CHF: USD/CHF holds firm above 0.9050 as USD strength persists

The Switzerland data of SECO Consumer climate came at -38.1 in April month from 38.0 printed in the March month and -40.0 as expected. The Swiss central bank announced CHF 720 billion in Foreign reserves, and it is a fifth consecutive rise in the reserves. Swiss Franc little stronger against counter pairs after the news came.

USD/CHF continues its upward trajectory, marking a second consecutive session of gains and hovering around 0.9070 during the European trading session on Monday. The resilience of the US Dollar contributes to the firmness of the pair, fueled by the prevailing hawkish sentiment surrounding the Federal Reserve (Fed). The Fed’s stance favors maintaining higher interest rates for an extended duration, bolstering the USD/CHF pair. This sentiment gains further support from the cautious remarks made by Federal Reserve officials regarding potential interest rate cuts.

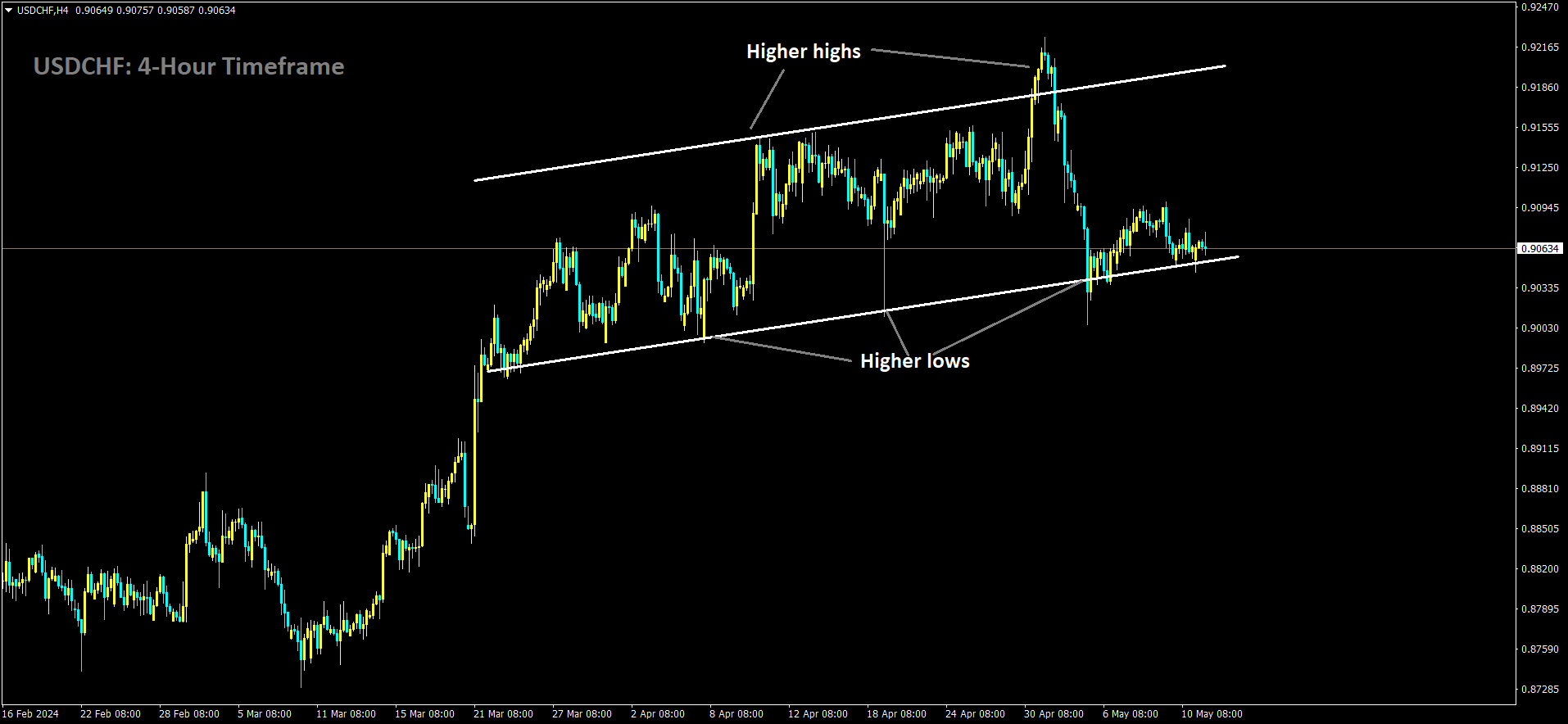

USDCHF is moving in Ascending channel and market has reached higher low area of the channel

However, recent economic indicators from the United States indicate a potential slowdown in the economy, putting pressure on the US Treasury yields and thus limiting the USD’s advance. The US Consumer Sentiment Index, released on Friday, dropped to 67.4 in May from April’s 77.2, signaling a six-month low and falling short of market expectations.

Neel Kashkari, President of the Minneapolis Federal Reserve, exercised prudence concerning the monetary policy’s tightness. Kashkari, in a CNBC interview on Friday, highlighted the cautious approach, suggesting that although the bar for another rate hike is high, it should not be ruled out entirely. Meanwhile, San Francisco Fed President Mary Daly emphasized the necessity of maintaining a prolonged tight policy stance to achieve the Fed’s inflation targets.

The US Dollar Index (DXY), reflecting the USD’s performance against six major currencies, remains around 105.30, while 2-year and 10-year yields on US Treasury bonds stand at 4.85% and 4.48%, respectively.

In Switzerland, the SECO Consumer Climate (YoY) experienced a slight decline in April, registering a reading of -38.1, compared to the previous -38.0 and an expected -40.0. However, it remains significantly below the long-term average.

Over the past week, the Swiss National Bank (SNB) observed a continuous increase in its foreign exchange reserves, reaching CHF 720 billion in April, marking the fifth consecutive rise. The SNB has shifted its focus from deliberately strengthening the Swiss Franc (CHF) to combating inflation, reflecting its intensified efforts in monetary policy.

CHF: Swiss Consumer Climate Boosts in Q2 2024

In April, the SECO Consumer Climate data for Switzerland registered at -38.1, marking a slight decline from the previous month’s figure of 38.0 and slightly underperforming against the expected -40.0. Meanwhile, the Swiss central bank disclosed a noteworthy increase in foreign reserves, reaching CHF 720 billion, marking the fifth consecutive rise in reserves. Following this announcement, the Swiss Franc exhibited a modest strengthening trend against its counterpart currencies.

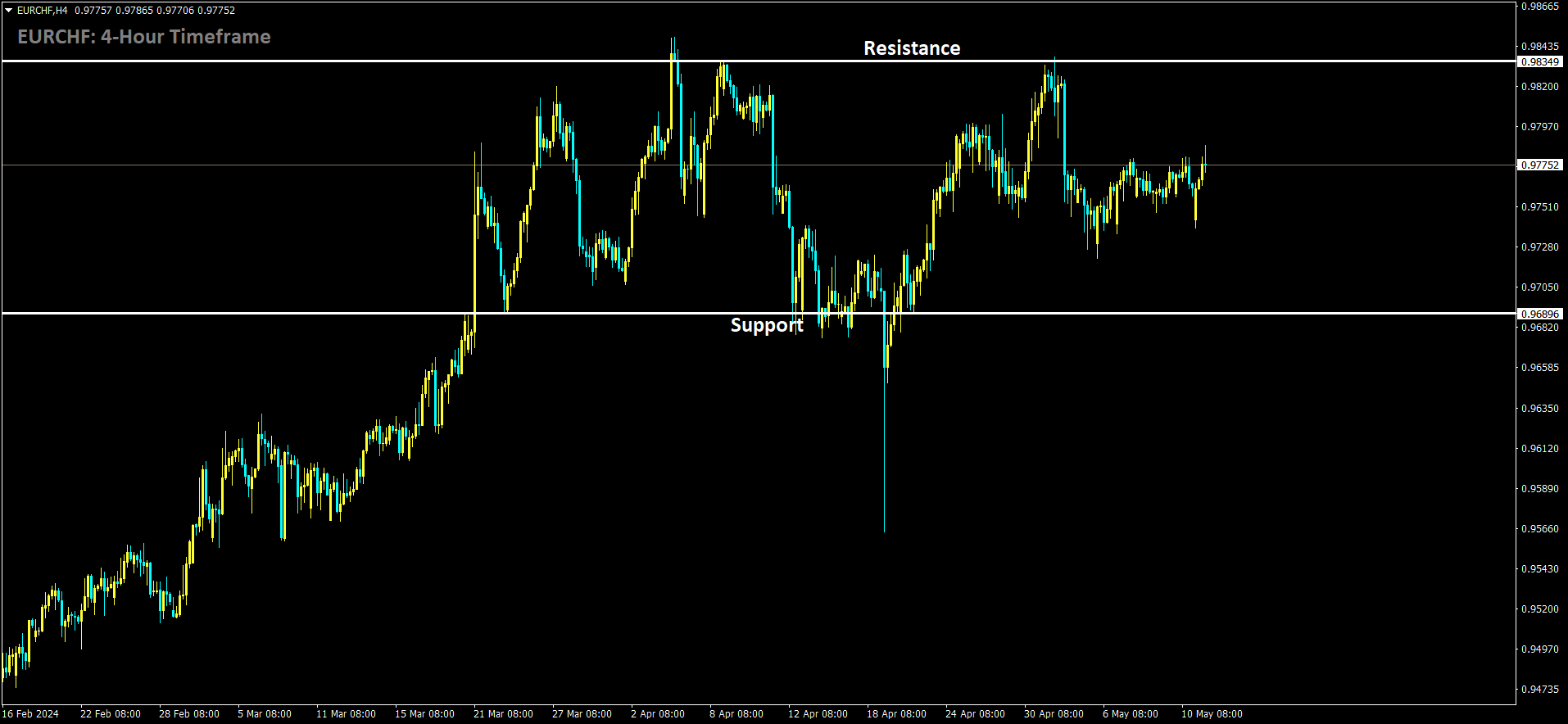

EURCHF is moving in box pattern and market has fallen from the resistance area of the pattern

The latest report from the State Secretariat for Economic Affairs (SECO) in Switzerland reveals encouraging developments in the consumer climate during the second quarter of 2024. Previously pegged at -38, the indicator has surged to -24, indicating a notable uptick in consumer confidence. This shift suggests a growing optimism among Swiss consumers regarding the economic trajectory in the near future.

As of May 13th, 2024, this updated data underscores a significant shift in consumer sentiment. The positive momentum in consumer outlook bears potential implications for the Swiss economy, as heightened confidence typically translates into increased spending and economic activity. The evolving consumer sentiment is poised to influence the broader economic landscape in Switzerland over the coming months.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/