GBP: Pound Sterling Falls on Weak UK PMI and Economic Concerns

UK Manufacturing PMI data for the month of June came at 51.4 versus 51.2 in the previous month. Services PMI data came at 51.2 versus 52.9 in the previous month. Composite PMI data came at 51.7 versus 53.0. Lower reading ahead of Elections GBP makes slump down against counter pairs.

The Pound Sterling (GBP) remained subdued during Friday’s London session, showing weakness against most currencies except for the Euro. This decline follows the release of mixed economic data from the United Kingdom (UK). The UK Office for National Statistics (ONS) reported stronger-than-expected Retail Sales for May, with a robust monthly growth of 2.9%, surpassing the anticipated 1.5%. On an annual basis, Retail Sales increased by 1.3%, defying expectations of a 0.9% decline.

Retail Sales are a crucial indicator of consumer spending, which significantly contributes to economic growth. The unexpected strength in retail sales, despite the Bank of England (BoE) maintaining high interest rates, indicates strong consumer demand but also suggests rising price pressures. Sustained high demand and increasing prices could complicate the BoE’s efforts to achieve price stability.

GBPCAD has broken Ascending channel in downside

On Thursday, the BoE held interest rates steady at 5.25% in a 7-2 vote. While acknowledging that headline inflation is expected to return to the 2% target within three years, BoE policymakers expressed concerns about persistent price pressures in the services sector. Financial markets currently anticipate that the BoE will start cutting rates in August, implying no rate cuts before the upcoming parliamentary elections. Pre-election polls show the Conservative Party, led by Prime Minister Rishi Sunak, trailing the opposition Labour Party by approximately 20 points, according to Reuters.

In contrast, the preliminary S&P Global/CIPS PMI report for June showed a surprising drop in the Composite PMI to 51.7, though it remained above the 50.0 threshold indicating expansion. Economists had forecasted a slight improvement to 53.1 from May’s 53.0. The decline was primarily due to slower growth in the Services PMI, though the Manufacturing PMI showed better-than-expected expansion. The report attributed the slowdown partly to uncertainty surrounding the business environment ahead of the general election, causing many firms to delay decisions pending policy clarity.

Daily Digest Market Movers: Pound Sterling Weakens, US Dollar Remains Firm

The Pound Sterling remains below 1.2700 against the US Dollar (USD) in Friday’s London session, pressured by the strong performance of the USD. The US Dollar has gained strength as Federal Reserve (Fed) policymakers continue to support the prospect of maintaining higher rates for longer, with at least one rate cut projected for this year. Despite these official projections, market participants anticipate two rate cuts by the Fed this year, with expectations bolstered by the recent decline in US inflation and Retail Sales data for May. The CME FedWatch tool indicates a 64% probability of rate cuts starting in September.

The US Dollar’s performance on Friday will be influenced by the release of the US S&P Global PMIs for June at 13:45 GMT. The Composite PMI is expected to decline but remain above the 50 mark, which separates expansion from contraction. Slowing growth in both manufacturing and services is anticipated. Weak PMI data would suggest that the US economy is cooling, thereby increasing the likelihood of Fed rate cuts in September, which could further impact the USD’s performance.

In summary, while the Pound Sterling faces downward pressure from mixed UK economic data, the US Dollar remains buoyant due to ongoing Fed rate cut speculations, with upcoming PMI data likely to provide further market direction.

GBP: Election Uncertainty Pushes UK Business Growth to 7-Month Low

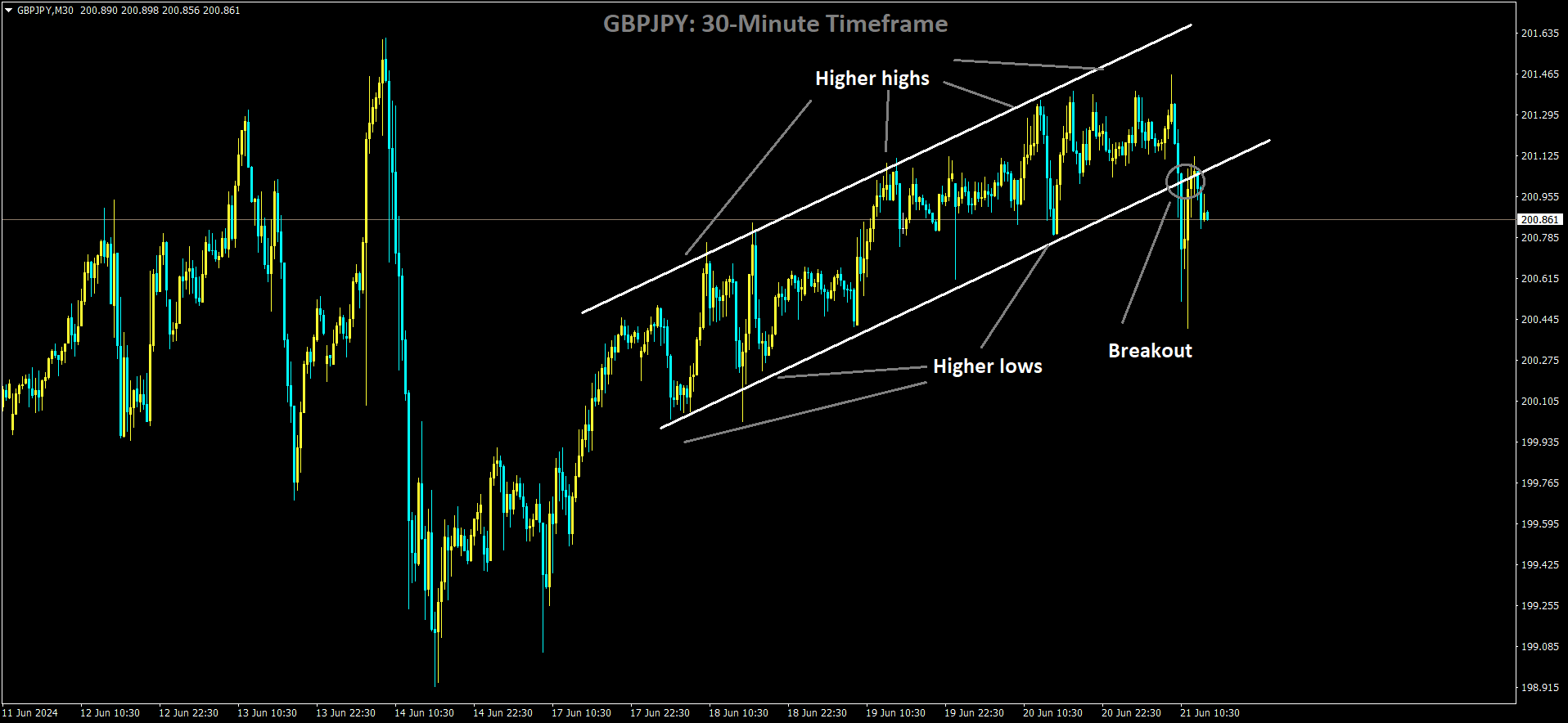

GBPJPY has broken Ascending channel in downside

UK Manufacturing PMI data for June came in at 51.4, slightly up from 51.2 in the previous month. However, Services PMI data declined to 51.2 from 52.9, and the Composite PMI fell to 51.7 from 53.0. These lower readings, especially ahead of the elections, have caused the GBP to slump against other currencies. The uncertainty and cautious business environment in the lead-up to the election period are contributing to this decline.

British businesses are expanding at their slowest pace since the economy was in recession last year, according to a survey released on Friday. Many companies are delaying major decisions until after the July 4 election, with opinion polls indicating that Keir Starmer’s Labour Party is poised to return to power for the first time since 2010. Prime Minister Rishi Sunak’s Conservative Party is expected to face a historic defeat.

The S&P Global Composite Purchasing Managers’ Index (PMI) dropped to 51.7 in June from 53.0 in May, the lowest level since November 2023 and below all forecasts in a Reuters poll of economists. Chris Williamson, chief business economist at S&P Global, noted that the slowdown is partly due to uncertainty around the business environment in the lead-up to the general election, with many firms pausing decision-making.

The euro zone’s composite PMI also fell sharply to 50.8 from 52.2, driven by a significant drop in German manufacturing activity and a broad decline in business activity in France ahead of snap parliamentary elections, where the far-right is expected to perform well.

Keir Starmer has emphasized his “pro-business and pro-worker” stance, aiming for Labour to be “the party of wealth creation.” However, not all businesses are set to benefit. Norwegian energy giant Equinor has suspended efforts to sell a stake in the Rosebank oil development in the North Sea due to political uncertainty. Labour has pledged to block new oil and gas exploration licenses and increase windfall taxes on energy companies.

June’s slowdown was led by a decline in the services PMI to 51.2 from 52.9, while the manufacturing sector PMI edged up to a two-year high of 51.4 from May’s 51.2. These figures suggest a quarterly GDP growth of 0.1%, according to Williamson. The Bank of England (BoE) on Thursday revised up its growth forecast for the second quarter of 2024 to 0.5%, with business surveys indicating underlying quarterly growth of around 0.25%.

Official retail sales data for May showed a strong rebound following a slump in April due to heavy rain, and consumer confidence rose to its highest level since November 2021. The BoE kept rates at a 16-year high on Thursday, but some policymakers noted that their decision had been “finely balanced,” bolstering expectations of an August rate cut.

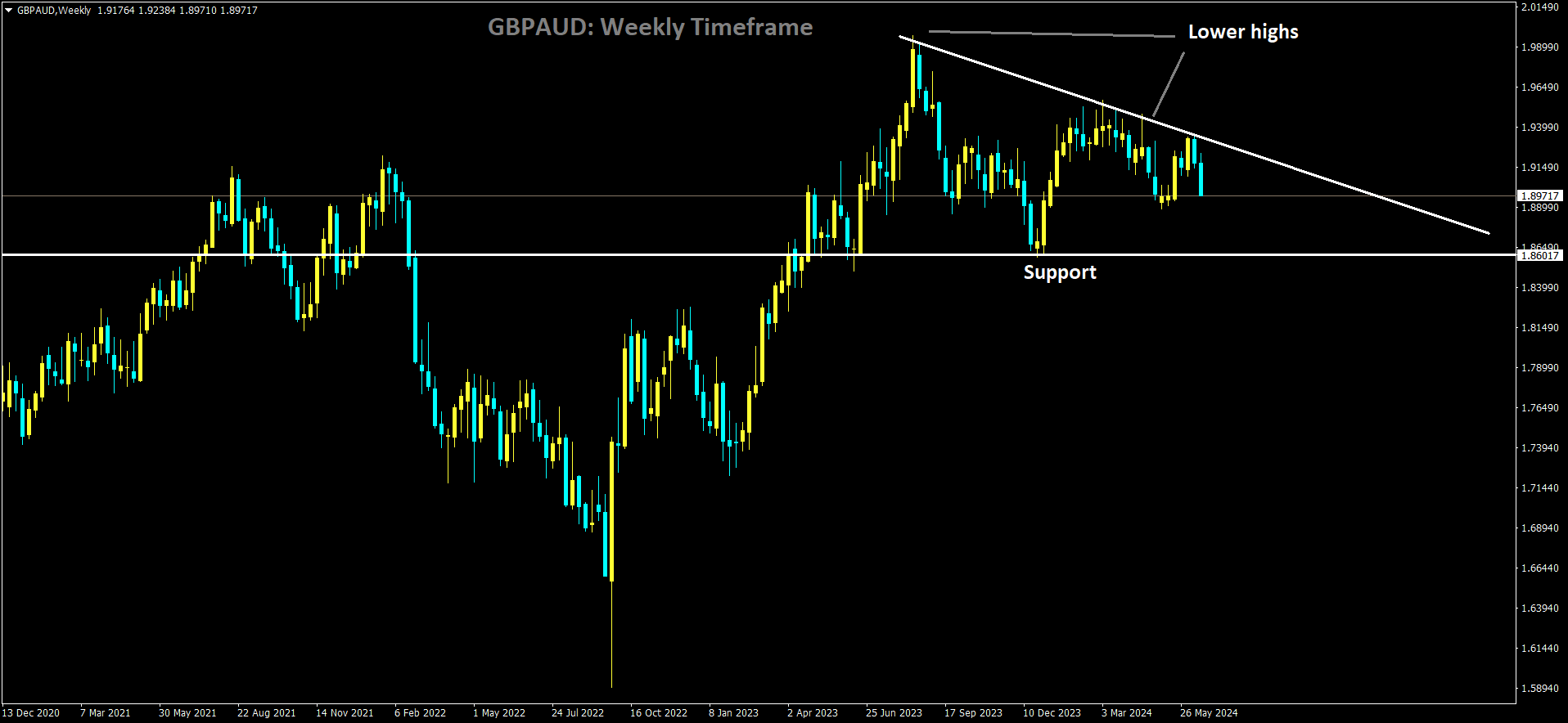

GBPAUD is moving in Ascending Triangle and market has fallen from the lower high area of the pattern

However, the PMI data revealed that businesses raised prices at the fastest pace in four months, with input costs accelerating due to global shipping bottlenecks, reversing the trend of growing at the weakest pace in more than three years in May. Rob Wood, chief UK economist at Pantheon Macroeconomics, commented that the rebound in PMI price balances suggests inflation pressures may exceed the Monetary Policy Committee’s expectations, predicting that the BoE might wait until September before implementing a rate cut.

GBP: UK June Flash Services PMI 51.2 vs 53.0 Expected

The United Kingdom’s Manufacturing PMI for June registered at 51.4, a marginal improvement from the prior month’s 51.2. Conversely, the Services PMI declined to 51.2 from 52.9, and the Composite PMI diminished to 51.7 from 53.0. These deteriorating figures, particularly in the pre-election milieu, have precipitated a depreciation of the GBP vis-à-vis its counterparts. The pervasive uncertainty and reticence within the business sector preceding the electoral period are exacerbating this downturn.

Election jitters are starting to creep in, as evidenced by the headline reading hitting a seven-month low, which is weighing on overall UK business activity for June. The only bright spot is that manufacturing conditions are improving, with the reading reaching a 23-month high. S&P Global notes that the slowdown in services activity is partly driven by a pause in client spending decisions ahead of the election period.

“Flash PMI survey data for June signal a slowing in the pace of economic growth, indicating that GDP is now growing at a sluggish quarterly rate of just over 0.1%.

“The slowdown in part reflects uncertainty around the business environment in the lead-up to the general election, with many firms seeing a hiatus in decision-making pending clarity on various policies.

“Meanwhile, from an inflation perspective, stubbornly persistent service sector inflation – a major barrier to lower interest rates – remains evident in the survey but should at least cool further from the current 5.7% pace in the coming months. However, companies’ costs are rising, most notably in manufacturing, where shipping costs in particular are spiking again and adding to a renewed rise in inflationary pressures from goods.

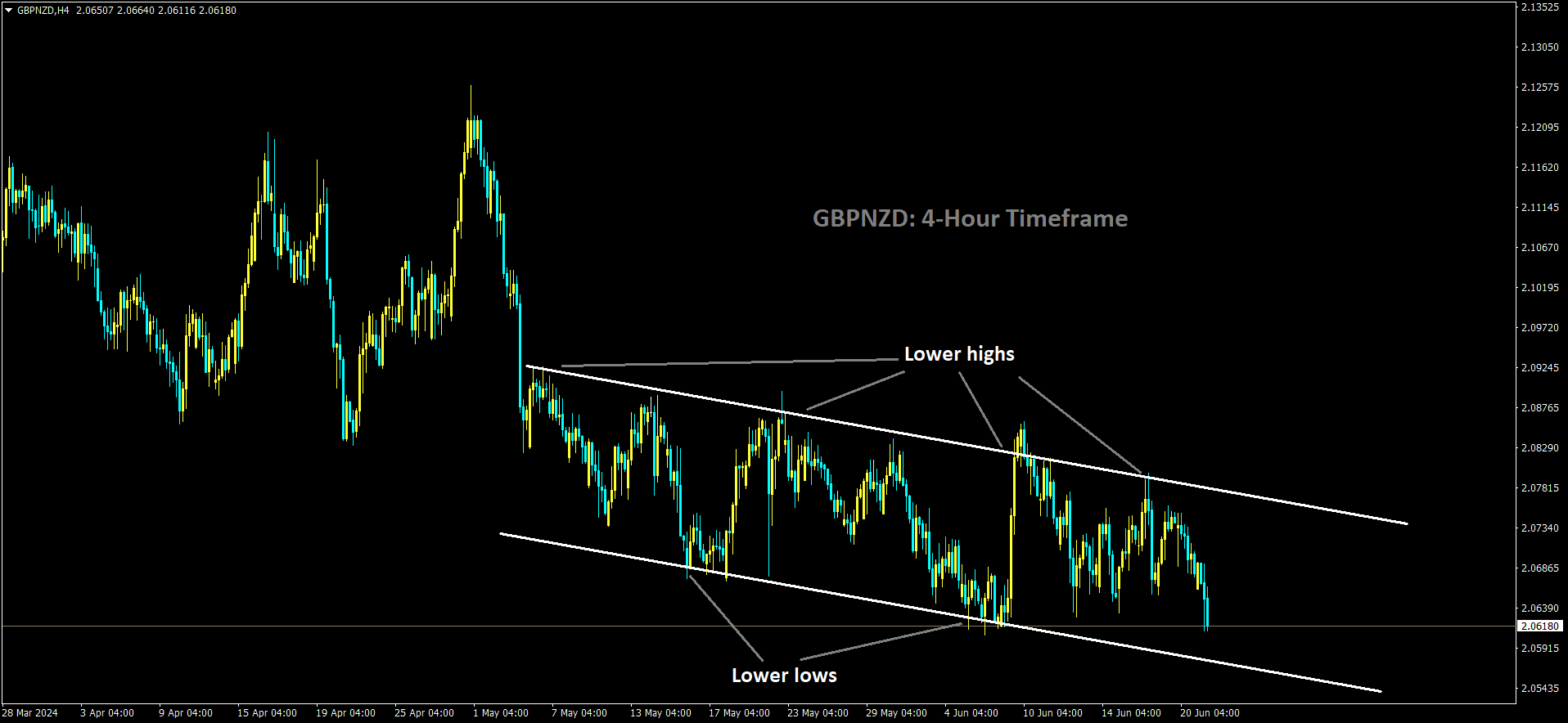

GBPNZD is moving in Descending channel and market has fallen from the lower high area of the pattern

“In short, while a slowdown in economic growth may prove temporary, should businesses react positively to the policies announced by any new government, the stubbornness of underlying inflationary pressures above the Bank of England’s target still looks somewhat engrained.”

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/