ETHUSDT: SEC Chair Gensler Expects Full Approval of Ether ETFs by September

SEC Chair Gary Gensler informed senators during a recent hearing that the Ethereum ETFs are expected to receive full approval and commence trading on exchanges in September. This revelation underscores the progress in regulatory processes surrounding these financial products.

ETHUSDT is moving in Ascending trend line and market has rebounded from the higher low area of the pattern

In related news, the practice of election predictions in the crypto markets has been definitively prohibited from exchanges. The head of the Commodity Futures Trading Commission (CFTC) emphasized that such activities contravene existing laws.

These developments reflect ongoing efforts to clarify and enforce regulations within the cryptocurrency and financial markets, addressing both investment products like ETFs and the permissible activities within crypto trading platforms.

In a recent budget hearing, U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler indicated that the final approvals for exchange-traded funds (ETFs) trading Ethereum’s ether (ETH) are nearing completion, expected by this summer. Gensler clarified that while initial approvals have been granted, the remaining steps involve finalizing registration details at the staff level, specifically the filings known as S-1s.

These ETFs would allow broader market access to funds holding actual ether, akin to the earlier introduction of bitcoin spot ETFs. Gensler highlighted that the SEC’s stance has evolved following a federal court ruling that criticized its handling of bitcoin ETFs, prompting a shift towards allowing such investment products.

Regarding whether ETH qualifies as a commodity, Gensler refrained from a direct response, reflecting ongoing ambiguity within the SEC on this matter. Conversely, Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam affirmed that ETH is considered a commodity under his agency’s purview.

The delineation between SEC and CFTC oversight remains pivotal, with Gensler emphasizing that while many digital assets should be classified as securities under SEC jurisdiction, those falling outside this category are subject to CFTC oversight. He reiterated concerns about widespread noncompliance with securities laws among unregistered tokens, criticizing the industry for disregarding regulatory obligations.

Furthermore, Gensler criticized the CFTC’s current readiness to enforce disclosure-based oversight in crypto markets, citing differences in regulatory tools between the agencies. Behnam echoed these sentiments, underscoring the CFTC’s need for expanded authorities and resources to effectively oversee crypto trading activities.

Behnam also addressed the CFTC’s recent stance against prediction markets, particularly those offering contracts predicting election outcomes, asserting that such activities contravene existing laws and necessitate regulatory intervention to prohibit them.

Overall, the regulatory landscape for cryptocurrencies and related financial instruments remains complex, with ongoing debates and developments shaping the oversight framework in the United States.

ETHUSDT: SEC Chair Gensler Aims for Ether ETF Approval by September

SEC Chair Gary Gensler disclosed in a recent senate hearing that Ethereum ETFs are slated for full approval and are anticipated to debut on exchanges in September. This update highlights advancements in regulatory procedures governing these financial instruments.

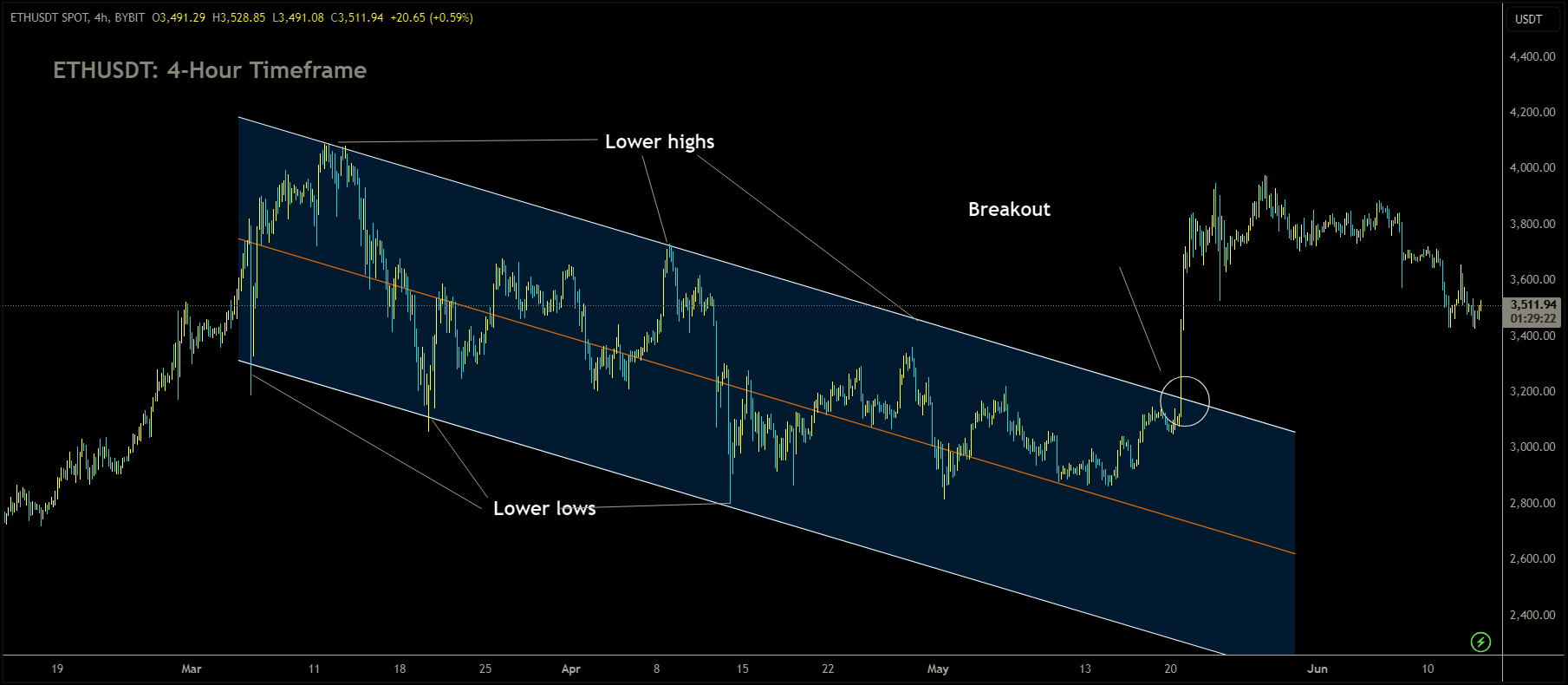

ETHUSDT has broken Descending channel in upside

Simultaneously, election predictions in crypto markets have been explicitly banned from exchanges, with the head of the Commodity Futures Trading Commission (CFTC) emphasizing their illegality under current legislation.

These developments underscore ongoing efforts to establish clear regulatory frameworks in both cryptocurrency investment vehicles like ETFs and permissible activities within crypto trading platforms.

SEC Chairman Gary Gensler indicated in a recent budget hearing that the Securities and Exchange Commission is aiming to fully approve Spot Ether ETFs by September. He informed senators that the applications for running these ETFs are expected to be finalized by the end of summer.

The initial approvals for Spot Ethereum ETFs were granted at the conclusion of May 2024, marking a surprising development for the digital asset market. The SEC’s history of resistance against crypto-based exchange-traded products contrasts with the successful launch of a Spot Bitcoin ETF approved in January. Despite ongoing deliberations, Gensler emphasized a revised, tighter timeline for the approval process.

Gensler clarified that the remaining steps involve finalizing registration details at the SEC staff level. He acknowledged persistent concerns within the agency regarding Ethereum ETFs and cryptocurrencies more broadly. Gensler reiterated criticisms of noncompliance within the crypto industry during the hearing and refrained from definitively classifying ETH as a commodity. He also argued that the Commodity Futures Trading Commission (CFTC) lacks readiness to effectively regulate crypto markets.

Spot Ethereum ETFs are structured as investment funds that hold Ethereum similar to stocks or commodities, trading on stock exchanges. Following the approval of all necessary filings, the first Spot Ethereum ETFs can commence trading. The initial approval news in May significantly boosted the price of ETH, which currently stands at $3,476.72, reflecting an increase of nearly 18% over the past 30 days. Anticipation surrounding full approval suggests ETH may reach new all-time highs, akin to Bitcoin’s market performance.

ETHUSDT: SEC Chair Gensler Sets September Deadline for Ethereum ETF Approval

The Ethereum ETFs File will be fully approval and come to exchange in the September month as per SEC chair Gary Gensler told to the senators meeting hearing on yesterday. Election predictions is workout by Crypto markets are fully banned from Exchanges, it is against law as per Commodity exchange commission head said.

ETHUSDT is moving in Symmetrical Triangle and market has reached lower high area of the pattern

SEC Chairman Gary Gensler’s statement on the approval process for Ethereum ETFs was prompted by a question from Tennessee Republican Senator Bill Hagerty. Gensler affirmed that the process was progressing smoothly, with product issuers undergoing administrative procedures handled by the SEC staff.

The timeline for when these Ethereum ETFs will commence trading has been a topic of speculation since the SEC unexpectedly approved the 19b-4 documents for eight spot Ether ETFs on May 23. Initial expectations suggested trading could begin as early as July, while others speculated it might occur before November.

Senior Bloomberg ETF analyst Eric Balchunas highlighted that issuers are currently awaiting feedback from the SEC Division of Corporation Finance on their S-1 filings. He noted uncertainty regarding the prioritization of this review, citing the unexpected nature of the approval decision and its implications.

James Seyffart, another Bloomberg ETF analyst, cautioned that previous predictions for a July launch were speculative, emphasizing instead that Ethereum ETFs are likely to launch at some point during the summer.

Criticism of regulatory actions towards the crypto industry was also voiced during the hearings. Senator Hagerty criticized Gensler’s approach, describing it as imposing unnecessary barriers that hinder the United States from becoming a leader in crypto innovation. Hagerty expressed concern that such regulatory uncertainty might drive crypto-related activities overseas, potentially stifling job creation, technological advancement, and economic growth within the country.

Senator Dick Durbin also questioned the effectiveness of the Commodities Futures Trading Commission (CFTC), led by Rostin Behnam, in regulating the rapidly evolving crypto sector. Durbin highlighted the challenges posed by the dynamic and expansive nature of crypto markets, calling into question the regulatory agency’s readiness to oversee such complex terrain effectively.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/