GBP: BoE’s Broadbent: Rate Cut Possible This Summer

The BoE Deputy Governor Broadbent said rate cut should be expected from this Summer season. Inflation is easing and MPC members worry about the rate cuts, Rate cuts see if inflation trend lowered to 2% target.

Bank of England (BoE) Deputy Governor Ben Broadbent stated on Monday that it is possible the BoE could reduce the policy rate this summer, according to Reuters.

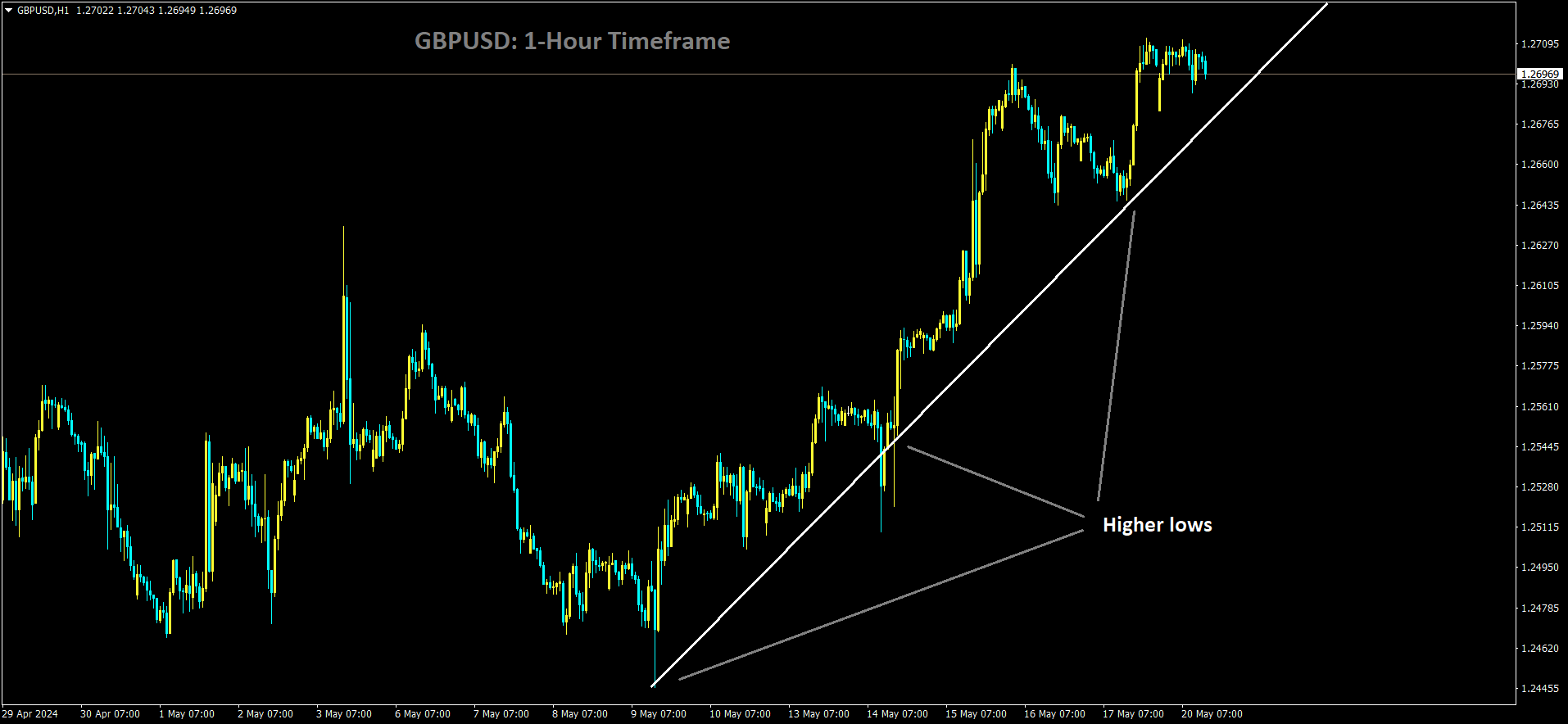

GBPUSD is moving in Ascending trend line

“If things continue to evolve in line with our forecasts—forecasts that suggest policy will have to become less restrictive at some point—then it’s possible the Bank Rate could be cut sometime over the summer,” Broadbent mentioned.

Key takeaways from Broadbent’s remarks include:

– “We are not on a knife-edge where any rate cut would produce above-trend growth; policy would still be restrictive.”

– “The experience of the past 2-3 years has made MPC members wary about cutting rates.”

– “Signs of inflation pressures easing are reassuring.”

– “It is a matter of individual opinion among MPC members how much evidence is needed for a rate cut.”

GBP: BoE’s Broadbent: UK Rates May Drop This Summer

The BoE Deputy Governor Broadbent said rate cut should be expected from this Summer season. Inflation is easing and MPC members worry about the rate cuts, Rate cuts see if inflation trend lowered to 2% target. The Real wage growth must increase with Business firms raise wages to labor then only inflation and services inflation will slowdown in the market.

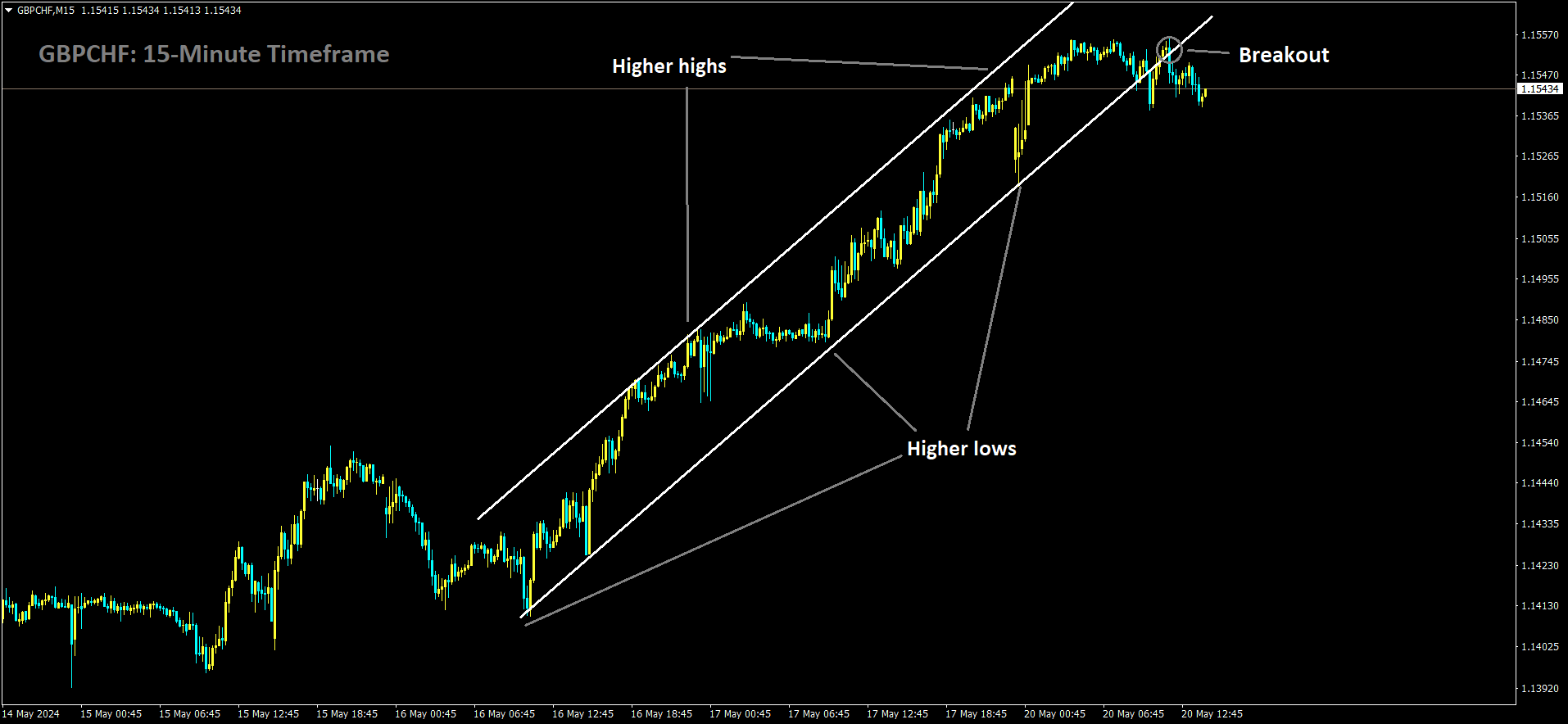

GBPCHF has broken Ascending channel in downside

The Bank of England (BoE) may be able to cut interest rates “some time over the summer” if second-round inflation pressures ease as expected, according to Deputy Governor Ben Broadbent. This decision would depend on the reduction of wage growth and whether businesses continue to pass higher payroll costs onto consumers.

In his final speech after 13 years at the BoE, Broadbent noted that the rate cut from the current 16-year high of 5.25% hinges on the speed at which real wages recover from the inflation shock. Faster real wage recovery would help return to normalcy and reduce these inflation pressures.

Earlier this month, BoE Governor Andrew Bailey suggested that a rate cut could occur as soon as June 20, coinciding with Broadbent’s last meeting. Inflation is expected to drop back to the 2% target this week when the Office for National Statistics releases the April numbers. The BoE will review another set of inflation and pay data before the next vote.

Broadbent, in his speech in London, stated, “If things continue to evolve with forecasts that suggest policy will have to become less restrictive at some point, then it’s possible Bank Rate could be cut some time over the summer.”

During a Q&A, Broadbent described the economy’s behavior in the past six months as “reassuring” but acknowledged policymakers’ wariness after recent inflation surges. He explained that the expected drop in inflation to 2%, from a peak of 11.1% in late 2022, is primarily due to falling energy prices and slower food price growth—factors beyond the BoE’s control.

Broadbent highlighted that while tradeable prices have largely driven the decline in inflation, the persistent second-round effects on domestic inflation are uncertain. The Monetary Policy Committee (MPC) anticipates that these second-round effects, particularly in wages and services prices, will take longer to dissipate than they did to emerge.

He suggested that a swift recovery in real pay could accelerate the disinflationary process. If real incomes’ recovery continues this year, it could mitigate the inflationary pressures. The BoE’s regional survey indicated that employers expect elevated earnings growth but foresee less ability to pass these higher wage costs onto consumers.

In the Q&A, Broadbent also mentioned that climate change could cause future inflation shocks, such as making food prices more variable. He noted that the MPC has considered that the significant investments required for climate transition might increase the real neutral level of interest rates due to the demand for financing.

GBP: BoE’s Broadbent: Rate Cut Possible This Summer

Bank of England (BoE) Deputy Governor Ben Broadbent indicated that a rate cut could be expected as soon as this summer. He explained that inflation is beginning to ease, which is influencing the Monetary Policy Committee’s (MPC) considerations about reducing rates. Broadbent emphasized that a rate cut would be more likely if inflation trends continue to decline towards the BoE’s 2% target.

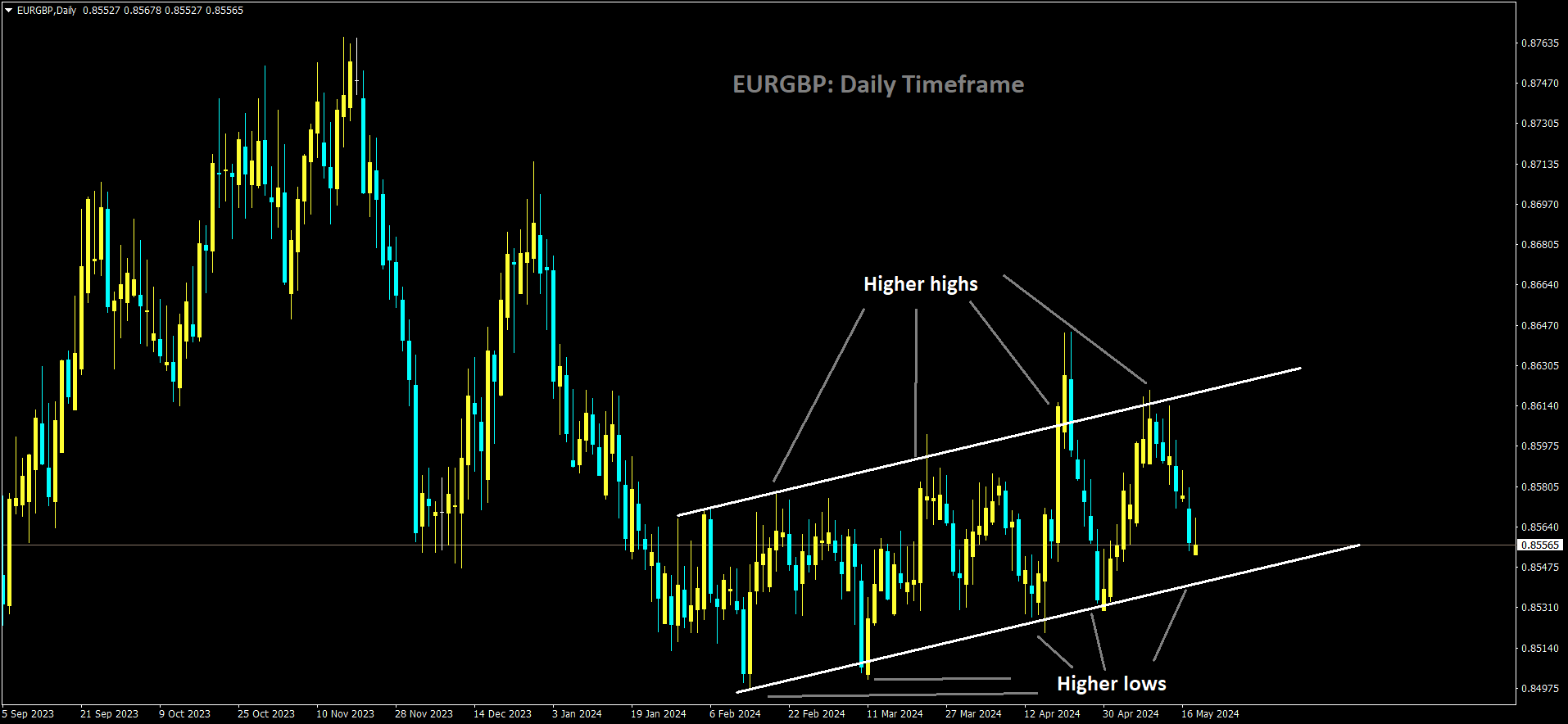

EURGBP is moving in Ascending channel and market has reached higher low area of the channel

Broadbent also highlighted the importance of real wage growth in this context. For inflation and the inflation of services to slow down in the market, businesses need to increase wages for their workers. He pointed out that while inflation is easing, it’s crucial for companies to boost wages, which in turn would help align inflation with the BoE’s targets. Broadbent’s remarks suggest a cautious but optimistic approach to potential rate cuts, contingent on ongoing economic developments.

The Bank of England (BoE) might reduce its key interest rate in the coming months if wage growth and the rise in services prices show signs of cooling as forecasted, Deputy Governor Ben Broadbent stated on Monday.

The U.K.’s central bank maintained its key interest rate at a 16-year high earlier this month but indicated a potential cut might be on the horizon. Two members of the Monetary Policy Committee (MPC) voted for a rate cut, although Broadbent aligned with the majority in maintaining the current rate.

“If things continue to evolve with [MPC’s] forecasts—forecasts that suggest policy will have to become less restrictive at some point—then it’s possible Bank Rate could be cut some time over the summer,” Broadbent mentioned in a speech.

Broadbent is set to step down after the June MPC meeting, with the committee’s first meeting without him scheduled for early August.

He noted that reports from the BoE’s network of agents across the U.K. suggest that wage growth will remain robust this year. However, these agents also report that businesses are less confident about passing on higher wage costs to consumers through increased prices.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/