JPY: Bank of Japan’s Inflation Measures Drop Below 2% in April

The Japan Median inflation indicator shows 1.1% printed in the April month versus 1.3% in the March month, Trimmed mean index came at 1.8% in the April month versus 2.2% in the March month, Inflation highest density reading came at 1.6% in the April month versus 1.9% printed in the March month. The BoJ now standing in the Difficult situation for pulling inflation to the target of 2% for coming months to rise the rates from Zero Levels. JPY pairs weakness against counter pairs after the reading came.

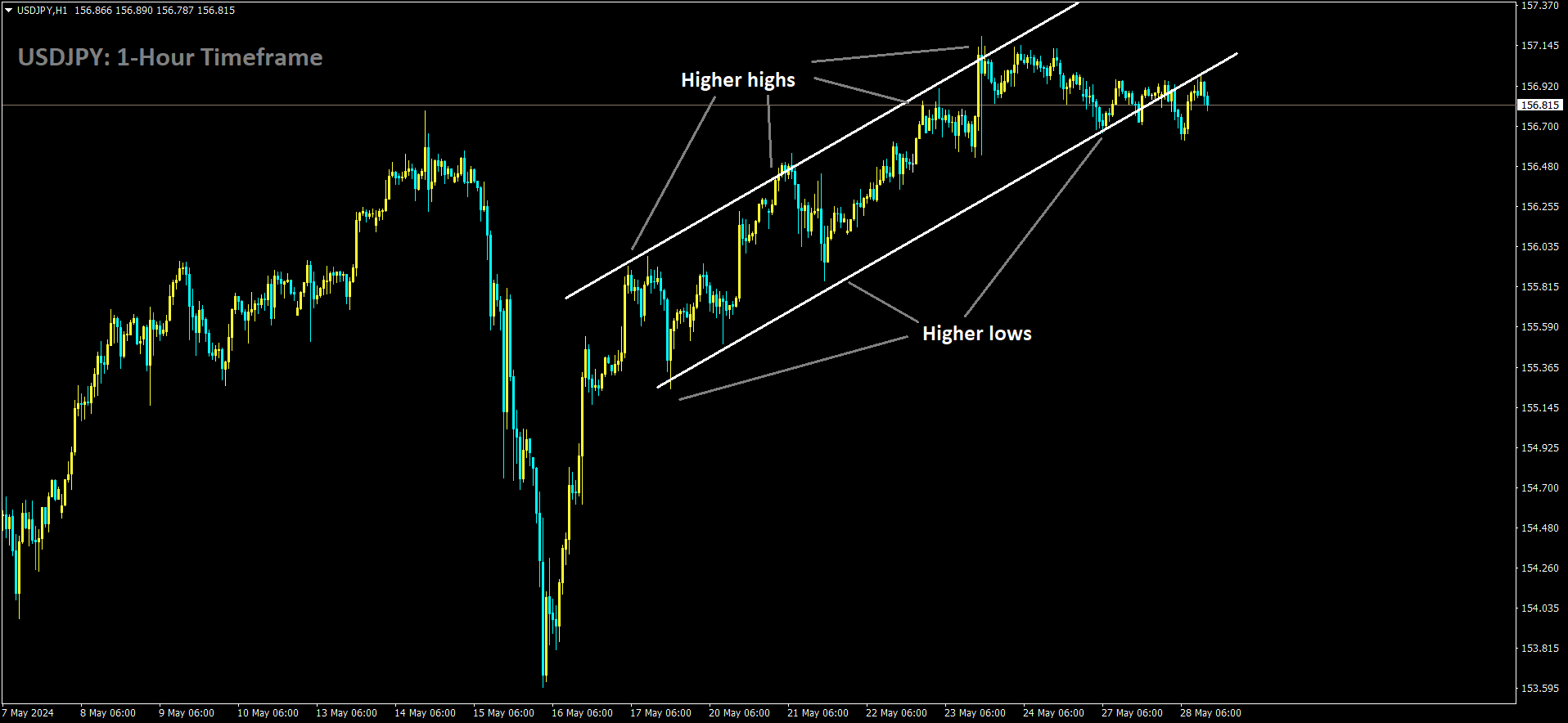

USDJPY is moving in Ascending channel and market has reached higher low area of the channel

The Bank of Japan’s key measurements of underlying inflation in April all fell below its 2 percent target for the first time since August 2022, data showed on Tuesday, increasing uncertainty about the timing of its next interest rate hike. The weighted median inflation rate, one of the three indicators closely watched to gauge whether price rises are broadening, rose 1.1 percent in April from a year earlier, after a 1.3 percent increase in March, the data showed.

The trimmed mean index, which excludes the upper and lower extremes of the price change distribution, rose 1.8 percent in April from a year earlier, slowing from the previous month’s 2.2 percent increase, the data indicated.

A third index that measures the inflation rate with the highest concentration in the distribution rose 1.6 percent in April, slowing from the previous month’s 1.9 percent increase, the data showed.

The BOJ ended eight years of negative interest rates and other remnants of its radical monetary stimulus in March, based on the view that sustained achievement of its 2 percent inflation target was within reach. BOJ Governor Kazuo Ueda has stated that the central bank will raise interest rates from current near-zero levels if underlying inflation accelerates toward 2 percent, as currently projected.

The new data casts doubt on the BOJ’s perspective that price rises are broadening beyond those driven by rising raw material costs, suggesting that sustained inflation supported by robust domestic demand may not yet be achieved.

JPY: AUD/JPY Rises to Near 104.50 on Soft Japan Inflation

The Japan Median inflation indicator showed a 1.1% increase in April, down from 1.3% in March. The trimmed mean index registered a 1.8% rise in April, compared to 2.2% in March. The inflation rate with the highest density reading came in at 1.6% in April, down from 1.9% in March. These figures place the Bank of Japan (BOJ) in a challenging position as it strives to reach its 2% inflation target in the coming months to justify raising interest rates from their current near-zero levels. Following the release of these inflation readings, the Japanese Yen (JPY) weakened against other currency pairs.

AUDJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

AUD/JPY continues its winning streak for the third consecutive session on Tuesday, trading around 104.50 during the European session. The appreciation of the AUD/JPY cross is attributed to the softer Japanese Yen (JPY) following the Bank of Japan (BoJ) publishing the latest data earlier in the day. Japan’s Weighted Median Inflation Index, a significant gauge of the country’s inflation trend, increased by 1.1% in April, slowing from the 1.3% increase recorded in March.

However, the Japanese Yen found some strength during the early Asian hours, supported by Japan’s improved Corporate Service Price Index (CSPI). The CSPI posted a year-over-year reading of 2.8% in April, surpassing expectations of 2.3% and marking its fastest rate of increase since March 2015.

Additionally, Japan Finance Minister Shun’ichi Suzuki emphasized the importance of currencies moving in a stable manner that reflects fundamentals. Suzuki stated that he is closely monitoring foreign exchange (FX) movements but refrained from commenting on whether Japan has conducted currency intervention.

Meanwhile, the Australian Dollar (AUD) continues to strengthen despite softer Australia’s Retail Sales (MoM), which rose by 0.1% in April, swinging from the previous 0.4% decline and falling short of market expectations of 0.2%.

Moreover, the latest Reserve Bank of Australia (RBA) meeting minutes indicated that the board found it difficult to forecast future changes in the cash rate, acknowledging that recent data increases the likelihood of inflation persisting above the 2-3% target for an extended period.

JPY: BOJ’s April Inflation Measures Fall Below 2%

In April, Japan’s Median inflation indicator increased by 1.1%, down from 1.3% in March. The trimmed mean index rose by 1.8%, compared to 2.2% in March. The highest density inflation rate was 1.6% in April, down from 1.9% in March. These lower inflation numbers put the Bank of Japan in a difficult position as it aims to reach its 2% target to justify raising interest rates from near-zero levels. Following these reports, the Japanese Yen weakened against other currencies.

EURJPY is moving in Ascending channel and market has reached higher high area of the channel

The Bank of Japan’s (BOJ) key measurements of underlying inflation in April all fell below its 2 percent target for the first time since August 2022, data showed on Tuesday (May 28), increasing uncertainty about the timing of its next interest rate hike.

The weighted median inflation rate, one of the three indicators closely watched to gauge whether price rises are broadening, rose 1.1 percent in April from a year earlier, down from a 1.3 percent increase in March, according to the data.

The trimmed mean index, which excludes the upper and lower extremes of the price change distribution, rose 1.8 percent in April from a year earlier, slowing from the previous month’s 2.2 percent.

A third index, which measures the inflation rate with the highest density in the distribution, rose 1.6 percent in April, down from the previous month’s 1.9 percent increase, the data showed.

The BOJ ended eight years of negative interest rates and other remnants of its radical monetary stimulus in March, believing that sustained achievement of its 2 percent inflation target was within reach.

BOJ Governor Kazuo Ueda has stated that the central bank will raise interest rates from current near-zero levels if underlying inflation accelerates towards 2 percent, as currently projected.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/