BTCUSDT: Bitcoin Surges Past $71K with $880M Inflows to BTC ETFs, Best Day Since March

The $880 Million Funds inflows in to Bitcoin ETFS in the Approved Bitcoin exchanges in the US. So The Bitcoin prices are soaring to $71K market second time after the March 2024 Peak. Funds inflows is the welcome one for Digital assets, Now US Presidential campaign main theme is Crypto regulations and avoiding Digital currency from Former US President Donald Trump words. So Crypto is the heading for both parties lead or lag based on the Crypto supporters to parties.

BTCUSDT Market price is moving in box pattern and market has reached resistance area of the pattern

On Tuesday, U.S.-listed spot bitcoin exchange-traded funds (ETFs) witnessed a significant influx of over $880 million, with Fidelity’s FBTC leading the pack, according to preliminary data released on Wednesday. Concurrently, the price of bitcoin surged past $71,000 during Asian trading hours, registering a 3% increase over the past 24 hours. The CoinDesk 20 (CD20) index, reflecting the performance of the largest tokens, also saw a rise of 2.65%.

Among the ETFs, Fidelity’s FBTC attracted the highest inflows, amounting to $378 million, followed by BlackRock’s IBIT with $270 million, and Grayscale’s GBTC, which notoriously experienced outflows, took in $28 million.

This surge in inflows marked the most significant uptick since March and the second-highest overall since the launch of 11 bitcoin ETFs in January.

The recent uptick in inflow activity follows a generally bullish sentiment, contrasting with a lackluster period from mid-April to early May, during which some days saw zero net inflows and even outflows from major ETFs like BlackRock’s IBIT.

According to Bloomberg analyst Eric Balchunas, the past four weeks have seen ETFs accumulate $3.3 billion, pushing their net inflows for the year past the $15 billion mark.

This increased activity comes shortly after the approval of an ether (ETH) spot ETF for listing in the U.S. and amid positive sentiments towards cryptocurrencies amid the ongoing U.S. presidential campaign.

BTCUSDT: Bitcoin Price Approaches $71K Amid Rate Cut Speculation

The Bitcoin prices are surged to $71K inflows by $880 Million Funds to Bitcoin ETFS due to hopes of Rate cuts in the September month from FED Side. Continuous slowdown reading of US economy shows FED rate cut expecatations are higher in the market. So US Dollar drawback helpful for Bitcoin prices in the market.

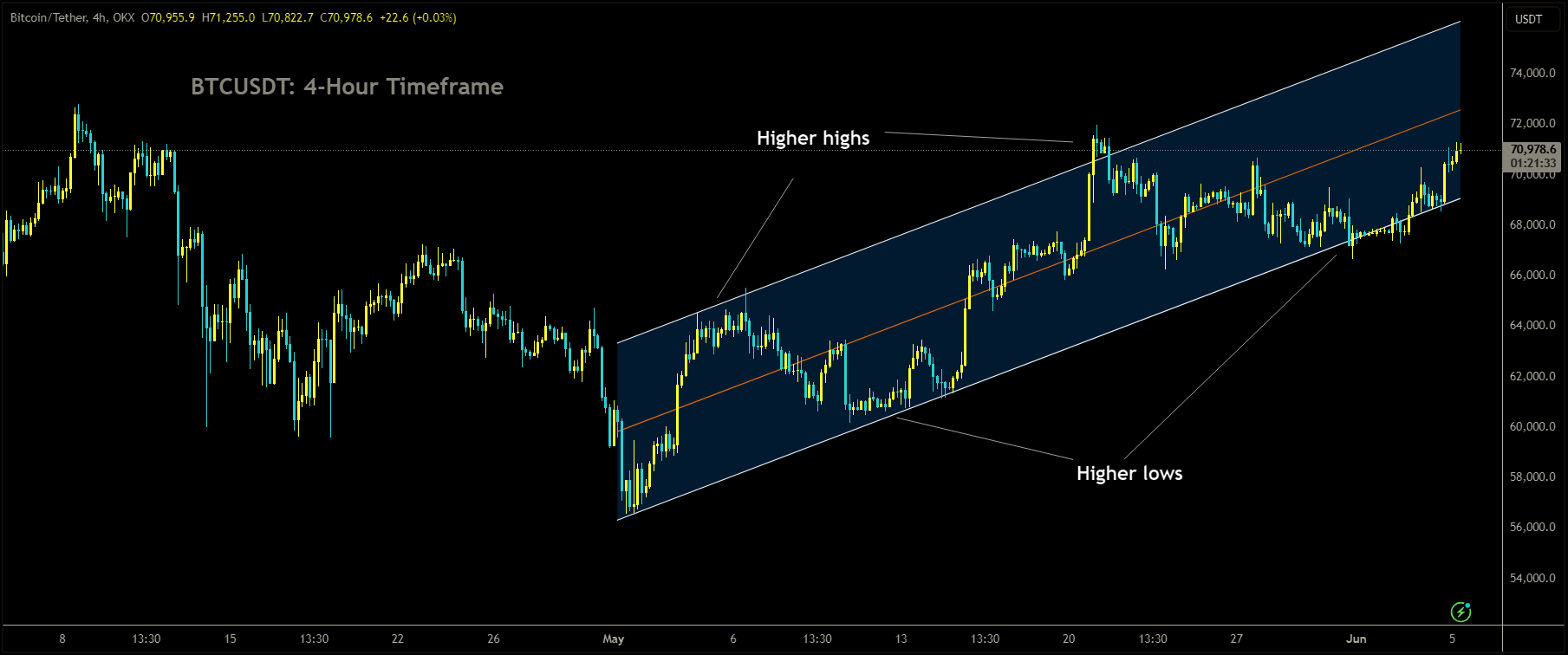

BTCUSDT Market price is moving in Ascending channel and market has rebounded from the higher low area of the channel

On Wednesday, the price of Bitcoin experienced a surge, driven by increasing expectations of interest rate cuts in the United States amid ongoing reports of weak economic indicators. This momentum also helped Bitcoin break out of a recent trading range. Additionally, broader cryptocurrency prices benefited from heightened capital inflows into the market over the past month, with the launch of spot Bitcoin exchange-traded funds (ETFs) in Australia further indicating potential capital inflows in the near future.

A recent decline in the value of the U.S. dollar also contributed to positive sentiment in the cryptocurrency markets.

Breaking out of a trading range that had persisted between $60,000 and $70,000 since mid-March, Bitcoin now stands approximately $3,000 away from reaching a new all-time high. Despite experiencing a period of consolidation due to factors such as profit-taking, concerns regarding high interest rates, and waning enthusiasm surrounding Bitcoin ETFs, the renewed interest in cryptocurrencies seems evident, especially with the anticipation of potential interest rate cuts later in the year.

Assets with higher risk profiles, such as cryptocurrencies, typically benefit from lower interest rates, as increased liquidity encourages more speculative trading activities.

BTCUSDT Market price is moving in Ascending channel

In addition to Bitcoin’s rise, other altcoins also saw gains on Wednesday, driven by expectations of future interest rate adjustments by the Federal Reserve in response to weak U.S. economic data. Ethereum, the second-largest cryptocurrency by market capitalization, rose by 0.7%, while other altcoins such as SOL, XRP, and ADA recorded gains ranging from 0.9% to 5%.

Meme tokens also experienced upward movements, with SHIB surging by 8% and DOGE adding 3.1%. Expectations of a rate cut in September gained traction following softer-than-expected job openings data released on Tuesday. This data was preceded by weak purchasing managers index data and a downward revision of U.S. gross domestic product for the first quarter.

However, while these indicators increased speculation about a September rate cut, market focus for the week remained on upcoming nonfarm payrolls data for clearer insights into the labor market and future interest rate trends.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/