ETHUSDT: ETH Jumps 17% as Polymarket Approval and ETF Progress Boosts Regulatory Outlook

ETHEREUM surged 17% yesterday after the SEC asked 19B-4 Filings from Application of ETFs management holders for regulation approval of ETH ETFS in the market. Prolonged delay for approving Ethereum ETFs in the market, now it is going to amendment in the market soon expected by experts. This positive news took Ethereum one day surge of 17%.

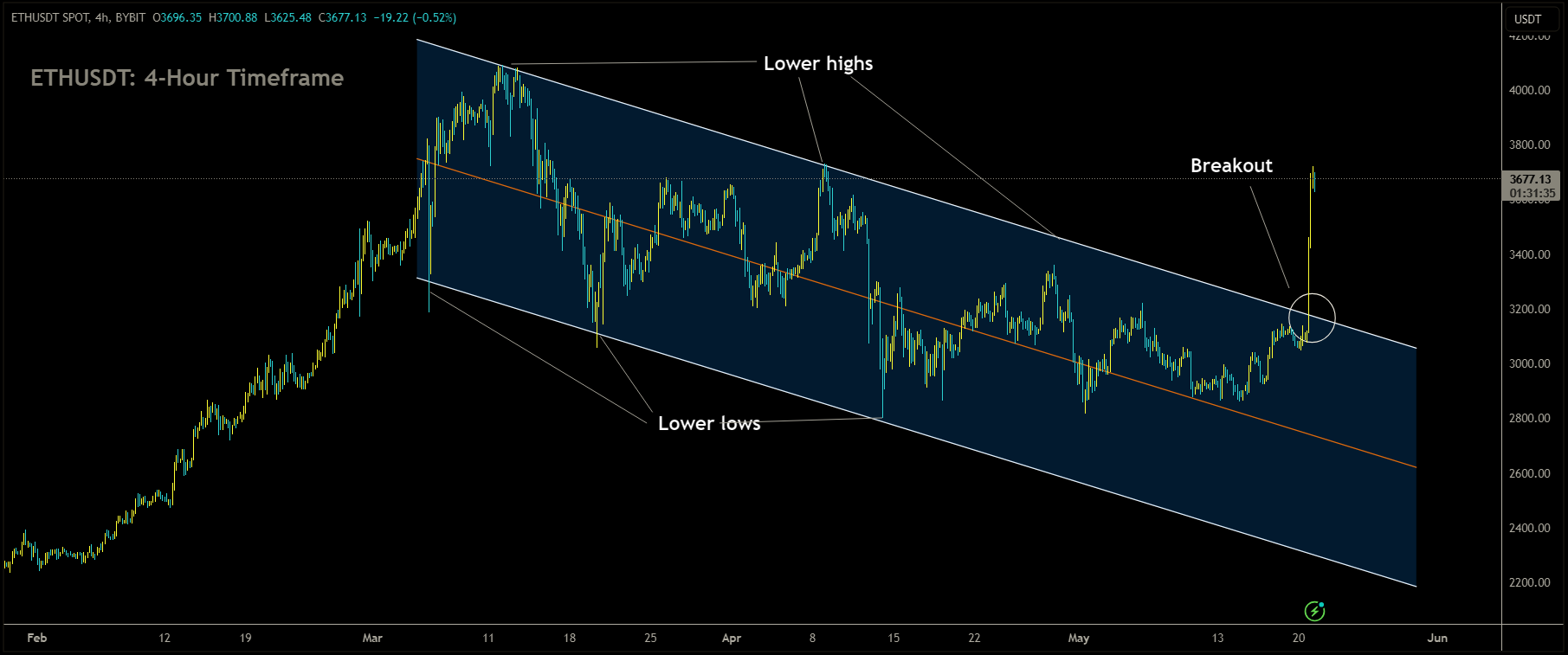

ETHUSDT has broken Descending channel in upside

On May 21, 2024, Ether (ETH) experienced a notable surge of 17%, surpassing the $3,600 mark, driven by favorable regulatory developments that heightened the likelihood of Ether exchange-traded fund (ETF) approval. This surge coincided with positive regulatory progress on Ether ETFs, as reflected in the CoinDesk 20, which tracks the largest digital assets and rose by nearly 8%.

CoinDesk reported that the U.S. Securities and Exchange Commission (SEC) had made significant strides in the approval process for an Ether ETF by requesting exchanges to update their 19b-4 filings, which propose rule changes related to Ether ETFs. While this progress suggests potential advancements toward spot Ether ETF approvals, it’s essential to note that approval is not guaranteed. The SEC could still reject the S-1 registration statement of the Ether ETF, potentially delaying its approval and trading commencement.

Following this development, the ether implied volatility curve flattened, indicating market expectations of future volatility across various strike prices and expirations. Additionally, 25-delta risk reversals surged to year-to-date highs above 18%, and traders heavily bought $4000 calls for May 24 and May 31, 2024, according to analysts at Presto Research.

The news also had an impact on prediction markets, particularly Polymarket, where the probability of an Ether ETF approval by May 31 soared from 10 cents to 55 cents, representing a 55% chance of approval by the end of May. Another Polymarket contract, speculating on ETF approval by June 30, is currently trading at 68%.

Investors are eagerly awaiting decisions on proposed Ether ETFs, with VanEck’s decision expected on May 23 and Ark’s decision on May 24. These developments mark significant progress in the regulatory landscape for Ether ETFs, but uncertainties regarding approval timelines and outcomes remain.

ETHUSDT: US SEC Requests Updated 19b-4 Filings for Ethereum ETFs

Yesterday, Ethereum experienced a significant surge of 17% following an announcement from the U.S. Securities and Exchange Commission (SEC) regarding the request for 19B-4 filings from ETF management holders seeking regulatory approval for Ethereum ETFs in the market. This development comes after a prolonged delay in approving Ethereum ETFs, raising hopes among experts that amendments in the market are imminent.

ETHUSDT is moving in Ascending trend line and market has rebounded from the higher low area of the pattern

The positive news regarding the potential approval of Ethereum ETFs sparked a one-day surge in Ethereum’s value by 17%. Investors and market participants reacted positively to the prospect of regulatory progress in the Ethereum ETF space, driving up demand for the cryptocurrency and contributing to its notable price increase.

According to recent news reports, the U.S. Securities and Exchange Commission (SEC) is instructing firms seeking to list and trade shares of spot ether exchange-traded funds (ETFs) to update and refile crucial documents necessary for potential approval.

These filings, known as Form 19b-4, are submitted to inform the SEC about proposed rule changes and are among the key documents required for the agency’s approval before spot ethereum ETFs can be launched.

The SEC’s Trading and Markets Division reportedly directed asset managers on Monday to revise their filings and resubmit them with amendments. This information was reported by The Wall Street Journal, citing sources familiar with the matter. Additionally, CoinDesk mentioned that exchanges were urged to update their 19b-4 filings on an “accelerated basis.”

The prospects for a spot ethereum ETF have brightened considerably. Bloomberg ETF analysts James Seyffart and Eric Balchunas now assess the likelihood of SEC approval for such a product at 75%, up from 25% previously.

Previously, when spot bitcoin ETFs were approved earlier this year, the SEC greenlit the 19b-4 forms, followed by the registration statements of issuers needing to become effective for trading commencement.

An SEC spokesperson declined to comment on specific filings when approached by The Block.

ETHUSDT: Ethereum Surges 18% on SEC Spot ETF Approval Speculation

Yesterday, Ethereum surged by a remarkable 17% following an announcement from the U.S. Securities and Exchange Commission (SEC) requesting 19B-4 filings from ETF management holders seeking regulatory approval for Ethereum ETFs in the market. This development marks a significant shift after a prolonged delay in approving Ethereum ETFs, prompting optimism among experts for forthcoming amendments in the market.

ETHUSDT is moving in Symmetrical Triangle and market has reached lower high area of the channel

The positive news of potential regulatory progress in the Ethereum ETF space fueled a one-day surge in Ethereum’s value by 17%. Investors and market participants responded favorably to the prospect of regulatory advancements, driving increased demand for the cryptocurrency and contributing to its substantial price uptick.

The value of Ethereum (ETH), the second-largest cryptocurrency by market capitalization, witnessed a notable surge of nearly 18% against the U.S. dollar, driven by speculation surrounding the potential approval of spot ether exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

Market Buzz Elevates Ethereum to $3,691

On Monday, Ethereum (ETH) soared to an intraday peak of $3,691 per coin, propelled by widespread rumors circulating on social media platforms and online forums regarding the imminent SEC approval of several spot ETH ETFs. According to a report from Coindesk, three sources familiar with the matter disclosed that exchanges had purportedly received instructions from the SEC to promptly update their 19b-4 filings “on an accelerated basis.”

Furthermore, Bloomberg analysts Eric Balchunas and James Seyffart revised their approval forecasts from 25% to 75%, contributing to the escalating speculation surrounding ETH.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/