Bitcoin, the leading cryptocurrency, has witnessed a remarkable bull run in 2023, achieving returns of over 150%. This surge has outpaced traditional assets like the S&P 500, gold, and the U.S. dollar by a significant margin.

Overcoming Anchoring Bias in Crypto Investments

While some investors may fear that Bitcoin is overvalued due to its rapid rise, it’s essential to understand the impact of anchoring bias. This cognitive bias can mislead investors who anchor their judgments to past market data, potentially causing them to miss out on opportunities.

Metrics Indicating Bitcoin’s Potential

Several key indicators, including the Puell Multiple, Z-score, and Mayer Multiple, suggest that Bitcoin is not overvalued and may continue to rally in 2024.

The Puell Multiple and Bitcoin’s Mining Rewards

The Puell Multiple, which measures the daily Bitcoin issuance relative to the 365-day moving average, indicates that miners’ profitability is currently favorable. However, it remains below levels associated with market peaks, leaving room for further growth.

Z-score: A Measure of Bitcoin’s Fair Value

The Z-score, comparing Bitcoin’s market capitalization to its realized value, currently stands at 1.6, signaling that Bitcoin remains undervalued. Historically, Z-scores above eight indicated overvaluation, while negative values pointed to discounted prices.

The Mayer Multiple and Bitcoin’s Moving Average

The Mayer Multiple, based on Bitcoin’s market price versus its 200-day moving average, is at a comfortable 1.404. This suggests that Bitcoin still has room to grow before reaching overbought territory, aligning with long-term bullish trends.

Federal Reserve and Bitcoin’s Resurgence

The Federal Reserve’s decision to maintain steady interest rates and hints of potential rate cuts in 2024 have rejuvenated the cryptocurrency market, pushing Bitcoin past the $43,000 mark.

Accounting Rules and Cryptocurrency Valuation

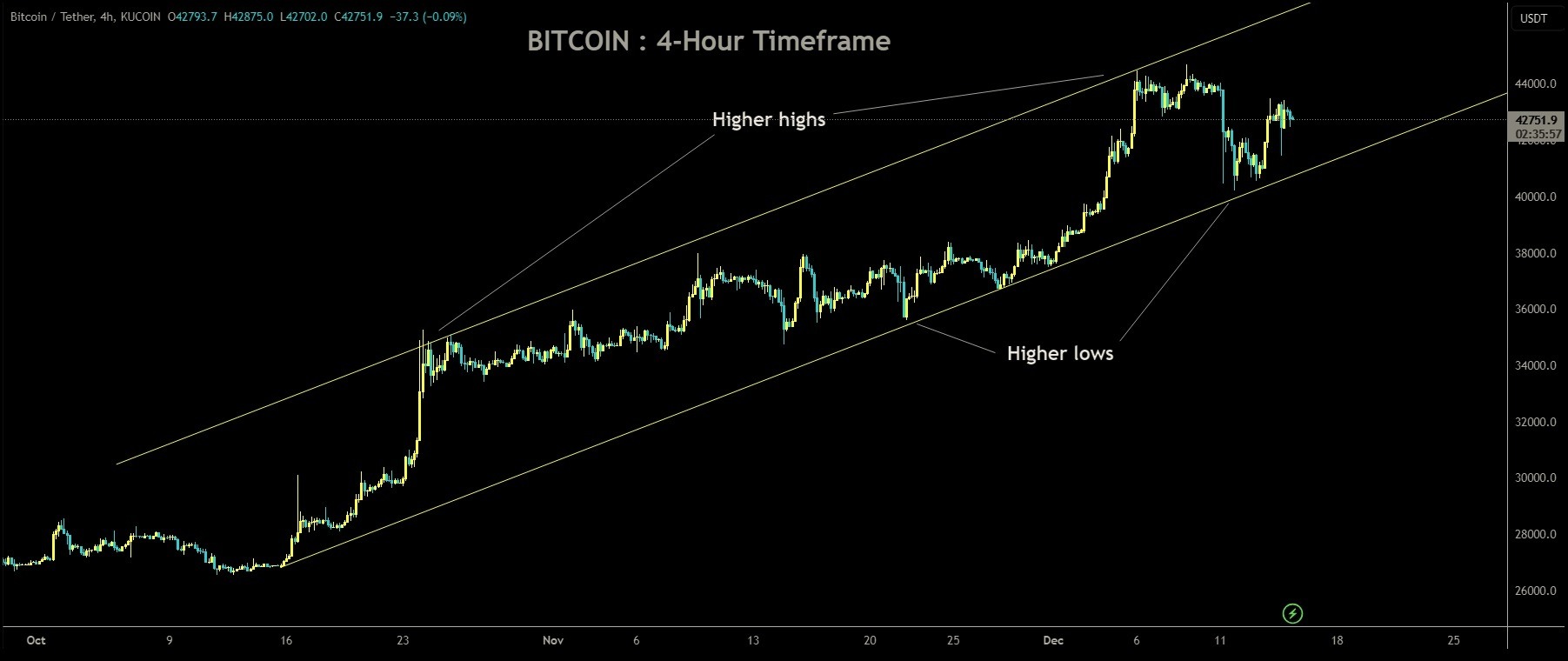

Market is moving in the consolidation mode and the market may be move between 43500-42000 area is possible.

New accounting rules set to be implemented in 2025 require companies to assess their cryptocurrency holdings at fair value. This change could provide a more accurate reflection of real-time asset fluctuations, contributing to Bitcoin’s resurgence.

The SEC and the Cash Redemption Model

The SEC’s introduction of the Cash Redemption Model for Bitcoin ETFs could significantly affect the cryptocurrency market, potentially leading to increased volatility as market participants adapt to this new regulatory framework.

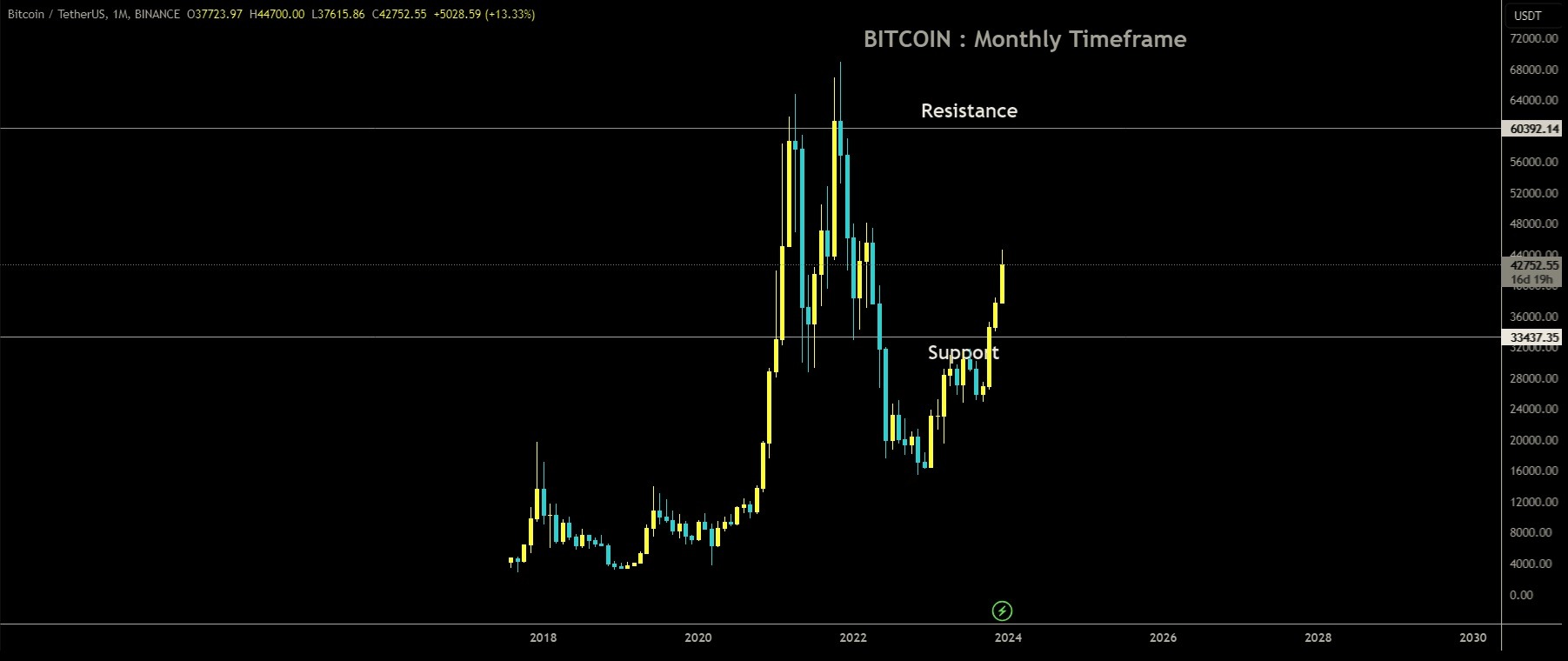

Technical Analysis of Bitcoin

Bitcoin’s current price at $42,900 and its technical analysis indicate both resistance and support levels, with potential for bullish advancement. Traders and investors are closely monitoring these indicators to navigate the dynamic cryptocurrency landscape.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/