BTCUSDT: US Bitcoin ETFs See Largest Outflow Ever: $563M, Despite Powell’s Rate Hike Rejection

The Bitcoin ETFS funds outflow till date is $563 Million from 11 ETFs and investors pulled out $1.2 billion after the FED announced they are going to buy Billions of Dollars in Government debts last day. FED speech is hawkish due to no rate cuts vision in this year is possible So Higher yielding assets like Crypto declined due to rates are kept higher in the FED central bank.

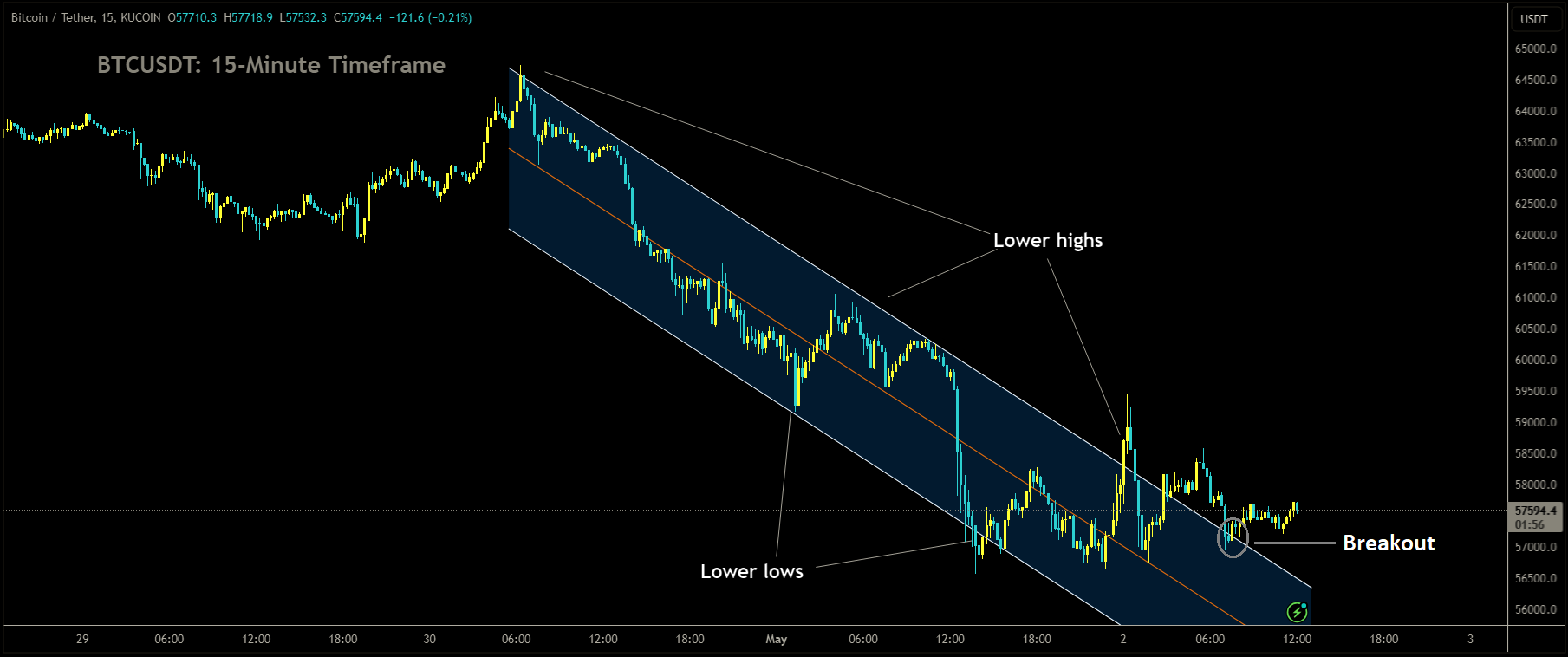

BTCUSDT has broken box pattern in downside

On Wednesday, despite Federal Reserve (Fed) chairman Jerome Powell’s dismissal of a rate hike, investors showed a remarkable lack of confidence in U.S.-based spot bitcoin (BTC) exchange-traded funds (ETFs). These ETFs experienced their fastest net outflow ever, totaling $563.7 million, marking the largest outflow since their inception on January 11. This significant divestment extended a five-day losing streak and added to the nearly $1.2 billion pulled out since April 24, according to data from Farside Investors and CoinGlass.

Among these ETFs, Fidelity’s FBTC bore the brunt of the outflows, witnessing withdrawals amounting to $191.1 million on Wednesday. This trend is particularly concerning for bullish investors, given that FBTC and BlackRock’s IBIT had consistently attracted funds in the first quarter, offsetting the frequent outflows from the relatively expensive Grayscale ETF (GBTC).

On the same day, GBTC saw the second-largest outflow, totaling $167.4 million, followed by ARKB’s $98.1 million and IBIT’s $36.9 million. Despite Powell’s net-dovish approach, which typically supports risk assets like bitcoin by favoring economic growth over liquidity tightening, other funds also experienced significant outflows. During the Fed’s announcement, Powell emphasized that the economy’s strength did not warrant rate cuts and downplayed concerns about renewed rate hikes or liquidity tightening, despite recent disappointing inflation data.

In addition to keeping the benchmark interest rate unchanged between 5.25% and 5.5%, the Fed announced plans to significantly reduce its quantitative tightening (QT) program starting in June. Simultaneously, the U.S. Treasury unveiled a program to repurchase billions of dollars in government debt, a move aimed at enhancing liquidity in the bond market.

Bitcoin, like other risk assets, is sensitive to changes in liquidity conditions. It initially rallied from $56,620 to $59,430 in response to Powell’s comments, while the yields on the 10- and two-year Treasury notes fell, along with the dollar index. However, BTC’s bounce was short-lived, with its price falling back to $57,300 at the time of reporting. Furthermore, the debut of Asia’s first spot bitcoin and ether (ETH) ETFs in Hong Kong earlier in the week, marked by disappointing volumes, further dampened sentiment in the crypto market.

BTCUSDT: U.S. Bitcoin ETF Outflows Exceed $560M, Further Declines Expected?

As of now, the cumulative outflow from Bitcoin ETFs stands at $563 million across 11 ETFs. This significant withdrawal of funds follows the Federal Reserve’s recent announcement of its intention to purchase billions of dollars in government debt. The Fed’s stance, characterized as hawkish, suggests a reluctance to implement rate cuts in the current year. Consequently, higher-yielding assets such as cryptocurrencies experienced a decline in value, as the Fed’s decision to maintain higher interest rates creates less attractive conditions for such investments in comparison to traditional financial instruments.

BTCUSDT has broken Descending channel in upside

The outflows from U.S. spot Bitcoin ETFs intensified on Wednesday, surpassing $500 million. This significant selling pressure coincided with the Federal Open Market Committee (FOMC) meeting, during which Fed Chair Jerome Powell announced the decision to keep interest rates unchanged. This announcement caused the price of Bitcoin to drop by another 5% to $57,500.

Fidelity Leads in Bitcoin ETF Outflows

Data from Farside Investors revealed that net outflows from spot Bitcoin ETFs on Wednesday amounted to $563.7 million. BlackRock’s Bitcoin ETF, IBIT, experienced its first outflow since its inception, totaling $37 million. Meanwhile, Fidelity’s FBTC recorded the highest outflows at $191 million, surpassing Grayscale’s GBTC at $167 million. Notably, all nine spot Bitcoin ETFs in the US registered net outflows on the same day for the first time.

Discounts on Bitcoin ETFs

Wednesday also witnessed some of the largest discounts on Bitcoin ETFs’ underlying assets. Discounts for leading Bitcoin ETFs, such as BlackRock’s IBIT, surged to nearly 1.8%. Similar discounts were observed across other Bitcoin ETFs.

James Seyffart, an ETF analyst at Bloomberg Intelligence, noted that while such discounts are unusual, they are not unprecedented. He emphasized that slight premiums or discounts to Net Asset Value (NAV) are common, depending on market conditions and trading activities.

BTCUSDT: Bitcoin ETFs Witness Record Outflows

At present, the collective egress from Bitcoin ETFs tallies a staggering $563 million, spanning a spectrum of 11 distinct ETFs. This notable exodus of capital emerges hot on the heels of the Federal Reserve’s latest proclamation detailing its ambitious foray into procuring billions worth of government debt securities. The Fed’s posture, hailed by pundits as decidedly hawkish, intimates a steadfast aversion towards the notion of executing interest rate ameliorations throughout the ongoing fiscal cycle. Consequently, assets of loftier yield, epitomized by the volatile realm of cryptocurrencies, bore the brunt of this monetary policy stance. Such digital assets, inherently susceptible to fluctuations in market sentiment, underwent a palpable downturn in valuation, rendered less alluring by the Federal Reserve’s unwavering commitment to upholding relatively elevated interest rates. This scenario paints a stark contrast against the backdrop of conventional financial instruments, which now appear comparatively more enticing in light of the prevailing monetary policy landscape.

BTCUSDT Market Price is moving in Ascending channel and market has fallen from the higher high area of the channel

On Wednesday, U.S.-based spot bitcoin exchange-traded funds (ETFs) experienced a significant milestone with a total net outflow of $563.7 million, marking the largest daily net outflows since their inception, as per data from SosoValue.

Among these ETFs, Fidelity’s FBTC saw the most substantial net outflows, totaling over $191 million, surpassing Grayscale’s GBTC, which recorded a net outflow of $167.3 million on the same day, according to SosoValue data.

Ark Invest’s ARKB ranked third in terms of net outflows, with $98.1 million, followed by BlackRock IBIT with $36.9 million and Bitwise BITB with $29 million. Notably, it was the first time that BlackRock’s spot bitcoin ETF experienced a net daily outflow.

All U.S. spot bitcoin ETFs, except Hashdex’s DEFI, registered daily net outflows on that day.

As of Wednesday, the cumulative total net inflow for all 11 ETFs stood at $11.2 billion.

Nate Geraci, president of investment advisor The ETF Store, highlighted the significance of the event, noting, “So, iShares Bitcoin ETF has the first day of outflows ($37 million). This is what ETFs do. Inflows don’t go up in a straight line.”

The enthusiasm surrounding spot bitcoin ETFs has seemingly waned, with April witnessing net monthly outflows amounting to $343.5 million, ending a streak of three consecutive months of inflows. GBTC led the outflows in April, with $2.5 billion exiting the ETF over the month.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/