NZD: NZ Finance Minister Willis: Govt Faces Economic Challenges

The NZ Finance Minister Nicola Willis said to pre- Budget speech as Tax relief package is added in this Budget and it is really benefit for 93% of House holds and 83% of Age group 15 people. NZ Government is more struggling in this Budget and it is not expensive budget this year and it is very Tight Budget due to NZ economy is doing tougher than the past. Higher rates environment makes income to Government less and Business paying lower taxes to the Government due to demand lower from the Public.

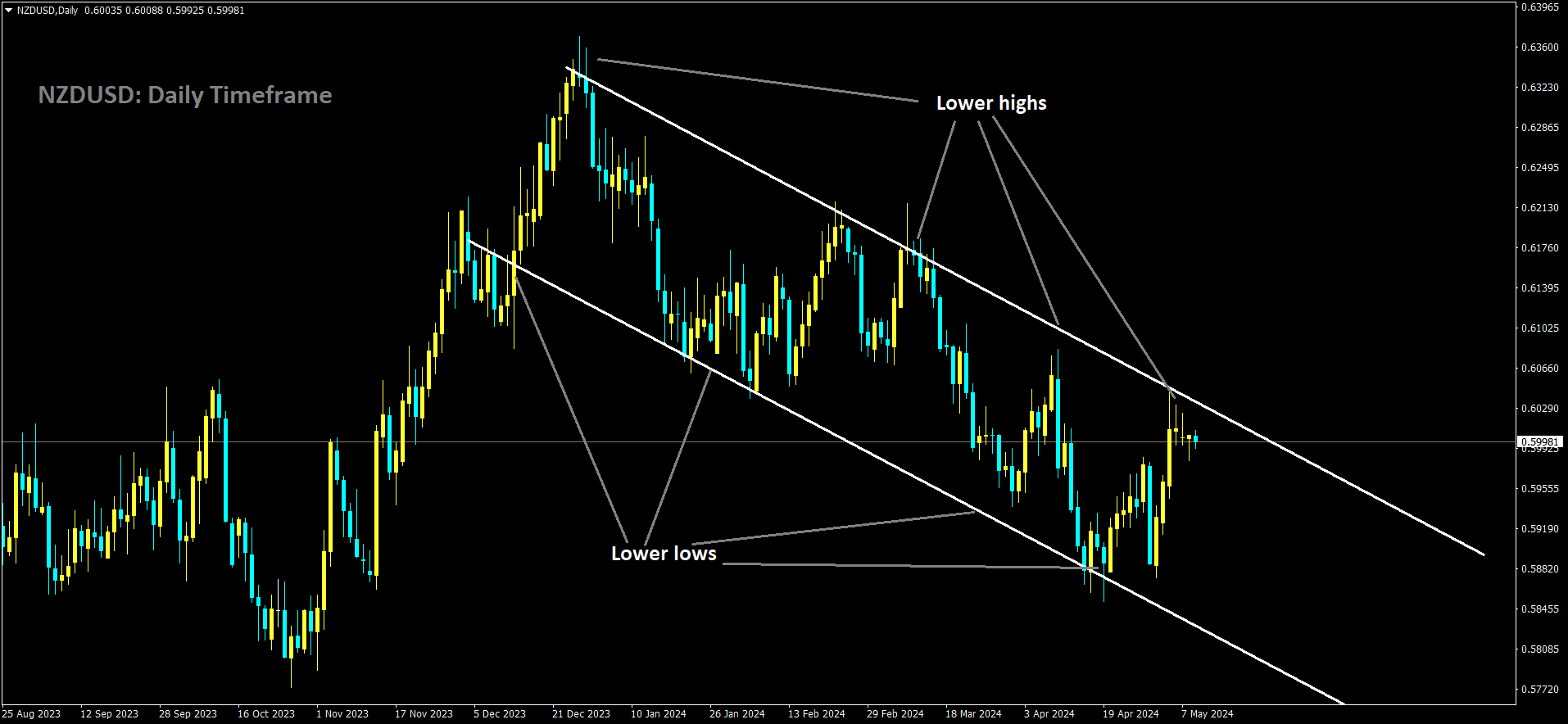

NZDUSD is moving in Descending channel and market has reached lower high area of the channel

In anticipation of the Pacific market session on Thursday, New Zealand’s Finance Minister Nicola Willis provided briefing points concerning the latest budget updates for New Zealand. Minister Willis emphasized that the economic condition of New Zealand is progressively worsening, creating considerable strain on both the populace and the operational capacities of the New Zealand government.

Key Highlights:

- The economic challenges are significantly impacting government finances.

- Projections for economic growth are continuously deteriorating.

- The upcoming budget will prioritize fiscal restraint over extravagant spending, avoiding austerity measures.

- Tax relief measures will be substantial, though within modest bounds.

- Assurances were given that tax cuts will not contribute to inflationary pressures.

NZD: Budget 2024: Tax Relief Changes Confirmed by Finance Minister Nicola Willis, Amount Uncertain

In her pre-Budget speech, New Zealand’s Finance Minister, Nicola Willis, highlighted the inclusion of a tax relief package in the upcoming Budget, emphasizing its significance for the vast majority of New Zealand households and individuals. Willis revealed that this package is poised to benefit 93% of households and 83% of individuals aged 15 and above, signifying a substantial relief for a significant portion of the population.

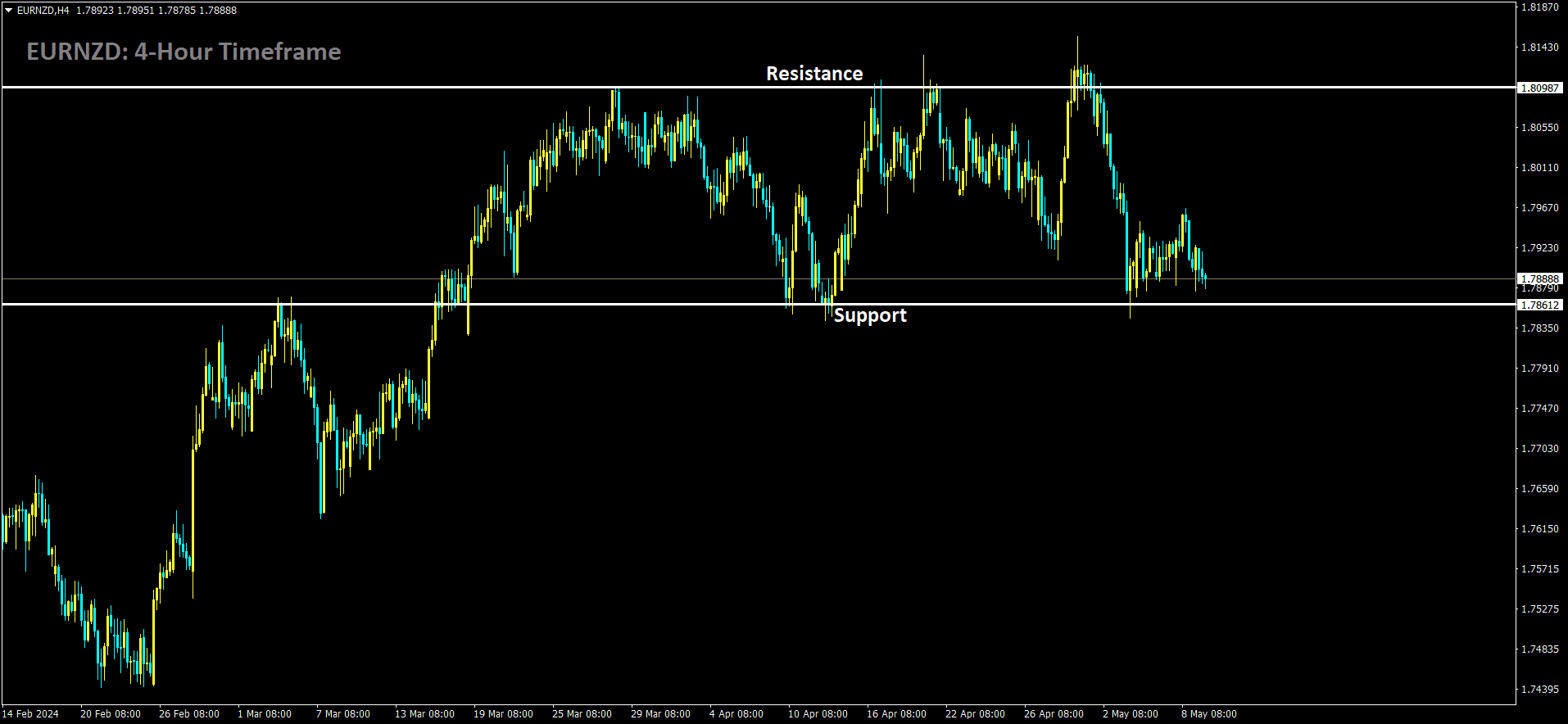

EURNZD is moving in box pattern and market has reached support area of the pattern

However, Willis acknowledged the formidable challenges facing the New Zealand government in crafting this Budget, characterizing the current economic climate as particularly arduous. With the economy experiencing heightened pressures and constraints, Willis stressed the necessity of exercising fiscal restraint and prudence. Unlike previous years, this Budget is not expected to be characterized by lavish spending, reflecting the tight fiscal environment and the need for judicious allocation of resources.

One of the primary factors contributing to the financial strain on the government is the challenging revenue landscape. The prevailing high-interest-rate environment has dampened consumer demand, leading to lower tax revenues for the government. Additionally, businesses are facing reduced profitability, resulting in decreased tax contributions to the government coffers.

Given these circumstances, the government finds itself grappling with diminished income streams while simultaneously facing heightened demands for public services and interventions. Consequently, Willis emphasized the imperative of crafting a Budget that strikes a delicate balance between addressing pressing needs and ensuring fiscal sustainability.

In essence, Willis’s remarks underscore the formidable challenges confronting the New Zealand government in formulating the upcoming Budget. Despite the daunting economic conditions, the government remains committed to delivering meaningful relief to its citizens while navigating the complexities of the current fiscal landscape.

Finance Minister Nicola Willis has made assurances that a significant portion of New Zealand’s population will benefit from tax relief measures set to be introduced in the upcoming Budget. In her inaugural pre-Budget address, Willis disclosed that adjustments to income tax thresholds would be included in the Budget, although the precise figures were not revealed. The National Party campaigned on raising tax thresholds by 11.5% to counteract inflation since the last adjustment in 2010.

Willis announced, “I’m very pleased to announce today that our tax relief package will increase the take-home income of 83% of New Zealanders over the age of 15 and 94% of households.” She emphasized responsible fiscal management, affirming that tax reductions for low and middle-income families would be fully funded through a combination of prudent savings and targeted revenue measures.

The remaining 17% of individuals over 15 years old in New Zealand, who do not pay traditional income tax due to being on benefits or exempt, were also acknowledged.

Typically, Finance Ministers deliver pre-Budget speeches throughout May, offering insights into the forthcoming Budget. Willis broke tradition by delivering her speech to the Hutt Valley Chamber of Commerce, marking the first time in 14 years that a Finance Minister’s first pre-Budget speech was held outside central Wellington.

The clarity provided by Willis comes after prolonged speculation regarding the economic outlook and potential shifts in tax policies. Instead of embarking on austerity measures, Willis pledged a balanced approach, involving spending cuts, new revenue sources, tax cuts, and new expenditures.

She assured that the proposed changes would not fuel inflation and would be financed through new revenue streams and reprioritization within the operating allowance, which is less than $3.5 billion. Willis referenced new Treasury modeling supporting the notion that fiscally neutral tax relief would not contribute to inflationary pressures.

In addition to tax relief measures, Willis announced the re-establishment of a stand-alone Social Investment Agency and the creation of a Social Investment Fund aimed at directly addressing the needs of vulnerable New Zealanders. These initiatives are part of a broader strategy to strengthen social investment across government agencies, with the aim of achieving better outcomes and measurable progress.

NZD: “Nicola Willis Rejects Austerity Budget: ‘Darkest Before the Dawn'”

In her address preceding the budget announcement, Finance Minister Nicola Willis of New Zealand articulated the pivotal inclusion of a tax relief package within the forthcoming budgetary framework. Willis underscored the profound impact of this package, noting its potential to extend beneficial outcomes to a vast majority of New Zealand’s households, encompassing approximately 93% of all households, as well as to a substantial demographic segment comprising 83% of individuals aged 15 and above. Such a comprehensive relief initiative signifies a significant stride towards alleviating financial burdens for a considerable portion of the nation’s populace.

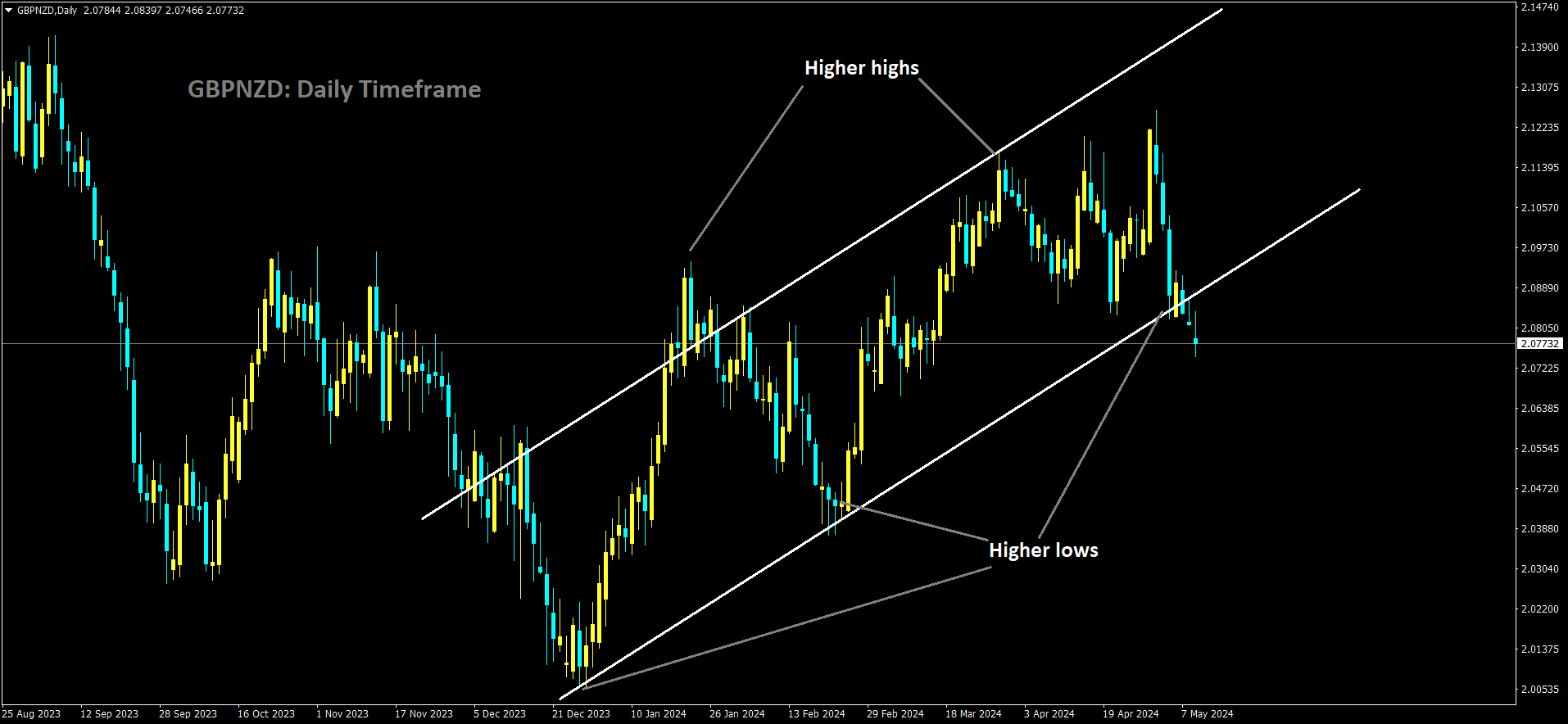

GBPNZD is moving in Ascending channel and market has reached higher low area of the channel

However, against the backdrop of formidable economic challenges, Willis candidly acknowledged the strenuous terrain that the New Zealand government currently confronts in delineating the contours of the upcoming budgetary plan. With the economic milieu marked by an array of exigencies and constraints, Willis espoused the imperative of exercising prudent fiscal stewardship. Unlike previous budgetary cycles characterized by profligate spending tendencies, the prevailing fiscal milieu necessitates a departure towards a more conservative approach, underpinned by a judicious deployment of financial resources.

Central to the government’s fiscal predicament is the conundrum posed by the revenue landscape, which is beset by a plethora of challenges. The prevailing environment of elevated interest rates has engendered a dampening effect on consumer demand, thereby precipitating a discernible downturn in tax revenues accruing to the government. Concurrently, businesses contend with diminished profit margins, translating into a commensurate reduction in tax contributions remitted to governmental coffers.

Against the backdrop of diminished revenue streams, the government is compelled to contend with a concomitant escalation in demand for public services and interventions. In light of these exigencies, Willis stressed the imperatives of crafting a budgetary blueprint that strikes an equitable balance between the imperatives of addressing pressing societal needs and safeguarding the tenets of fiscal sustainability.

In essence, Willis’s address portends the formidable challenges that loom large on the horizon as the New Zealand government embarks on the momentous task of formulating the forthcoming budget. Despite the daunting contours of the economic landscape, the government remains resolute in its commitment to furnishing meaningful relief to its citizenry, all while navigating the intricate labyrinth of fiscal constraints and exigencies that define the contemporary milieu.

Nicola Willis, amidst the country’s economic challenges, has categorically dismissed the notion of implementing an austerity Budget, asserting that New Zealand is currently at a pivotal moment of “darkest before the dawn.” In a significant address delivered on Thursday, the Finance Minister underscored that her inaugural Budget would depart from previous practices, ensuring that it does not merely espouse good intentions but tangibly delivers results.

Recognizing the importance of fiscal prudence, Willis clarified that while her Budget wouldn’t be characterized by lavish spending, it also wouldn’t adopt the austere measures suggested by some commentators. She emphasized the adverse consequences of abandoning long-overdue tax relief, slashing investments in public services, and scaling back ambitions for economic growth, stressing that such actions would adversely affect families and businesses alike.

Instead, Willis pledged a balanced and responsible Budget, charting a middle course that addresses pressing needs while ensuring financial sustainability. As part of this vision, she announced the establishment of a new Social Investment Fund, intended to leverage data and evidence to provide more effective support for vulnerable segments of the population.

Highlighting the need for efficiency and effectiveness in public spending, Willis expressed concern over the discrepancy between the substantial expenditure on social services and the lack of commensurate outcomes. The proposed Social Investment Fund, set to replace the existing Social Wellbeing Agency, aims to address this gap through collaboration with community organizations and iwi providers.

Regarding tax relief, Willis confirmed the government’s commitment to delivering lower taxes for low and middle-income families, with 83% of individuals over 15 and 94% of households expected to benefit. She assured that these tax reductions would be financed through a combination of careful savings and targeted revenue measures, ensuring fiscal responsibility.

In terms of fiscal discipline, Willis disclosed that the government had set an operating allowance of less than $3.5 billion for the Budget, a significant constraint necessitated by the economic challenges. However, she affirmed that this limitation would be adhered to, underscoring the government’s commitment to redirect existing spending towards more beneficial purposes.

Despite the challenging economic climate characterized by high inflation, soaring interest rates, and sluggish growth, Willis reiterated the government’s determination to address pressing issues such as the cost of living, fairer taxation, and improving the efficiency of public spending. She promised significant funding boosts for health and essential frontline services, reflecting the government’s overarching goal of fostering a stronger and more productive economy.

In response to questions, Willis emphasized the importance of fulfilling promises made to the public, particularly regarding tax cuts. She also emphasized the need for diversifying exports, supporting the agricultural sector, and enhancing productivity through improvements in education standards, infrastructure, and regulatory frameworks.

Regarding the newly announced Social Investment Agency, Willis emphasized its focus on personalized and effective service delivery, aiming to ensure that government interventions are genuinely beneficial for the recipients. She acknowledged the challenges faced by some government agencies in meeting spending reduction targets, citing examples such as the police, where concerns about potential cuts to frontline services warranted careful consideration.

In summary, Willis’s address outlined a comprehensive vision for the upcoming Budget, emphasizing fiscal responsibility, targeted interventions, and a commitment to delivering tangible benefits for New Zealanders amidst economic uncertainty.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/