AUD: AUD steadies as USD maintains strength

The Australian Q1 Wage price index came at 0.80% versus 0.90% expected, Employment change came at 38.2K versus 23.7K expected and Unemployment rate rise to 4.1% in the April month versus 3.9% printed in the March month. China is planned to Rise 1 Trillion Yuan by issuing 20 and 50 Yr Bonds in the market. Local Governments in the China is planned to buy the Unsold homes in the China to recover the property losses in the Chinese economy. This is the Bold step taken by China for it Real estate boom from Bottom area by no investors ready to invest in the China property sector. So Australian Dollar Jumped up by this massive efforts taken by China Government on Real estate sector crisis.

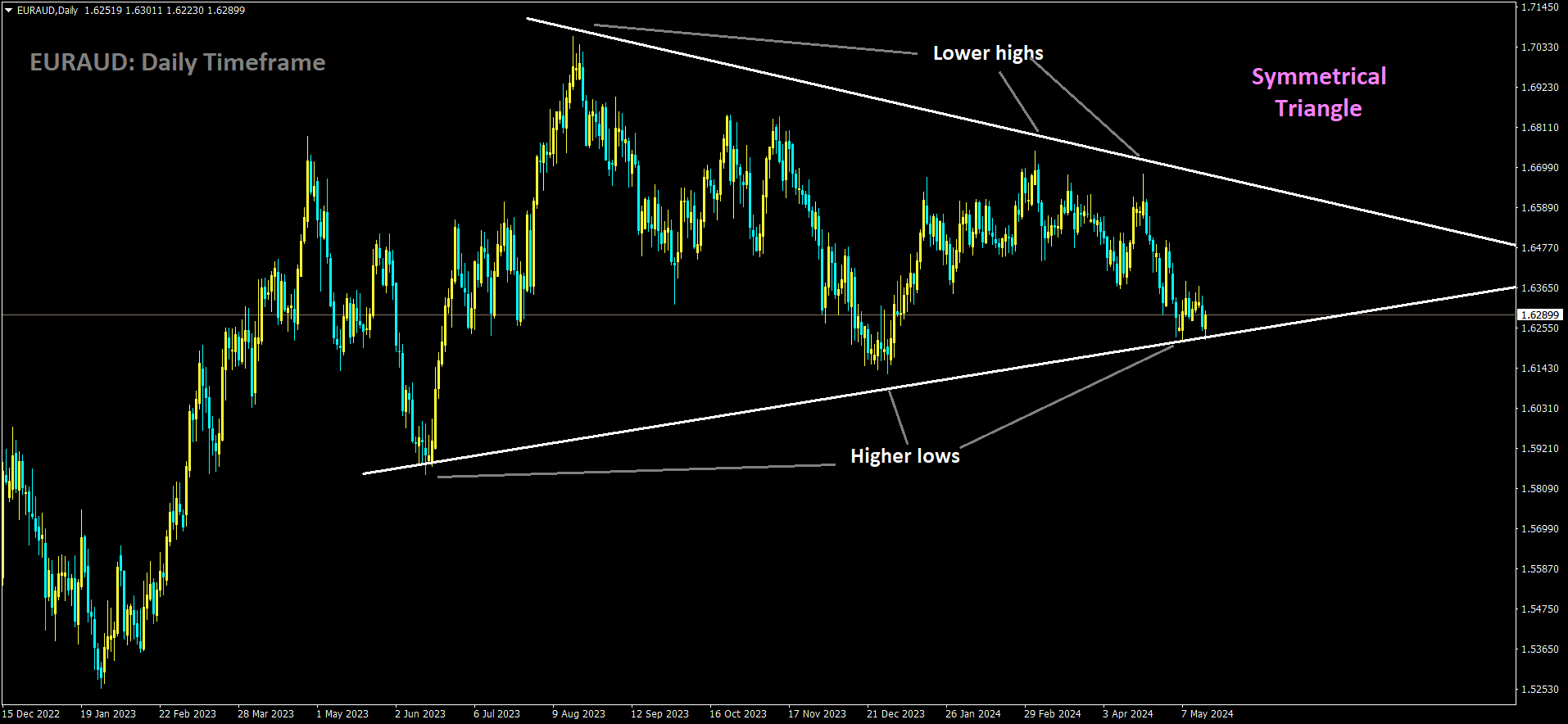

EURAUD is moving in Symmetrical Triangle and market has reached higher low area of the pattern

The Australian Dollar (AUD) faced a setback after a streak of three consecutive days of gains, primarily due to the release of mixed employment data on Thursday. Furthermore, the Australian 10-year government bond yield dipped to approximately 4.2% following the Wage Price Index (QoQ) report, which showed a 0.8% increase in the first quarter, slightly below the expected rise of 0.9%. These factors contributed to a dovish sentiment surrounding the Reserve Bank of Australia (RBA), which weighed on the AUD/USD pair.

However, earlier on Thursday, the Australian Dollar had found support from an improved risk appetite driven by lower-than-expected monthly Consumer Price Index (CPI) and Retail Sales data from the United States (US), released the day before. This bolstered expectations of multiple rate cuts by the Federal Reserve (Fed) in 2024, consequently weakening the US Dollar (USD) and boosting the AUD/USD pair to a four-month high of 0.6714.

Meanwhile, the US Dollar Index (DXY), which measures the USD against six major currencies, retraced its losses due to improved US Treasury yields, lending support to the Greenback. The 2-year and 10-year yields on US Treasury bonds stood at 4.73% and 4.33%, respectively, by the press time.

Key events shaping the market dynamics included the release of the Australian Bureau of Statistics’ Employment Change data for April, which exceeded market expectations, and the rise in the Australian Unemployment Rate to 4.1%. Sarah Hunter, Chief Economist and Assistant Governor (Economic) at the RBA, addressed the REIA Centennial Congress, discussing strategies to address housing supply and demand imbalances.

Other influential factors included the US CPI deceleration in April, the Australian Budget for 2024-25 returning to a deficit, and reports of China’s finance ministry planning stimulus measures. Federal Reserve Chair Jerome Powell anticipated a continued decline in inflation, emphasizing positive GDP growth forecasts attributed to the strength of the labor market.

AUD: Living Standards Plummet: Australians Face 14-Year Setback

In the first quarter, Australia’s Wage Price Index surprised analysts, coming in at 0.80%, slightly below the anticipated 0.90%. Concurrently, the Employment Change figures exceeded expectations, showing an increase of 38.2K against the forecasted 23.7K. However, the Unemployment Rate saw a concerning uptick in April, rising to 4.1% from the previous month’s 3.9%.

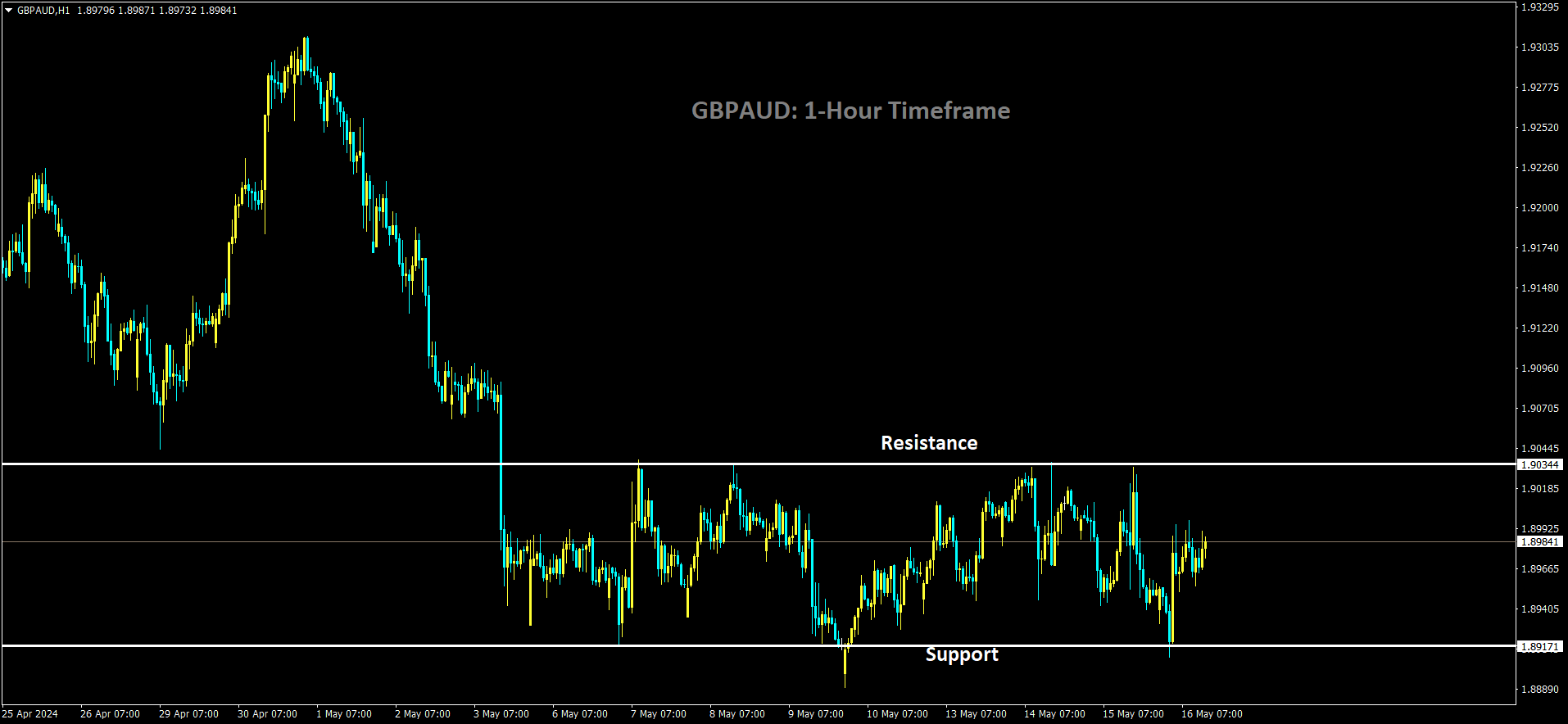

GBPAUD is moving in box pattern and market has rebounded from the support area of the pattern

Meanwhile, China is gearing up for a significant financial move, aiming to inject 1 trillion Yuan into the market through the issuance of 20 and 50-year bonds. This strategy is part of China’s efforts to address its real estate sector’s challenges, particularly the issue of unsold homes. To tackle the property market downturn, local governments across China are planning to purchase these unsold properties, aiming to revitalize the sector from its foundations.

This bold initiative by the Chinese government has reverberated across global markets, including Australia, leading to a surge in the Australian Dollar. The Australian currency responded positively to China’s proactive measures to stabilize its real estate market, which has been under strain due to a lack of investor confidence and sluggish demand.

It’s a Myth: Wages Can’t Drive Inflation When They’re Lagging Behind

In the realm of economic discourse, there has been much chatter about wage-price spirals and the notion that wages could be the driving force behind inflation. Yet, recent data from the Australian Bureau of Statistics paints a different picture, highlighting the uphill battle wages face in keeping pace with inflation.

In December, annual wage growth surged to 4.2%, the highest since 2009, sparking concerns about overheating and potential interest rate hikes by the Reserve Bank. However, the latest figures from the March quarter show a slight dip to 4.1%, indicating that the peak may have passed.

Despite ongoing debates about economic forecasts between the government and the Reserve Bank, it appears that the government’s predictions on wage growth might be more accurate. While the RBA estimated June wage growth at 4.1%, the government’s forecast was slightly lower at 4.0%.

The trajectory of wage growth is expected to taper off, especially as quarterly figures indicate a slowdown in both the public and private sectors. Although most industries saw faster wage growth than inflation over the past year, the finance and utilities sectors were the only ones to outpace price increases in the March quarter.

Overall, wage growth of 0.8% in the March quarter fell short of the 1% rise in inflation. As has been highlighted over the past two years, it’s illogical to suggest that wages could drive inflation when they are actually rising slower than inflation.

While nominal wage growth outpaced price growth over the past year, the reality is that this increase in real wages has not been equally distributed. For many low and middle-income earners, especially those spending a larger portion of their income on essential items like rent, energy bills, and food, there has been little to no increase in real wages.

Even for those with higher discretionary spending, the average growth of real wages remains lackluster. The mere 0.5% real wage growth over the past year is below the levels seen during 2013-2016, let alone the robust growth experienced during the mining boom years.

The budget offers a glimmer of hope, predicting further real wage growth over the next four years. However, the forecast suggests that by June 2028, the average wage will only reach the level it was at in 2014, indicating a setback of 14 years in living standards.

In essence, unless real wages accelerate beyond pre-pandemic levels, the gap in living standards is likely to persist until the middle of the next decade.

AUD: March Sees Annual Wage Increase

In Q1, the Australian Wage Price Index (WPI) registered a growth of 0.80%, falling short of the expected 0.90%. Concurrently, employment change exceeded expectations, reaching 38.2K against the forecasted 23.7K. However, the unemployment rate climbed to 4.1% in April compared to 3.9% in March.

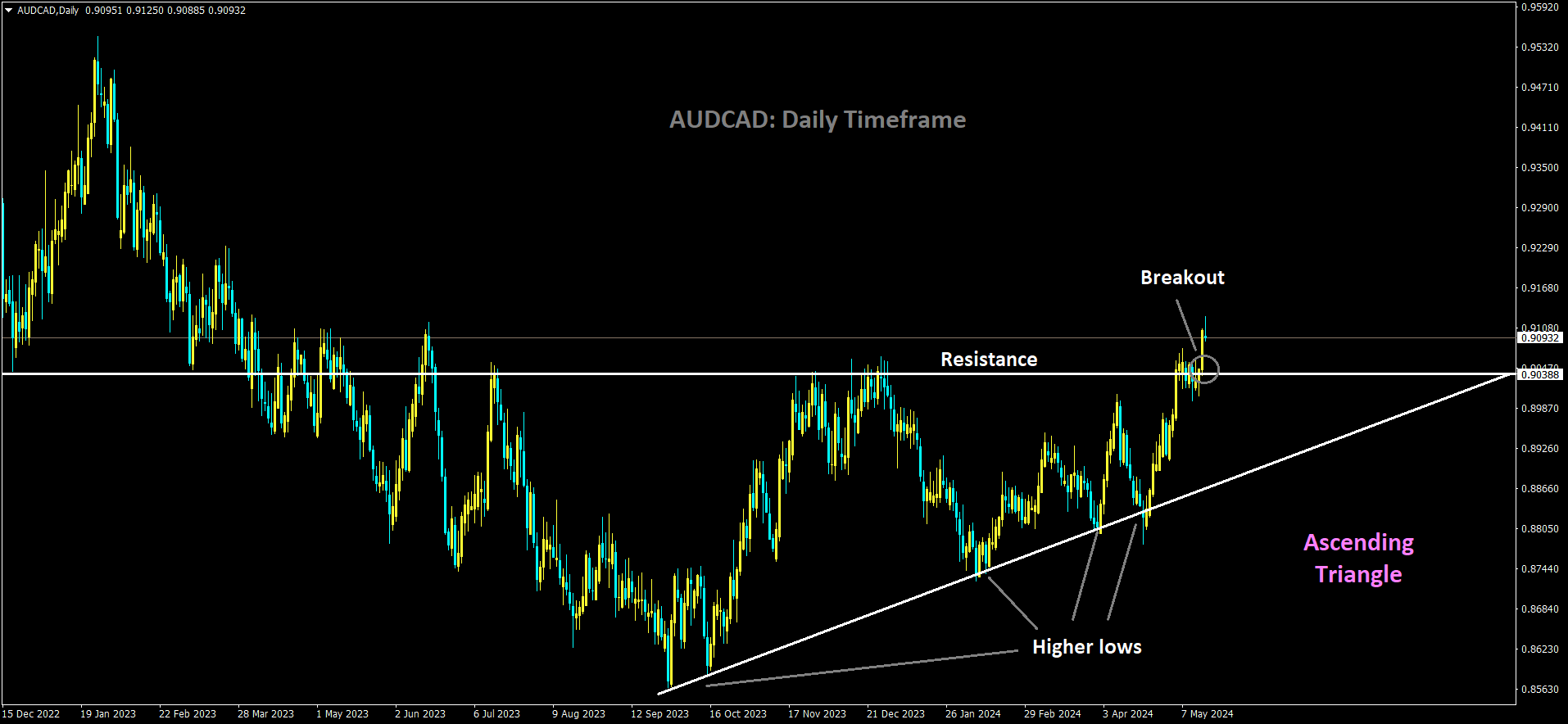

AUDCAD has broken Ascending Triangle in upside

Meanwhile, China unveiled plans to bolster its economy by issuing 20 and 50-year bonds worth 1 trillion Yuan. Additionally, local Chinese governments intend to address the property market’s challenges by purchasing unsold homes, aiming to revitalize the sector. This bold move by China to stimulate its real estate sector resonated positively in the market, leading to an upward surge in the Australian Dollar.

Australia’s annual wage growth reached 4.1% in the March quarter, as revealed by the latest Wage Price Index (WPI) from the Australian Bureau of Statistics (ABS). This increase of 0.8% in the first quarter of 2024 contributed to the overall rise over the past year, demonstrating a persistent upward trend in wages despite economic fluctuations.

Michelle Marquardt, Head of Prices Statistics at ABS, emphasized the significance of these wage trends. She highlighted that the WPI’s annual all sectors wage growth has consistently remained at or above 4% since the September quarter of 2023, a level not seen since March quarter 2009.

Marquardt also noted the specific impact on public sector wages, attributing the current figures to scheduled rises from new agreements made last year.

In terms of sectoral differences, public-sector annual wage growth stood at 3.8%, slightly down from 4.3% in December 2023 but notably higher than the 3% recorded last year. Meanwhile, private sector wages grew faster at 0.8% in the quarter, compared to 0.5% in the public sector. This marked the smallest quarterly increase since March 2022’s 0.7%.

Marquardt further explained that the smaller increase in public sector wages was due to various factors, including new enterprise agreements implemented last year and changes to wage caps. Additionally, many jobs covered by these agreements received scheduled rises paid in the September or December quarters of the previous year instead of the March quarter of 2024.

For comprehensive details, one can refer to the Wage Price Index report by ABS.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/