BTCUSDT: House votes to overturn SEC crypto policy; President Biden threatens veto

The SAB 121 Bulletin is willing to pass by House of Representatives on today and US President Joe Biden is unwilling to pass this Bulletin. The members of Houses said SEC Crypto accounting policies are danger and they are surpassing Banks regulations and they do with own accouting and regualtions. This will harmful for customers using crypto assets than Banks using transactions.

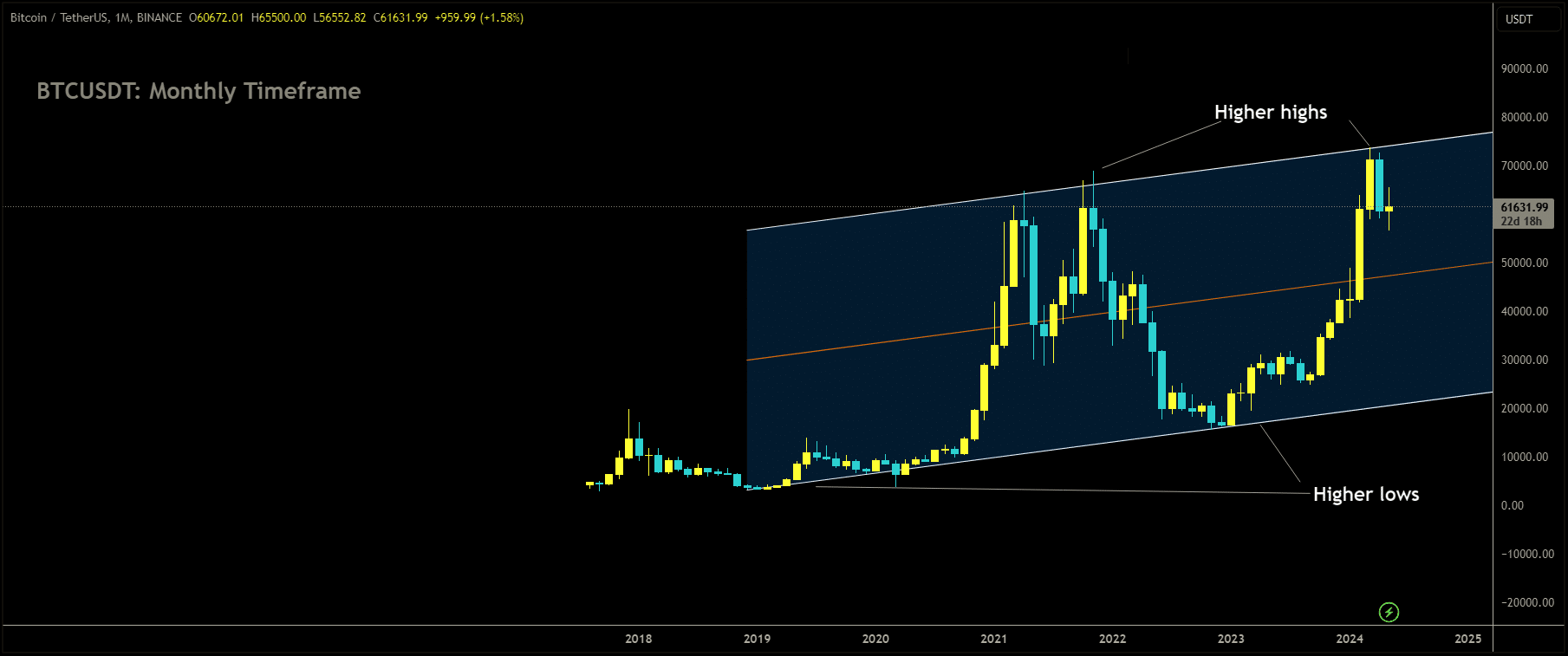

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

SEC’s Head Gary Gensler recently make more Digital assets Custody without using Banks accounting approvals. Without Banks, none other than maintaining the traditional assets of Customers like Digital Crypto asset management. Inperson Guidance is more important than Online custody of Customer assets.

US President Joe Biden is clearly opposing the matter and House of representatives who stands against SEC’s Crypto accounting proposals. This news is favour for Crypto assets in the US if Bill not signed by US President Joe Biden.

The U.S. House of Representatives initiated a formal process on Wednesday to overturn the Securities and Exchange Commission’s (SEC) contentious accounting policy regarding cryptocurrency custody. This policy, known as Staff Accounting Bulletin No. 121 (SAB 121), has faced criticism from the digital assets industry and Republican lawmakers since its introduction. SAB 121 aims to provide clarity on the accounting treatment of crypto assets, requiring banks to hold customers’ digital tokens on their own balance sheets, potentially incurring significant capital expenses.

Rep. Mike Flood (R-Neb.), the sponsor of the resolution, criticized SEC Chair Gary Gensler for using accounting guidance to restrict large publicly traded banks from custodying digital assets without consulting banking regulators. The House vote on the resolution went against the SEC’s policy, with support from 21 Democrats despite President Joe Biden’s promise to veto the resolution if it reaches his desk.

President Biden expressed his support for the SEC’s policy, citing concerns about technological, legal, and regulatory risks that could harm consumers. However, critics argue that the SEC’s approach deviated from traditional banking regulations and undermined the rulemaking process.

Rep. Patrick McHenry (R-N.C.) denounced SAB 121 on the House floor, emphasizing its departure from established banking practices. Conversely, Rep. Maxine Waters (D-Calif.), the ranking Democrat on the House Financial Services Committee, cautioned against overturning the policy entirely, suggesting that some aspects, such as crypto disclosures, are necessary and could be threatened by the resolution.

The resolution to disapprove of the SEC’s guidance was introduced by Rep. Flood alongside two Democrats. Sen. Cynthia Lummis (R-Wyo.) is advocating for a similar resolution in the Senate. If passed, the resolution would not only nullify SAB 121 but also prevent similar policies from being implemented in the future.

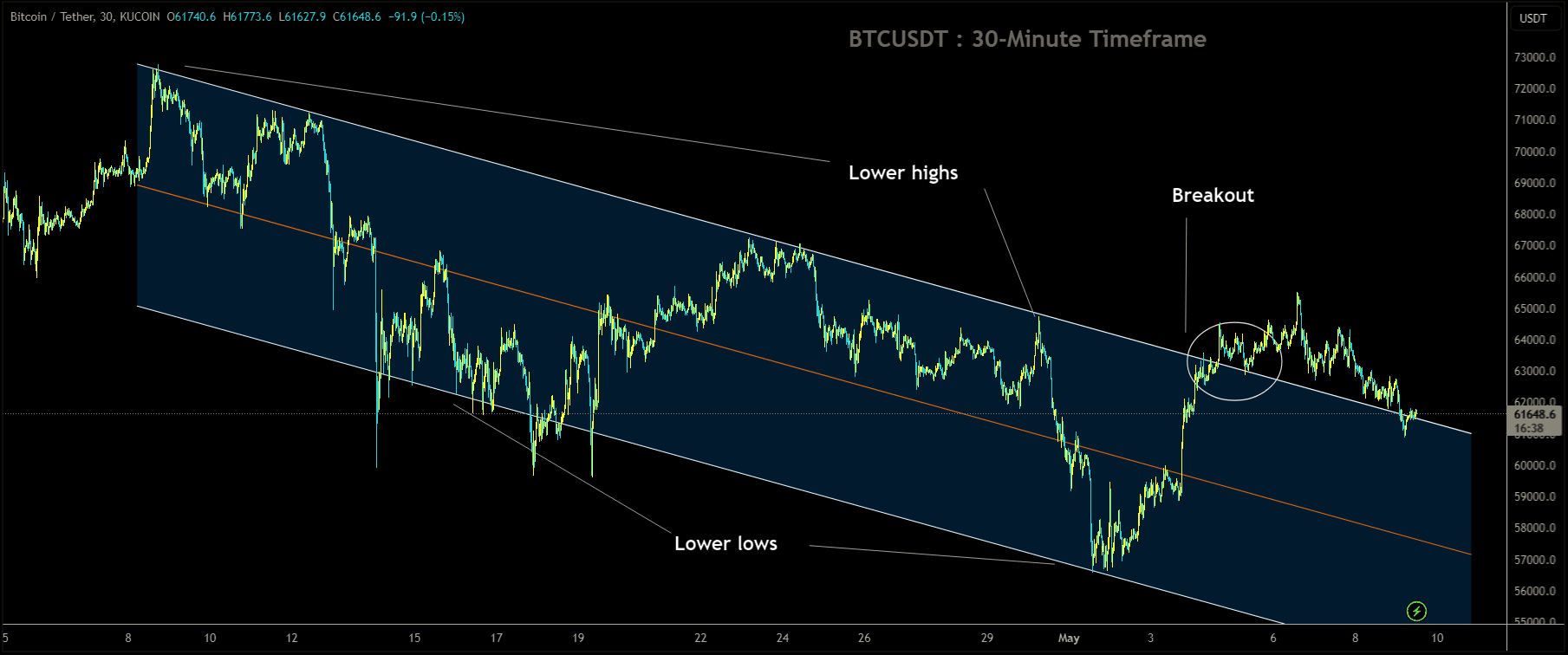

BTCUSDT has broken Descending channel in upside

President Biden expressed concerns about the potential consequences of overturning the SEC’s policy, warning that it could limit the agency’s ability to regulate crypto-assets effectively and maintain financial stability. Despite Biden’s opposition, Rep. Flood remains determined to pursue avenues to challenge the SEC’s policy through legislative means.

BTCUSDT: House votes to overturn SEC’s crypto custody guidance

Today, the House of Representatives is poised to pass the SAB 121 Bulletin, despite opposition from US President Joe Biden. Members of the House argue that the Securities and Exchange Commission’s (SEC) cryptocurrency accounting policies pose a threat, as they circumvent banking regulations and impose their own accounting and regulatory standards. This deviation from traditional banking practices could potentially harm customers using crypto assets for transactions, as it removes the oversight provided by banks.

SEC Chair Gary Gensler has recently expanded digital assets custody without seeking approval from banks, bypassing traditional channels for managing customer assets. Members of the House emphasize the importance of in-person guidance and oversight in managing customer assets, particularly in the realm of digital crypto asset management.

President Biden has voiced clear opposition to the SEC’s crypto accounting proposals, aligning himself with the House members who stand against them. If the bill is not signed by President Biden, it would be a favorable outcome for crypto assets in the US, as it would prevent the implementation of the SEC’s controversial policies.

On Wednesday evening, House lawmakers made a decisive move to overturn a Securities and Exchange Commission (SEC) staff bulletin pertaining to the accounting of digital asset custody. Notably, 21 Democrats joined the vote in favor of the repeal, reflecting a bipartisan concern over the contentious bulletin.

SAB 121, as the bulletin is formally known, has emerged as a focal point of contention, drawing criticism from both crypto firms and major banks alike. The guidance memo instructs custodians of digital assets to record them as a liability on their balance sheets, a directive that opponents argue could impede banks’ expansion into the crypto sector by imposing burdensome capital requirements.

The significance of this issue has heightened with the recent approval of 11 spot bitcoin funds, raising concerns among traditional Wall Street banks about their ability to effectively serve as custodians for these funds on a large scale.

Introduced in February by Representatives Mike Flood and Wiley Nickel, the resolution to repeal SAB 121 contends that the SEC overstepped its authority by effectively creating a rule without undergoing the requisite notice and comment process. Senator Cynthia Lummis (R-Wyo.) introduced a complementary measure in the Senate, underscoring the bipartisan pushback against the SEC’s guidance.

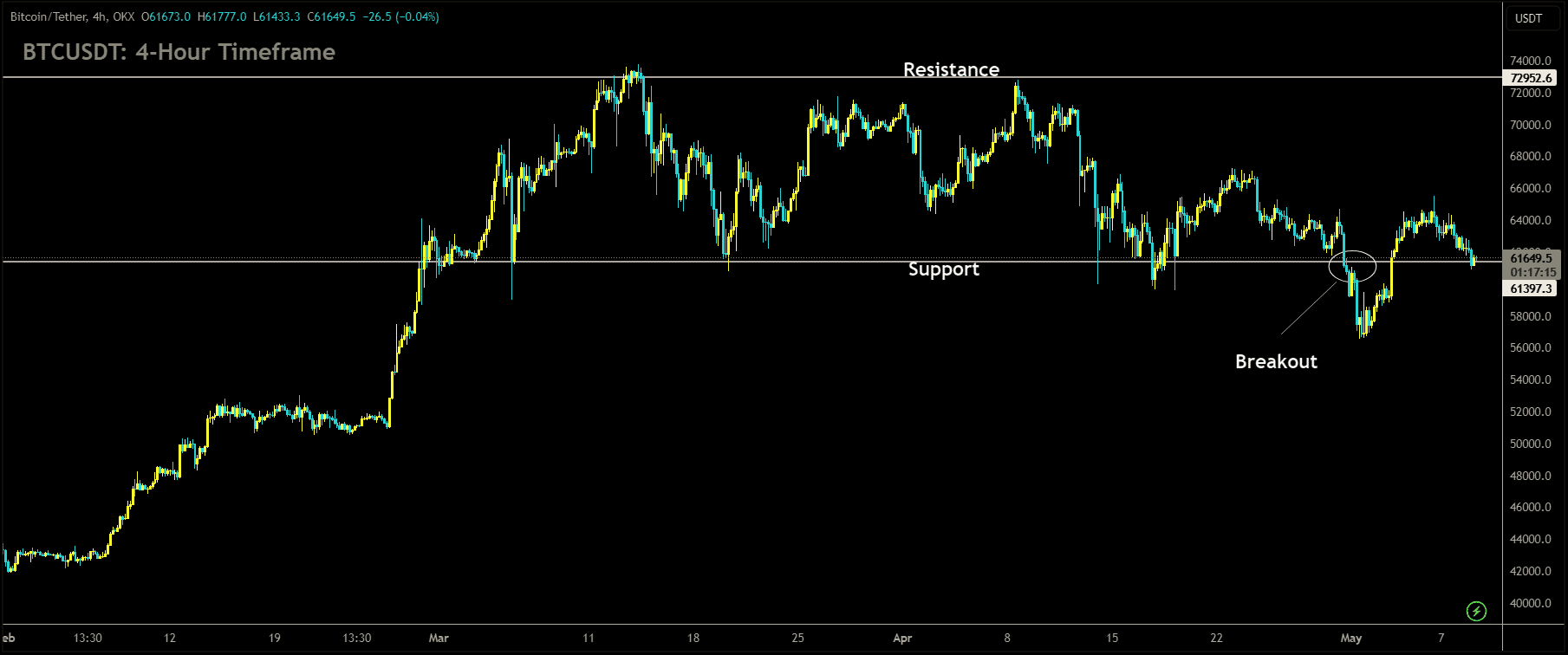

BTCUSDT is moving in box pattern and market has reached support area of the pattern

SEC Chair Gary Gensler has staunchly defended SAB 121, despite a Government Accountability Office (GAO) report characterizing the memo as a rule subject to the Congressional Review Act (CRA).

The resolution will now advance to the Senate, where it is anticipated to receive significant support from Republicans. This move underscores the growing momentum behind efforts to challenge the SEC’s approach to crypto custody regulation.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/