage upticks and the persistent inflationary trends exceeding the Federal Reserve’s stipulated 2% benchmark.

Despite a faction within the FOMC advocating for rate reductions, citing exigencies in addressing prevailing economic dynamics and the protracted failure to align inflationary trajectories with the 2% target, the predominant sentiment within the committee seems predisposed towards maintaining the present equilibrium.

The US Dollar has evinced remarkable resilience vis-a-vis its currency counterparts, sustaining its ascendancy sans conspicuous erosions over the bygone month. This steadfastness mirrors market anticipations and investor sentiment surrounding the Federal Reserve’s monetary policy orientation and the broader economic panorama.

US Federal Reserve’s policy meeting commences today, drawing significant attention from the market amidst persistent inflation concerns. Experts anticipate no rate cut this time, given the ongoing inflationary pressures and the Fed’s cautious approach to avoid premature actions that could exacerbate inflation, especially amid volatile commodity prices influenced by geopolitical tensions.

Recent economic indicators reveal a 0.4% month-on-month increase and a 3.5% year-on-year rise in the US consumer price index (CPI), surpassing expectations. Additionally, the US GDP grew at its slowest pace in two years, with a 1.6% annualized rate in the March quarter.

Several experts shared their insights on what to expect from the US Fed in its May policy meeting:

V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services:

Anticipates the Fed to maintain status quo due to core inflation at 3.7%, leaving little room for rate cuts. Two rate cuts may be possible later in the year, albeit backloaded.

Apurva Sheth, Head of Market Perspectives & Research, SAMCO Securities:

Foresees the Fed to focus on higher-than-expected inflation at 3.5%, amid concerns of stagflation. Expectation is for the Fed to maintain the interest rates at 5.5%, with limited market impact but close attention to the Fed’s comments.

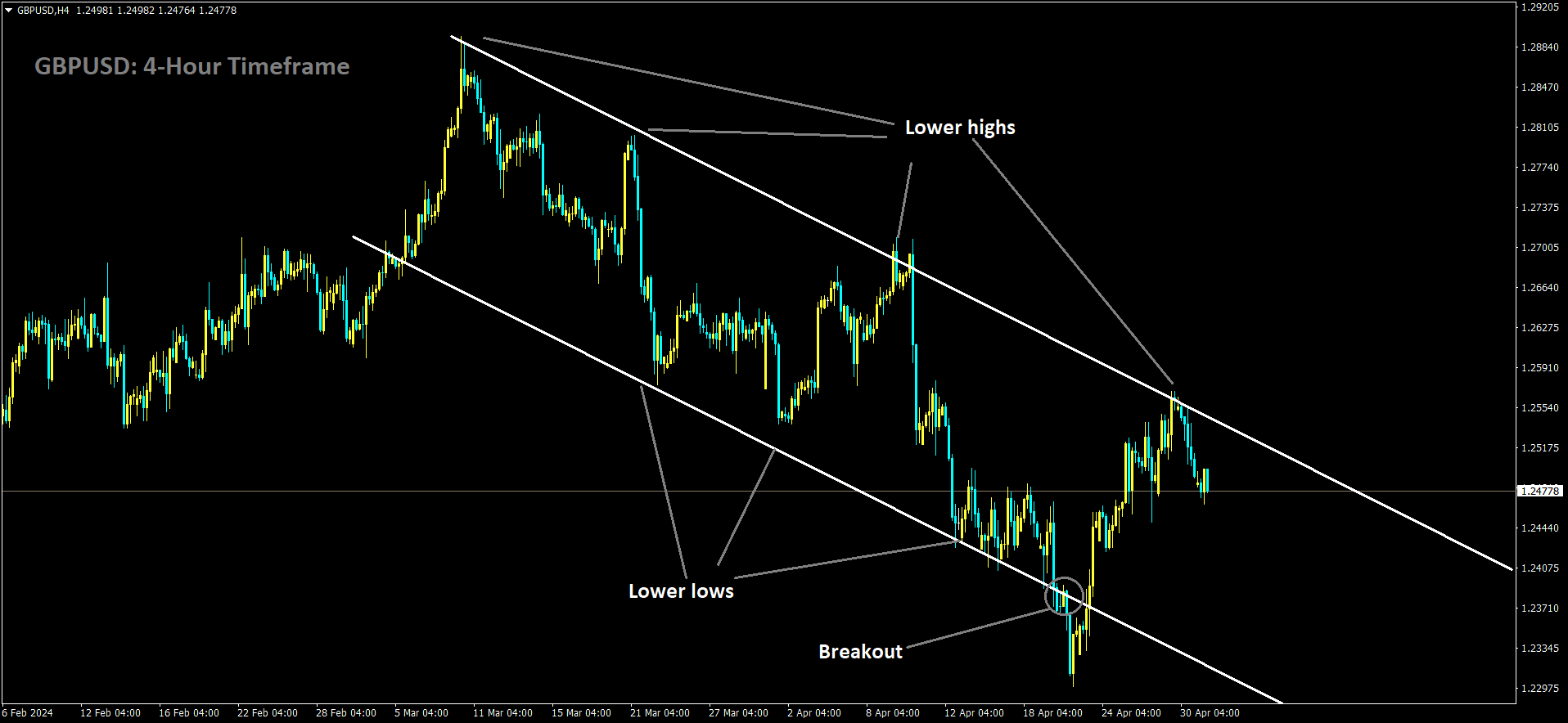

GBPUSD is moving in Descending channel and market has fallen from the lower high area of the channel

Palka Arora Chopra, Director, Master Capital Services:

Highlights the Fed’s consideration of various factors such as inflation, employment, economic growth, and global developments in its decision-making process, emphasizing the importance of maintaining price stability and employment.

Shrey Jain, Founder and CEO of SAS Online:

Expects the Fed to continue its data-driven approach, monitoring factors like rising oil prices, inflation, and slow GDP growth, while assessing the impact on economic activity.

Vijay Singh Gour, Senior Analyst at Choice Broking:

Notes persistent inflation above the 2% target due to geopolitical tensions and rising commodity prices, suggesting no rate cut in the short term, with expectations of one to two rate cuts for the year.

Pravesh Gour, Senior Technical Analyst, Swastika Investmart:

Highlights the Fed’s comprehensive analysis of economic indicators, financial market dynamics, and global trends to fulfill its dual mandate of price stability and full employment, indicating a cautious and holistic approach to monetary policy decisions.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/