BTCUSDT: Bitcoin Dips to $63K Amidst U.S. Regulatory Pressure on Crypto Market

The Robin Hood Broker received the Crypto fraud allegations in its company from US Securities and exchange Board. This news created Crypto Brokers fears on Crypto trading and transactions by clients. So Crypto markets Bitcoin moving in the Range bound between $60K-$65K in the market.

Hong Kong introduced Bitcoin ETFS is accessible only for investment for China public people, Already China Government ban on Crypto transactions for Chinese People last year. Crypto ETF launched by Hong Kong is not well move around the public investments due to more restrictions on China Government on Crypto regulations.

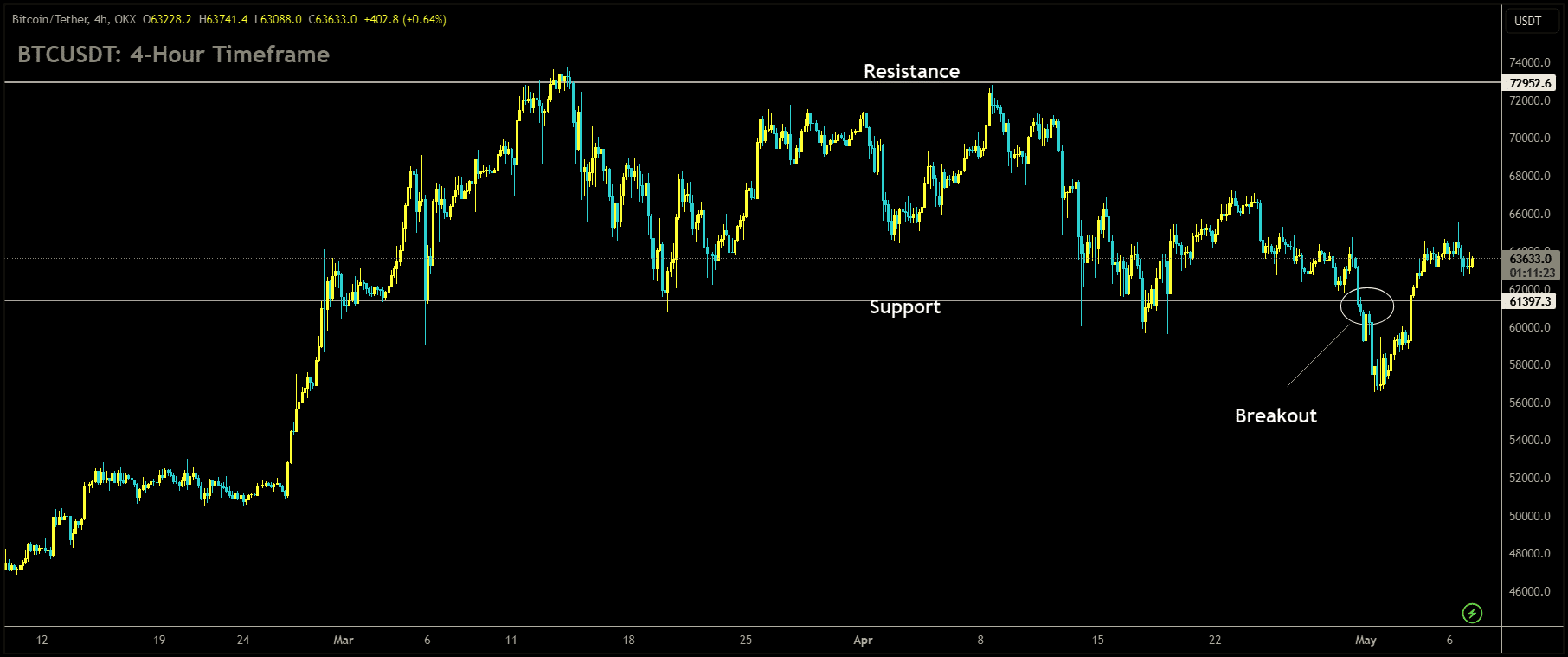

BTCUSDT is moving in box pattern and market has rebounded from the support area of the pattern

Despite a recent rebound, one technical analyst believes that the correction in Bitcoin’s price is not yet complete. They anticipate Bitcoin to decline to the low-mid $50,000 range before rallying to new all-time highs.

The cryptocurrency market experienced mixed performance, with Bitcoin (BTC) slipping by 1.5%, while Solana’s SOL and XRP saw gains among major cryptocurrencies. Robinhood, a popular brokerage platform, revealed that its crypto arm had received a warning from the U.S. Securities and Exchange Commission (SEC), potentially indicating forthcoming regulatory enforcement.

Bitcoin’s price retreated to near $63,300 during U.S. trading hours, reversing an earlier move above $65,000. The pressure intensified after Robinhood’s disclosure about the SEC notice. Despite this setback, most crypto assets remained above last week’s lows. BTC declined by 1.5% over the past 24 hours but remained up over 10% from the previous Wednesday.

Notably, there was renewed demand for Bitcoin call options for September with strike prices of $75,000 and $100,000, indicating increased optimism about Bitcoin’s potential for higher prices in the coming months.

Rumors circulated about broadening access to recently listed Hong Kong spot Bitcoin and Ether ETFs for Chinese investors, potentially impacting the market positively. However, there has been no official communication about changing regulations concerning Chinese investors’ access to crypto ETFs.

BTCUSDT: Robinhood Crypto Gets SEC Warning for Alleged Violations

The Robin Hood Brokerage Firm found itself embroiled in allegations of crypto fraud by the US Securities and Exchange Board. This development has instilled apprehension among crypto brokers regarding trading and transactions conducted by their clients. Consequently, the crypto markets, including Bitcoin, have been fluctuating within a range of $60,000 to $65,000.

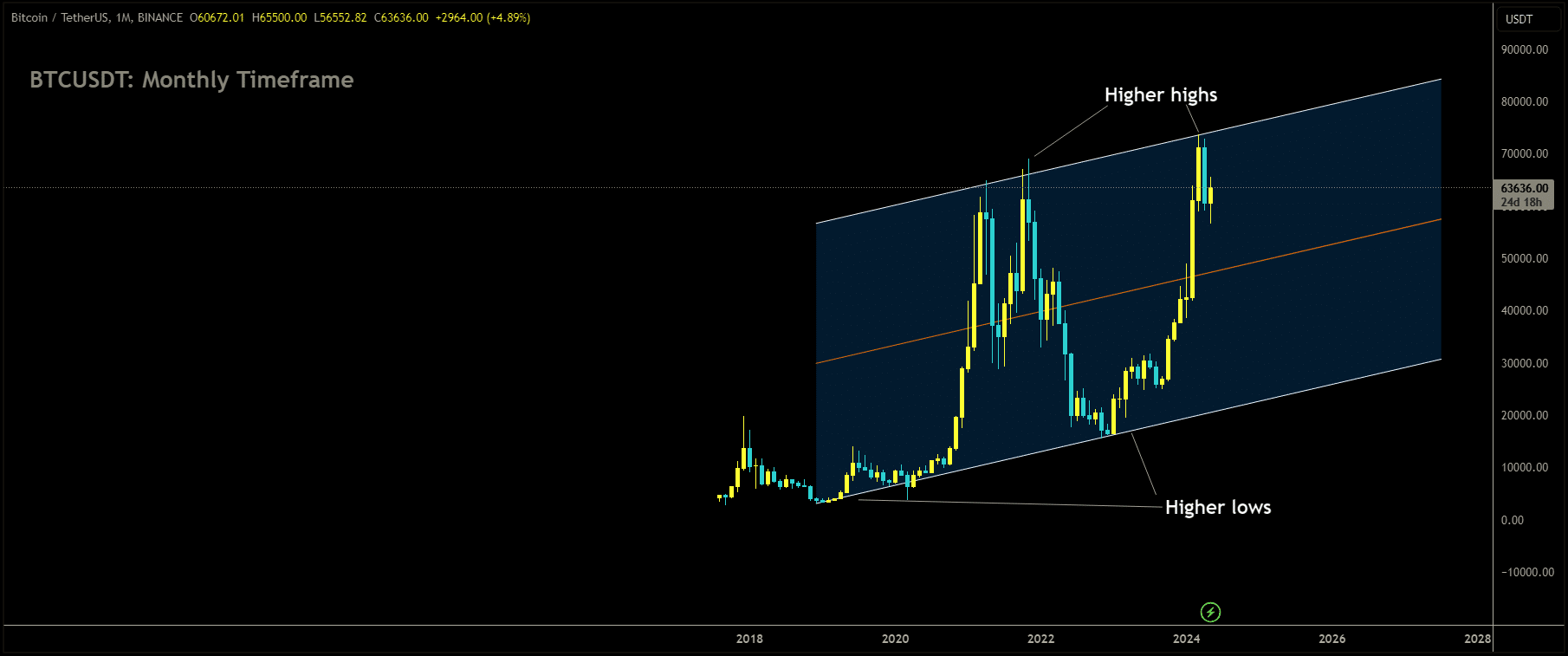

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

In a separate development, Hong Kong has introduced Bitcoin ETFs, but these are only accessible for investment by the Chinese public. However, this move comes amidst existing restrictions imposed by the Chinese government on crypto transactions for its citizens, implemented last year. Consequently, the launch of crypto ETFs in Hong Kong may not garner significant public investment interest due to the stringent crypto regulations imposed by the Chinese government.

Robinhood’s cryptocurrency arm is facing potential trouble with the Securities and Exchange Commission (SEC). In a filing submitted on Saturday, Robinhood disclosed that it received a Wells notice from the SEC’s staff, advising the agency to pursue action against the trading platform for alleged securities violations.

This notice came after Robinhood cooperated with the SEC’s investigative subpoenas regarding its cryptocurrency listings, custody practices, and operational procedures. A Wells notice is a formal letter from the SEC warning a company about potential enforcement action. The SEC’s response could involve various measures such as injunctions, cease-and-desist orders, disgorgement, activity restrictions, and civil penalties.

Coinbase had a similar experience, receiving a Wells notice before the SEC filed a lawsuit against it for alleged securities law violations. Similarly, the SEC sued Binance on comparable grounds, leading to the former CEO, Changpeng Zhao, facing potential imprisonment.

“We firmly believe that the assets listed on our platform are not securities, and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law,” stated Dan Gallagher, Robinhood’s chief legal, compliance, and corporate affairs officer.

In response to SEC lawsuits against other trading platforms, Robinhood had already made the decision to delist certain tokens, including Solana, Polygon, and Cardano. The SEC has previously argued that some cryptocurrencies could be considered securities, necessitating exchanges to register with the SEC. This registration would grant the agency regulatory authority over both the exchanges and the registered tokens.

If Robinhood opts to challenge the potential enforcement action by the SEC, it could face a protracted legal battle. The company’s shares have already experienced a decline in response to this news.

BTCUSDT: Robinhood Faces SEC Action Threat Over Crypto Operations

The Robin Hood Brokerage Firm has been ensnared in allegations of crypto fraud by the US Securities and Exchange Board. This occurrence has sown trepidation among crypto brokers regarding the trading and transactions carried out by their clientele. As a result, the crypto markets, encompassing Bitcoin, have experienced fluctuations within a bracket ranging from $60,000 to $65,000.

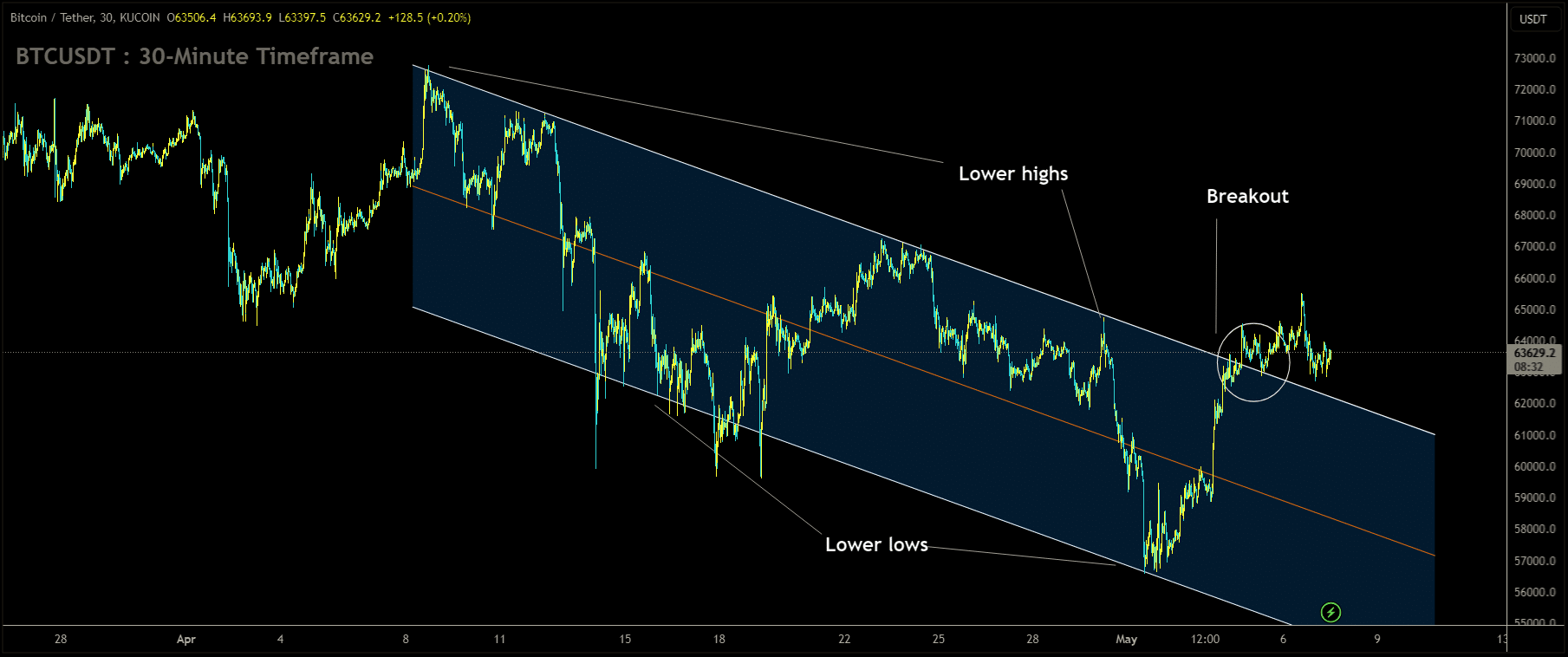

BTCUSDT has broken Descending channel in upside

In a distinct development, Hong Kong has unveiled Bitcoin ETFs, albeit restricted solely to investment by the Chinese populace. However, this unveiling occurs against the backdrop of extant constraints enforced by the Chinese government on crypto transactions for its denizens, which were imposed the previous year. Consequently, the introduction of crypto ETFs in Hong Kong may fail to elicit substantial interest from the public for investment, owing to the stringent crypto regulations promulgated by the Chinese government.

The Securities and Exchange Commission (SEC) is considering taking enforcement action against Robinhood, as revealed by the trading firm itself.

In a filing submitted on Monday, Robinhood disclosed that over the weekend, the regulator issued a warning indicating that upon the completion of its investigation, the company could face charges.

Dan Gallagher, Robinhood’s chief legal, compliance, and corporate affairs officer, expressed disappointment in a blog post, highlighting the firm’s efforts over the years to collaborate with the SEC for regulatory clarity. He emphasized that Robinhood firmly believes the assets listed on its platform are not securities and expressed readiness to engage with the SEC to demonstrate the weakness of any potential case against Robinhood Crypto, both factually and legally.

Initially, shares of Robinhood fell by 2% but later rebounded, currently trading up by 1%.

In February, Robinhood had disclosed receiving subpoenas from the SEC related to its crypto business, specifically regarding its cryptocurrency listings, custody practices, and platform operations. According to the filing on Monday, the SEC has now found reason to suggest that Robinhood may have violated securities laws.

The filing stated, received a ‘Wells Notice’ from the Staff of the SEC … stating that the Staff has advised RHC that it made a ‘preliminary determination’ to recommend that the SEC file an enforcement action against RHC alleging violations of Sections 15(a) and 17A of the Securities Exchange Act of 1934, as amended.

The potential enforcement action may involve various measures, including civil injunctive action, public administrative proceedings, and/or cease-and-desist proceedings, with possible remedies such as injunctions, cease-and-desist orders, disgorgement, pre-judgment interest, civil money penalties, and censure, revocation, and limitations on activities.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/