BTCUSDT: Bitcoin May Reach $150K by 2024-End Due to Potential Trump Re-Election: Standard Chartered

The Bitcoin is ready to reach $150K by the year end if Former President Donald Trump re-elected in the US Presidential election in the 2024. This predictions given by standard chartered Chief analyst to Coin desk today. The ETFs Funds flows is reached $15 Billion in the May end to June 1st week, Bitcoin ETFs So far $880 Million reached in the Bitcoin investment Trusts.

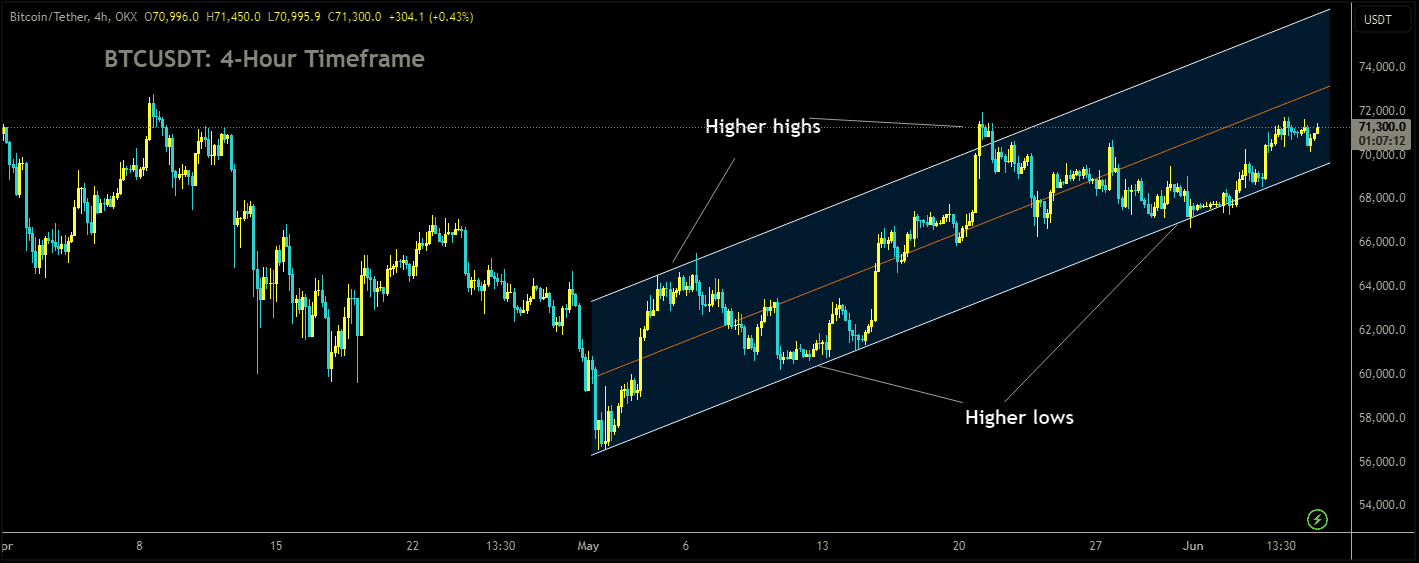

BTCUSDT is moving in Ascending channel and market has rebounded from the higher low area of the channel

Bitcoin Eyes $150,000 by Year-End Fueled by ETF Inflows and Potential US Election Outcome

Bitcoin bulls remain optimistic about the price reaching new highs in 2024, with some analysts predicting a surge to $150,000 by year-end. Here’s a breakdown of the key factors driving this sentiment:

Strong ETF Inflows: The approval and subsequent popularity of spot Bitcoin exchange-traded funds (ETFs) are seen as a significant boost for the cryptocurrency. These investment vehicles allow traditional investors to gain exposure to Bitcoin without directly owning it, leading to increased mainstream adoption and potentially higher demand. Recent data shows record inflows into these ETFs, exceeding $15 billion on Tuesday, which signals growing investor confidence in the market.

Analyst Predictions: Standard Chartered’s Geoffrey Kendrick maintains a bullish outlook, reiterating his forecast of Bitcoin reaching $150,000 by December 2024 and $200,000 by the end of 2025. He further predicts a potential all-time high this weekend if tomorrow’s US payroll data is positive.

US Election Speculation: The upcoming US election adds another layer of intrigue. Kendrick speculates that a potential win by Donald Trump could accelerate Bitcoin’s rise, with a price target of $100,000 potentially reached before reaching $150,000 by year-end. Cryptocurrency markets tend to be sensitive to political developments, and Trump’s past statements suggest a more favorable stance towards cryptocurrencies compared to the current administration. However, it’s important to note that these are just predictions, and the actual winner of the election remains uncertain. Current betting odds on Polymarket favor Trump at 56% compared to 36% for incumbent Joe Biden.

Overall, the confluence of strong ETF inflows, optimistic analyst predictions, and potential political tail winds are fueling a bullish sentiment in the Bitcoin market. However, it’s crucial to remember that cryptocurrency markets are inherently volatile, and these predictions should not be taken as financial advice.

BTCUSDT: Bitcoin to hit $150k if Trump wins presidency – Standard Chartered

According to a report released today by Standard Chartered, the price of Bitcoin is poised to surge to $150,000 by the end of the year, provided that former President Donald Trump secures re-election in the upcoming 2024 US Presidential election. The Chief Analyst at Standard Chartered shared this prediction with CoinDesk during an interview.

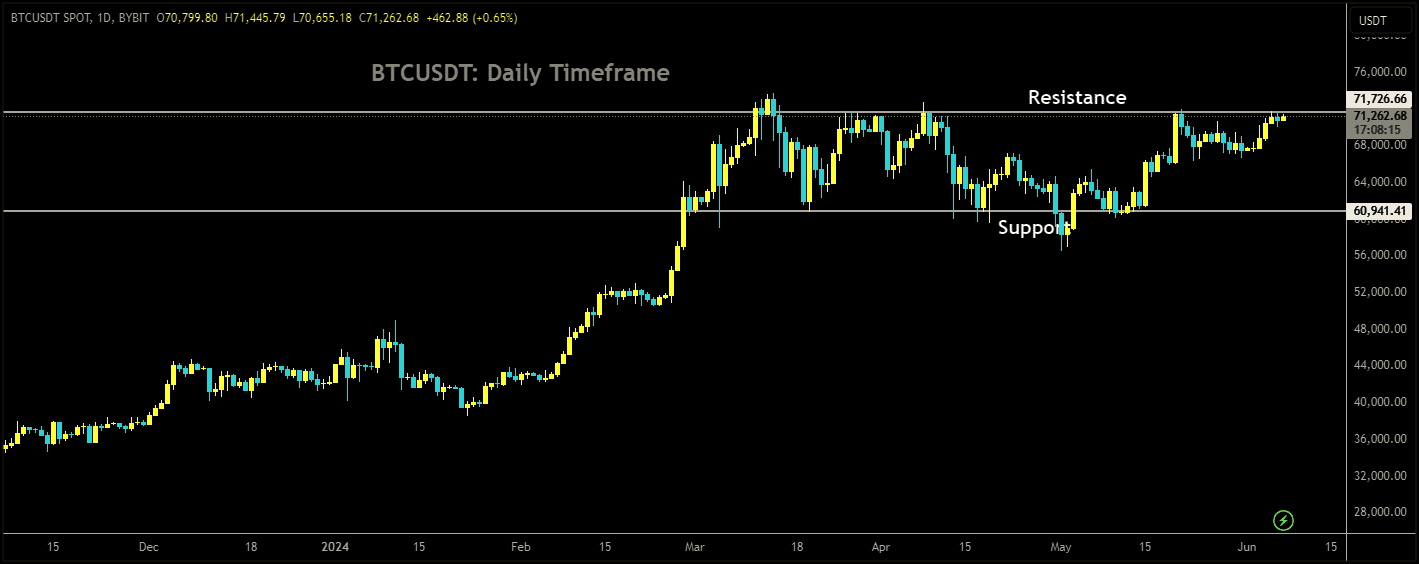

BTCUSDT is moving in box pattern and market has reached resistance area of the pattern

The report also highlights significant inflows into Bitcoin Exchange-Traded Funds (ETFs) in recent weeks. From the end of May to the first week of June, ETF funds witnessed a substantial increase, totaling $15 billion. Additionally, investments in Bitcoin through ETFs have reached a milestone, with Bitcoin Investment Trusts amassing a total of $880 million.

Standard Chartered predicts that the upcoming U.S. presidential election will significantly impact Bitcoin’s price, potentially propelling it to $150,000 by the year’s end. This forecast comes after the launch of U.S. Bitcoin exchange-traded funds earlier this year, which has sparked growing bipartisan interest in cryptocurrencies in Washington. Despite the historical anti-crypto stance of the U.S., lawmakers are increasingly questioning its sustainability.

Geoff Kendrick, the head of digital assets research at Standard Chartered, anticipates that Bitcoin will reach $100,000 as the election approaches, with the possibility of hitting $150,000 in the event of a Trump victory. Kendrick notes that the election will become a major driver for Bitcoin’s price following Friday’s significant jobs report.

He highlights differences between the Trump and Biden administrations regarding cryptocurrency policies, suggesting that Trump’s approach is more favorable. Kendrick points to Biden’s recent approval of Ethereum exchange-traded funds (ETFs) as a pragmatic move but also notes Biden’s veto of efforts to repeal Securities and Exchange Commission accounting policy SAB 121. This policy requires banks to treat digital assets as liabilities on their balance sheets.

BTCUSDT: Bitcoin Could Reach $150K with Trump Presidency, Says Standard Chartered

Standard Chartered’s latest report suggests that Bitcoin could surge to $150,000 by the end of 2024, contingent upon Donald Trump’s re-election in the upcoming US Presidential election. The Chief Analyst at Standard Chartered shared this prediction with CoinDesk during an interview, highlighting the potential impact of political outcomes on cryptocurrency markets.

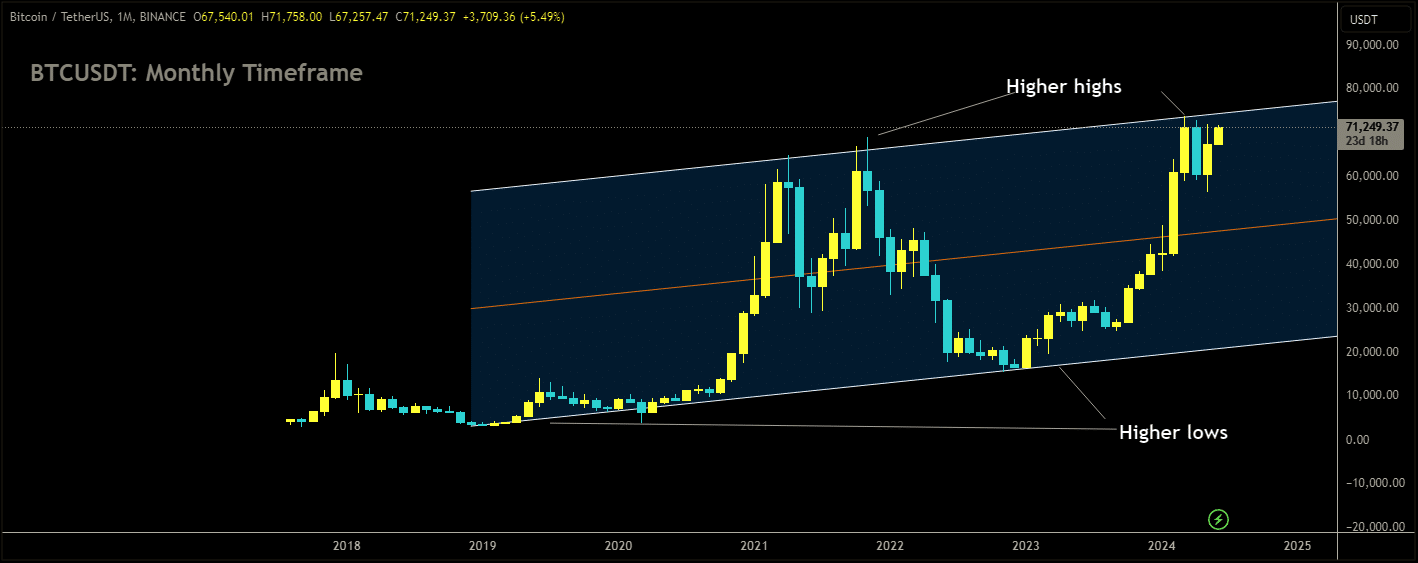

BTCUSDT Market price is moving in Ascending channel and market has reached higher high area of the channel

Moreover, the report sheds light on notable inflows into Bitcoin Exchange-Traded Funds (ETFs) in recent weeks. Between the end of May and the first week of June, ETF funds witnessed a substantial increase, reaching a total of $15 billion. Additionally, investments in Bitcoin via ETFs have hit a significant milestone, with Bitcoin Investment Trusts amassing a total of $880 million.

Geoff Kendrick, the head of digital assets research at Standard Chartered, has made a striking prediction regarding Bitcoin’s potential trajectory. Kendrick forecasts that if Donald Trump secures victory in the upcoming U.S. presidential election, Bitcoin could skyrocket to an impressive $150,000. He elaborated, stating, “As we approach the U.S. election, I expect $100,000 to be reached and then $150,000 by year-end in the case of a Trump victory.”

This prediction comes amidst a complex landscape where various economic indicators and political developments significantly influence the Bitcoin market. Kendrick emphasized that the forthcoming U.S. election would serve as a pivotal catalyst for Bitcoin’s price movement.

Furthermore, Kendrick suggested that Bitcoin could hit a new all-time high over the weekend, contingent upon the outcome of the nonfarm payrolls report scheduled for release on Friday. He pointed out that Bitcoin’s current record, established on March 14, sits at $73,770. Should the jobs report yield positive results, Kendrick believes Bitcoin could surge to $80,000 by the end of this month.

This forecast underscores the profound impact that political events can exert on the Bitcoin market. With a substantial number of Bitcoin and cryptocurrency holders in the United States—exceeding 50 million—the outcome of the presidential election is poised to wield significant influence over Bitcoin’s future trajectory.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/