ETHUSDT: Gensler Unfazed as New Crypto ETFs Enter SEC Realm

US SEC Chairman Gary Gensler said ETHEREUM ETFs approval will be delayed due to exchanges has to give proper disclosures to the Public investment in this ETH ETFs. Still So many tokens on the way after this Ethereum approval cycle. The Crypto assets are unsafe and has to legal by ETFS regulated by US SEC, but investors has to read the proper disclosures given by the exchanges before investing in the ETFs.

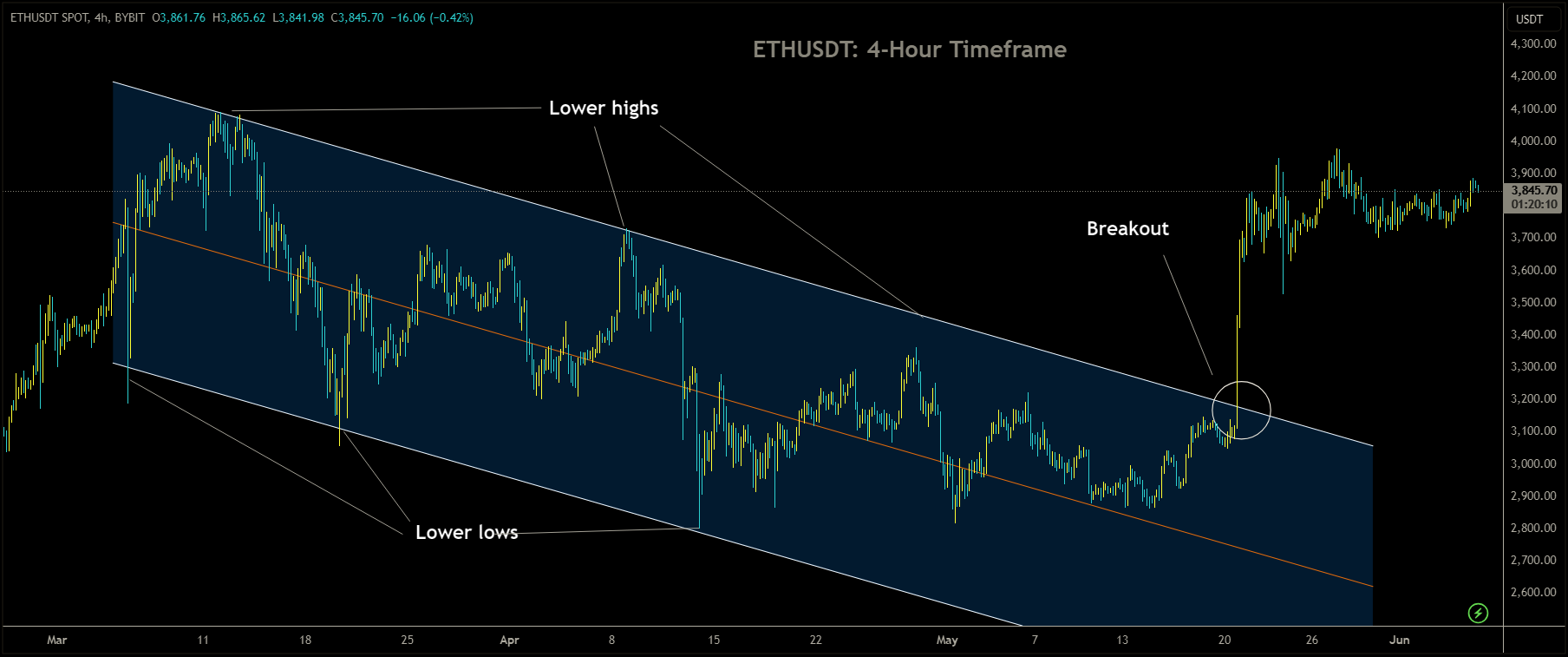

ETHUSDT Market price has broken Descending channel in upside

Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), hinted at the possibility of Ethereum (ETH) exchange-traded funds (ETFs) following the approval of spot bitcoin ETFs. Speaking to CNBC on Wednesday, Gensler noted Ethereum’s history of trading as futures on the Chicago Mercantile Exchange for several years, suggesting that ETH had fulfilled the necessary criteria for an ETF.

Despite widespread anticipation in the crypto industry that the SEC would reject ETH spot ETFs, Gensler’s remarks seemed nonchalant as he described the ongoing approval process in two separate interviews. He mentioned that SEC staff had approved ETF applicants’ 19b-4 forms, reflecting a similar process to the approval of bitcoin exchange-traded products four months earlier at the commission level.

Gensler’s comments aligned with his previous statements regarding the SEC’s commitment to act within the confines of the law and court interpretations. This stance implied that the SEC was inclined to approve ETH ETFs, akin to its approach with bitcoin.

However, while Gensler appeared optimistic about the ETF applications, he emphasized the crypto industry’s need for proper disclosures. He reiterated concerns about tokens lacking required public disclosures, highlighting potential risks for investors. Additionally, when asked about Ethereum’s classification as a security, Gensler pointed to indications such as entrepreneurs promoting projects at conferences, suggesting characteristics of securities.

Despite acknowledging the innovative aspects of the Satoshi Nakamoto bitcoin white paper, Gensler expressed concerns about the centralized nature of the crypto industry, cautioning against reliance on a small number of intermediaries. He emphasized the importance of investor protection outlined in existing laws and regulations, particularly in light of past bankruptcies and frauds within the industry.

ETHUSDT: SEC Chair: US Ether ETF Launch Timing Depends on Issuer Speed

Gary Gensler, Chairman of the United States Securities and Exchange Commission (SEC), highlighted the expected delay in the approval process for Ethereum exchange-traded funds (ETFs). He emphasized that exchanges need to provide appropriate disclosures to the public regarding investments in these ETH ETFs. Despite the forthcoming approval of Ethereum ETFs, Gensler pointed out that numerous tokens are still awaiting approval in this cycle.

ETHUSDT Market price is moving Ascending trend line and market has rebounded from the higher low area of the pattern

Gensler underscored the importance of ensuring the legal and regulatory compliance of crypto assets through ETFs regulated by the SEC. However, he cautioned investors to carefully review the disclosures provided by exchanges before investing in these ETFs. This emphasizes the SEC’s commitment to protecting investors and ensuring transparency in the cryptocurrency market.

On Wednesday, SEC Chair Gary Gensler provided insight into the potential timing of exchange-traded funds (ETFs) linked to the cryptocurrency ether, emphasizing that the pace of issuance largely depends on how promptly issuers address queries from the U.S. Securities and Exchange Commission (SEC).

Last month, the SEC surprised the cryptocurrency industry by approving applications from Nasdaq, CBOE, and NYSE to list spot ether ETFs. This decision was unexpected, as many anticipated the SEC to reject the filings following discouraging interactions with the regulator.

However, before these ETFs can commence trading, the SEC must approve the registration statements of the ETF issuers, outlining investor disclosures. Typically, this process involves extensive communication between the ETF issuers and SEC officials.

Gensler noted that while the registrants are motivated to respond to the comments they receive, the speed of their response ultimately lies with them. He declined to speculate on whether this process would take weeks or months.

Regarding the SEC’s apparent change in stance towards approving ether exchange filings, Gensler attributed it to a court challenge initiated by Grayscale Investments last year. This challenge led to the SEC’s approval of spot bitcoin ETFs in January, as Grayscale successfully argued that since the SEC approved ETFs tied to bitcoin futures, it should also approve spot bitcoin ETFs due to the high correlation between bitcoin futures and spot prices.

Gensler highlighted the similarities between the cases, noting that ethereum futures have been trading since last year and their correlations are relatively similar to those in the bitcoin space. He acknowledged the court’s decision and emphasized that approving these products was deemed the most sustainable path forward.

Despite these approvals, Gensler maintained his concerns about the crypto space, describing it as “rife with fraud and scams and conflicts.” Nonetheless, he acknowledged that the SEC had adjusted its approach following court rulings and continues to adapt to developments in the cryptocurrency industry.

ETHUSDT: Spot Ether ETF Approvals Will Take Time – Gensler

Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC), indicated that the approval process for Ethereum exchange-traded funds (ETFs) will face delays. He stressed the necessity for exchanges to furnish proper disclosures to the public regarding investments in these ETH ETFs. Despite the forthcoming approval of Ethereum ETFs, Gensler highlighted the ongoing pipeline of tokens awaiting approval in this cycle.

ETHUSDT Market price is moving in Symmetrical Triangle and market has reached lower high area of the pattern

Gensler emphasized the importance of ensuring the legality and regulatory compliance of crypto assets through ETFs regulated by the SEC. However, he cautioned investors to thoroughly review the disclosures provided by exchanges before investing in these ETFs. This underscores the SEC’s commitment to protecting investors and ensuring transparency in the cryptocurrency market.

Gary Gensler, Chair of the United States Securities and Exchange Commission (SEC), has indicated a potential delay in the final approvals for asset managers offering spot Ether (ETH) exchange-traded funds (ETFs) on exchanges.

During a June 5 interview on CNBC, Gensler suggested that the next steps in the SEC’s approval process for spot Ether ETFs will “take some time,” implying a possible delay or slow progress in signing off on S-1 registration statements. The SEC had previously granted approval for 19b-4 filings from various firms, including VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Invesco Galaxy, and Bitwise, on May 23. However, final approvals enabling the listing and trading of ETFs on U.S. exchanges could still take several months.

Gensler also mentioned in the interview that cryptocurrency firms were engaging in activities not permitted by traditional exchanges, indicating that the SEC’s stance on enforcement actions is unlikely to change under his leadership. The SEC has filed lawsuits against Ripple, Coinbase, Binance, and Kraken. However, it faced setbacks, such as the closure of one of its regional offices after a Utah judge ordered the SEC to pay $1.8 million due to “bad faith conduct” in court.

While Gensler suggested a potential slowdown in the spot Ether ETF approval process, the SEC has initiated steps toward eventually listing shares on exchanges. The approval of spot Ether ETF 19b-4 filings came five months after the SEC approved several spot Bitcoin ETF applications, marking an industry first. Bloomberg ETF analyst Eric Balchunas had previously predicted a July 4 launch date for spot Ether ETFs.

Unlike spot Bitcoin ETFs, which received approval from all five SEC commissioners, spot Ether ETFs were greenlighted by the SEC’s Trading and Markets Division without a formal vote. Gensler is expected to serve as SEC chair until 2026. While SEC Commissioner Caroline Crenshaw’s term officially ended on June 5, U.S. President Joe Biden had not announced whether he intends to nominate a replacement or extend her tenure at the time of publication.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/