BTCUSDT: Italy Plans Crypto Market Surveillance, Fines Up to 5M Euros: Reuters

BTCUSDT Market price is moving in Ascending channel and market has reached higher high area of the channel

The Italy Government takes measures on Crypto asset running companies, those who do manipulations in the market, insider trading and money laundering frauds fine between 5K Euros to 5 Million Euros. This is the protection for Consumers in the Crypto asset transactions and money laundering from Domestic people more in the Gray market Crypto assets.

Italy is poised to implement stringent measures aimed at curbing manipulation within the crypto asset market, according to a Reuters report citing a reviewed draft decree. This initiative is part of a broader effort to enhance surveillance and mitigate risks associated with the sector.

The draft decree, expected to receive cabinet approval today, outlines significant fines ranging from 5,000 euros ($5,400) to 5 million euros for offenses including insider trading, unlawful disclosure of inside information, and market manipulation.

Within the European Union, countries are gearing up to enforce the regulatory framework known as Markets in Crypto Asset (MiCA). As part of this framework, Italy plans to designate its central bank and market regulator, Consob, as the National Competent Authorities (NCA) responsible for supervising crypto activities.

Italy has been preparing to adopt these regulations despite relatively low adoption rates of cryptocurrencies among Italian households, as reported by the central bank. A survey indicated that only about 2% of households hold modest amounts of crypto assets on average, and exposure of Italian intermediaries to the market is limited.Previously, Italy established mandatory registration requirements for crypto firms operating in the country. However, concerns were raised when 73 firms were approved as virtual currency service providers without undergoing thorough checks for investor safety, as reported by CoinDesk.

Despite these challenges, optimism surrounding crypto in Italy has been evident. For instance, Conio, a cryptocurrency wallet company, partnered with Coinbase (COIN) to introduce digital assets to Italian banks and financial institutions, reflecting ongoing developments and interest in the sector.

BTCUSDT: Italy Strengthens Crypto Oversight, Toughens Sanctions

BTCUSDT Market price is moving in box pattern and market has fallen from the resistance area of the pattern

The Italian government has introduced stringent measures aimed at regulating companies involved in crypto assets. These measures target market manipulation, insider trading, and money laundering frauds, with fines ranging from 5,000 Euros to 5 million Euros. The objective is to safeguard consumers engaging in crypto asset transactions and to combat the prevalence of domestic actors in the gray market of crypto assets. These regulations are crucial steps towards enhancing transparency and security within Italy’s crypto asset industry.

Italy is preparing to enhance its oversight of cryptoassets by implementing stricter measures, as outlined in a draft decree reviewed by Reuters on Thursday. This initiative, expected to be ratified by the cabinet later in the day, includes imposing substantial fines ranging from 5,000 to 5 million euros ($5,400-$5.4 million) for offenses such as insider trading, unlawful disclosure of inside information, and market manipulation.

The regulatory framework aligns with European guidelines established last year, designating Italy’s central bank and market regulator, Consob, as the authorities responsible for overseeing crypto activities. The primary goals are to safeguard financial stability and ensure the orderly functioning of markets amidst concerns raised by central banks and international bodies about the inherent risks of cryptocurrencies.

The regulatory framework aligns with European guidelines established last year, designating Italy’s central bank and market regulator, Consob, as the authorities responsible for overseeing crypto activities. The primary goals are to safeguard financial stability and ensure the orderly functioning of markets amidst concerns raised by central banks and international bodies about the inherent risks of cryptocurrencies.

Cryptocurrencies facilitate global money transfers outside traditional financial systems. Transactions are recorded on a blockchain, a decentralized digital ledger, where participants are identified solely by their wallet addresses composed of alphanumeric characters. This technology enables secure and transparent transaction tracking, albeit with implications for regulatory oversight and financial stability.

Italy’s proactive stance underscores global efforts to manage and regulate the evolving landscape of cryptoassets amid ongoing scrutiny and the potential for fraud highlighted by international investigations.

BTCUSDT: Italy Set to Introduce Stricter Crypto Regulation

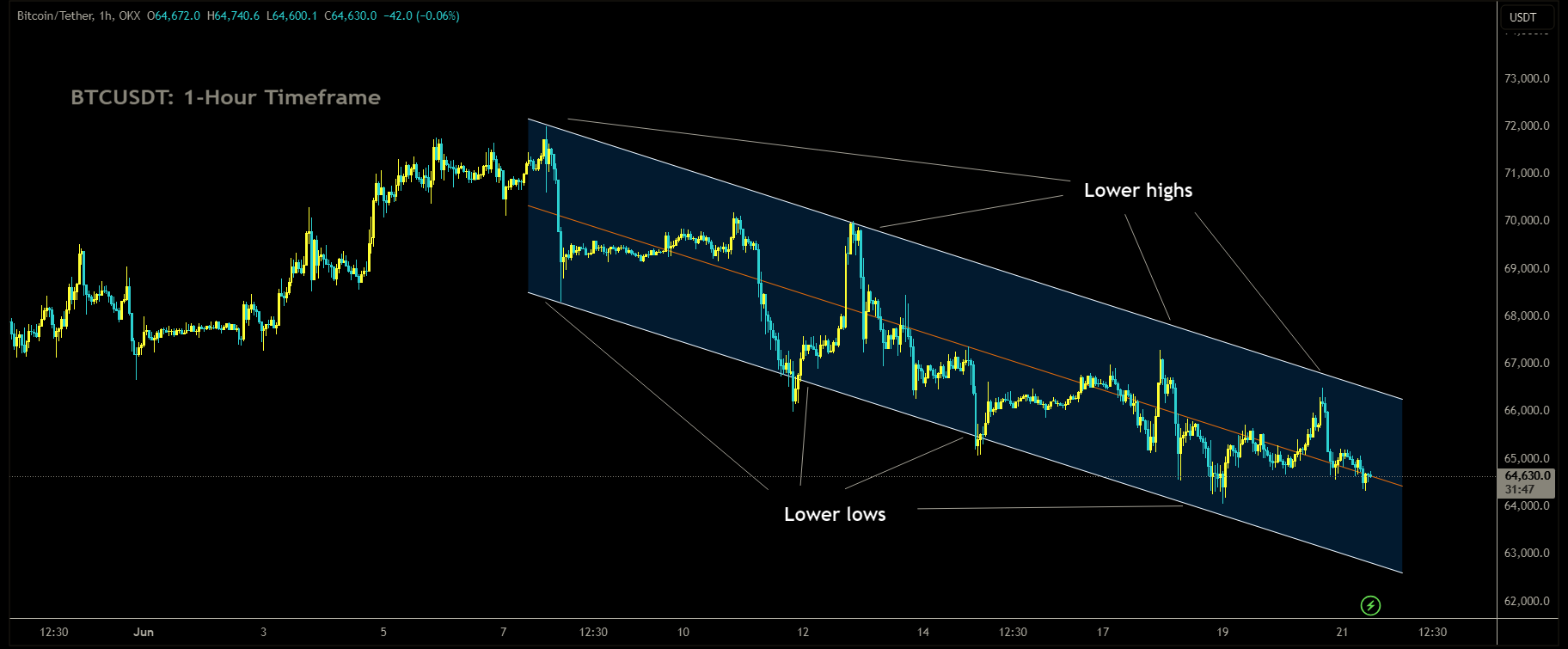

BTCUSDT Market price is moving in Descending channel and market has fallen from the lower high area of the channel

The Italian government has enacted robust measures to oversee companies operating in the crypto asset sector, focusing on tackling market manipulation, insider trading, and money laundering frauds. Violators can face fines ranging from 5,000 Euros to as much as 5 million Euros. The primary aim is to protect consumers involved in crypto asset transactions and address the significant presence of domestic entities within the gray market of crypto assets. These regulatory efforts represent critical steps toward promoting transparency and bolstering security within Italy’s crypto asset ecosystem.

Italy is set to tighten regulations on its cryptocurrency market, aiming to combat market manipulation and insider trading with hefty fines, as reported by Reuters. The proposed measures, outlined in a draft decree slated for cabinet approval, include fines ranging from 5,000 to 5 million euros ($5,400 to $5.4 million) for offenses such as insider trading, unauthorized disclosure of confidential information, and market manipulation.

Central banks and international organizations have voiced concerns over cryptocurrencies, citing their lack of intrinsic value and potential risks to macroeconomic and financial stability. Global investigations have also highlighted crypto’s susceptibility to fraudulent activities.

In line with a European regulation introduced last year, Italy plans to designate its central bank and market regulator, Consob, as the principal authorities overseeing cryptocurrency activities. This move aims to ensure the stability of the financial system amidst the growing prominence of digital assets.

Meanwhile, the Vatican Library has embarked on a pioneering initiative in the crypto realm by launching a non-fungible token (NFT) program. This program will issue non-transferable NFTs to supporters of its manuscript collections, offering access to high-resolution images of historic manuscripts.

Meanwhile, the Vatican Library has embarked on a pioneering initiative in the crypto realm by launching a non-fungible token (NFT) program. This program will issue non-transferable NFTs to supporters of its manuscript collections, offering access to high-resolution images of historic manuscripts.

The Vatican Library, renowned for its extensive collection of ancient manuscripts and printed books, sees this NFT initiative as an experimental project aimed at engaging donors, particularly from Italy. Donors who promote the NFT project on social media can earn Silver NFTs, granting access to a curated set of manuscript images. Those contributing more substantially will receive Gold NFTs, providing access to a broader selection of high-resolution images. Looking ahead, the library envisions expanding this initiative to potentially include virtual explorations of its collection using extended reality (XR) technology.

Father Mauro Mantovani, prefect of the Vatican Apostolic Library, emphasized the project’s commitment to preserving and promoting cultural heritage through innovative digital approaches.