EURO: ECB’s Lane: Growing Confidence in Lowering Inflation

The ECB Chief Economist Philip Lane said he has more confidence on rate cut in the June month from ECB side due to April month inflation and Q1 GDP is more appreciated one and near to 2% target of inflation level. US and Euro Area has more divergence in the inflation area and we do appropriate reduction in Borrowing costs once inflation settled down to 2% target in Euro area.

EURUSD is moving in Descending channel and market has reached lower high area of the channel

Philip Lane, Chief Economist of the European Central Bank (ECB), conveyed on Monday that recent economic indicators in the Eurozone have bolstered his confidence in the return of inflation to the ECB’s target of 2%. This development raises the likelihood of an interest rate cut in June, as reported by Bloomberg.

Lane emphasized the significance of the April flash estimate for Eurozone inflation and the first-quarter GDP figure, which contribute to his optimism regarding the timely achievement of the inflation target. He noted a personal increase in confidence compared to the ECB’s April meeting, although he acknowledged that further data will shape the outlook leading up to June.

In discussing the impact of the US economy and interest rates on the Eurozone, Lane cautioned against overstating their influence. He highlighted the contrasting mechanisms at play, suggesting that developments in the US often affect the Eurozone differently.

Despite the positive economic indicators, Lane underscored the ongoing geopolitical tensions that could pose challenges in the long term. He emphasized the need for a cautious, month-by-month assessment of economic conditions, while acknowledging the persistent geopolitical uncertainties anticipated in the years ahead.

EURO: ECB’s Lane: Rate Cut Case Strengthening

The European Central Bank’s Chief Economist, Philip Lane, expressed increased confidence in the likelihood of a rate cut by the ECB in June. This confidence stems from the positive indicators observed in April’s inflation figures and the first-quarter Gross Domestic Product (GDP) data, which are approaching the ECB’s target inflation rate of 2%. Lane emphasized the divergence in inflation dynamics between the United States and the Euro Area. He highlighted the ECB’s commitment to adjusting borrowing costs appropriately once inflation stabilizes at the desired 2% target in the Euro Area.

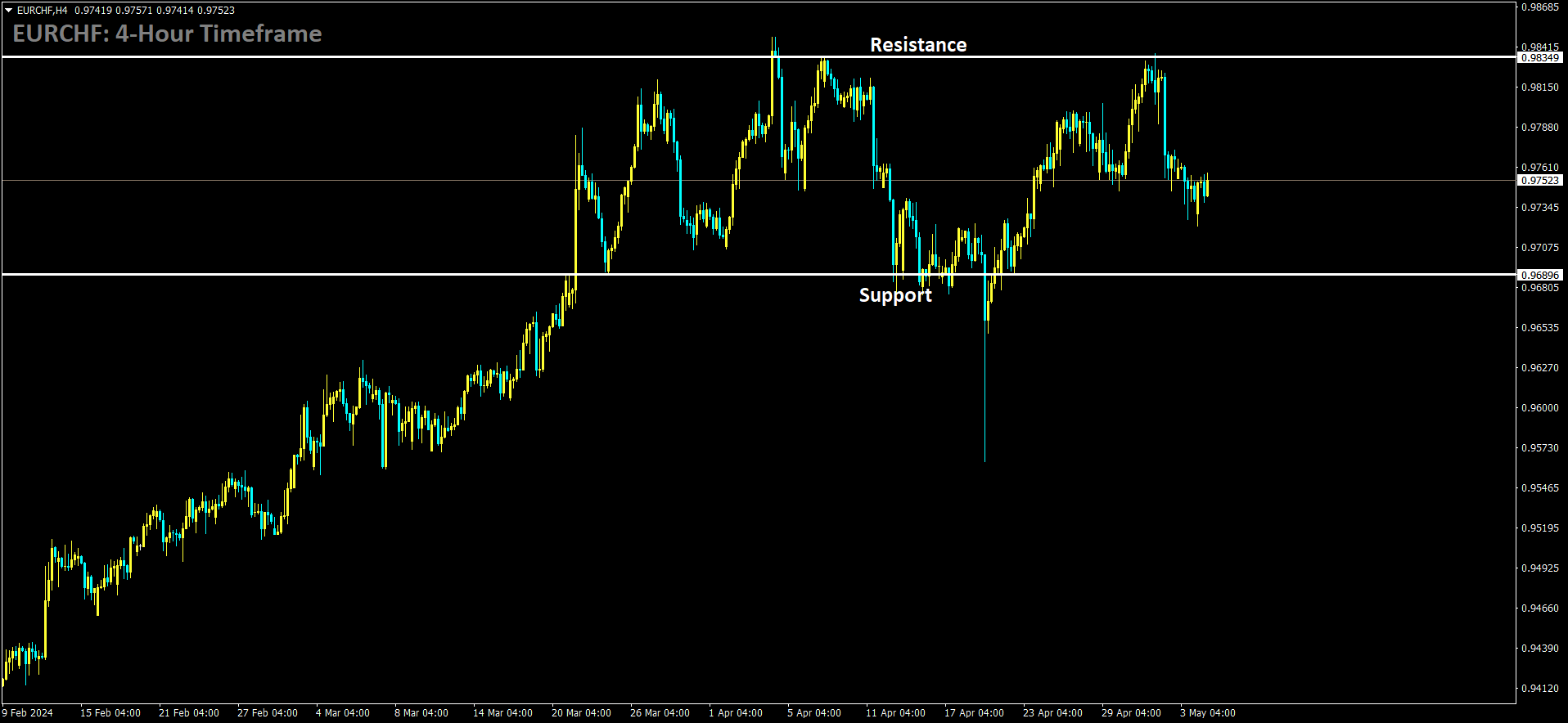

EURCHF is moving in box pattern and market has fallen from the resistance area of the pattern

The anticipation for a European Central Bank (ECB) interest rate cut in June is gaining momentum as services inflation shows signs of easing, stated ECB Chief Economist Philip Lane in an interview with Spanish newspaper El Confidencial on Monday. The ECB has strongly hinted at the possibility of a rate cut on June 6, contingent upon incoming data bolstering policymakers’ confidence in inflation returning to its 2% target by mid-next year.

Lane highlighted the recent April flash estimate for euro area inflation and the first-quarter GDP figures as contributors to his growing confidence in inflation’s trajectory. He noted that while there has been progress, more crucial data is yet to be released in the coming weeks.

Market sentiment also suggests that a rate cut in June is highly likely, although uncertainties regarding subsequent actions have escalated following signals from the U.S. Federal Reserve indicating potential delays in its own policy easing.

While the ECB emphasizes its independence from the Fed, a widening interest rate gap between the two central banks could lead to a weaker euro and higher European inflation, potentially constraining the ECB’s inclination to act autonomously.

Lane emphasized the importance of monitoring services prices closely to ensure that progress made in curbing inflation is sustained and does not reverse course. Despite overall inflation standing at 2.4% last month, the ECB anticipates fluctuations around this level for the majority of the year, with a projected decline in 2025.

EURO: ECB’s Lane: Increasing Confidence in Inflation Goal

Philip Lane, the Chief Economist of the European Central Bank (ECB), has signaled a growing likelihood of a rate cut by the ECB in June. This confidence is supported by favorable indicators in April’s inflation figures and first-quarter Gross Domestic Product (GDP) data, both of which are moving closer to the ECB’s target inflation rate of 2%. Lane underscored the contrasting inflation trends between the United States and the Euro Area. He reiterated the ECB’s commitment to adjusting borrowing costs accordingly once inflation stabilizes at the desired 2% target in the Euro Area.

EURCAD is moving in Ascending channel and market has reached higher high area of the channel

European Central Bank (ECB) Chief Economist Philip Lane expressed growing confidence in the return of inflation to the ECB’s 2% target, suggesting an increased likelihood of an interest-rate cut in June. Lane’s comments came in an interview with Spanish newspaper El Confidencial, where he highlighted recent euro-area data indicating a potential easing of inflationary pressures in the service sector, marking an essential step toward achieving the inflation goal.

Lane pointed to the April flash estimate for euro-area inflation and the first-quarter GDP number as factors bolstering his confidence in the inflation outlook. He emphasized that while his personal confidence level has improved since the ECB’s April meeting, he acknowledged that more data would arrive before the June meeting, influencing the final decision.

Despite inflation holding steady at 2.4% in the previous month, Lane noted that an underlying measure, excluding volatile items such as energy and food, continued to decline. Additionally, GDP growth in the first quarter exceeded economists’ expectations, indicating a resilient economic performance.

Lane’s remarks suggested that while expectations of an interest-rate cut at the June 6 meeting remain intact, uncertainties linger regarding future monetary policy actions, particularly in light of potential delays to monetary easing in the United States.

Addressing the interconnectedness of global economies, Lane emphasized that while decisions by the Federal Reserve could impact the euro area, the effects would be manageable. He cautioned against overestimating the influence of US economic conditions and interest rates on the euro area, noting the divergent mechanisms at play.

Lane also highlighted the significance of geopolitical tensions, particularly in the Middle East, emphasizing the need for careful analysis and a cautious approach. He stressed the importance of monitoring geopolitical developments, acknowledging the potential long-term impact on global economic dynamics.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/