GBP: BoE Survey: UK Public’s Inflation Expectations for Year Ahead Drop from 3.0% to 2.8% in May

The BoE conducted Inflation expectations survey in the May month shows 2.8% in one year time period, it is down from 3.0% projected in the May month. 42% of Public thinks if rates are go down it will be best for consumer spending. It is up from 41% printed in 2007 February month same higher rates persistent time. Five Years inflation rate expected is 3.1%.

The UK public’s inflation expectations for the coming year are seen at 2.8% in May, down from the 3.0% projected in February, according to the Bank of England’s (BoE) quarterly survey released on Friday.

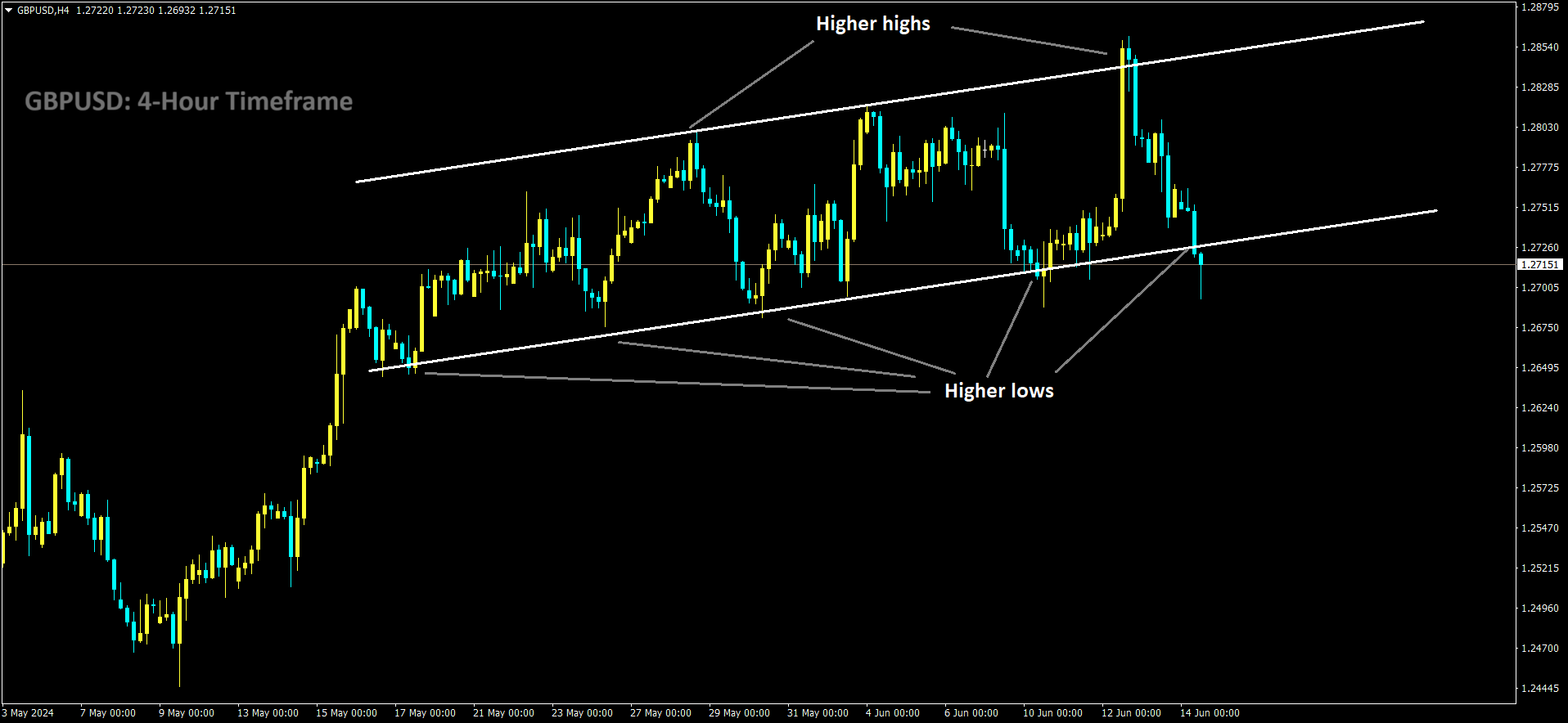

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

Additional Findings:

Inflation Expectations for Next 12 Months:The public’s inflation expectations for the following 12 months decreased from 2.8% to 2.6%.

Long-Term Inflation Expectations: For five years’ time, the public’s inflation expectations remained steady at 3.1%.

Interest Rate Sentiment: 42% of the UK public believe it would be best for the economy if interest rates were lowered. This is the highest share since November 2008, up from 41% in February.

These findings highlight a slight easing in inflation expectations over the short term, while long-term expectations remain unchanged. Additionally, there is a growing sentiment among the public in favor of lower interest rates.

GBP: BoE Survey: UK Inflation Expectations Ease in May

The Inflation Expectations Survey conducted by the Bank of England (BoE) in May has yielded intricate insights into the prevailing public perceptions regarding future inflationary trends and interest rate movements. The survey elucidates that the projected inflation rate for the forthcoming year has diminished to 2.8%, a decrement from the previously anticipated 3.0% recorded in February. This attenuation in short-term inflation expectations signifies a perceptible shift in the public’s inflation outlook.

GBPJPY is moving in Ascending channel and market has fallen from the higher high area of the channel

Furthermore, the survey delineates that 42% of the populace conjectures that a reduction in interest rates would be most propitious for augmenting consumer spending. This percentage marks an incremental rise from the 41% documented in February 2007, a period characterized by persistently elevated interest rates. This uptick underscores an increasing public inclination towards the advocacy of lower interest rates as a mechanism to invigorate economic dynamism.

Additionally, the survey discloses that the anticipated inflation rate over a five-year horizon steadfastly remains at 3.1%, mirroring the projections from the prior survey period. This constancy in long-term inflation expectations suggests a sustained equilibrium in public sentiment regarding the macroeconomic environment, notwithstanding the prevailing economic vicissitudes. This enduring stability in the five-year inflation forecast denotes a nuanced confidence in the strategic efficacy of current economic policies and their anticipated longitudinal impacts.

Britons’ short-term inflation expectations softened in May, according to the quarterly Inflation Attitudes Survey conducted by Ipsos on behalf of the Bank of England, released on Friday.

Key Findings:

One-Year Ahead Inflation Expectations: The expectations for inflation one year ahead fell to 2.6% in May from 2.8% in February.

Current Inflation Perception: Respondents perceived current inflation at 5.5%, down from 6.1% in the previous survey period.

Five-Year Inflation Expectations: Inflation expectations for five years ahead remained unchanged at 3.1%.

Economic Impact of Rising Prices: By a margin of 65% to 6%, respondents believed the economy would weaken if prices started to rise faster. This compared to 69% and 5%, respectively, in February.

Inflation Target Perception: 40% of respondents felt the inflation target was “about right,” unchanged from February. Those who felt the target was “too high” or “too low” were 34% and 10%, respectively.

Interest Rate Forecast: About 34% of respondents forecasted an increase in interest rates over the coming year, down from 36% in February. Nearly 25% believed interest rates would stay the same over the next twelve months, compared to 26% in the previous survey.

GBP: UK Inflation Expectations Ease in May: BoE Survey

The Bank of England (BoE) conducted its Inflation Expectations Survey in May, revealing significant insights into public sentiment regarding future inflation and interest rates. The survey shows that the one-year inflation expectation has decreased to 2.8%, down from the 3.0% projection reported in February. This reduction indicates a modest easing in short-term inflation expectations among the public.

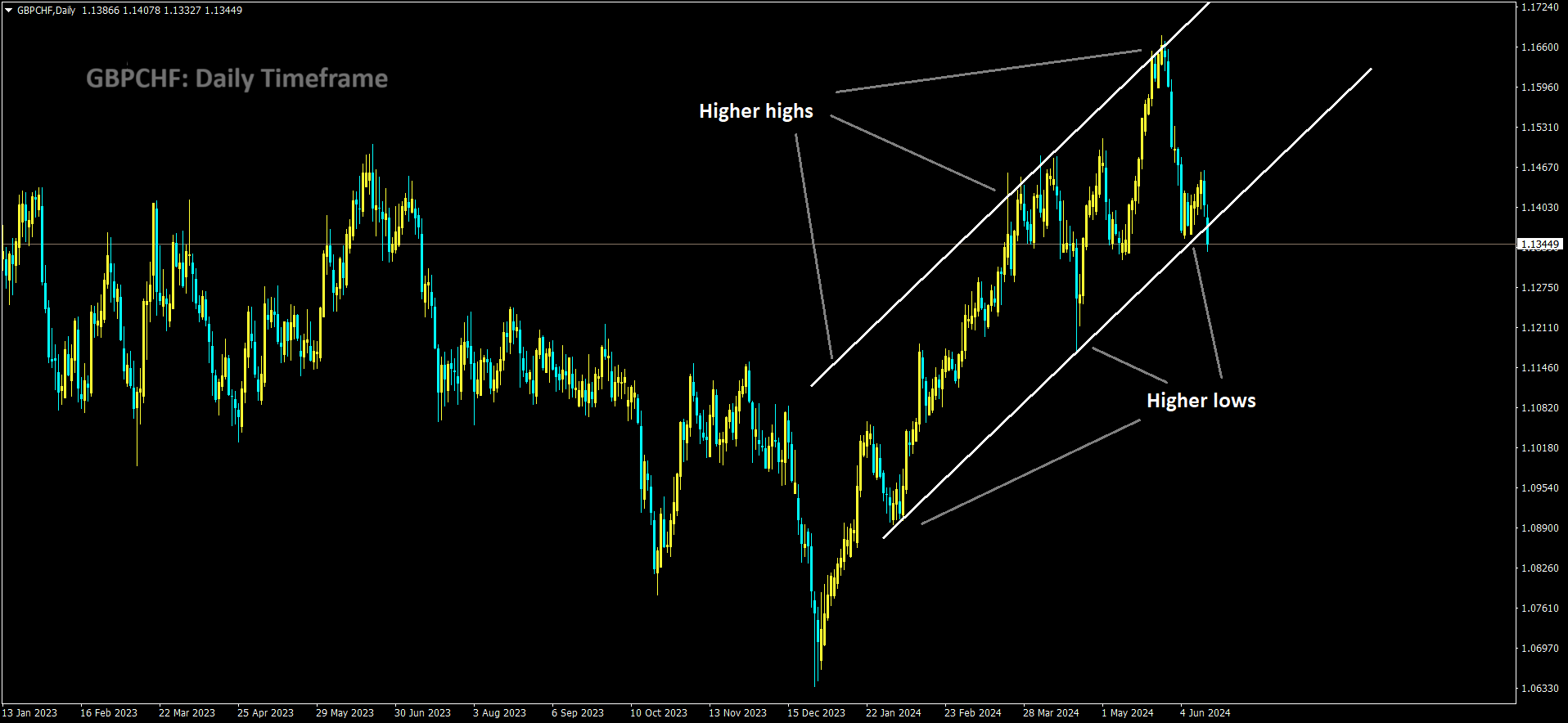

GBPCHF is moving in Ascending channel and market has reached higher low area of the channel

In addition to this, the survey highlights that 42% of respondents believe a decrease in interest rates would be most beneficial for consumer spending. This figure has risen slightly from 41% in February 2007, a time when similarly high interest rates were persistent. This increase suggests growing public support for lower interest rates as a means to boost economic activity.

The survey also reveals that the five-year inflation rate expectation remains unchanged at 3.1%, indicating that long-term inflation expectations are stable despite the current economic fluctuations. This consistency in the five-year outlook reflects a cautious optimism or steady confidence in the economic policies and their long-term impacts.

Short-term inflation expectations among Britons eased in May, according to the quarterly Inflation Attitudes Survey conducted by Ipsos for the Bank of England, released on Friday. Inflation expectations for the next year declined to 2.6% from 2.8% in February. Respondents estimated the current inflation rate to be 5.5%, down from 6.1% in the previous survey.

Projections for inflation in five years remain steady at 3.1%, unchanged from the last survey period. An overwhelming 65% of respondents believed the economy would weaken if prices started to rise more rapidly, compared to 6% who felt it would strengthen. This marks a slight shift from February’s figures, which were 69% and 5%, respectively.

Projections for inflation in five years remain steady at 3.1%, unchanged from the last survey period. An overwhelming 65% of respondents believed the economy would weaken if prices started to rise more rapidly, compared to 6% who felt it would strengthen. This marks a slight shift from February’s figures, which were 69% and 5%, respectively.

Additionally, the survey revealed that 40% of respondents felt the inflation target was ‘about right’, consistent with February’s results. Those who thought the target was ‘too high’ or ‘too low’ constituted 34% and 10%, respectively. Approximately 34% of respondents anticipated an increase in interest rates over the coming year, down from 36% in February. Meanwhile, nearly 25% believed interest rates would remain stable over the next twelve months, a slight decrease from 26% in the previous survey.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/