ECB’s Kazimir: Rate Cut Nearing

The ECB Member and Slovakian Central bank Governor Peter Kazimir said inflation is in the Good tracking path and ECB is near in its rate cut tool in the next meeting. This speech Gives thumbs down for Euro pairs due to rate cut expected. The Euro zone Business services are expanded in the April month and one month data is not enough for ECB hold on the rates. Quarterly data shows near the Goal of ECB targets, So rate cut more expected in the Tomorrow meeting.

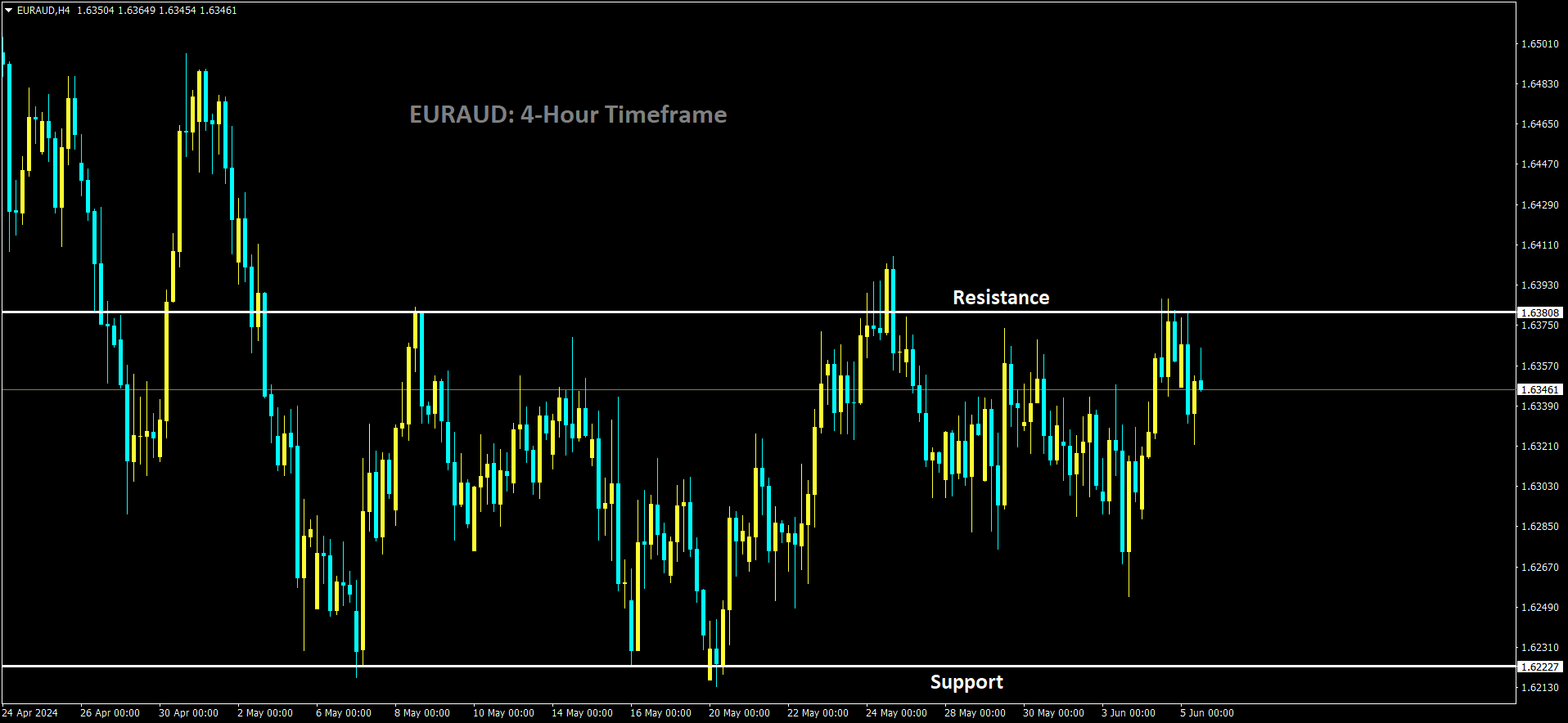

EURAUD is moving in box pattern and market has fallen from the resistance area of the pattern

European Central Bank (ECB) policymaker and Slovakian central bank Governor Peter Kazimir made a notable statement on Wednesday, expressing his belief that the ECB is approaching its first interest rate cut. Kazimir highlighted that “inflation is on a good trajectory” during his presentation of the Slovakian central bank’s financial stability report (FSR).

These comments are unexpected, given the ECB is currently in its quiet period preceding Thursday’s policy announcements. Kazimir’s remarks suggest a potential shift in the ECB’s monetary policy, signaling a possible easing of rates in response to improving inflation dynamics.

European shares rebound on soft US jobs data; ECB decision eyed

European Central Bank (ECB) member and Slovakian Central Bank Governor Peter Kazimir expressed optimism about the current inflation trajectory, stating that inflation is on a positive path. He also indicated that the ECB is approaching its first rate cut in the upcoming meeting. Kazimir’s remarks have created a bearish sentiment for Euro pairs, as markets now anticipate an imminent rate reduction.

Adding to the market sentiment, recent data revealed that the eurozone’s business services sector expanded in April. However, Kazimir emphasized that a single month’s data is insufficient for the ECB to hold off on rate adjustments. Instead, the focus is on broader trends and quarterly data, which show that the ECB is nearing its targets. This has heightened expectations for a rate cut in tomorrow’s meeting.

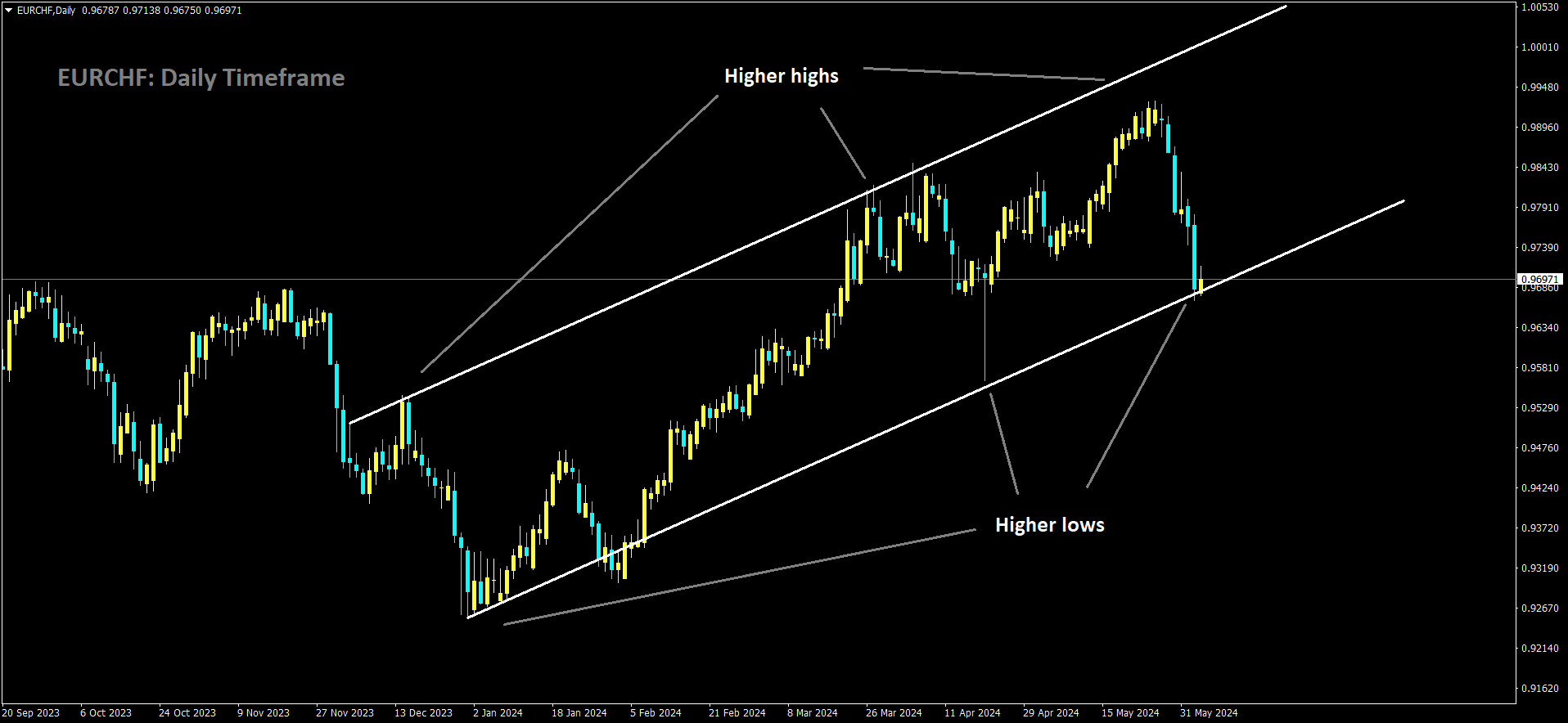

EURCHF is moving in Ascending channel and market has reached higher low area of the channel

Kazimir’s comments come at a crucial time, as the ECB prepares for its next policy decision. The anticipation of a rate cut is based on a comprehensive assessment of economic indicators, including inflation trends and business activity. Despite the positive growth in the services sector, the overall economic outlook suggests that easing borrowing costs may be necessary to sustain momentum and achieve long-term targets.

In summary, Kazimir’s speech has reinforced market expectations for a rate cut, impacting the Euro’s performance and shaping investor sentiment ahead of the ECB’s decision.

European shares gained on Wednesday, reflecting global market optimism driven by soft U.S. labor market data, which bolstered expectations of a Federal Reserve rate cut ahead of the European Central Bank’s key rate decision later this week. The pan-European STOXX 600 index rose 0.5% as of 0840 GMT, rebounding from the previous session’s losses.

Wall Street ended higher on Tuesday, and Asian equities broadly rose on Wednesday after data showed U.S. job openings fell in April. This indicated an easing labor market, reinforcing expectations of a Fed rate cut in September.

“If you’re optimistic about the labor market and see that earnings revisions are broadly positive in the U.S., it creates a favorable backdrop for equities,” said Richard Flax, chief investment officer at Moneyfarm.

Most sectoral indexes traded higher, with the retail sector advancing 1.4% to hit a two-year high. This was led by Zara-owner Inditex, which jumped 4.7% on better-than-expected current trading numbers in its first-quarter results. Spain’s benchmark IBEX index rose 0.6%.

Adding to the sector’s gains, WH Smith advanced 3.7% after the British retailer said it was well-positioned for the peak summer, betting on strong travel demand.

Investors are now focused on the ECB’s key interest rate decision on Thursday, where it is expected to ease borrowing costs by 25 basis points from the current record levels of 4%.

“Even if the ECB cuts rates tomorrow, one question that will arise, especially given recent inflation data, is to what extent the ECB can cut further from here and on what timeframe,” Moneyfarm’s Flax added.

In the foreword to the Slovak central bank’s financial stability report published on Wednesday, policymaker Peter Kazimir said the ECB is nearing its first interest rate cut, with inflation on a favorable path.

Meanwhile, a survey showed eurozone business activity expanded at its quickest rate in a year in May, as growth in the bloc’s dominant services industry outpaced contraction in manufacturing.

Among other stocks, ASML rose 3.3% after Jefferies reported positive feedback from the Dutch semiconductor equipment maker’s CFO on talks with TSMC during a small group call. The technology sector climbed 1.6%, while European lenders were market laggards, down 0.2%.

ECB’s Kazimir: Inflation on Track

European Central Bank (ECB) member and Slovakian Central Bank Governor Peter Kazimir has shared positive news about inflation, stating it is on a good path. He also hinted that the ECB is close to implementing its first interest rate cut at the upcoming meeting. This announcement has led to a decrease in confidence for Euro pairs due to the expected rate cut.

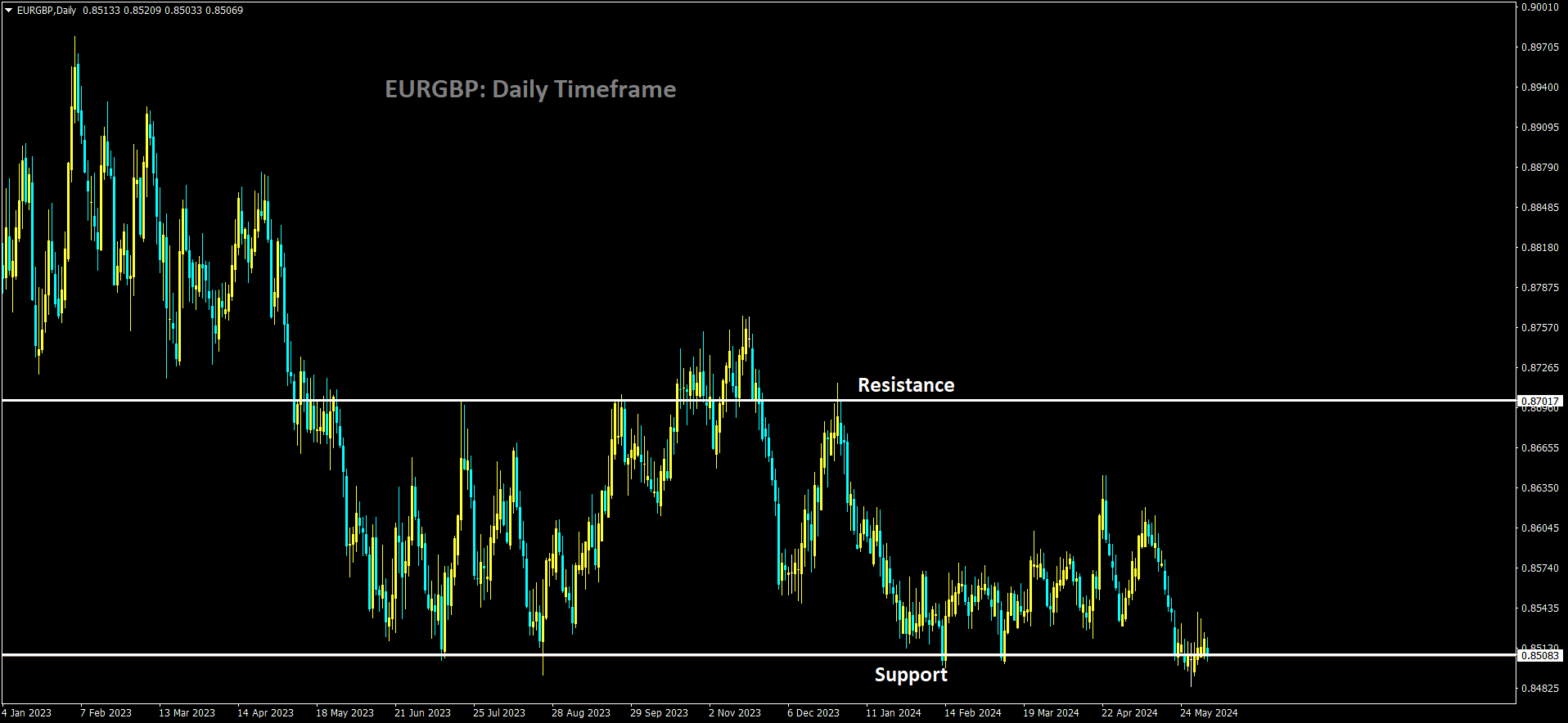

EURGBP is moving in box pattern and market has reached support area of the pattern

Recent data showed that the eurozone’s business services sector grew in April. However, Kazimir noted that one month of data isn’t enough for the ECB to maintain current rates. Instead, quarterly data suggests the ECB is nearing its targets, making a rate cut more likely in tomorrow’s meeting.

Kazimir’s remarks come at a critical time as the ECB prepares for its next policy decision. The anticipation of a rate cut is based on a thorough review of economic indicators, including inflation and business activity. While the services sector is growing, the broader economic outlook points to the need for lower borrowing costs to maintain momentum and achieve long-term goals.

In summary, Kazimir’s speech has reinforced market expectations for a rate cut, influencing the Euro’s performance and shaping investor sentiment ahead of the ECB’s decision.

European Central Bank (ECB) Governing Council member and National Bank of Slovakia (NBS) Governor Peter Kazimir commented in the NBS financial stability report issued on Wednesday, indicating that inflation is on a “good trajectory” towards reaching the target of 2%.

Kazimir stated that the ECB might be ready to cut interest rates at its next meeting. He praised the robustness of the Eurozone’s banking system but cautioned about ongoing challenges, particularly geopolitical uncertainties linked to conflicts in Ukraine and the Middle East.

Despite the progress, we must remain vigilant about certain risks still present in our bank portfolios. The primary concern is loans in the commercial real estate sector, where some segments are currently experiencing negative trends. The good news is that banks, in cooperation with the NBS, are addressing these risks and preparing for the long term, Kazimir added.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/