CHF: Swiss inflation hits 1.4%, 4-month high

The Swiss Franc is appreciated against counter pairs after the Swiss inflation came at 1.4% YoY versus 1.0% YoY printed in the March month. On Monthly basis, reading rose to 0.30% in the April month versus 0.10% is expected. Monthly retail sales declined to 0.30% in the March month when compared to 0.10% increase in the February month. Foods and non-Alcoholic beverages rose to 1.0% in the April month when compared to decline of 0.30% in the March month.

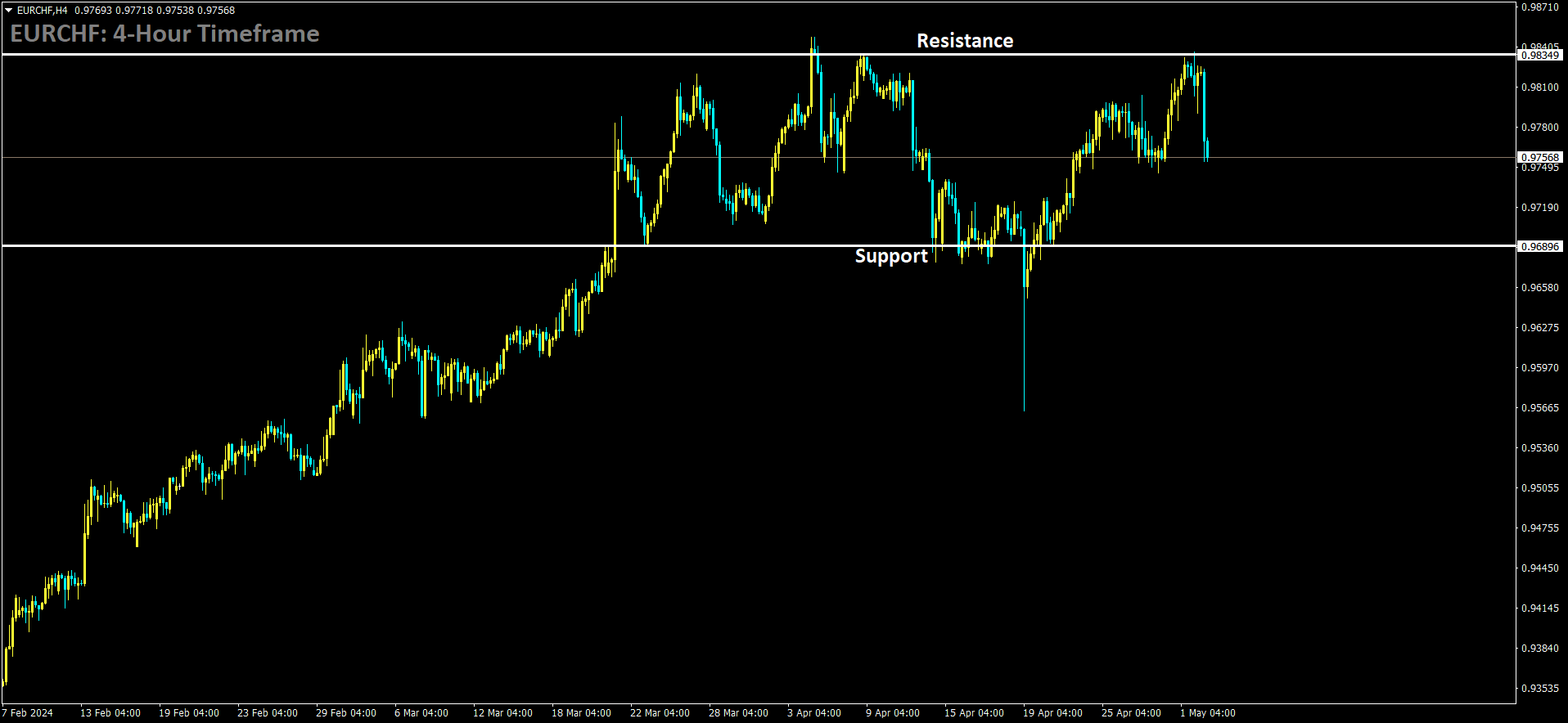

EURCHF is moving in box pattern and market has fallen from the resistance area of the pattern

In April, Switzerland’s consumer price inflation surged beyond expectations, reaching its highest level in four months, as reported by the Federal Statistical Office on Thursday.

The Consumer Price Index (CPI) rose by 1.4 percent year-over-year in April, marking a significant increase from the 1.0 percent gain recorded in March. This exceeded economists’ projections of a slight uptick to 1.1 percent. Despite the uptick, inflation remained within the central bank’s target range of 0-2 percent.

Notably, prices for food and non-alcoholic beverages increased by 1.0 percent annually in April, reversing a 0.4 percent decline in the previous month. Meanwhile, costs for housing and utilities saw a substantial rise of 3.3 percent.

On a monthly basis, consumer prices saw a 0.3 percent increase in April, following a period of stagnation in March.

In a separate report, official data revealed a 0.1 percent year-on-year decline in retail sales for March, contrasting with a 0.2 percent increase in the previous month. Both non-food and food product sales experienced a downturn of 0.6 percent in March compared to the same period last year.

Furthermore, monthly figures indicated a 0.4 percent drop in retail sales for March, contrasting with a 0.1 percent uptick observed in February.

CHF: USD/CHF stays subdued under 0.9150 post-Swiss CPI update

The Swiss Franc is appreciated against counter pairs after the Swiss inflation came at 1.4% YoY versus 1.0% YoY printed in the March month. On Monthly basis, reading rose to 0.30% in the April month versus 0.10% is expected.

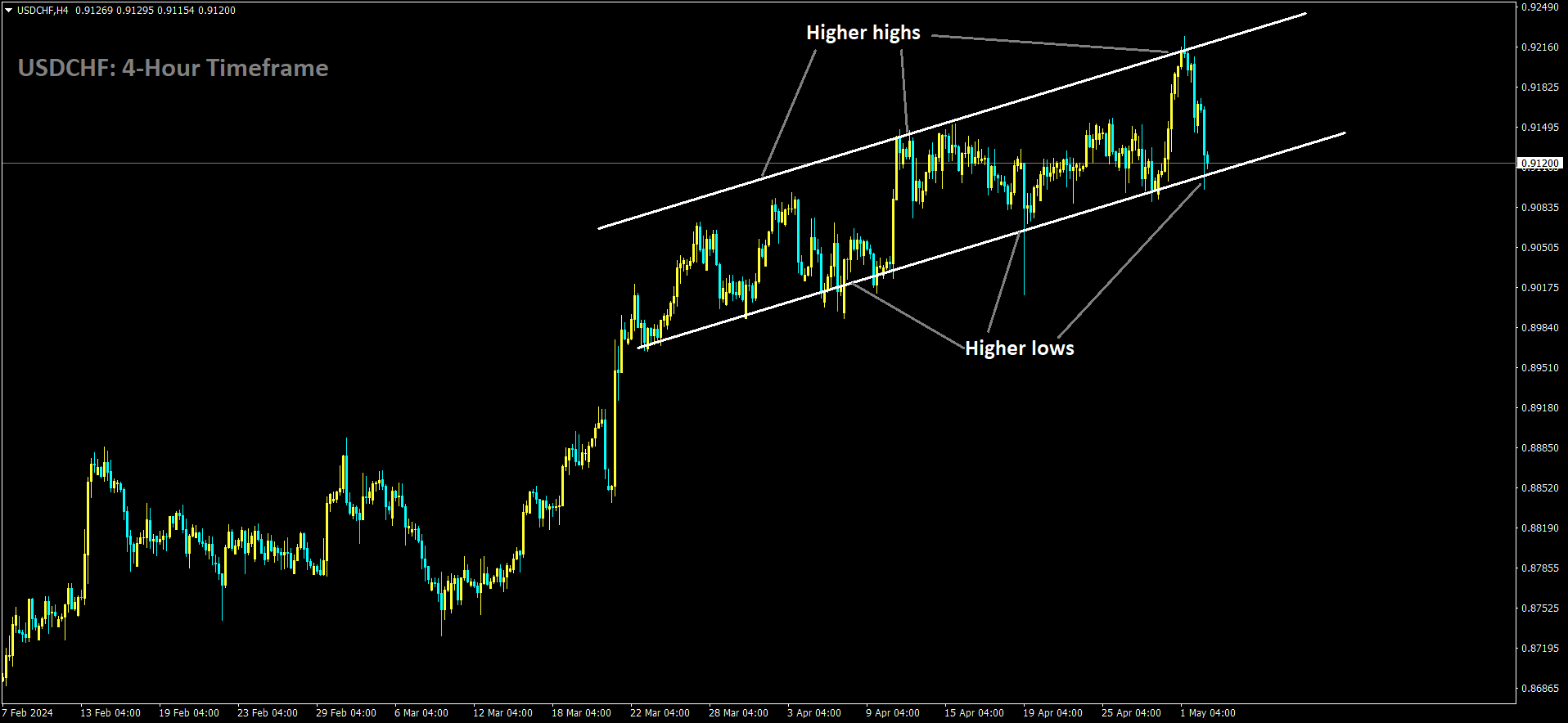

USDCHF is moving in Ascending channel and market has reached higher low area of the channel

The USD/CHF pair experiences downward pressure on Thursday, influenced by robust Swiss inflation data. Currently hovering around 0.9110, the pair is down 0.48% for the day. The US Dollar (USD) weakened following the US Federal Reserve’s decision to maintain interest rates at their current levels, further contributing to the pair’s decline.

Switzerland’s inflation figures for April, released by the Federal Statistical Office of Switzerland, exceeded expectations. The Swiss Consumer Price Index (CPI) climbed to 1.4% year-on-year (YoY) in April, up from 1.0% in March. On a monthly basis, the Swiss CPI saw a 0.3% increase in April, surpassing the market consensus of 0.1%. Consequently, the Swiss Franc (CHF) attracted buyers, causing the USD/CHF pair to test the support level at 0.9100.

The US Federal Reserve’s decision on Wednesday to keep interest rates unchanged was influenced by persistently high inflation levels in recent months. Fed Chair Jerome Powell emphasized that the Fed would refrain from cutting interest rates until there is “greater confidence” that inflation is slowing sustainably toward the 2% target. Powell also indicated that interest rates are currently “restrictive” enough, and it is “unlikely” that the Fed will raise rates again in this economic cycle. These remarks weighed on the Greenback, creating headwinds for the USD/CHF pair.

Market participants await the release of US employment data on Friday, particularly the Nonfarm Payrolls (NFP) report for April. Analysts expect the report to show an addition of 243,000 jobs in the US economy, with the Unemployment Rate projected to remain unchanged at 3.8% for the same period.

CHF: Swiss Franc Climbs on Robust CPI Figures

The Swiss Franc saw a surge against its counterparts following the release of stronger-than-anticipated inflation data from Switzerland. In April, the year-over-year consumer price inflation rose to 1.4%, surpassing the previous reading of 1.0% in March. Additionally, on a monthly basis, the inflation rate increased to 0.3% in April, contrasting with the flat reading observed in March.

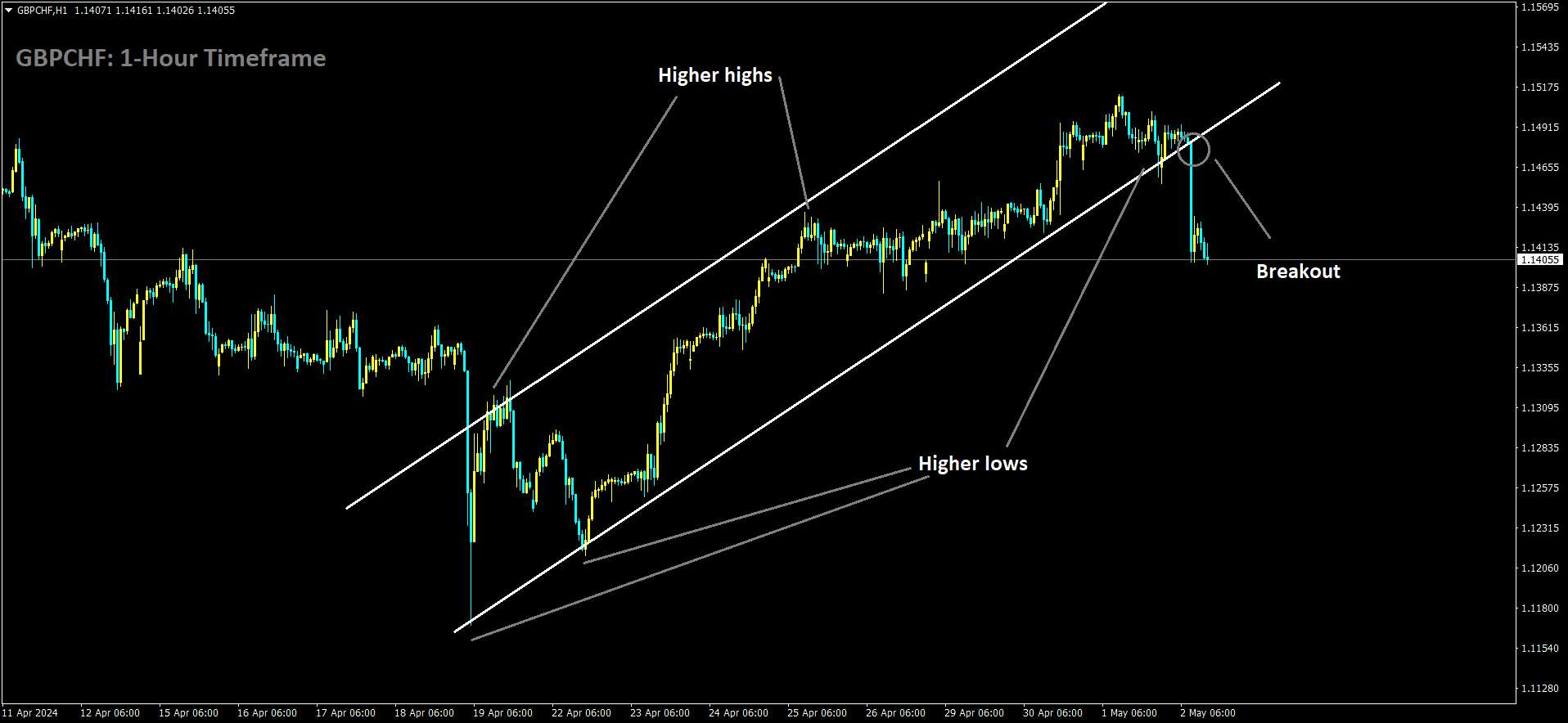

GBPCHF has broken Ascending channel in downside

Moreover, retail sales exhibited a decline of 0.1% annually in March, reversing the 0.2% gain recorded in the previous month. Specifically, sales of both non-food and food products dropped by 0.6% in March compared to the same period last year. Conversely, in April, the prices of food and non-alcoholic beverages surged by 1.0%, contrasting with the 0.3% decline witnessed in March.

Swiss Franc Strengthens on Surging CPI Figures

The Swiss franc exhibited strength against other major currencies during the European trading session on Thursday, buoyed by robust consumer price inflation data from Switzerland. According to the Federal Statistical Office, the consumer price index (CPI) surged by 1.4 percent year-over-year in April, marking the highest level in four months. This increase followed a 1.0 percent gain in March, surpassing economists’ expectations of a more modest rise to 1.1 percent. Notably, despite this uptick, inflation remained within the Swiss central bank’s target range of 0-2 percent.

On a monthly basis, consumer prices experienced a notable climb of 0.3 percent, reversing the previous month’s stagnation in March. Concurrently, official data revealed a slight annual decline of 0.1 percent in retail sales for March, reversing the 0.2 percent gain observed in the prior month. Sales of both non-food and food products experienced a decline of 0.6 percent in March compared to the previous year. Moreover, monthly retail sales figures dropped by 0.4 percent in March, in contrast to a modest 0.1 percent increase in February.

The European stock market experienced downward pressure following indications from the U.S. Federal Reserve signaling its readiness to maintain higher interest rates for an extended period. Additionally, sentiment was dampened by a survey indicating a deepening downturn in euro zone manufacturing activity in April.

In European trading, the Swiss franc surged to a three-day high of 1.1405 against the pound, from an early low of 1.1494. Against the euro and the U.S. dollar, the franc also reached two-day highs of 0.9757 and 0.9100, respectively, following early lows of 0.9827 and 0.9173. If the franc continues its upward trajectory, it may encounter resistance around 0.96 against the euro and 0.90 against the greenback.

Against the Japanese yen, the franc strengthened to 170.70 from an early low of 169.67. The next significant resistance level for the franc against the yen is anticipated at 176.00.

Looking ahead, investors are awaiting the release of U.S. and Canada trade data for March, as well as U.S. factory orders for the same month during the New York trading session.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/