ENA: Ethena’s ENA Surges 8% on Bybit’s Endorsement of USDe Token for Derivatives Trading

The ETHENA Decentralised Finance Protocol token ENA is used as collateral for Derivatives trading in the Bybit exchange. The Bybit Exchange announced this system in order to joined the Centralised and Decentralised Finance in the crypto system. ENA Token surged 8% after the move of Bybit exchange.

Ethena, a prominent decentralized finance (DeFi) protocol, saw a significant surge in the price of its governance token, ENA, on Tuesday following the announcement of integration with crypto exchange Bybit. Bybit’s decision to incorporate Ethena’s USDe “synthetic dollar” for various trading activities expanded the utility of the token within the crypto ecosystem.

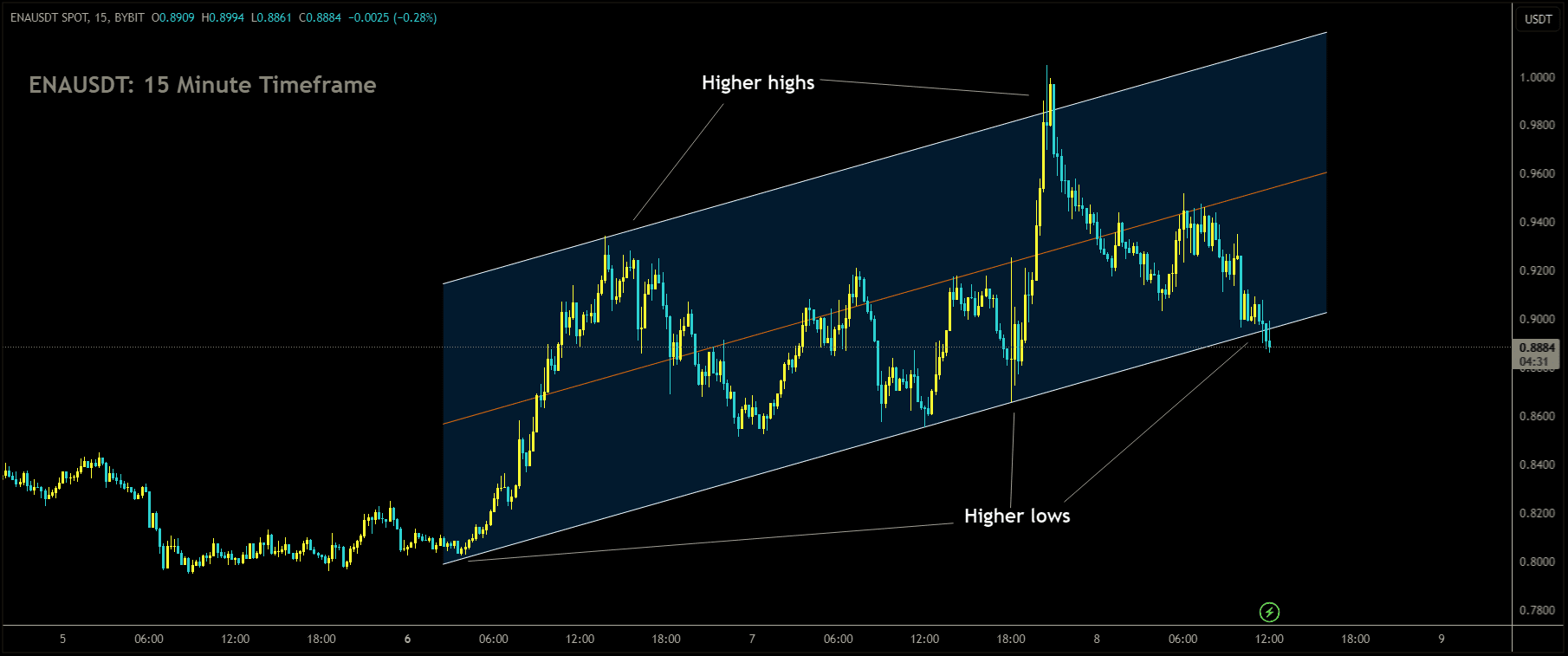

ENAUSDT Market price is moving in Ascending channel and market has reached higher low area of the channel

According to a press release, Bybit included USDe as a collateral asset for perpetual futures trading with leverage, and also introduced spot trading pairs for bitcoin (BTC) and ether (ETH) against the USDe token.

CoinGecko data reveals that ENA reached its highest price in two weeks, peaking at $0.96, before experiencing a slight retracement. Nevertheless, the token remained up by more than 8% over the past 24 hours, outperforming the relatively stagnant broader crypto market benchmark, the CoinDesk 20 Index (CD20).

Bybit’s decision to accept USDe as a collateral asset was seen as a significant development by industry experts. Joshua Lim, co-founder of derivatives dealer company Arbelos, highlighted that this integration further solidifies Ethena’s role as a bridge between centralized finance (CeFi) and decentralized finance (DeFi). Lim emphasized that this addition reduces risk for perpetual traders, as USDe inherently carries an embedded short position.

Ethena has garnered attention in the crypto space this year, emerging as one of the fastest-growing DeFi protocols. Its tokenized yield-generating investment offering has attracted over $2 billion in deposits, although it has also faced scrutiny from market observers wary of risks following the crypto implosions of the bear market.

The USDe token, often referred to as a “synthetic dollar,” is a structured finance product encapsulated within a token. It offers consistent yields to investors by utilizing ETH liquid staking derivatives, such as Lido’s stETH, as backing assets. These assets are paired with an equivalent value of short ETH perpetual futures positions on derivatives exchanges to maintain a stable price of $1. This strategy, known as a “cash and carry” trade, leverages derivatives funding rates to generate yield.

Recently, Ethena expanded its backing assets to include BTC and launched its governance token, ENA, further enhancing its ecosystem and utility within the DeFi space.

ENA: Bybit Integrates Ethena Labs’ USDe as Collateral and BTC/ETH Trading Pairs

The ETHENA Decentralized Finance (DeFi) Protocol’s native token, ENA, has been integrated as collateral for derivatives trading on the Bybit exchange. This integration signifies a significant development in the crypto space, as it bridges the gap between Centralized Finance (CeFi) and Decentralized Finance (DeFi) within the cryptocurrency ecosystem. Bybit’s decision to incorporate ENA as collateral aims to offer users enhanced flexibility and accessibility in trading derivatives while leveraging the benefits of decentralized protocols.

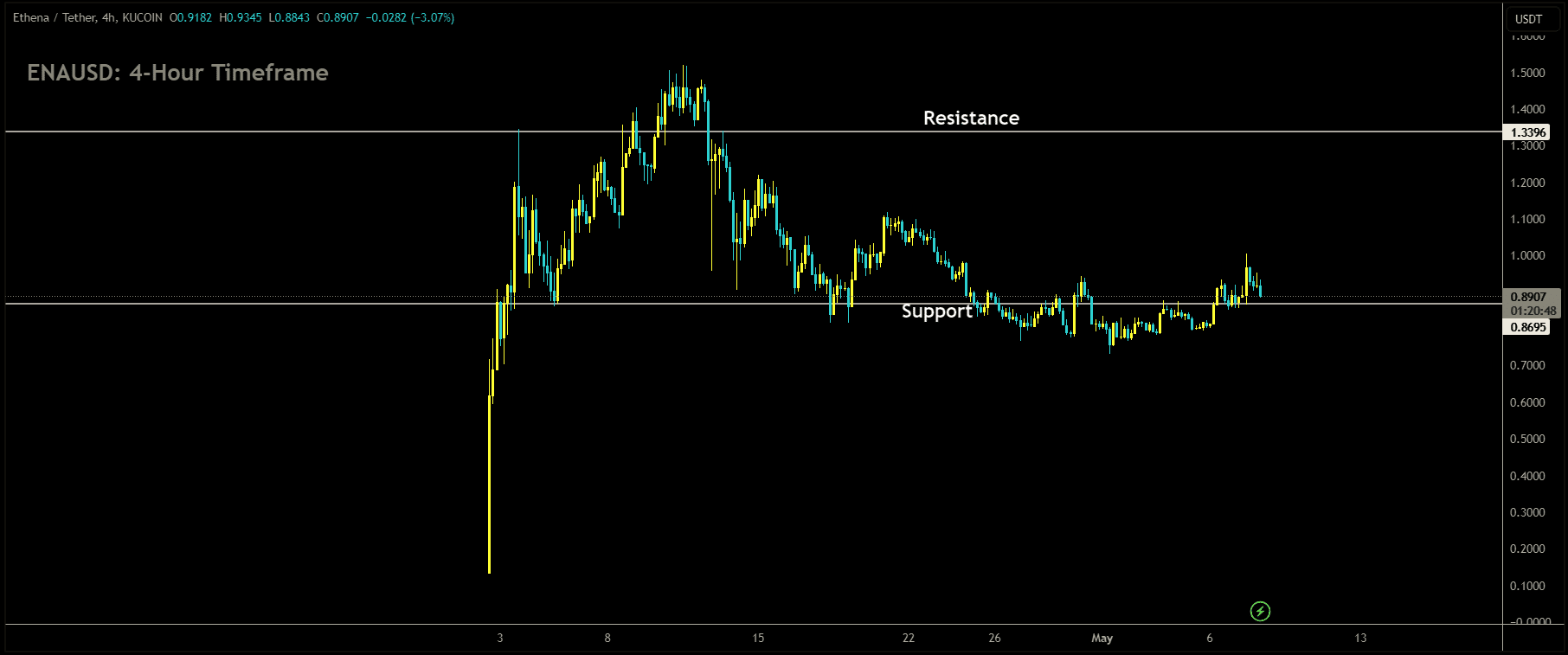

ENAUSD Market price is moving in box pattern and market has reached support area of the pattern

The announcement of this integration by the Bybit Exchange has sparked notable excitement and interest within the crypto community. This move underscores Bybit’s commitment to providing innovative solutions and expanding its offerings to cater to the evolving needs of traders in the crypto market.

As a result of Bybit’s proactive approach towards embracing DeFi principles and integrating ENA as collateral, the ENA token witnessed a remarkable surge of 8%. This surge in ENA’s value highlights the market’s positive response to Bybit’s initiative and reinforces the potential of decentralized protocols to revolutionize traditional financial systems.

Ethena recently unveiled a strategic collaboration with cryptocurrency exchange Bybit, marking a significant milestone in the crypto landscape. This partnership entails the integration of Ethena’s USDe as a collateral asset for trading perpetual futures across all assets within Bybit’s Unified Trading Account (UTA). This integration holds the promise of empowering users with the potential to earn yield and unlock enhanced capital efficiency.

Moreover, as part of this integration, Bybit will introduce bitcoin and ether spot trading pairs paired with USDe, offering traders additional flexibility and opportunities within the platform.

In addition to facilitating trading activities, USDe will also debut on Bybit’s Earn platform, enabling users to utilize their synthetic dollars for Bybit launchpool farming, thereby expanding the utility and accessibility of the USDe stablecoin within the Bybit ecosystem.

Commenting on this collaboration, Guy Young, CEO and founder of Ethena Labs, expressed enthusiasm about the prospects of USDe within Bybit’s ecosystem. He remarked, “Ethena’s integration with Bybit is a significant step in driving use cases for USDe.” He further emphasized the potential of offering USDe as collateral on Bybit, one of the premier derivative venues in the crypto space, to catalyze the next phase of growth for USDe. This move is poised to challenge the existing stablecoin dominance by providing a tailored product specifically designed for crypto-native users.

USDe, billed as “the first-ever scalable synthetic dollar,” is a stablecoin supported by Ethena Labs. Notably, last month, Ethena Labs expanded the backing assets for USDe by including bitcoin, further enhancing the stability and resilience of the synthetic dollar. Additionally, the organization conducted an airdrop of its governance token, ENA, to eligible users, underscoring its commitment to fostering community engagement and participation.

ENA: Ethena Partners with Bybit: USDe Added as Collateral

In the ever-evolving landscape of cryptocurrency, the ETHENA Decentralized Finance (DeFi) Protocol has made a groundbreaking stride. Their native token, ENA, now serves as collateral for derivatives trading on the renowned Bybit exchange. This integration signifies a pivotal moment, bridging the chasm between Centralized Finance (CeFi) and the decentralized realm of DeFi within the cryptocurrency domain. By incorporating ENA as collateral, Bybit endeavors to provide users with heightened flexibility and accessibility in their derivative trading endeavors, all while harnessing the transformative power of decentralized protocols.

The announcement of this integration has ignited a fervent buzz within the crypto community, underscoring Bybit’s unwavering dedication to innovation and adaptation to meet the dynamic demands of traders. Bybit’s proactive embrace of DeFi principles through the inclusion of ENA as collateral has garnered widespread acclaim. This move exemplifies Bybit’s commitment to pioneering solutions and broadening its array of offerings to cater to the ever-shifting landscape of the crypto market.

The market response to Bybit’s initiative has been nothing short of remarkable. The ENA token experienced a notable surge of 8%, indicative of the market’s enthusiasm for this groundbreaking integration. This surge underscores the burgeoning potential of decentralized protocols to revolutionize conventional financial systems. Bybit’s strategic move has not only captured the attention of traders but has also validated the transformative impact of DeFi principles in reshaping the cryptocurrency ecosystem.

Today, synthetic stablecoin startup Ethena Labs has unveiled a significant integration with the popular cryptocurrency exchange, Bybit. This integration entails the addition of Ethena’s USDe token as a collateral asset on the Bybit platform, marking a notable expansion of utility for the token within the crypto ecosystem.

The incorporation of USDe support on Bybit presents users with the opportunity to engage in perpetual trading while potentially earning yield on the Ethena platform, currently offering an attractive yield of 15.3%. Additionally, Bybit users will benefit from zero-fee trading on bitcoin and ether spot trades, further enhancing their trading experience on the platform. Moreover, Bybit will integrate the USDe token into its Earn platform, providing users with additional avenues to utilize and earn rewards through the token.

Following the announcement of this integration, Ethena’s native token, ENA, experienced a modest increase in value. As of now, ENA has seen a 1.5% uptick, reaching $0.97, with a market capitalization of $1.3 billion. Notably, Ethena initiated a strategic “Sats Campaign” alongside the launch, which saw a 5% airdrop of ENA’s total supply to early adopters, resulting in a remarkable $1 billion market cap on the first day of the project.

The integration of USDe on Bybit adds fuel to the ongoing competition in the stablecoin arena, particularly as other players like PayPal and Ripple enter the fray with their respective stablecoin offerings. Ethena aims to emulate the success of leading stablecoins such as USDT and USDC, which collectively dominate over 90% of the $160 billion stablecoin market capitalization.

Bybit’s stature within the cryptocurrency exchange landscape further amplifies the significance of this integration for the broader crypto ecosystem. With impressive trading volumes, monthly visits, and a top trust score on CoinGecko, Bybit’s adoption of USDe underscores its potential to drive further adoption and liquidity for the token.

Ethena’s ecosystem has witnessed substantial growth since its controversial launch in mid-February 2024. The integration of USDe as a synthetic stablecoin, backed by staked ETH on Lido and hedged with short ETH positions on centralized exchanges, has propelled the token’s ascent in the stablecoin rankings. Despite fluctuations in market cap, USDe continues to solidify its position among the top stablecoins, further supported by the recent addition of bitcoin as a collateral asset, enhancing its scalability and utility within the crypto market.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/