EURO: Eurozone HICP Inflation Rises to 2.6% YoY in May vs. 2.5% Forecast

The Euro area CPI inflation data came at 2.6% YoY in the May month versus 2.4% YoY printed in the April month. Core CPI data came at 2.9% YoY versus 2.7% YoY in the April month. monthly basis, CPI came at 0.20% MoM versus 0.60% printed in the April month and Core CPI 0.40% MoM printed in the May month versus 0.70% printed in the last month. Euro pairs traded higher against counter pairs after the reading came.

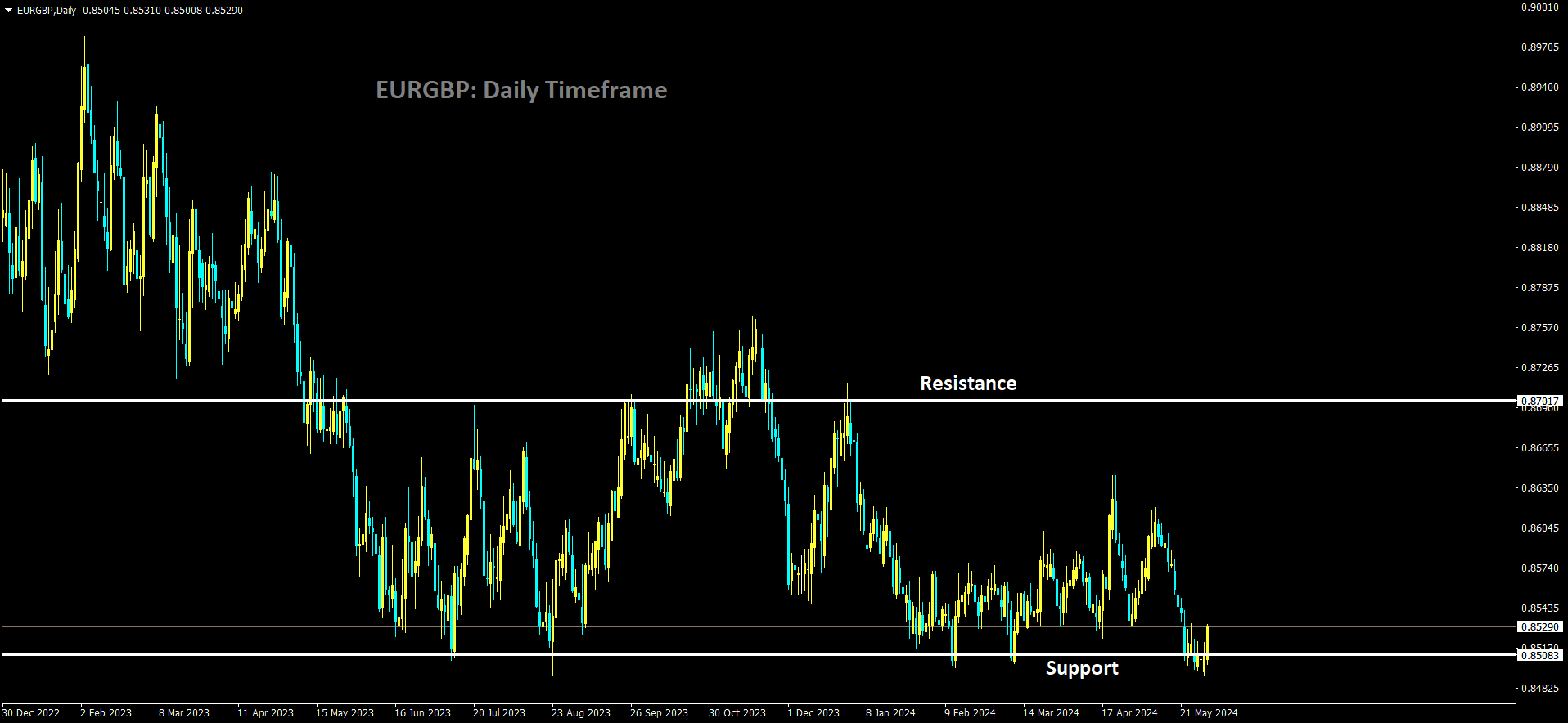

EURGBP is moving in box pattern and market has rebounded from the support area of the pattern

The Eurozone Harmonized Index of Consumer Prices (HICP) increased at an annual rate of 2.6% in May, higher than the 2.4% growth observed in April, according to official data released by Eurostat on Friday. This figure surpassed market expectations, which had predicted a 2.5% increase for the period.

The Core HICP inflation, which excludes volatile items like food and energy, rose to 2.9% year-over-year in May, compared to a 2.7% increase in April, and also exceeded the forecasted 2.8%.

On a monthly basis, the Eurozone’s HICP rose by 0.2% in May, following a 0.6% increase in April. Core HICP inflation increased by 0.4% month-over-month in May, down from the 0.7% growth seen previously.

The European Central Bank (ECB) has an inflation target of 2.0%. The HICP inflation data is crucial for the market’s expectations regarding potential ECB interest rate adjustments.

Commenting on the inflation data, ECB executive board member Fabio Panetta stated, “The Eurozone’s latest inflation rate of 2.6%, reported on Friday, aligns with forecasts and is ‘neither good nor bad’.”

Key details from the Eurozone inflation report (via Eurostat):

– Services are expected to have the highest annual rate in May at 4.1%, up from 3.7% in April.

– Food, alcohol, and tobacco prices are expected to rise by 2.6% annually, compared to 2.8% in April.

– Non-energy industrial goods are projected to see a 0.8% annual increase, slightly down from 0.9% in April.

– Energy prices are expected to increase by 0.3%, reversing a -0.6% decrease in April.

EURO: Euro Area Inflation Rises to 2.6%

The Consumer Price Index (CPI) inflation data for the Euro area showed an annual increase of 2.6% in May, compared to a 2.4% increase in April. Additionally, the Core CPI, which excludes volatile items such as food and energy, reported a year-over-year increase of 2.9% in May, up from 2.7% in April. On a monthly basis, the CPI rose by 0.20% in May, a slowdown from the 0.60% increase recorded in April. The monthly Core CPI increased by 0.40% in May, compared to a 0.70% rise in April. Following the release of this data, Euro currency pairs traded higher against other major currencies.

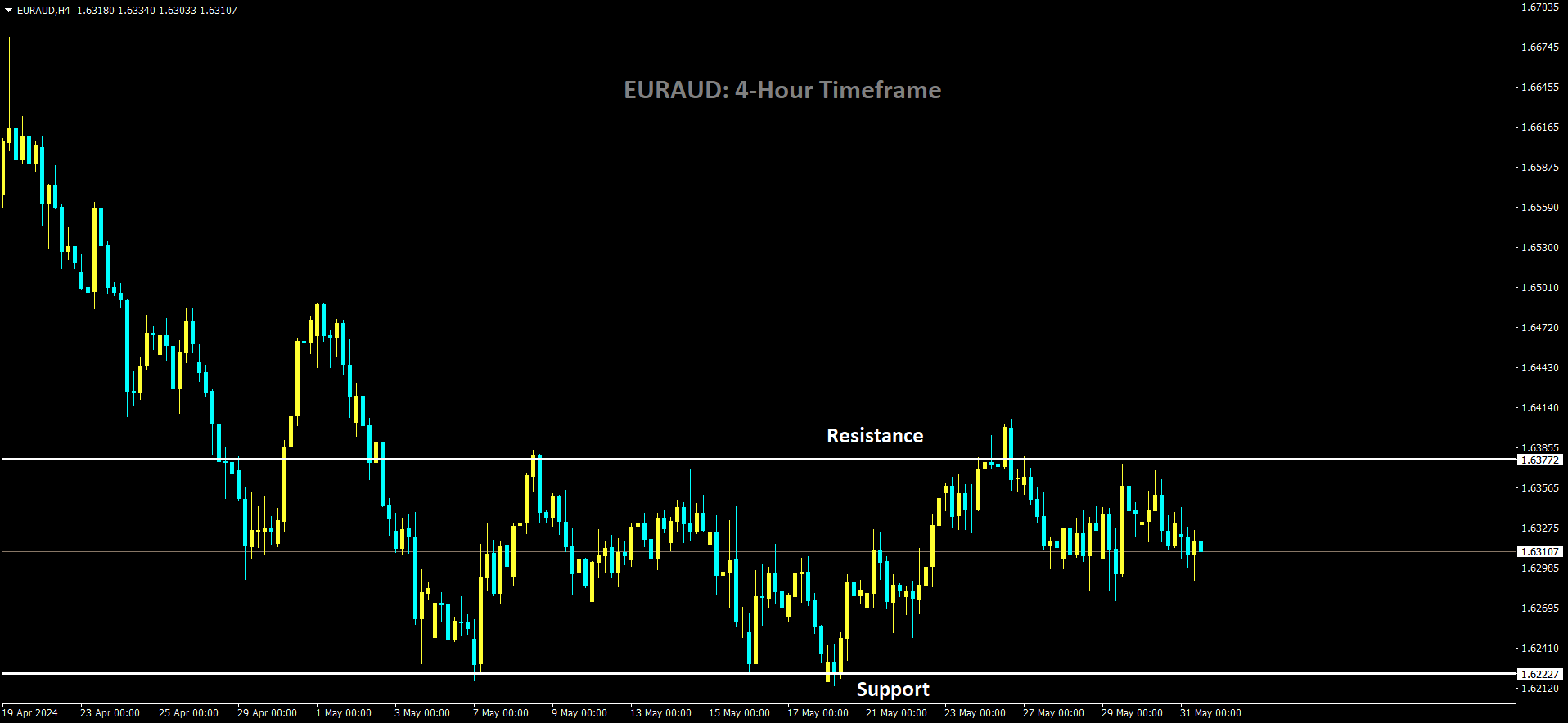

EURAUD is moving in box pattern and market has fallen from the resistance area of the pattern

Euro area annual inflation is projected to reach 2.6% in May 2024, up from 2.4% in April, according to a flash estimate from Eurostat, the statistical office of the European Union.

Examining the primary components of euro area inflation:

– Services are expected to have the highest annual rate in May at 4.1%, an increase from 3.7% in April.

– Prices for food, alcohol, and tobacco are anticipated to rise by 2.6% annually, though this is slightly lower than the 2.8% increase seen in April.

– Non-energy industrial goods are expected to see an annual increase of 0.8%, down from 0.9% in April.

– Energy prices are projected to increase by 0.3%, a notable change from the -0.6% decrease recorded in April.

EURO: Eurozone Inflation Rises, Signaling ECB Caution

The Euro area CPI inflation data for May showed a 2.6% year-over-year increase, up from 2.4% in April. Core CPI rose 2.9% year-over-year in May, compared to 2.7% in April. On a monthly basis, CPI increased by 0.20% in May, down from 0.60% in April, while Core CPI increased by 0.40% in May, down from 0.70% in April. Following these reports, Euro pairs traded higher against other currencies.

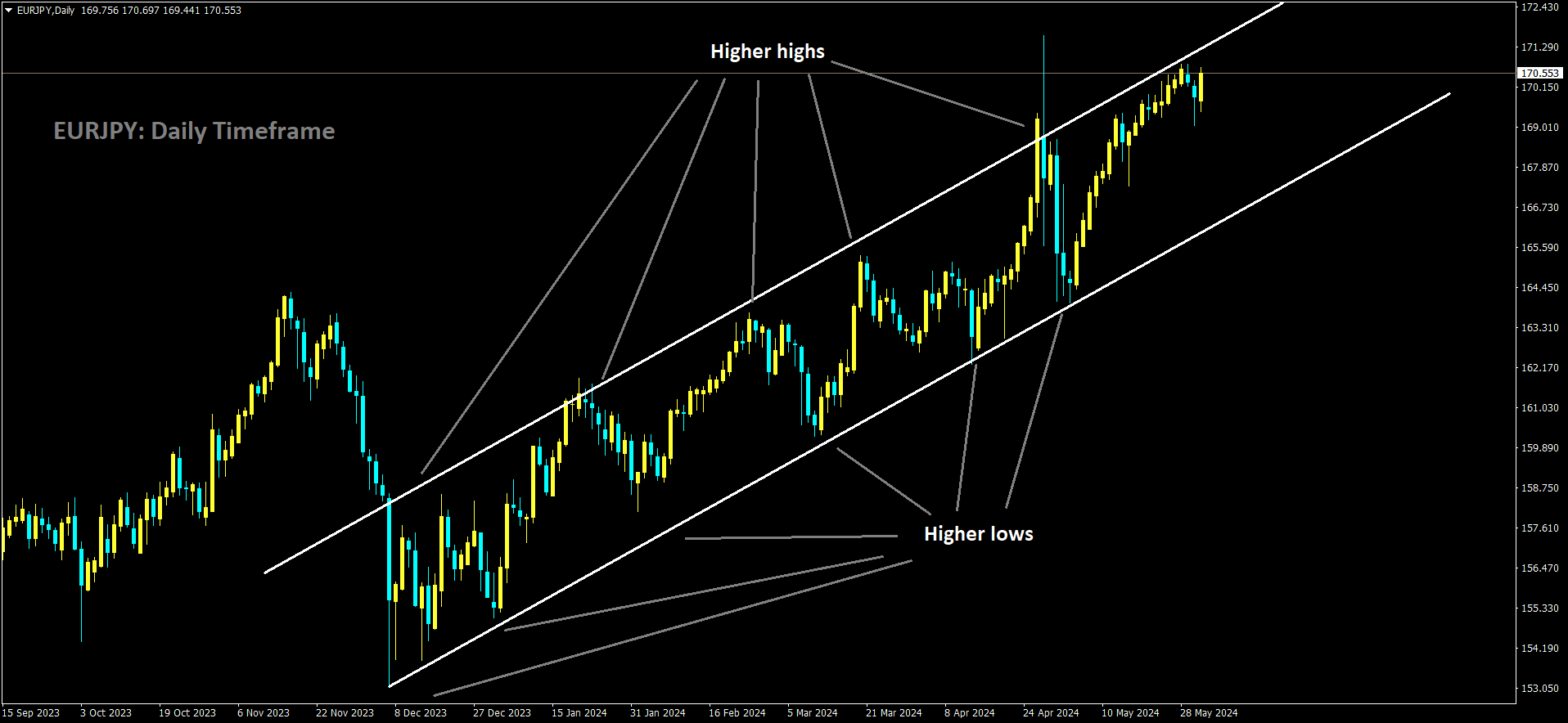

EURJPY is moving in Ascending channel and market has reached higher high area of the channel

Eurozone inflation rose in May, as indicated by data released on Friday, signaling that the European Central Bank (ECB) still faces a challenging path to achieving its goal of fully controlling price increases.

The larger-than-expected rise in inflation is unlikely to prevent the ECB from lowering borrowing costs from their current record high next week. However, it may support the argument for a pause in July and a slower pace of interest rate reductions in the months ahead.

“These numbers strengthen the hands of those who say we need to be cautious,” said Dirk Schumacher, an economist at Natixis.

Consumer prices in the 20 countries that share the euro increased by 2.6% year-on-year in May, moving further from the ECB’s 2% target after a 2.4% rise in the previous two months, according to Eurostat’s flash estimate. Economists polled by Reuters had expected inflation to rise to 2.5%, partly due to unfavorable comparisons with the previous year when Germany had subsidized rail travel and other one-off factors.

ECB policymaker Fabio Panetta, the governor of the Bank of Italy, stated that the latest reading was neither good nor bad. He reaffirmed his view that the central bank could cut rates several times while still maintaining control over the economy.

More notably, a closely watched measure of underlying inflation, which excludes food, energy, alcohol, and tobacco, came in at 2.9%, up from 2.7% in April. Prices in the services sector, which some policymakers consider particularly important as they reflect domestic demand, rebounded to 4.1% from 3.7%.

This increase likely mirrors larger-than-expected wage increases in the first quarter of the year, which have improved consumers’ disposable income after years of wages lagging behind inflation.

The ECB’s most significant series of rate hikes ever has helped reduce inflation, which peaked at around 10% in late 2022 due to the surge in energy prices following Russia’s invasion of Ukraine. The hikes have stabilized consumer inflation expectations but also restricted credit availability.

This means that policymakers meeting next week are likely to adhere to well-communicated plans to cut rates despite growing market doubts about a global trend of falling inflation.

“We think that the latest inflation and wage figures decrease the likelihood of back-to-back interest rate cuts in July, but we see the ECB cutting rates twice more before the end of the year if the downward trend in inflation resumes during the third quarter as expected,” said Diego Iscaro, head of European economics at S&P Global Market Intelligence.

German government bond yields, the benchmark for eurozone borrowing costs, reached their highest level in over six months following the release of the inflation data.

Markets are currently pricing in around 57 basis points of ECB rate cuts in 2024, indicating a 25 basis point cut in June and another by the end of the year. However, in recent weeks, they have gradually reduced expectations of a third cut this year.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/