Euro: ECB’s Rehn: June is ripe to ease monetary policy

The ECB Policy maker Oli Rehn said it is the Time has come to cut the rates in the June month, Inflation is eased to near 2% target, it is sustainable in future and no distractions from Geopolitical side can affect the inflation prices in the Euro zone. Most of the ECB members believed that rate cut in the June month is appropriate for the current declining inflation in the Euro zone.

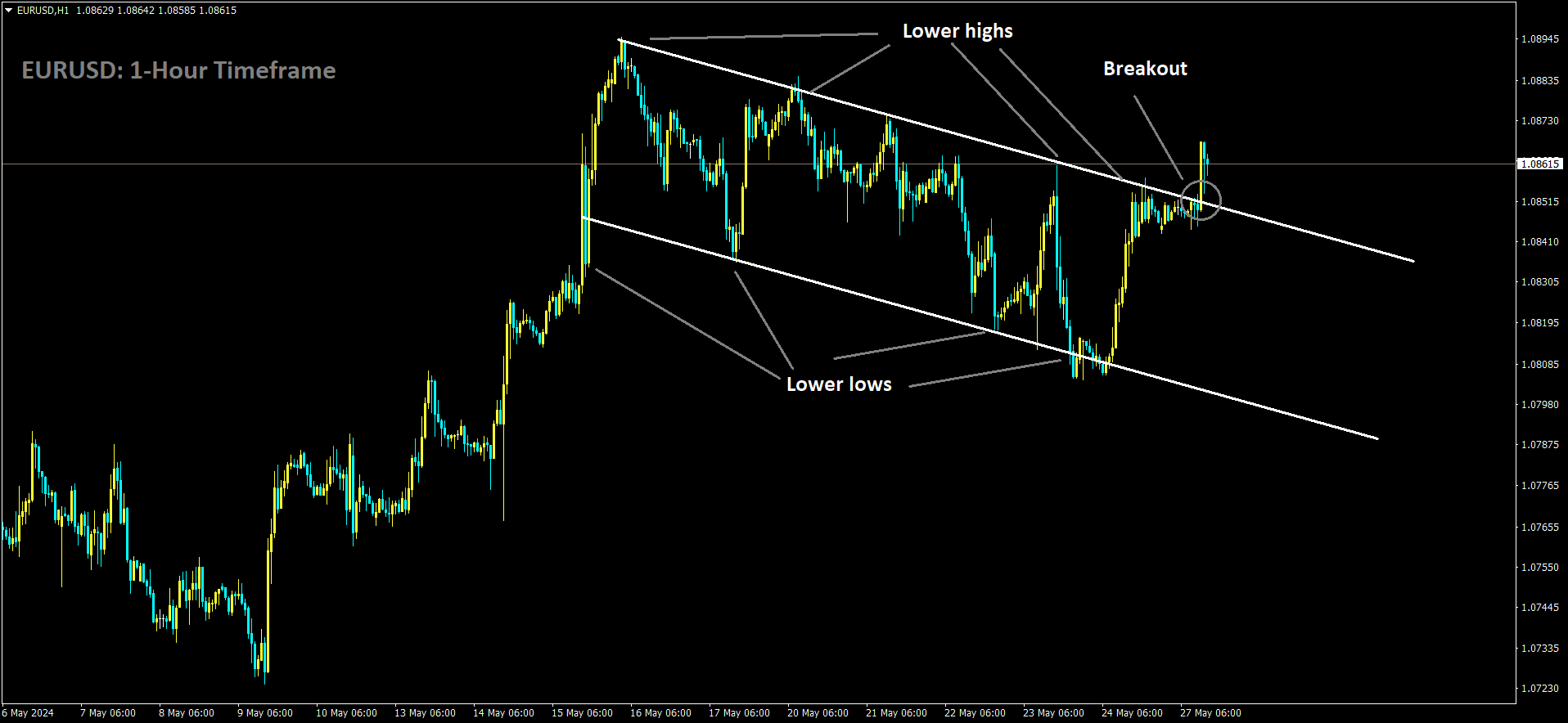

EURUSD has broken Descending channel in Upside

European Central Bank (ECB) policymaker Olli Rehn discussed the timing of the central bank’s interest rate cut on Monday, highlighting that the conditions may soon be favorable for such a move.

Key quotes:

“Inflation is converging to our 2% target in a sustained way, and the time is thus ripe in June to ease the monetary policy stance and start cutting rates.”

Rehn emphasized that this projection is based on the assumption that the disinflationary trend will persist and that there will be no significant setbacks in the geopolitical situation or energy prices. This cautious optimism underscores the ECB’s careful consideration of various economic factors before making any changes to its monetary policy.

EURO: ECB’s Rehn: Next week is ideal for rate cuts

European Central Bank (ECB) policymaker Olli Rehn announced that the time has come to cut interest rates in June. Rehn highlighted that inflation has eased to near the ECB’s 2% target and is expected to remain stable in the future. He also emphasized that there are no anticipated geopolitical distractions that could significantly impact inflation prices in the Eurozone.

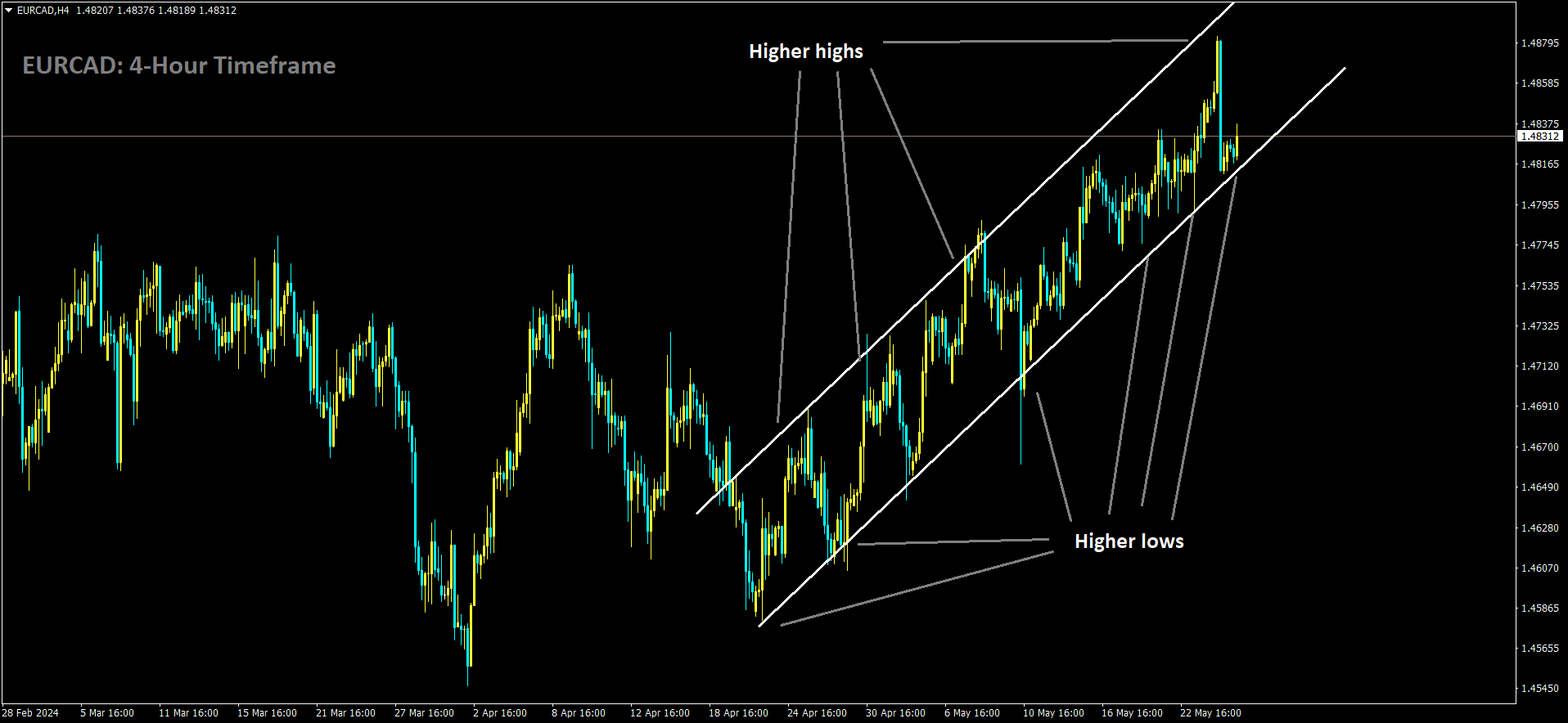

EURCAD is moving in Ascending channel and market has reached higher low area of the channel.

Rehn stated, “Inflation is converging to our 2% target in a sustained way, and the time is thus ripe in June to ease the monetary policy stance and start cutting rates.” He added that the disinflationary trend is likely to continue, assuming there are no further setbacks in geopolitical situations and energy prices.

Rehn’s comments align with the broader consensus among ECB members, who believe that a rate cut in June is appropriate given the current declining inflation in the Eurozone. This sentiment reflects the ECB’s commitment to adjusting its monetary policy in response to the evolving economic landscape and maintaining price stability in the region.

Two key European Central Bank (ECB) figures on Monday signaled strong support for an interest rate cut next week, suggesting it is almost certain.

Olli Rehn, an ECB governing council member and head of Finland’s central bank, emphasized in a speech that euro area inflation is declining steadily. He noted that inflation held steady at 2.4% in April, marking the seventh consecutive month below 3%, despite a slight rebound in December. The latest inflation figures for May are expected on Friday.

“Thanks to this disinflationary process, inflation is converging to our 2% target in a sustained way, and the time is thus ripe in June to ease the monetary policy stance and start cutting rates,” Rehn said in a speech published on the Finnish central bank’s website. He added that this depends on the continuation of the disinflationary trend and stability in geopolitical and energy price situations.

Meanwhile, ECB Chief Economist Philip Lane echoed this sentiment in an interview with the Financial Times. “Barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction,” Lane stated.

These remarks come ahead of the ECB’s next meeting on June 6, with markets now anticipating a high likelihood of a quarter-percentage-point cut to the ECB’s main rate, currently at 4%.

Rehn and Lane’s comments align with similar views from other ECB members, indicating a potential move by the ECB sooner than the U.S. Federal Reserve, which typically leads in monetary policy decisions.

“The Fed and the ECB look set to decouple, with an ECB cut likely in June while bracing for high-for-longer in the U.S.,” Bank of America economists led by Claudio Irigoyen noted in a Friday report.

In the U.S., debate continues over the timing of the Fed’s rate reductions. Recent strong economic and labor data have prompted Goldman Sachs to delay its forecast for a Fed cut from July to September. Minutes from the Fed’s April 30 to May 1 policy meeting highlighted uncertainty among policymakers regarding the timing of easing.

Bank of America’s Irigoyen concluded that recent comments and minutes indicate that U.S. rate cuts are unlikely for now. “We think that ECB and Fed rate cut cycles will differ, a lot,” he stated.

EURO: ECB could cut rates in June, Rehn says

European Central Bank (ECB) policymaker Olli Rehn announced that the time has come to cut interest rates in June. Rehn highlighted that inflation has eased to near the ECB’s 2% target and is expected to remain stable in the future. He also emphasized that there are no anticipated geopolitical distractions that could significantly impact inflation prices in the Eurozone.

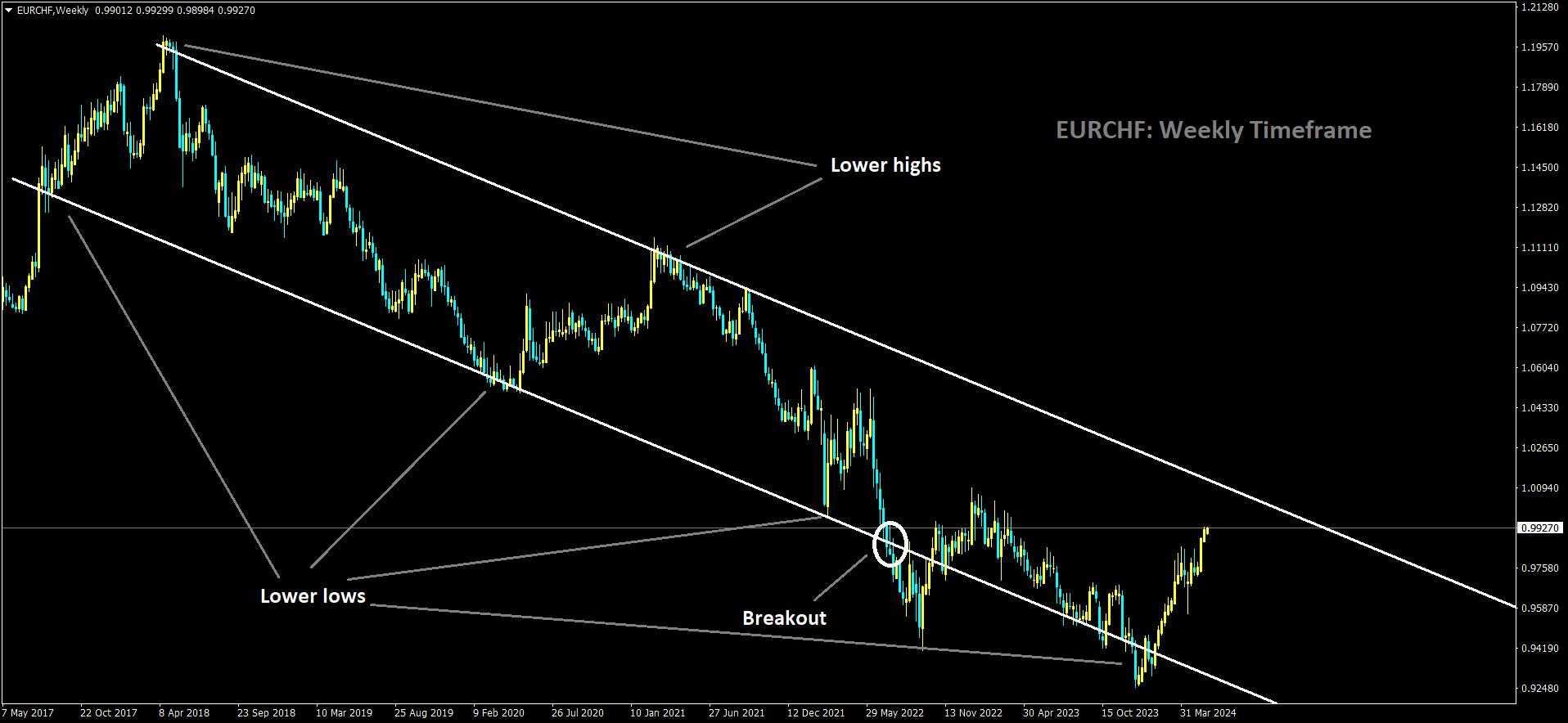

EURCHF is moving in Descending channel and market has rebounded from the lower low area of the channel

Key quotes from Rehn:

– “Inflation is converging to our 2% target in a sustained way, and the time is thus ripe in June to ease the monetary policy stance and start cutting rates.”

– “This obviously assumes that the disinflationary trend will continue and there will be no further setbacks in the geopolitical situation and energy prices.”

Rehn’s comments align with the broader consensus among ECB members, who believe that a rate cut in June is appropriate given the current declining inflation in the Eurozone. This sentiment reflects the ECB’s commitment to adjusting its monetary policy in response to the evolving economic landscape and maintaining price stability in the region.

COPENHAGEN: Inflation is converging to the European Central Bank’s (ECB) 2% target, making it feasible to ease monetary policy and begin cutting rates in June, ECB policymaker Olli Rehn stated on Monday.

“Inflation is converging to our 2% target in a sustained way, and the time is thus ripe in June to ease the monetary policy stance and start cutting rates,” Rehn said in a speech published on the Finnish central bank’s website.

However, he cautioned that this assumes the disinflationary trend will continue without significant setbacks in the geopolitical situation or energy prices. “This obviously assumes that the disinflationary trend will continue and there will be no further setbacks in the geopolitical situation and energy prices,” he added.

Geopolitical tensions remain a concern for eurozone stability, but the current inflation trajectory supports a shift towards rate cuts in the near term.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/