Bitcoin’s Price Rally and Federal Reserve’s Rate Decision

Bitcoin Price Rally from Correction and Reaches $42K Again. the price rally, rebounding from a recent correction and reaching the $42,000 mark once more. This surge in Bitcoin’s value coincided with the Federal Reserve’s decision regarding interest rates.

Federal Reserve Maintains Rates Amid Economic Uncertainty

As widely anticipated, the U.S. Federal Reserve chose to maintain its benchmark federal funds rate range at 5.25%-5.50%. However, it adjusted its rate outlook for the end of 2024, lowering it from 5.1% to 4.6%. This decision comes amid concerns of tightening financial and credit conditions, which could have implications for economic activity, employment, and inflation.

Economic Projections and Bitcoin’s Response

Alongside the rate announcement, the Federal Reserve released its quarterly economic projections. Notably, it revised its expectations for core inflation, GDP growth, and the fed funds rate. These adjustments suggest a potential 75 basis points of rate cuts in the coming year. In response to the Fed’s decision, the price of Bitcoin increased by approximately 2.2%, reaching $42,370.

Market Reactions and Asset Performance

Wider financial markets displayed optimism following the Federal Reserve’s announcement. Major stock indices, including the Nasdaq, S&P 500, and Dow Jones Industrial Average, all recorded gains. Additionally, the cryptocurrency market cap increased by 1.2% in the 24 hours following the announcement, reaching a total of $1.65 trillion.

Ethereum and Federal Reserve’s Economic Goals

Notably, Ethereum also responded positively to the Federal Reserve’s decision, gaining 1% in the hour following the announcement and trading at $2,234. The Federal Open Market Committee’s stated objectives include achieving maximum employment and maintaining inflation at 2% over the long term.

Cryptocurrency and Interest Rate Correlation

Cryptocurrency investors often view the Federal Reserve’s decisions on interest rates as a significant factor influencing market sentiment. Low interest rates tend to favor risk assets like stocks and cryptocurrencies, while high rates may lead to a flight to traditional currencies. Historical data has shown that Bitcoin’s price can be impacted by central bank policies and equity market performance.

Investor Expectations and FOMC’s Press Conference

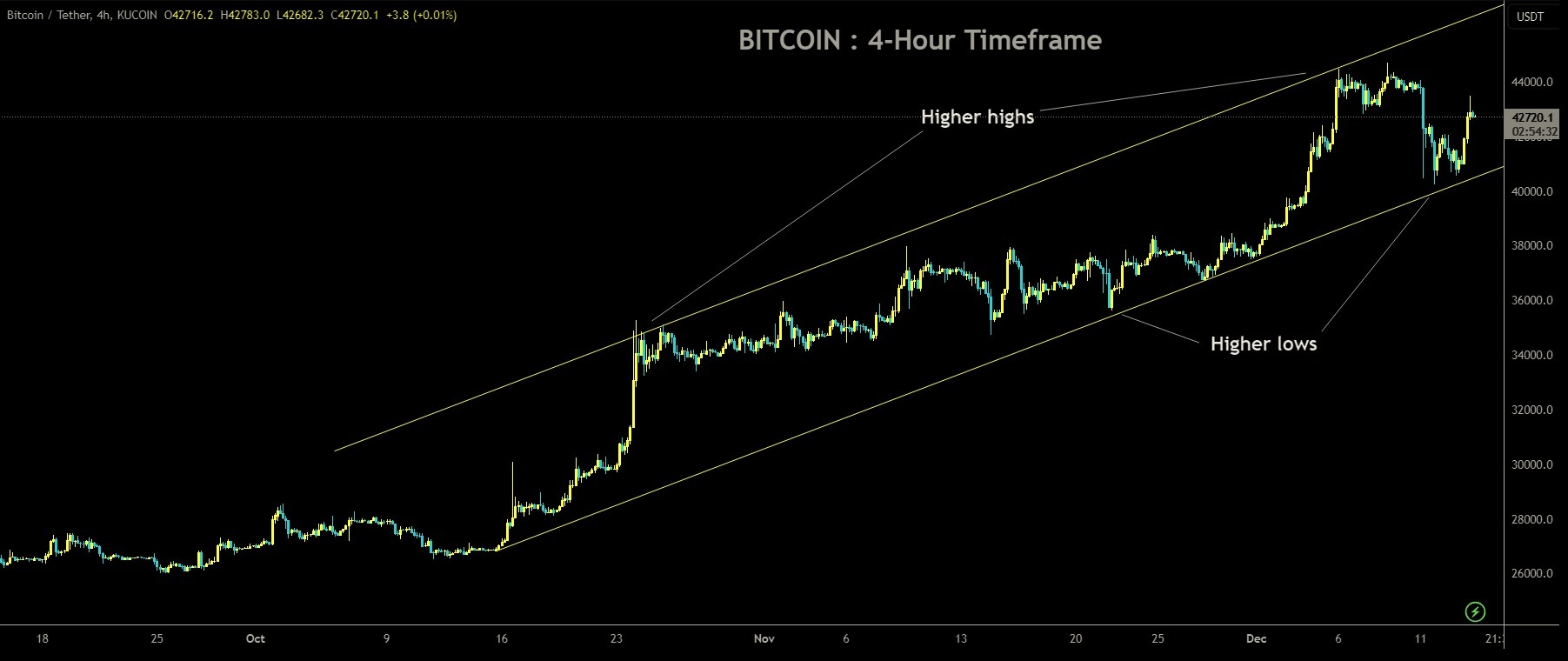

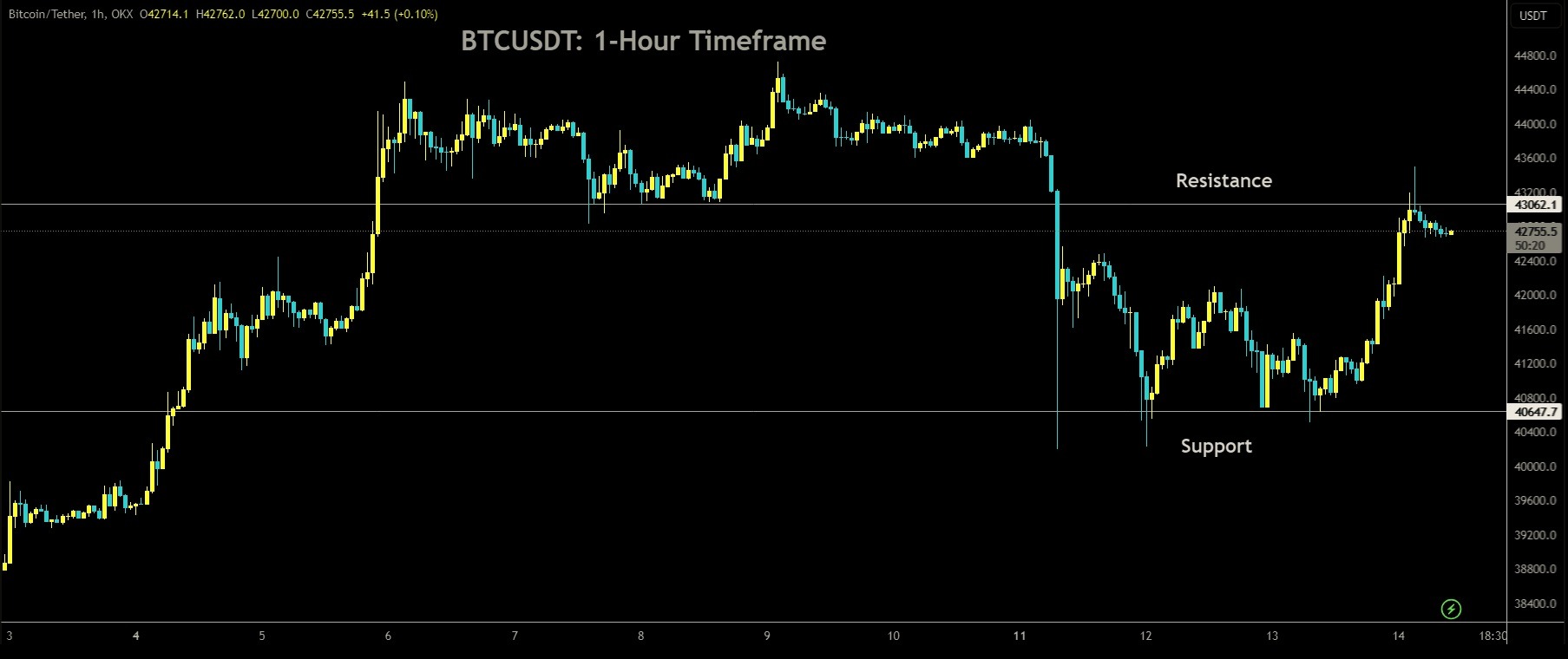

Market is moving in a Strong Uptrend, Market may be move up to the resistance area of 42500-43500 is possible.

Investors had widely expected the Federal Reserve to maintain interest rates, with the CME FedWatch tool indicating a 98% probability of this outcome. During a press conference, Federal Reserve Chairman Jerome Powell acknowledged the faster-than-expected U.S. economic recovery but highlighted ongoing uncertainty in the economic outlook.

Federal Reserve’s Rate Changes and Crypto Market History

In the past, significant movements in Bitcoin’s price have coincided with the Federal Reserve’s interest rate decisions. For instance, Bitcoin experienced a substantial uptrend in 2020 and early 2021 following the Fed’s decision to lower interest rates to 0.25%. However, the Fed’s subsequent rate hikes in 2022 had a negative impact on the value of cryptocurrencies, stocks, and equities.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/