JPY: BoJ’s Adachi: Impact of Yen Moves on Economy, Prices Uncertain

The BoJ Board Member Seiji Adachi said When is going to do reduction of Bond purchasing in the market by BoJ I don’t Know, FX prices affecting Economy and prices of Goods in the Japan. Import costs higher when compared to Exports. Next rate hike is expected soon this year if inflation towards 2% target. Bond purchasing reduction has to plan accordingly inorder to hiking rates in the market, then only JPY Yen reduced gradual weakness against currency pairs. Comments from Adachi is favourable for JPY strengthness in the market.

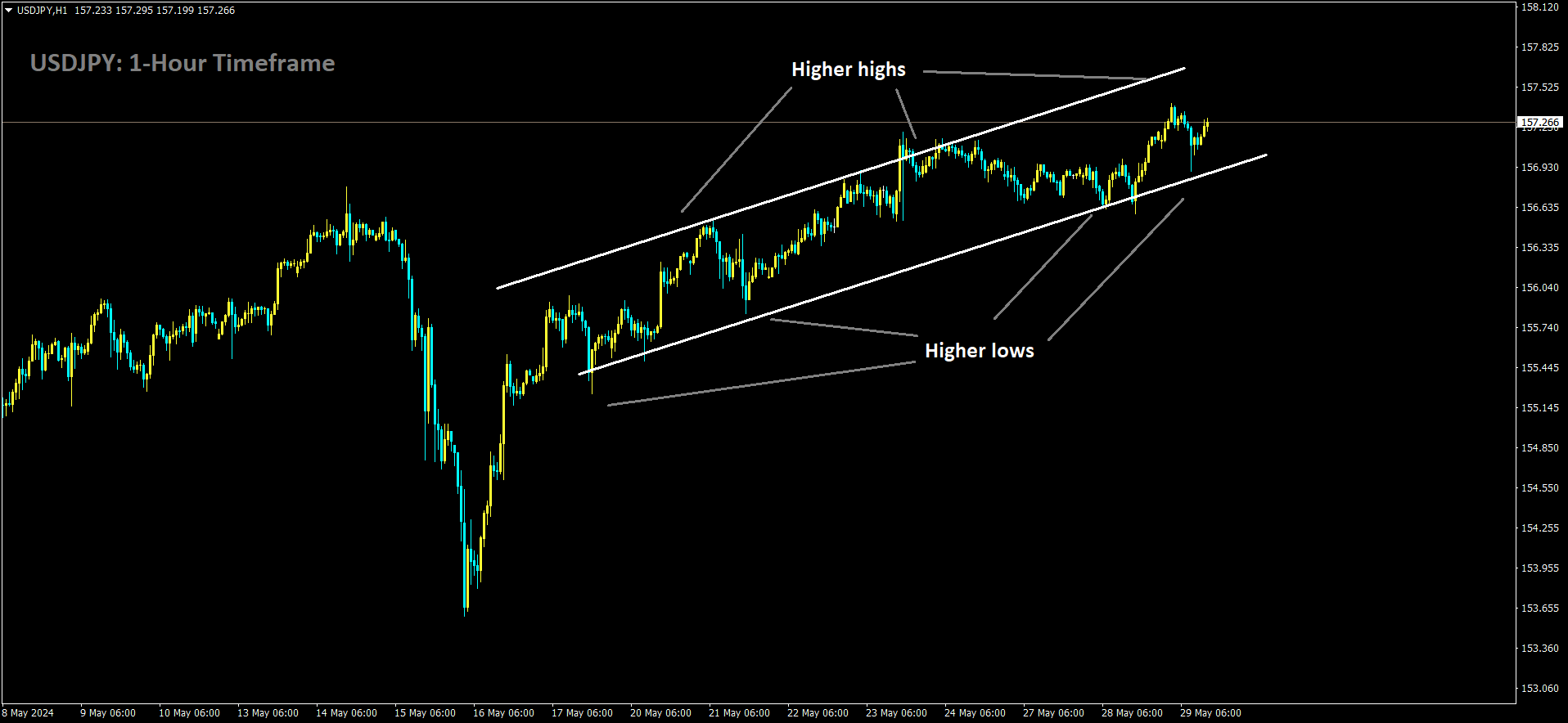

USDJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

Bank of Japan (BoJ) board member Seiji Adachi spoke on Wednesday, sharing his views on the central bank’s monetary policy and exchange rate outlook.

Key quotes:

– The BoJ’s single-day decrease in bond buying has no policy implication.

– Adachi is undecided on whether the reduction in BoJ bond buying should occur soon or later.

– The BoJ will monitor long-term interest rate movements more carefully.

– If current foreign exchange (FX) trends persist, they will impact the economy and prices.

– The BoJ will respond with monetary policy if FX movements materially affect the economy and prices.

– It is currently unclear whether Yen movements will affect the economy and prices.

– The BoJ will take a long time and consult various experts before deciding what to do with its ETF holdings.

– Bond buying should be reduced in stages to allow long-term yields to serve as market signals.

– There is no preset plan or timeline for reducing the BoJ’s bond buying.

– Adachi’s inflation forecasts have not changed significantly since April.

– It is appropriate to adjust interest rates slowly if underlying inflation moves steadily toward 2%.

– It is too early to consider the specific timing of the next rate move.

– Adachi has no specific view on Japan’s terminal rate.

– It is hard to determine if the recent rise in Japan’s long-term interest rates will be sustained.

– It is too early to predict at what pace the BoJ could reduce bond buying.

JPY: BoJ Hints at Rate Hike if Yen’s Impact on Inflation Grows

Bank of Japan (BoJ) board member Seiji Adachi discussed the uncertainty surrounding the timing of the BoJ’s bond purchasing reduction. “I don’t know when we will reduce bond purchasing,” Adachi said. He pointed out that foreign exchange (FX) prices are affecting Japan’s economy and goods prices, with import costs currently higher than export earnings.

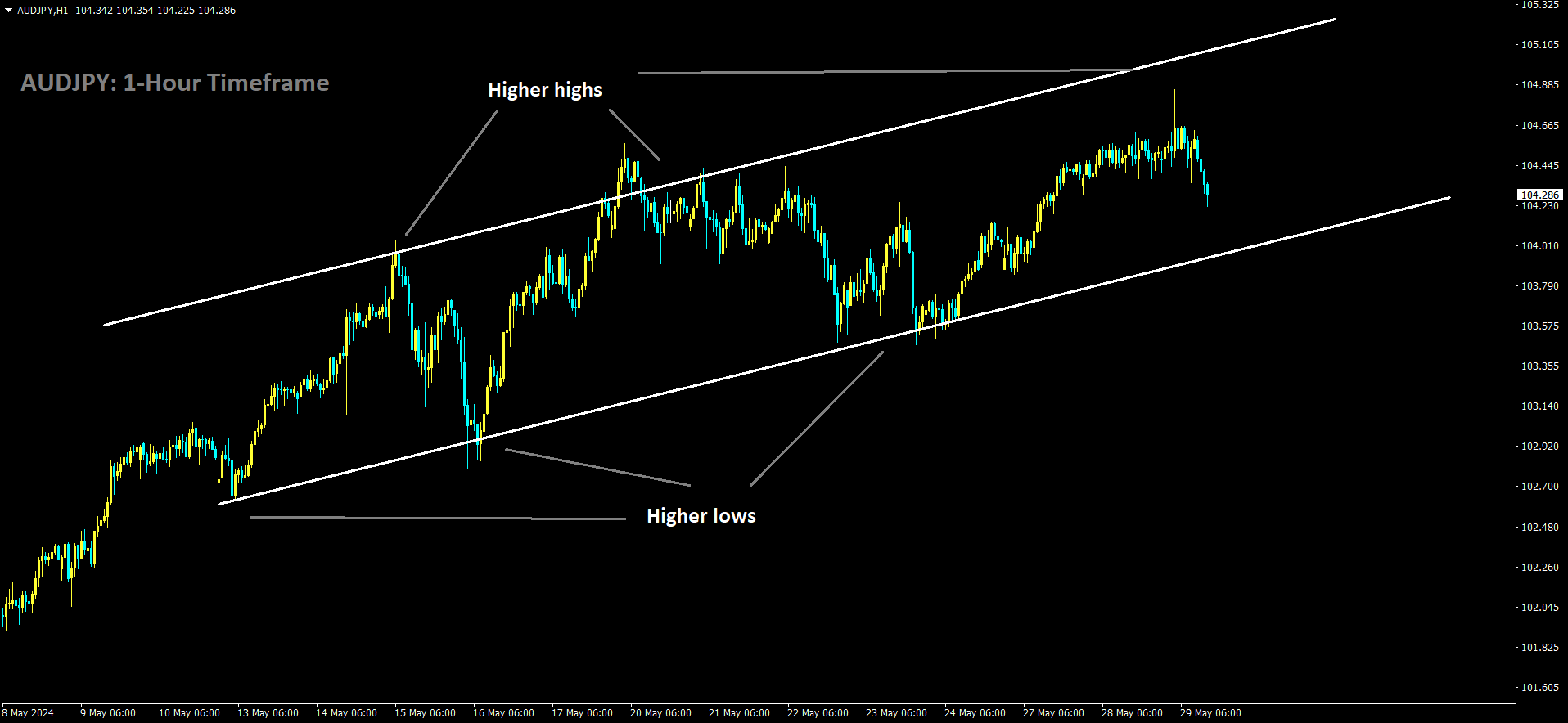

AUDJPY is moving in Ascending channel and market has fallen from the higher high area of the channel

Adachi mentioned that a rate hike is expected soon this year if inflation continues toward the 2% target. He stressed the importance of planning the bond purchasing reduction carefully to support the rate hike. “We need to plan the reduction in bond purchasing carefully to back up the rate hike,” Adachi explained. This approach aims to gradually strengthen the Japanese yen (JPY) against other currencies.

Adachi’s comments suggest that the BoJ is focused on the yen’s strength in the market. By addressing bond purchasing and FX impacts, Adachi’s remarks indicate a strategic plan to stabilize and potentially boost the yen.

The Bank of Japan may consider raising interest rates if significant declines in the yen boost inflation or alter public expectations about future prices more than anticipated, board member Seiji Adachi stated on Wednesday.

While short-term currency movements alone won’t prompt a policy shift, the central bank could raise rates if persistent and excessive yen depreciation significantly impacts inflation expectations, Adachi explained during a speech.

He emphasized that the BoJ must consider both downside and upside risks to the economy and prices when guiding policy. “We must avoid prematurely raising interest rates. However, focusing too much on downside risks could lead to accelerated inflation, forcing us to tighten monetary policy sharply later,” Adachi warned.

Adachi suggested that as long as underlying inflation trends towards 2%, it is crucial to gradually adjust monetary support according to economic, price, and financial developments, indicating a possible near-term rate hike.

His remarks underscore the increasing importance of a weak yen on the timing of the BoJ’s next rate hike, which some analysts predict could happen as early as July. Despite his comments, the yen weakened to a four-week low against the dollar due to rising U.S. yields, with the dollar reaching 157.10 yen on Wednesday after an intraday high of 157.41 yen.

Adachi projected that consumer inflation would re-accelerate from summer through autumn this year due to rising import costs and prospects of sustained wage gains. “If yen falls accelerate or persist, consumer inflation may rebound sooner than expected. Should this coincide with a higher likelihood of inflation exceeding 2% durably, we may need to advance the timing of an interest rate hike,” he noted.

Ideally, the BoJ would raise rates at a “slow pace” in line with steady increases in underlying inflation, Adachi mentioned in a news conference after his speech in Kumamoto, southern Japan. The yen has depreciated by roughly 10% against the dollar this year, despite the BoJ ending eight years of negative rates in March, as markets focus on the significant divergence between U.S. and Japanese interest rates.

The weak yen has become a concern for policymakers due to its impact on consumption from rising import costs, prompting some market participants to speculate on a near-term rate hike to curb the currency’s depreciation. Japan’s consumer sentiment worsened for the second consecutive month in May due to rising prices, as reported by a Cabinet Office survey.

Expectations of a near-term rate hike pushed Japan’s 10-year government bond yield to 1.07% on Wednesday, the highest since December 2011. Some traders also anticipated that the BoJ might decide on a full-scale tapering of bond purchases next month, following an unexpected cut in bond buying on May 13.

Adachi reiterated that the BoJ would reduce its bond buying in the future as per its March decision to end a policy that capped bond yields around zero. However, he clarified that the May 13 reduction had no policy implications and it was too early to determine if recent increases in Japanese long-term yields would persist. “I don’t have a strong view on whether the BoJ should reduce bond buying soon or wait longer,” Adachi said, adding there was no preset idea or schedule for the future pace of tapering. Any reduction in bond purchases would be done in stages to avoid market destabilization, he added.

BoJ Governor Kazuo Ueda has indicated that the central bank intends to hike rates to neutral levels for the economy, provided growth and inflation align with projections. The governor also mentioned that the BoJ would eventually scale back its bond purchases and reduce the size of its balance sheet as part of its long-term strategy.

JPY: BoJ’s Adachi: Policy Changes Need Caution — Update

Bank of Japan (BoJ) board member Seiji Adachi addressed the timing of the BoJ’s reduction in bond purchasing, expressing uncertainty. “When we will reduce bond purchasing, I don’t know,” Adachi said. He highlighted that foreign exchange (FX) prices are significantly impacting Japan’s economy and the prices of goods, with import costs currently higher than export earnings.

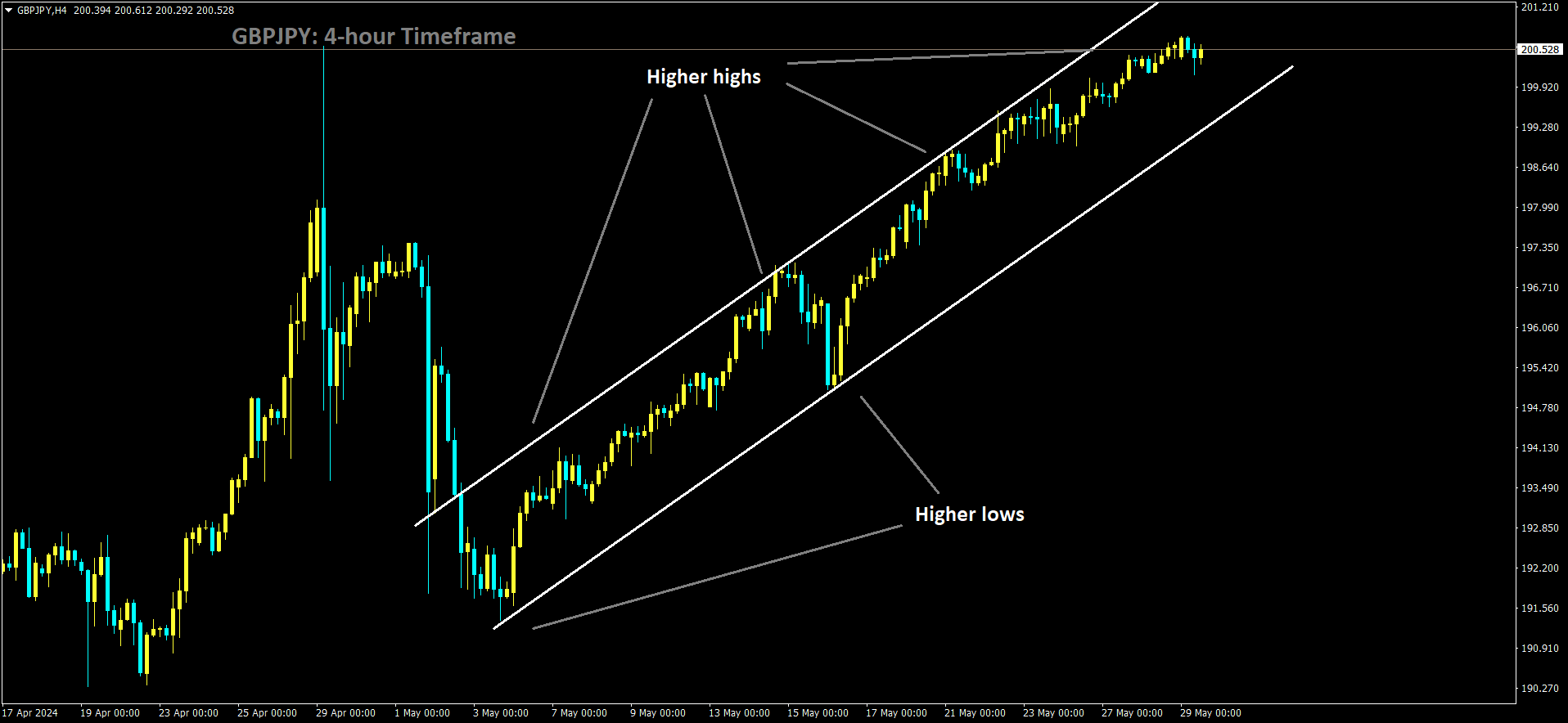

GBPJPY is moving in Ascending channel and market has reached higher high area of the channel

Adachi indicated that a rate hike is expected soon this year if inflation continues to approach the 2% target. He emphasized the need for a well-planned reduction in bond purchasing to facilitate the rate hike. “Bond purchasing reduction must be planned carefully to ensure it supports the rate hike,” Adachi explained. This strategic approach aims to gradually strengthen the Japanese yen (JPY) against other currencies, preventing further weakness.

Adachi’s comments are seen as favorable for the yen, suggesting that the BoJ is mindful of the currency’s strength in the market. By addressing the necessary measures for reducing bond purchasing and considering the impacts of FX prices, Adachi’s remarks provide insight into the BoJ’s approach to stabilizing and potentially strengthening the yen.

The Bank of Japan must proceed cautiously with any further policy changes, stated policy board member Seiji Adachi, emphasizing that the central bank’s decision to end easing measures does not signal a shift towards monetary tightening.

“We need to absolutely avoid premature rate increases, which could undermine the Japanese economy’s chance for recovery,” Adachi said in a speech on Wednesday.

While the likelihood of achieving sustainable and stable 2% inflation is increasing, it is not yet certain, Adachi noted, stressing the need to maintain accommodative monetary conditions.

In March, the BoJ raised interest rates for the first time since 2007, citing a positive cycle of wages and prices beginning to take effect. Adachi clarified that this decision did not indicate a shift to a tightening stance.

Adachi’s remarks come amid rising expectations for further policy changes, which have pushed the yield on benchmark 10-year Japanese government bonds to 1.065%, the highest since December 2011.

The prospect of early monetary tightening in Japan is growing as the yen’s continued weakness fuels concerns over prolonged inflation. Recent government data shows that overall consumer prices rose 2.5% in April compared to the previous year, staying above the BoJ’s 2% target for two years.

Although the BoJ is not directly responsible for managing foreign exchange rates, Adachi mentioned that the central bank might consider monetary policy responses if a weak yen threatens the goal of maintaining price stability.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/