GBP: Pound Sterling Holds above 1.2700 Despite Weak UK PMI

UK Manufacturing PMI increased to 51.3 in the May month from 49.1 printed in the April month and 49.5 is expected. But Services PMI declined to 52.8 in the May month from 55.0 printed in the last month and 54.7 is expected. Composite PMI declined to 52.8 in the May month from 54.1 printed in the April month and 54.0 is estimated. Mixed bag of reading makes GBP higher against counter pairs. But BoE is expected to rate cut in the August month due to CPI lower to 2.3% last day.

GBPUSD is moving in Symmetrical Triangle and market has reached lower high area of the pattern

The Pound Sterling (GBP) maintains its strength above 1.2700 during Thursday’s London session following the release of weak preliminary UK PMI data for May. The S&P Global/CIPS PMI report reveals that the Composite PMI fell to a two-month low of 52.8, down from the estimated 54.0 and the previous reading of 54.1. This decline was primarily driven by a drop in the Services PMI, which hit a six-month low of 52.9, below the consensus of 54.7 and the prior reading of 55.0. However, the Manufacturing PMI rose above the 50.0 threshold, indicating expansion, and increased significantly to 51.3, exceeding economists’ forecast of 49.5 and the previous figure of 49.1.

The GBP/USD pair remains steady as traders adjust their expectations regarding the Bank of England’s (BoE) policy shift in the June meeting. Initially, there was speculation that the BoE would begin normalizing its policy after maintaining a hawkish stance on interest rates for over two years. However, these expectations have waned following the April Consumer Price Index (CPI) report, which indicated that inflation is decelerating more slowly than anticipated.

According to the CPI report, annual headline and core inflation dropped to 2.3% and 3.9%, respectively. The service price index, which fell slightly to 5.9% from 6.0%, dashed hopes of a June rate cut. Persistent service inflation, driven by wage growth, remains a significant obstacle to disinflation.

Market movers for the day show the Pound Sterling remains robust against the US Dollar as investors anticipate a delay in BoE rate cuts due to the slower-than-expected decline in UK inflation for April. Before the June meeting, the BoE will review one more set of employment and inflation data, which could reinforce the case for a rate cut if it aligns with the central bank’s forecasts.

Pound coins

Sterling is likely to stay active on Friday as the UK Office for National Statistics (ONS) will release the Retail Sales data for April. Retail Sales data, which reflect household spending and offer insights into the inflation outlook, are expected to have declined by 0.4% month-on-month after stagnating in the previous month. Annually, Retail Sales are projected to have contracted by 0.2%, compared to a growth of 0.8% in March.

Across the Atlantic, the US Dollar is struggling to maintain gains amid concerns that the progress toward the 2% inflation target in the United States has stalled. The Federal Open Market Committee (FOMC) minutes from the May meeting, released on Wednesday, indicated that recent inflation data has dampened the confidence needed to consider rate cuts.

Looking ahead, investors will focus on the preliminary S&P Global PMI for May and the Initial Jobless Claims data for the week ending May 17. For the past two weeks, the number of individuals claiming jobless benefits has exceeded expectations, suggesting a weakening labor market.

GBP: UK Business Growth Dips in May, Early Blow to Sunak: PMI Survey

In May, the UK Manufacturing PMI increased to 51.3, up from 49.1 in April and surpassing the expected 49.5. However, the Services PMI declined to 52.8 in May, down from 55.0 in April, and below the anticipated 54.7. Consequently, the Composite PMI also fell to 52.8 in May from 54.1 in April, against an estimated 54.0. Despite these mixed readings, the GBP strengthened against other currencies.

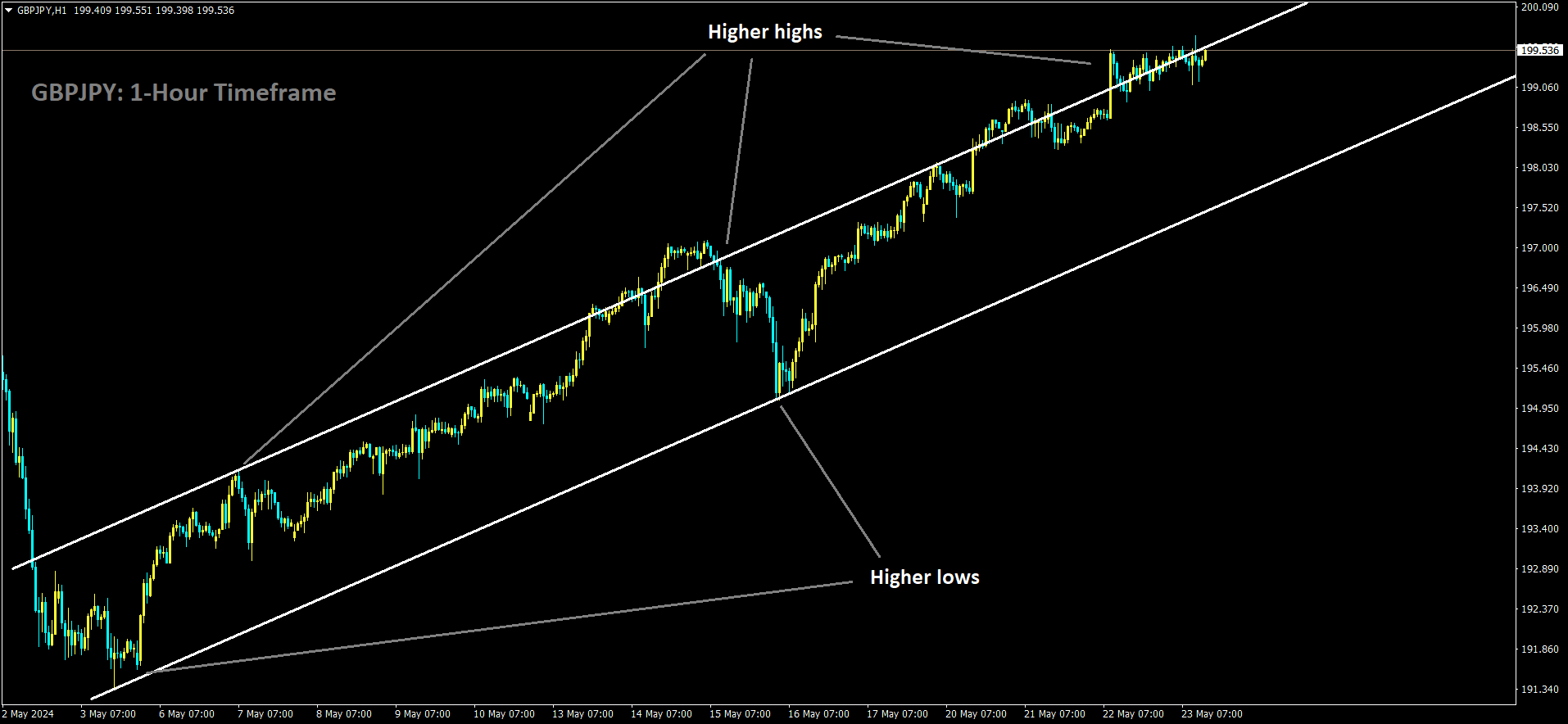

GBPJPY is moving in Ascending channel and market has reached higher high area of the channel

The Bank of England (BoE) is anticipated to implement a rate cut in August, influenced by the recent CPI data showing a reduction to 2.3%.

Growth across British businesses has significantly slowed this month, more than any economist polled by Reuters had predicted, according to a survey released on Thursday. This presents an early setback for Prime Minister Rishi Sunak’s election campaign.

The S&P Global UK Composite Purchasing Managers’ Index (PMI), which measures activity in the services and manufacturing sectors, dropped to 52.8 in May from 54.1 in April. This was well below the median poll forecast, which anticipated a modest decline to 54.0. A PMI reading above 50 indicates expansion.

The services sector, which dominates the UK economy, experienced its weakest growth in six months, overshadowing a recovery in the manufacturing sector, which had its best month in almost two years. Overall, the PMI results suggest a loss of momentum in the UK economy following a strong start to 2024, when it emerged from a shallow recession.

The services sector, which dominates the UK economy, experienced its weakest growth in six months, overshadowing a recovery in the manufacturing sector, which had its best month in almost two years. Overall, the PMI results suggest a loss of momentum in the UK economy following a strong start to 2024, when it emerged from a shallow recession.

This downturn is unwelcome news for Sunak’s Conservative Party, which is trailing behind the opposition Labour Party in opinion polls. Economic competence is central to Sunak’s appeal to voters.

S&P Global stated that the survey results align with an economic growth rate of 0.3% for the current quarter, down from the unexpectedly strong 0.6% expansion in the first quarter. New orders grew at the slowest pace so far this year. The index measuring companies’ cost pressures fell to its lowest level since October, following a spike in April due to a nearly 10% increase in the UK’s minimum wage.

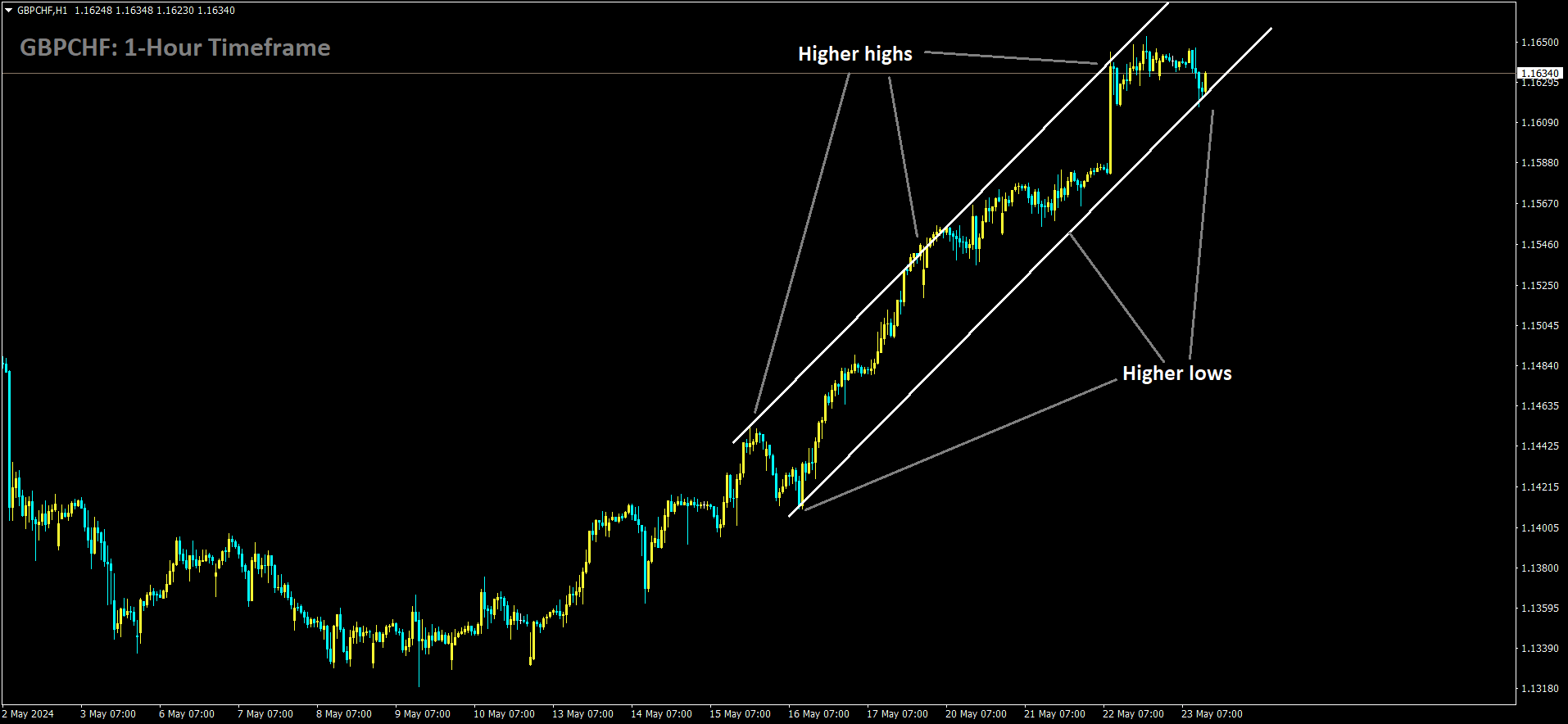

GBPCHF is moving in Ascending channel and market has reached higher low area of the channel

Chris Williamson, chief business economist at S&P Global, commented, “The PMI data support the view that the Bank of England will start cutting interest rates in August, provided the data continue to move in the right direction over the summer.” Investors, who had delayed bets on an early rate cut after Wednesday’s inflation data showed a smaller-than-expected drop in April, now see about a 50% chance of a first rate cut in August, with a quarter-point reduction not fully anticipated until November.

The services PMI decreased to 52.9 in May from an 11-month high of 55.0 in April, falling short of the Reuters poll consensus of 54.7. Meanwhile, the manufacturing PMI rose to 51.3, its highest level since July 2022, up from 49.1 in April, driven by increasing output and new orders.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/