AUD: China’s May Caixin Manufacturing PMI Rises to 51.7, Beating Expectations

China Caixin Manufacturing PMI data came at 51.7 in the May month versus 51.4 printed in the April month and 51.5 is expected.

Output surged to 23 Month high, Input price inflation surged to 7 month high and Total new orders rose to 10 month high. Consumer confidence increased So Production orders are ramp up Since June 2022.

AUDUSD is moving in Descending channel and market has reached lower high area of the channel

China’s Caixin S&P Global Manufacturing Purchasing Managers’ Index (PMI) increased from 51.4 in April to 51.7 in May, according to the latest data released on Monday.

This reading surpassed the market consensus of 51.5 for the reported month.

Key highlights (via Caixin):

– Production expanded at the most pronounced pace since June 2022.

– Purchasing activity grew at the fastest rate in three years as confidence improved.

– Input price inflation rose to a seven-month high.

“Both supply and demand expanded amid the upturn. Growth in manufacturers’ output reached a 23-month high in May, with particularly strong increases in consumption goods production,” said Wang Zhe, an economist at Caixin Insight Group.

Wang added, “Total new orders registered the 10th consecutive month of growth, although demand for intermediate goods was relatively weak.”

AUD: China’s Manufacturing Surges, Caixin PMI Shows, Amid Growing Global Risks

China’s Caixin Manufacturing PMI data for May came in at 51.7, up from 51.4 in April, and surpassing the expected 51.5.

AUDJPY is moving in Ascending channel and market has reached higher low area of the channel

Key highlights include:

– Output surged to its highest level in 23 months.

– Input price inflation climbed to a seven-month high.

– Total new orders rose to a ten-month high.

The increase in consumer confidence has driven production orders to ramp up significantly since June 2022.

China’s factory activity grew at the fastest pace in nearly two years in May, driven by gains in production and new orders, especially at smaller firms, according to a private sector survey released on Monday. This positive performance boosts the outlook for the second quarter.

The Caixin/S&P Global manufacturing PMI rose to 51.7 in May from 51.4 in April, the highest level since June 2022, surpassing analysts’ forecasts of 51.5. The 50-point mark separates growth from contraction.

In response to weak domestic demand and a prolonged property crisis, China has increased infrastructure investment and invested in high-tech manufacturing to support the broader economy this year. However, the full impact of these policy measures is yet to be felt by businesses and workers.

The upbeat Caixin PMI contrasts with an official PMI survey from Friday, which showed a surprising decline in manufacturing activity. The mixed indicators, along with other data, suggest that the economic recovery is struggling to maintain momentum in the second quarter.

“The key question is whether China’s exports will continue to hold up well in the coming months,” said Zhou Hao, an economist at Guotai Junan International. “The export orders index dropped significantly in the official PMI but remained relatively resilient in the Caixin PMI.”

The Caixin survey is considered to be more focused on smaller, export-oriented firms compared to the broader official PMI. According to the Caixin survey, output rose at the fastest pace since June 2022, with firms in the consumer segment reporting sharp growth in May. Production was supported by higher inflows of new work, as both domestic and global demand bolstered client interest in new products.

Thanks to improved economic indicators and new policy measures in the first quarter, the International Monetary Fund (IMF) last week raised its forecast for China’s 2024 economic growth to 5% from an earlier forecast of 4.6%. However, this is still below a previous IMF forecast of 5.2% growth. Rating agency Moody’s also increased its 2024 China growth forecast to 4.5% from 4.0%, while maintaining its 2025 projection at 4.0%.

The outlook for China’s trade remains volatile due to a sluggish global economy. According to Caixin, new export orders grew at a much slower pace in May, following April’s 41-month high. Some survey respondents attributed new work to recent trade fairs, while others cited strategic expansion into overseas markets.

To meet ongoing production needs, factories increased their purchasing activity, with the quantity of purchases accelerating at the fastest rate in three years. Producer sentiment improved from April, with expectations of better market demand both domestically and internationally.

Rising prices for metals, plastics, and energy led to an increase in average input costs, with the rate of input price inflation reaching its highest level since last October. However, employment remained weak, staying in contractionary territory for the ninth consecutive month. The rate of job losses slowed, with consumer goods manufacturers even recording a slight rise in staffing levels.

AUD: China Factory Activity Hits 2-Year High, Caixin PMI Shows

China’s Caixin Manufacturing PMI rose to 51.7 in May, up from 51.4 in April and above the expected 51.5.

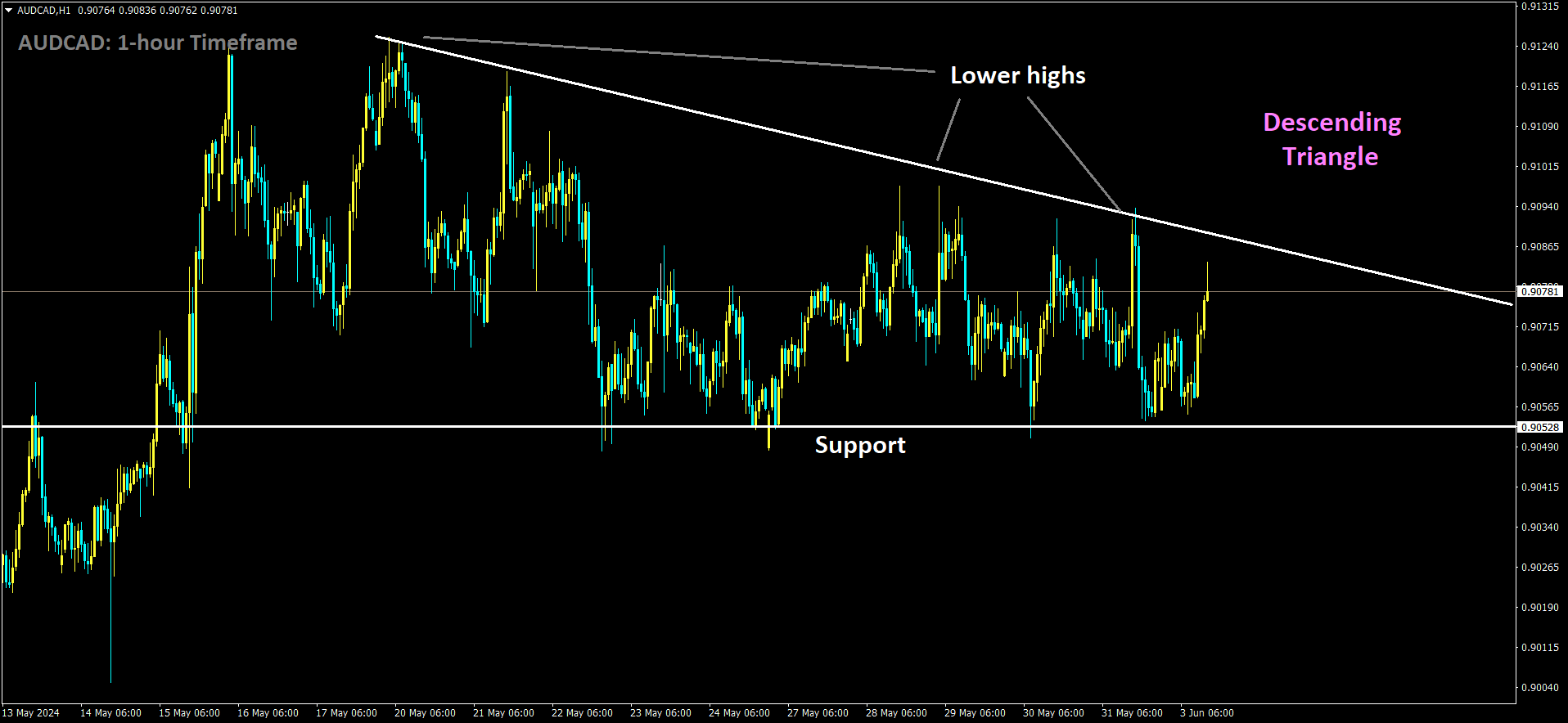

AUDCAD is moving in Descending Triangle and market has rebounded from the support area of the pattern

Key highlights:

– Output reached a 23-month high.

– Input price inflation hit a 7-month high.

– Total new orders increased to a 10-month high.

Increased consumer confidence has led to a ramp-up in production orders since June 2022.

China’s factory activity experienced the fastest growth in nearly two years in May, driven by production gains and new orders, particularly at smaller firms, according to a private sector survey released on Monday. This boost has improved the outlook for the second quarter.

The Caixin/S&P Global Manufacturing PMI rose to 51.7 in May from 51.4 in April, the highest reading since June 2022, surpassing analysts’ expectations of 51.5. A reading above 50 indicates growth.

In an effort to counteract weak domestic demand and a prolonged property crisis, China has increased infrastructure investment and channeled funds into high-tech manufacturing to support the broader economy this year. However, the full impact of these policy measures has yet to be felt by businesses and workers.

The positive Caixin PMI contrasts with an official PMI survey from Friday, which showed an unexpected decline in manufacturing activity. The mixed signals from these indicators suggest that the economic recovery is struggling to maintain momentum in the second quarter.

“The key question is whether China’s exports will continue to hold up well in the coming months,” said Zhou Hao, an economist at Guotai Junan International. “The export orders index dropped significantly in the official PMI but remained relatively resilient in the Caixin PMI.”

The Caixin survey is believed to be more focused on smaller, export-oriented firms than the broader official PMI. According to the Caixin survey, output rose at the fastest pace since June 2022, with firms in the consumer segment reporting sharp growth in May. Production was supported by higher inflows of new work, as both domestic and global demand boosted client interest in new products.

Thanks to improved economic indicators and new policy measures in the first quarter, the International Monetary Fund (IMF) last week raised its forecast for China’s 2024 economic growth to 5% from an earlier forecast of 4.6%. However, this remains below a previous IMF forecast of 5.2% growth.

The outlook for China’s trade remains volatile due to a sluggish global economy. According to Caixin, new export orders grew at a much slower pace in May, following April’s 41-month high. Some survey respondents attributed new work to recent trade fairs, while others cited strategic expansion into overseas markets.

To meet ongoing production needs, factories increased their purchasing activity, with the quantity of purchases accelerating at the fastest rate in three years. Producer sentiment improved from April, with expectations of better market demand both domestically and internationally.

Rising prices for metals, plastics, and energy led to an increase in average input costs, with the rate of input price inflation reaching its highest level since last October. However, employment remained weak, staying in contractionary territory for the ninth consecutive month. The rate of job losses slowed, with consumer goods manufacturers even recording a slight rise in staffing levels.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/