ETHEREUMUSDT: Ether ETFs Overcome Key Hurdle, Awaiting SEC Approval for Trading

Ethereum ETFs are finally approved by SEC today and give 19B- 4 Filings to respective Digital assets Running ETFS company like Gray Scale and Blackrock, other Digital assets ETFs companies who filed for thier regulations of ETFs. Now waiting for S-1 regulator approval for Investors trade with this ETFs companies to buy or Sell. It is the huge welcome one after the Bitcoin ETFs approved earlier this year and Followed by Ethereum ETFs approval in the one week period.

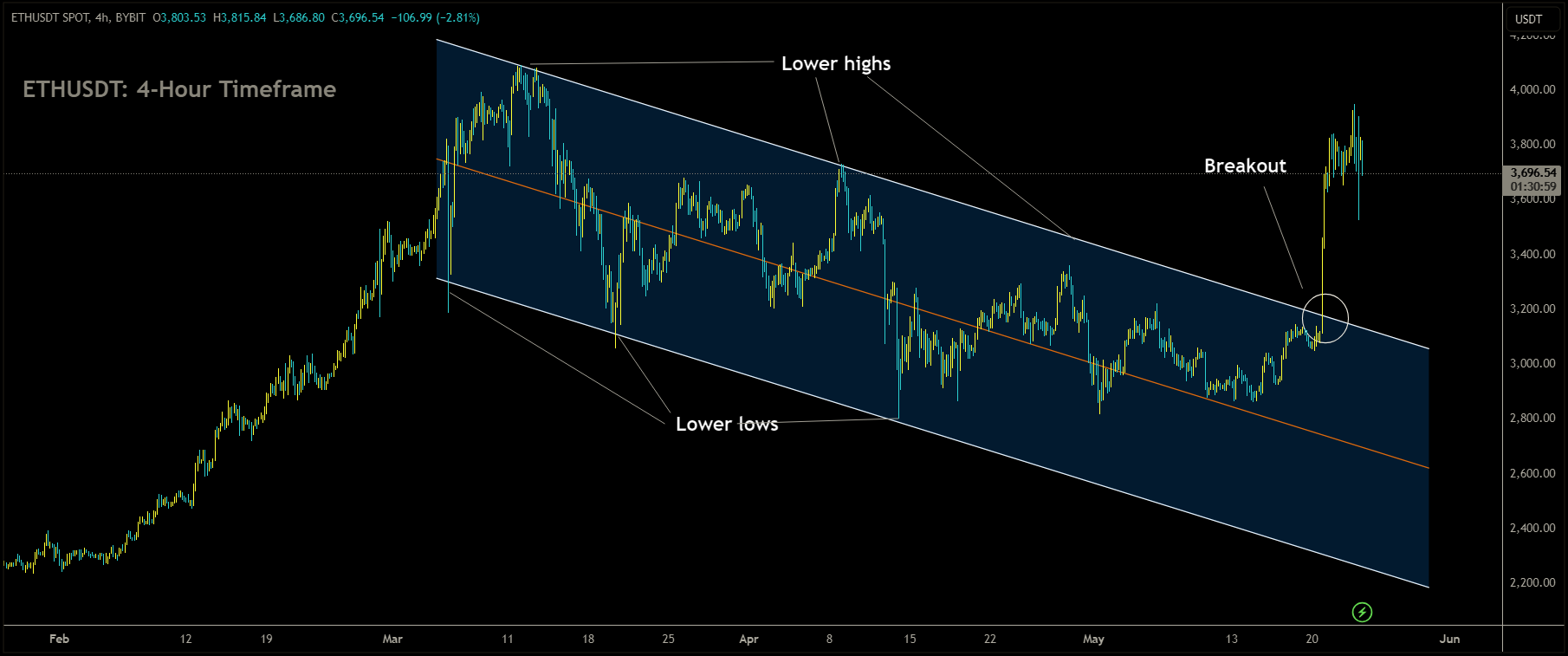

ETHUSDT has broken Descending channel in upside

On Thursday, spot ether (ETH) exchange-traded funds (ETFs) made significant progress toward becoming a reality as the U.S. Securities and Exchange Commission (SEC) approved key regulatory filings associated with them. This development marks a significant milestone for the second-largest cryptocurrency, although these ETFs are not yet cleared for trading. While the SEC granted approval for the so-called 19b-4 forms related to the ETFs, the regulator must still approve their S-1 filings before investors can purchase them.

This approval follows an unexpected shift by the markets regulator. After previously clearing spot bitcoin ETFs earlier in the year, the SEC had shown little engagement with issuers regarding ether ETFs. However, this stance changed in recent days.

“A week ago, I would’ve said you were a little crazy to think that these ETFs were going to get SEC approval,” remarked James Seyffart, ETF analyst at Bloomberg Intelligence, in an interview prior to the decision.

In response to the approval, a spokesperson from Grayscale confirmed that the regulator had approved its 19b-4 filing. They expressed appreciation for the opportunity to engage constructively with regulators and expressed optimism about the potential for bringing Ethereum further into the US regulatory perimeter through the ETF wrapper.

Several potential spot ether ETF issuers include BlackRock, Fidelity, Grayscale, VanEck, Franklin Templeton, Ark/21Shares, and Invesco/Galaxy. While the approval of the 19b-4 filings suggests a willingness by regulators to allow issuers to introduce spot ether ETFs to the market, it does not guarantee approval of the final S-1 forms filed by all issuers.

“There is likely to be a gap before we see S-1 approvals and these ETFs begin trading. My guess is that this will take at least a week, but likely more. If history is any guide it could be much longer and be measured in months. But I personally think the gap will be measured in weeks. Everyone is just guessing right now though,” Seyffart explained.

An SEC spokesperson declined to comment beyond what was published in the order on Thursday. Andrew Jacobson, Head of Legal at 21Shares, described the approval as “a significant step in the right direction.” Rob Marrocco, Head of ETP Listings at Cboe Global, expressed excitement about expanding their offerings to include ETFs and highlighted the benefits these products could provide for U.S. investors.

VanEck anticipates being the first issuer to launch its spot ether ETF, according to Matthew Sigal, the company’s head of digital assets research.

ETHUSDT: US SEC Approves Spot Ether ETF Listings

Today, the U.S. Securities and Exchange Commission (SEC) granted approval for Ethereum exchange-traded funds (ETFs), marking a significant milestone for the cryptocurrency industry. The SEC provided 19B-4 filings to various digital assets ETF companies, including Grayscale and Blackrock, among others, which had applied for regulatory approval of their ETFs. These filings signify a crucial step towards making Ethereum ETFs available to investors.

However, the process is not yet complete. While the SEC has approved the 19B-4 filings, investors must await the regulator’s approval of the S-1 filings before they can engage in trading activities with these ETF companies, either to buy or sell ETF shares. This regulatory approval process is crucial for ensuring investor protection and market integrity.

ETHUSDT is moving in Ascending trend line and market has rebounded from the higher low area of the pattern

The approval of Ethereum ETFs comes after the SEC’s earlier approval of Bitcoin ETFs earlier in the year. The consecutive approvals within a week’s time underscore the increasing acceptance of cryptocurrencies within the regulatory framework. This development is likely to further boost investor confidence in the cryptocurrency market and expand opportunities for investment in digital assets.

On Thursday, the U.S. Securities and Exchange Commission (SEC) granted approval to Nasdaq, CBOE, and NYSE to list exchange-traded funds (ETFs) linked to the price of ether, a significant development that could potentially lead to the trading of these products later in the year. While the ETF issuers must also receive approval before launching the products, Thursday’s approval comes as a surprise win for these firms and the cryptocurrency industry as a whole. Just days before, market expectations were geared towards the SEC rejecting the filings.

Nine issuers, including VanEck, ARK Investments/21Shares, and BlackRock, are hopeful of launching ETFs tied to the second-largest cryptocurrency following the SEC’s approval of bitcoin ETFs in January, marking a landmark moment for the industry.

Andrew Jacobson, Vice President and Head of Legal at 21Shares, described the SEC’s decision as “a significant step” towards making these products available for trading, reflecting the industry’s excitement.

Thursday marked the deadline for the SEC to decide on VanEck’s filing. Market participants anticipated a negative response due to the lack of engagement from the SEC on the applications. However, in an unexpected move, SEC officials requested the exchanges to expedite the filings, prompting a rush within the industry to complete weeks of work in just days.

Rob Marrocco, Global Head of ETP Listings at Cboe Global Markets, highlighted the potential benefits of spot ether ETFs for U.S. investors, drawing parallels with the positive impact observed with spot bitcoin ETFs.

While Nasdaq and NYSE declined to comment, SEC Chair Gary Gensler, known for his cautious stance on crypto, refrained from commenting when asked about the ether ETFs at an industry event. An SEC spokesperson stated that the agency would not provide further comments beyond the approval announcement.

The exchange applications sought SEC approval for a rule change necessary to list new products. However, the issuers still await SEC approval for ETF registration statements outlining investor disclosures before trading can commence. The timeline for the SEC’s decision on these statements remains uncertain, with indications that the corporate finance division may request changes and updates in the coming days and weeks.

While the SEC had previously rejected spot bitcoin ETFs over concerns about market manipulation, the recent approval marks a notable shift, reflecting the growing acceptance of cryptocurrencies in mainstream finance. This decision, along with other regulatory developments globally, underscores the increasing momentum towards integrating cryptocurrencies into traditional financial systems.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/