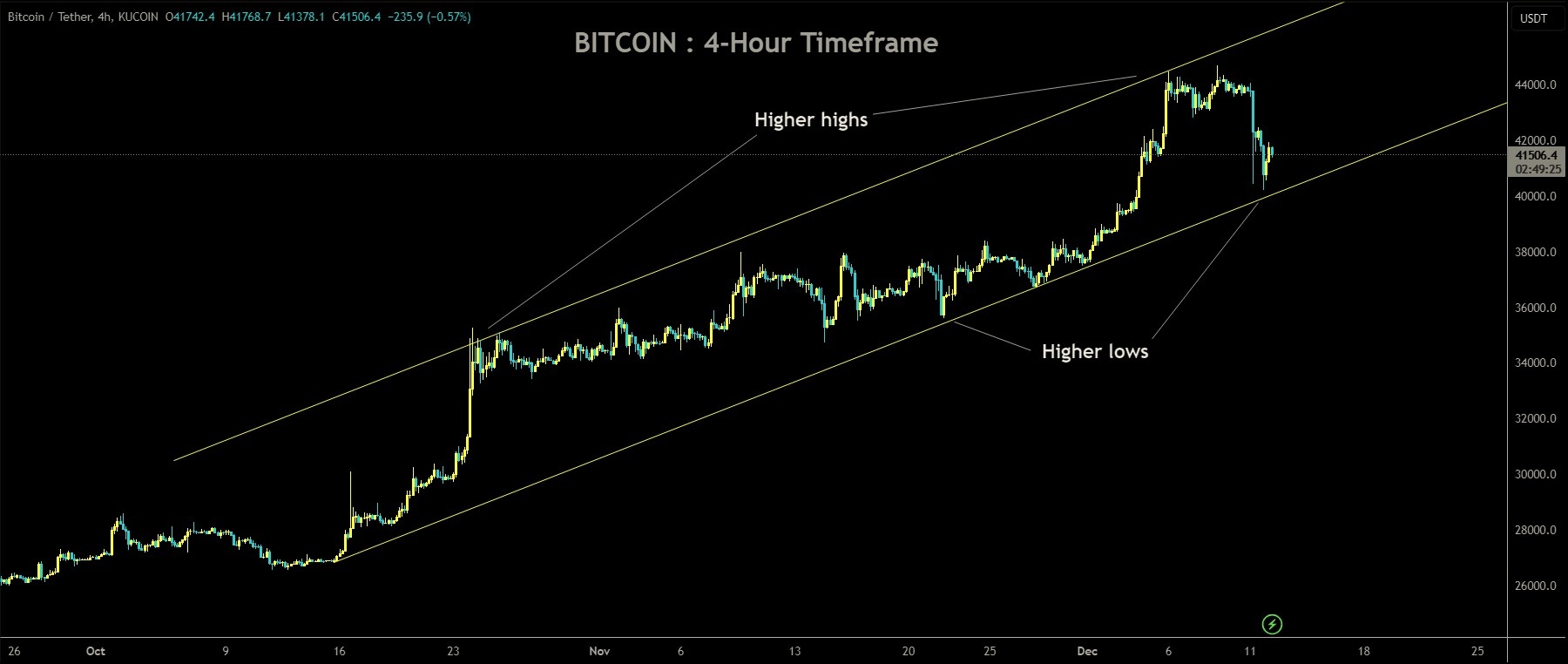

Bitcoin prices experienced a decline on Monday following a prolonged rally that saw them surge from $30,000 to $44,000. Analysts are anticipating the possibility of corrections down to $40,000 in the near term.

A notable 5% price correction within a 24-hour period, bringing its value to $41,645 on December 11. Despite this decline, various indicators and on-chain data provide insights into Bitcoin’s market dynamics.

On-Chain Data Signals Overheating

Julio Moreno, who serves as the head of research at CryptoQuant, an on-chain analytics firm, expressed concerns regarding Bitcoin’s price heating up. This apprehension stems from Bitcoin’s recent surge, particularly its move above the psychologically significant $40,000 level. Such rapid price increases often trigger discussions among analysts.

Stiff Resistance at $44,000 Supply Zone

One of the key challenges Bitcoin is currently facing is the formidable barrier at the $44,000 supply zone. This resistance level has been identified by the Lookintobitcoin golden ratio multiplier indicator, which examines Bitcoin’s adoption curve and market cycles. The indicator highlights that the 1.6 multiplier target has been reached around the $44,000 area. Bitcoin has struggled to convincingly breach this resistance in recent days, and this persistence of resistance has been corroborated by on-chain data from IntoTheBlock.

Bullish Outlook Despite Resistance

Despite these challenges, there is a prevailing bullish sentiment surrounding Bitcoin’s prospects. Investors and traders anticipate further upward momentum from current price levels, with the primary objective being the break above $44,000. A successful breakout beyond this critical level could propel Bitcoin towards the psychologically significant milestone of $50,000. This optimism is driven by several factors, including potential developments expected in early 2024, such as the decision by the United States Securities and Exchange Commission regarding spot Bitcoin exchange-traded fund applications and the occurrence of the next Bitcoin halving event.

Market-Wide Correction and Impact on Cryptocurrencies

Bitcoin’s recent rally led to profit-taking among investors, resulting in a notable price correction. The cryptocurrency market is highly interconnected, and Bitcoin’s price movements often have a cascading effect on other digital assets. During this correction, other cryptocurrencies also experienced declines. For instance, Ethereum, Solana, and Ripple’s XRP all saw their prices decrease.

Impact on Crypto Equities and Mining Stocks

The correction in the cryptocurrency market extended to crypto equities and mining stocks. Coinbase, a major cryptocurrency exchange, and MicroStrategy, a well-known company with significant Bitcoin holdings, both saw declines in their stock prices. Similarly, Bitcoin mining-related stocks, such as Riot Platforms and Marathon Digital, witnessed substantial double-digit decreases. Additionally, Wall Street favorites CleanSpark and Iris Energy also experienced notable drops in their stock prices.

Expectations for Bitcoin’s Momentum

Despite the recent correction, many analysts and investors remain optimistic about Bitcoin’s ongoing momentum. The cryptocurrency had been steadily climbing in value in the weeks leading up to the correction, following a period of relative market stability. Although the correction did trigger some liquidations, chart analysts generally believe that Bitcoin would need to experience a more significant decline before questioning the strength of the overall rally.

Positive Catalysts for Bitcoin in 2024

Looking ahead to the year 2024, several potential catalysts are generating excitement among cryptocurrency enthusiasts. These include the possibility of the United States Securities and Exchange Commission approving the first spot Bitcoin exchange-traded fund (ETF), which could significantly impact Bitcoin’s accessibility to traditional investors. Furthermore, the Bitcoin community is eagerly anticipating the next Bitcoin halving event, scheduled for spring 2024. This event historically has had a significant impact on Bitcoin’s price. Additionally, market participants are closely monitoring the Federal Reserve’s actions, particularly in relation to its policy meetings, for any indications of potential interest rate cuts in 2024, as such actions can also influence the cryptocurrency market.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/