AUD: Australian Dollar Fails to Gain Support Despite Robust Employment Data

The Australian Employment change came at 39.7K in the May month from 38.5K in the April month and 30.0 is expected. Unemployment rate came at 4.0% in the May month from 4.1% in the last month. The Australian Dollar loses even better employment data printed in the May month.

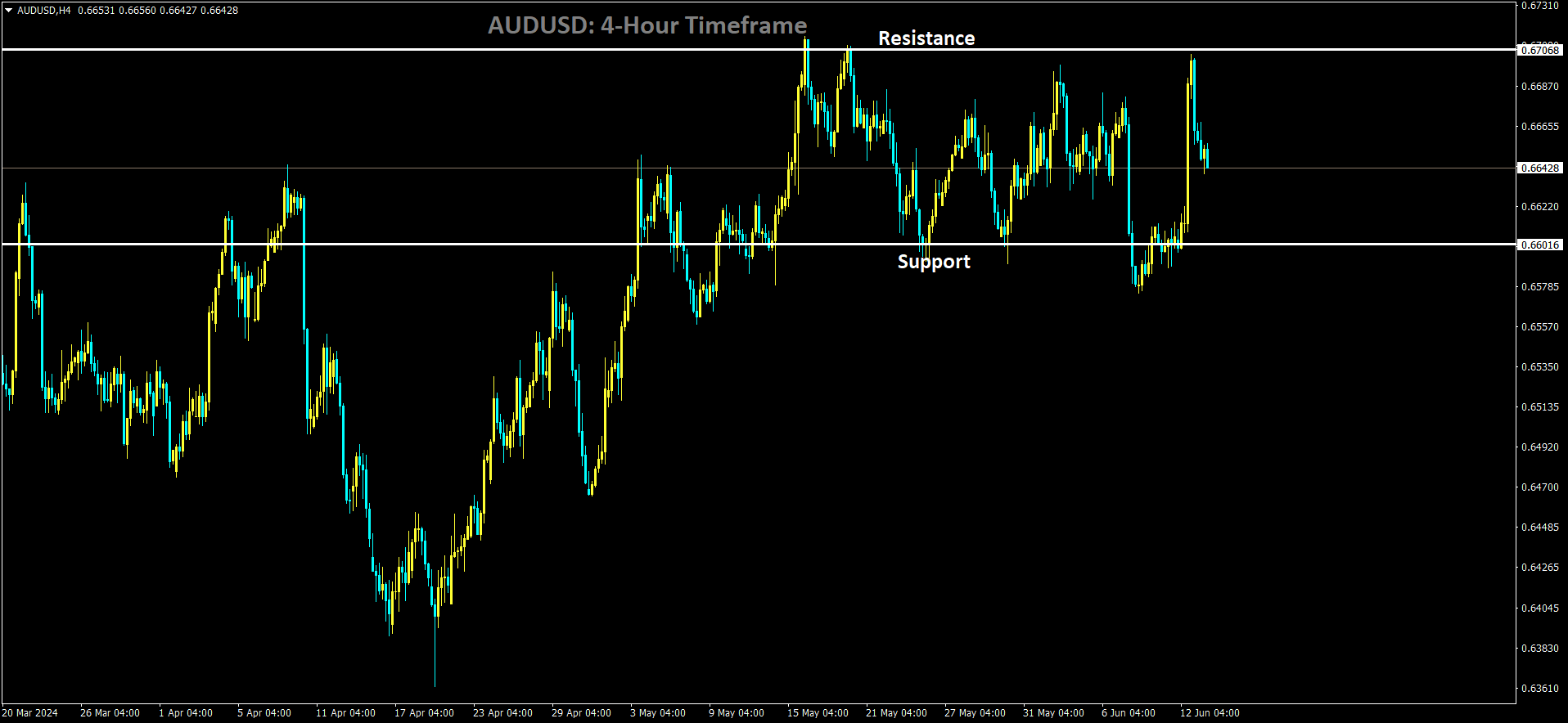

AUDUSD is moving in box pattern and market has fallen from the resistance area of the pattern

The Australian Dollar (AUD) experienced slight depreciation despite positive employment data released on Thursday. Australia reported an increase of 39.7K employed individuals in May, surpassing expectations of a 30.0K rise and April’s 38.5K increase. Concurrently, the Unemployment Rate decreased to 4.0%, slightly lower than April’s 4.1% as forecasted.

However, the US Dollar (USD) regained strength following the US Federal Reserve’s (Fed) hawkish stance, which weighed on the AUD/USD pair. Market participants are now awaiting the US weekly Initial Jobless Claims and Producer Prices Index (PPI) on Thursday for further insights into the US economic landscape.

In its June meeting, the Federal Open Market Committee (FOMC) kept its benchmark lending rate unchanged within the 5.25%–5.50% range for the seventh consecutive time, aligning with market expectations.

Key highlights from the market movement include:

Fed Chair Jerome Powell affirmed in a post-decision press conference that the Fed’s current restrictive monetary policy stance is yielding the anticipated effects on inflation. The FOMC now anticipates only one rate cut this year, down from the three previously projected in March.

The US Consumer Price Index (CPI) for May rose by 3.3% year-over-year, slightly below both the prior reading and expectations of 3.4%. Meanwhile, the core CPI, which excludes volatile food and energy prices, increased by 3.4% year-over-year in May, down from April’s 3.6% and below the anticipated 3.5%.

China’s CPI data for May showed a 0.3% year-over-year increase, missing expectations of a 0.4% rise. Month-over-month (MoM), inflation declined by 0.1%, contrasting with April’s 0.1% increase.

Australian Treasurer Jim Chalmers emphasized the significance of China Premier Li Qiang’s visit to Australia, acknowledging underlying economic challenges in China and suggesting caution regarding immediate economic recovery expectations.

Australia’s NAB Business Confidence index dropped to -3 index points in May, the lowest in six months, turning negative for the first time since November last year. Concurrently, Business Conditions slipped to 6 index points, slightly below the long-term average.

National Australia Bank (NAB) Chief Economist Alan Oster highlighted concerns about growth prospects alongside cautious optimism regarding inflation. Oster expects the Reserve Bank of Australia (RBA) to maintain its current interest rates as it navigates these economic dynamics.

RBA Governor Michele Bullock recently indicated readiness to adjust interest rates should the Consumer Price Index (CPI) fail to return to the target range of 1%-3%.

Overall, the AUD’s movement reflects a combination of domestic economic data releases, global market sentiment influenced by the Fed’s monetary policy stance, and international developments impacting Australia’s economic outlook.

AUD: Unemployment Rate Drops to 4.0% in May

In May, Australia’s employment data showed a positive trend with an increase in employment and a decrease in the unemployment rate. Here are the key points:

- Employment Change:

Employment increased by 39.7K in May, surpassing both the April increase of 38.5K and the expected increase of 30.0K.

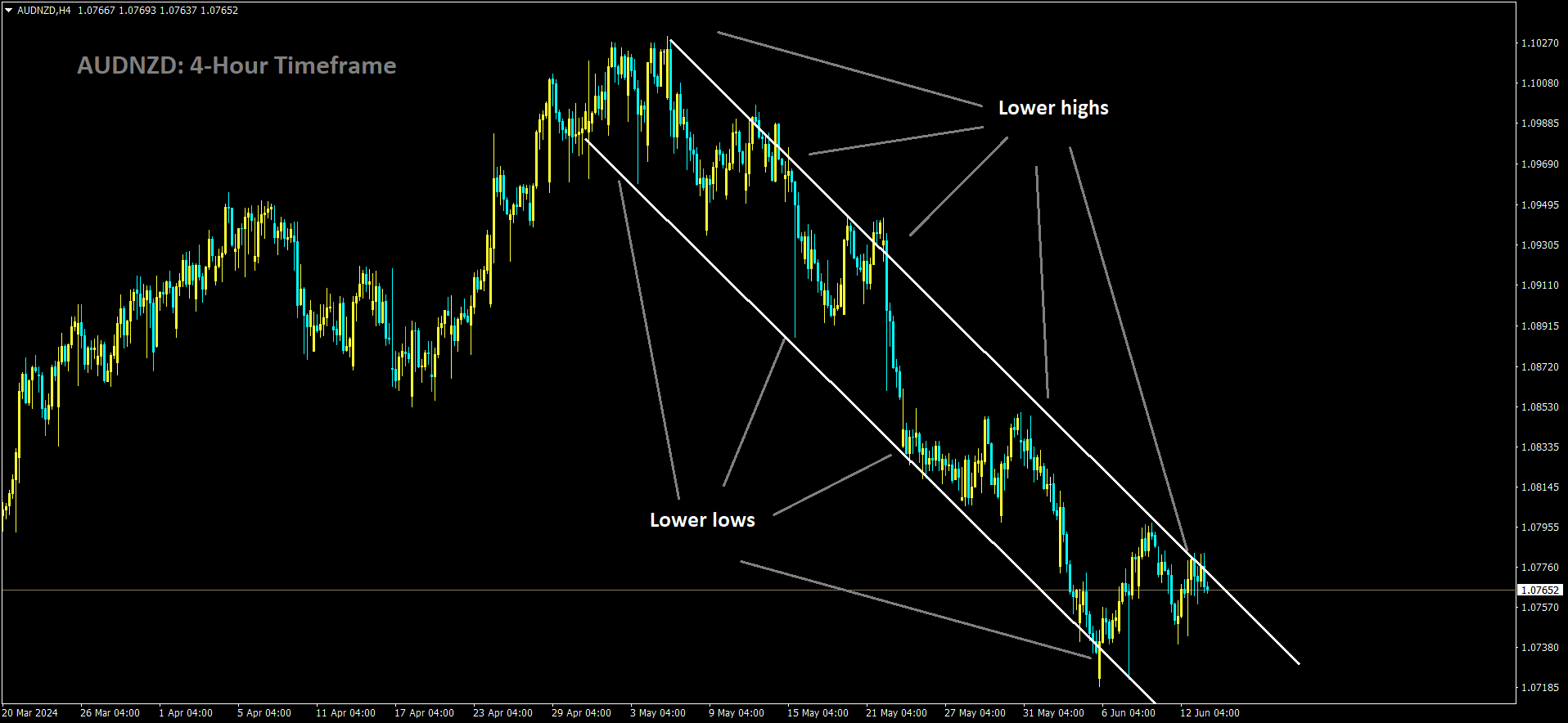

AUDNZD is moving in Descending channel and market has reached lower high area of the channel

- Unemployment Rate:

The unemployment rate fell to 4.0% in May, down from 4.1% in April.

Despite these favorable employment figures, the Australian Dollar (AUD) weakened. This reaction can be attributed to several factors:

Factors Affecting the Australian Dollar:

- Global Economic Conditions:

The USD strength driven by the Federal Reserve’s (Fed) hawkish stance significantly influenced the AUD/USD exchange rate. The Fed maintained its restrictive monetary policy, which bolstered the USD despite the favorable Australian employment data.

- Market Sentiment:

The market often reacts not just to domestic data but also to global economic conditions and expectations. Investors might have been more focused on global events, such as US economic data and Fed policy, than on the positive employment data from Australia.

- Interest Rate Expectations:

The Reserve Bank of Australia (RBA) has shown a cautious approach towards monetary policy. The market perceives a lower probability of rate hikes in Australia compared to the US, where the Fed maintains a hawkish outlook. This differential in interest rate expectations can lead to a weaker AUD.

- Economic Uncertainty:

Broader economic uncertainties, including those related to global trade tensions and geopolitical risks, can impact investor sentiment and lead to a preference for the USD as a safe-haven currency.

Conclusion:

While the employment data for May was positive, with more jobs added than expected and a lower unemployment rate, the AUD’s weakness can be primarily attributed to the stronger USD. The Fed’s hawkish stance and global economic conditions overshadowed the domestic employment gains, leading to a decline in the AUD despite the favorable data.

The Australian labour market showed signs of strength in May, with the unemployment rate falling by 0.1 percentage point to 4.0%, according to data from the Australian Bureau of Statistics (ABS). This decline was driven by an increase in employment and a reduction in the number of unemployed individuals.

Key Highlights:

- Employment and Unemployment:

Employment increased by approximately 40,000 people in May.

The number of unemployed individuals decreased by 9,000, bringing the total to nearly 600,000, which is still significantly lower than pre-pandemic levels by about 110,000 people.

The unemployment rate dropped to 4.0%, down from 4.1% in April.

- Labour Market Participation:

The employment-to-population ratio remained stable at 64.1%.

The participation rate held steady at 66.8%, both indicators significantly higher than their pre-pandemic levels.

- Hours Worked:

Seasonally adjusted monthly hours worked decreased by 0.5% in May. This decline was partially due to an increase in the number of people working fewer hours due to illness, similar to the trend seen in May 2023.

- Underemployment and Underutilisation:

The seasonally adjusted underemployment rate remained constant at 6.7%.

The underutilisation rate, combining unemployment and underemployment, also stayed steady at 10.7%.

- Trend Data:

The trend unemployment rate rose slightly to 4.0% in May, up from a revised 3.9% in April.

Trend employment growth continued at a rate of 0.3%, faster than the pre-pandemic 20-year average of 0.2%.

Hours worked increased by 0.3% in trend terms from April to May.

- Participation by Gender:

The participation rate for women was 62.7%, about 1.5 percentage points higher than pre-pandemic levels.

The participation rate for men was 70.8%, around 0.7 percentage points higher than in March 2020.

The gender gap in participation rates has narrowed to about 8.0 percentage points over the past year, compared to 9.6 percentage points before the pandemic.

Analysis:

The Australian labour market remains relatively tight, with elevated job vacancies and strong participation rates suggesting robust employment conditions. The data indicates ongoing resilience, although the slight rise in trend unemployment and the consistent underemployment rate highlight underlying challenges. Despite these, the overall employment landscape is significantly stronger compared to pre-pandemic levels.

The ABS will provide more detailed information in its upcoming publications, including the Labour Force, Australia, Detailed report on June 20, 2024, and updated regional labour market data on June 27, 2024.

AUD: Australia’s Unemployment Rate Drops to 4% in May, Creating ‘Goldilocks’ Scenario for Reserve Bank

In May, Australia’s employment data presented a positive outlook with notable increases in employment and a reduction in the unemployment rate. Here are the highlights:

Key Employment Data:

- Employment Change:

Increased by 39.7K in May, exceeding both April’s 38.5K increase and the forecasted 30.0K increase.

AUDCAD is moving in Ascending channel and market has fallen from the higher high area of the channel

- Unemployment Rate:

Dropped to 4.0% in May from 4.1% in April.

Despite these encouraging figures, the Australian Dollar (AUD) weakened. Several factors contributed to this:

Factors Influencing AUD Weakness:

- Global Economic Conditions:

The USD strengthened following the Federal Reserve’s (Fed) hawkish stance, impacting the AUD/USD exchange rate. The Fed maintained its restrictive monetary policy, bolstering the USD even with positive Australian employment data.

- Market Sentiment:

Market reactions are often influenced by global economic conditions and expectations. Investors likely focused more on US economic data and Fed policy than on Australia’s favorable employment numbers.

- Interest Rate Expectations:

The Reserve Bank of Australia (RBA) has taken a cautious approach to monetary policy. The market sees a lower probability of rate hikes in Australia compared to the US, where the Fed maintains a hawkish outlook. This difference in interest rate expectations contributes to a weaker AUD.

- Economic Uncertainty:

Broader economic uncertainties, including global trade tensions and geopolitical risks, impact investor sentiment, leading to a preference for the USD as a safe-haven currency.

Conclusion:

Despite positive employment data in May, with higher job additions and a reduced unemployment rate, the AUD weakened due to a stronger USD. The Fed’s hawkish stance and prevailing global economic conditions overshadowed domestic employment gains, leading to a decline in the AUD.

In May, Australia’s seasonally adjusted unemployment rate fell to 4.0%, down from 4.1% in April, as reported by the Australian Bureau of Statistics (ABS). This decline is attributed to a rise in employment by 40,000 people and a reduction in the number of unemployed by 9,000.

Key Highlights:

- Unemployment Rate and Employment Figures:

The headline unemployment rate fell to 4.0% in May.

Employment increased by 40,000 people, while the number of unemployed decreased by 9,000.

The trend unemployment rate, which smooths out monthly volatility, rose slightly from 3.9% to 4.0%, the highest since the trend series data was reintroduced in April 2022.

- Labour Market Trends:

Full-time employment drove the growth, increasing by 41,700 jobs, while part-time employment declined by 2,100.

Over the past year, most new jobs have been part-time positions, but May saw a deviation from this trend.

- Labour Market Indicators:

The employment-to-population ratio remained at 64.1%.

The participation rate held steady at 66.8%, indicating a high level of labour market engagement.

Underemployment and underutilisation rates were stable at 6.7% and 10.7%, respectively.

4. Economic and Monetary Policy Implications:

Analysts predict a gradual rise in the unemployment rate in the coming months.

The Reserve Bank of Australia (RBA) is expected to keep interest rates on hold at 4.35% for the fifth consecutive meeting, aligning with its forecast of a 4.0% unemployment rate for Q2.

Economic forecasts suggest that monetary policy is effective, though its impact has been slower than desired by the RBA.

- Youth and Marginalized Groups:

Youth and new migrants are disproportionately affected by the softening labour market, with a notable increase in their unemployment and underemployment rates.

The long-term unemployed population has risen from 90,800 to 125,500 since April last year.

- Economic Outlook:

The RBA’s latest forecast expects the unemployment rate to rise to 4.3% by mid-2025.

Economists anticipate a further increase in unemployment due to economic pressures, potentially adding 100,000 more people to the unemployed ranks by the end of 2024.

Larger businesses and some smaller ones are making redundancies, indicating a cooling labour market.

Conclusion:

Australia’s labour market showed resilience in May with a reduction in the unemployment rate and a significant increase in employment, primarily in full-time jobs. However, underlying indicators and trends suggest a gradual increase in unemployment and underemployment, especially among younger workers and new migrants. The RBA is likely to maintain a cautious approach, keeping interest rates steady as it monitors economic conditions and labour market trends. The broader economic context, including cost-of-living pressures and business challenges, will continue to influence employment dynamics in the coming months.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/