USDCHF Rebounds Above 0.8950 as Swiss CPI Rises 0.3% in May

The Swiss CPI inflation data came at 1.4% YoY in the May month versus same reading in the previous month. MoM data came at 0.30% MoM versus 0.40% printed in the April month. Slight decrease in the inflation expected SNB rate cuts in the June month. But SNB Chairman Thomas Jordan said FX Intervention will be there inorder to keep CHF higher.

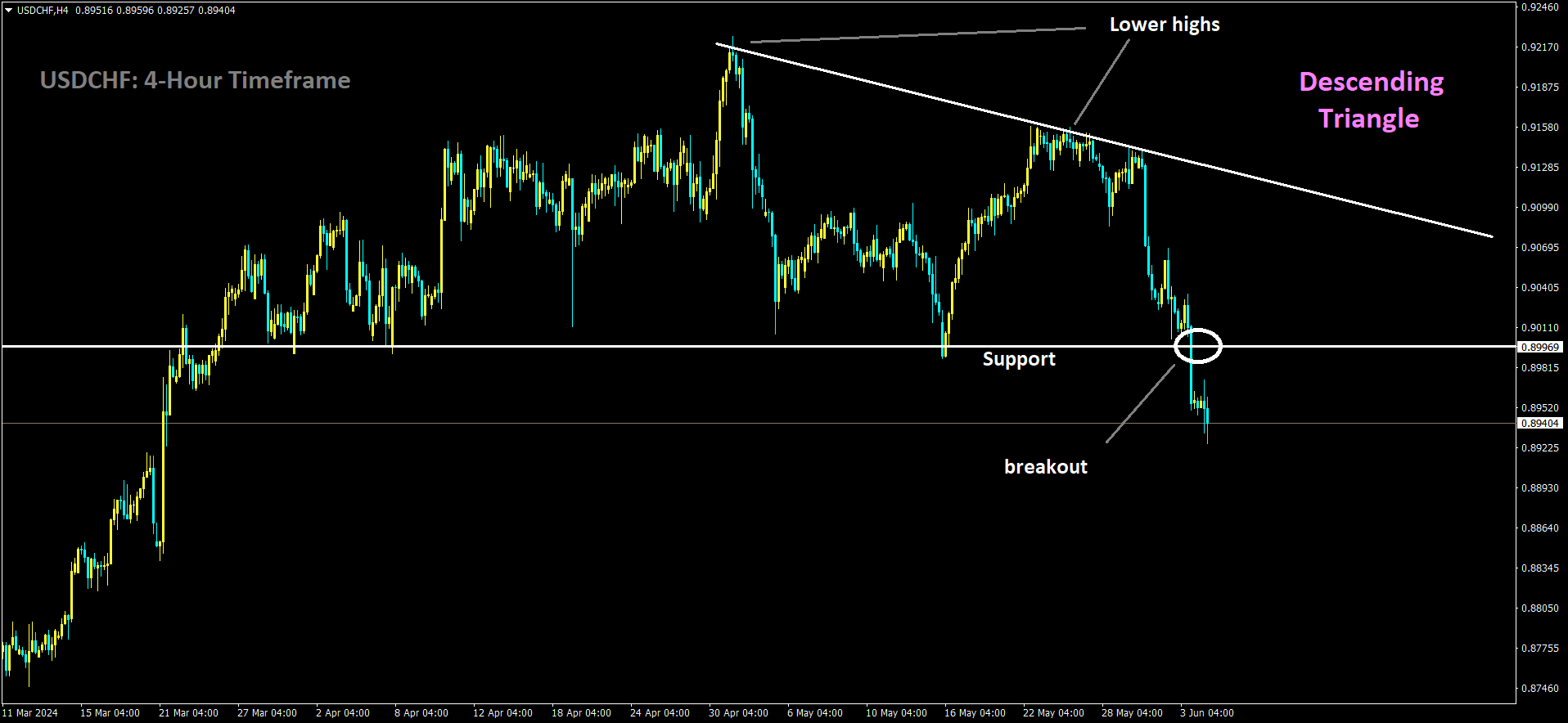

USDCHF has broken Descending Triangle in downside

On Tuesday, the USD/CHF pair broke a three-day losing streak, rising to around 0.8970 during early European trading hours. The Swiss Franc (CHF) faced selling pressure following cooler-than-expected Swiss inflation data.

According to the Swiss Federal Statistical Office, Switzerland’s Consumer Price Index (CPI) increased by 1.4% year-on-year in May, matching the previous reading of 1.4%. Monthly CPI inflation rose by 0.3% in May, falling short of the market consensus of 0.4%. The lower inflation figures have led to speculation about a potential rate cut by the Swiss National Bank (SNB) on June 28, which is weighing on the CHF. However, the downside for the CHF may be limited as SNB President Thomas Jordan suggested that the Swiss central bank might intervene in foreign exchange markets to control inflation.

Conversely, in the US, PCE inflation remained steady in April, while the ISM Manufacturing PMI for May came in weaker than expected, increasing the likelihood of rate cuts by the US Federal Reserve (Fed) in September. This development might put pressure on the USD against the CHF. Attention will now turn to the upcoming US employment data on Friday.

Projections for the US Nonfarm Payrolls (NFP) indicate 190,000 job additions in May, with the Unemployment Rate expected to hold steady at 3.9%. Any signs of weaker labor market data could further undermine the Greenback, posing a potential headwind for the USD/CHF pair.

USDCHF Rebounds After Swiss CPI Data Release

The Swiss CPI inflation data for May showed an annual increase of 1.4%, matching the previous month’s figure. On a monthly basis, the CPI rose by 0.3%, slightly below the 0.4% increase recorded in April. The slight decrease in inflation has fueled expectations of potential rate cuts by the Swiss National Bank (SNB) in June.

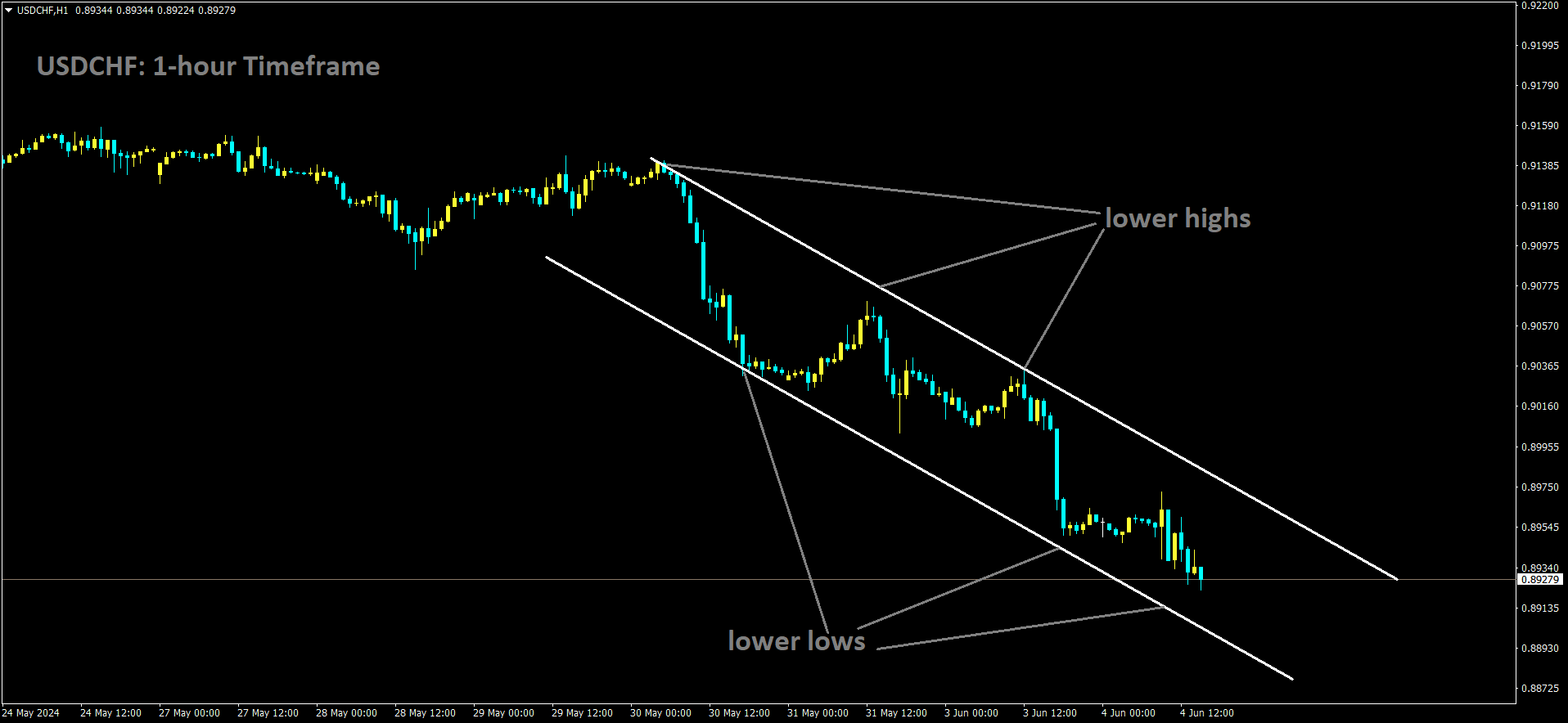

USDCHF is moving in the Descending channel and the market has reached the lower low area of the channel

However, SNB Chairman Thomas Jordan indicated that the central bank might intervene in the foreign exchange markets to keep the CHF strong, despite the lower inflation numbers. This suggests that the SNB is prepared to take action to support the Swiss Franc and manage inflationary pressures through currency intervention if necessary.

Swiss CPI inflation data for May was released today at 7:30 pm BST. The report was anticipated to show annual inflation remaining unchanged at 1.4% year-over-year, while the monthly reading was expected to accelerate from 0.3% in April to 0.4% in May. This data was closely monitored by CHF traders following the Swiss National Bank’s (SNB) unexpected rate cut at its Q1 policy meeting. The next SNB rate decision is scheduled for June 20, 2024.

The actual report matched expectations for annual CPI, holding steady at 1.4% YoY. However, the monthly CPI came in slightly lower than expected at 0.3% MoM. It should be noted that market expectations for the monthly reading were nearly evenly split between 0.3% and 0.4%. Following the release, the CHF weakened, resulting in the USD/CHF pair erasing its daily drop.

The actual report matched expectations for annual CPI, holding steady at 1.4% YoY. However, the monthly CPI came in slightly lower than expected at 0.3% MoM. It should be noted that market expectations for the monthly reading were nearly evenly split between 0.3% and 0.4%. Following the release, the CHF weakened, resulting in the USD/CHF pair erasing its daily drop.

Swiss Inflation Steady at 1.4%

Swiss CPI inflation data for May showed a 1.4% year-on-year increase, the same as the previous month. Month-on-month, CPI rose by 0.3%, down from 0.4% in April. The slight decrease in inflation has led to expectations of SNB rate cuts in June. However, SNB Chairman Thomas Jordan stated that the central bank might intervene in the foreign exchange market to keep the CHF strong.

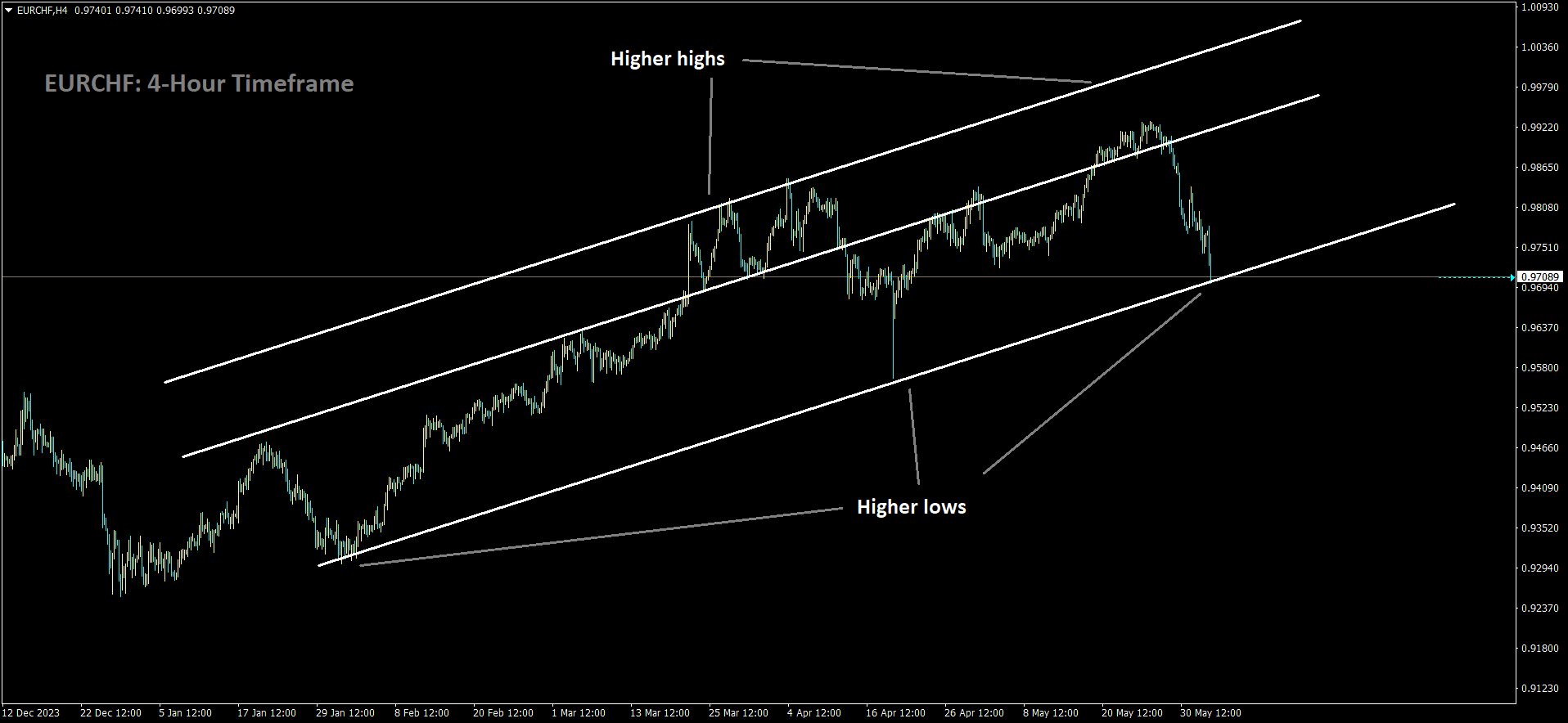

EURCHF is moving in Ascending channel and market has reached higher low area of the channel

Switzerland’s consumer prices posted a steady increase in May, according to the Federal Statistical Office’s report on Tuesday.

The consumer price index (CPI) grew by 1.4 percent on a yearly basis, maintaining the same rate as in April.

On a monthly basis, consumer prices advanced by 0.3 percent. This rise was attributed to several factors, including increasing prices for housing rentals and international package holidays. Additionally, prices for various fresh vegetables and petrol saw increases, while prices for heating oil and foreign red wine decreased in May.

Core consumer prices, which exclude volatile items like food and energy, gained 0.2 percent on a monthly basis, bringing the annual core inflation rate to 1.2 percent in May.

The Swiss National Bank (SNB) forecasts overall consumer prices to increase by 1.4 percent this year and 1.2 percent in 2025.

During its quarterly meeting in March, the SNB lowered its policy rate by a quarter point to 1.5 percent, reflecting the effectiveness of its inflation-fighting measures over the past two and a half years.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/