BTCUSDT: Bitcoin Approaches $70K; Bitfinex Optimistic Selling Pressure Easing Off

The Bitfinex exchange analysts said Bitcoin is surged over $70K Market this week after March 2024 this year. The Selling pressure is come to an end due to new contracts of Bitcoin Buying is showing in the data. Accumulation phase is going in the past 3 months according to data for New buyers in the Market.

BTCUSDT is moving in box pattern and market has reached resistance area of the pattern

On Monday, Bitcoin (BTC) briefly surged above the $70,000 mark for the first time in a week before retracing back to its typical trading range, maintaining its sideways price movement. The leading cryptocurrency by market capitalization was recently trading around $69,200, marking a 2% increase over the past 24 hours, while Ethereum’s ether (ETH) remained relatively stable, hovering slightly below $3,800. The CoinDesk 20 Index, which tracks the broader cryptocurrency market, saw a 1.6% gain over the same period.

Bitcoin and the broader crypto market have been in a consolidation phase for over two months since March, when BTC reached a record price surpassing $73,000.

Bitfinex analysts expressed optimism in a Monday market update, suggesting that the correction phase for Bitcoin appears to be nearing its end. They highlighted that selling by long-term holders was a significant factor contributing to Bitcoin’s correction from its all-time highs. However, blockchain data indicates that these holders have begun re-accumulating BTC for the first time since December 2023. Additionally, the number of new accumulation addresses for both Bitcoin and Ethereum has been increasing over the past month, signaling growing bullish sentiment despite the price stability.

According to CryptoQuant data cited by Bitfinex analysts, the rise in new BTC and ETH accumulation addresses over the past month suggests increasing confidence among investors. However, Swissblock, a crypto analytics firm, pointed out significant resistance levels at $70,000 and $73,000, which have been limiting BTC’s price movement. They noted that short-term pullbacks are viewed as buying opportunities, with $67,000 serving as a reliable support level.

Looking ahead, Joshua Lim, co-founder of crypto derivatives principal trader Arbelos Markets, highlighted the upcoming week as potentially interesting to watch. Key inflation data releases and the Federal Reserve meeting could introduce volatility in either direction for the cryptocurrency market.

BTCUSDT: Bitcoin Nears $70K; Bitfinex Optimistic Correction’s End Is Near

The analysts at Bitfinex exchange have reported a significant milestone for Bitcoin this week, with its price surging beyond the $70,000 mark for the first time since March 2024. This resurgence in Bitcoin’s value coincides with a notable shift in market dynamics, particularly concerning selling pressure.

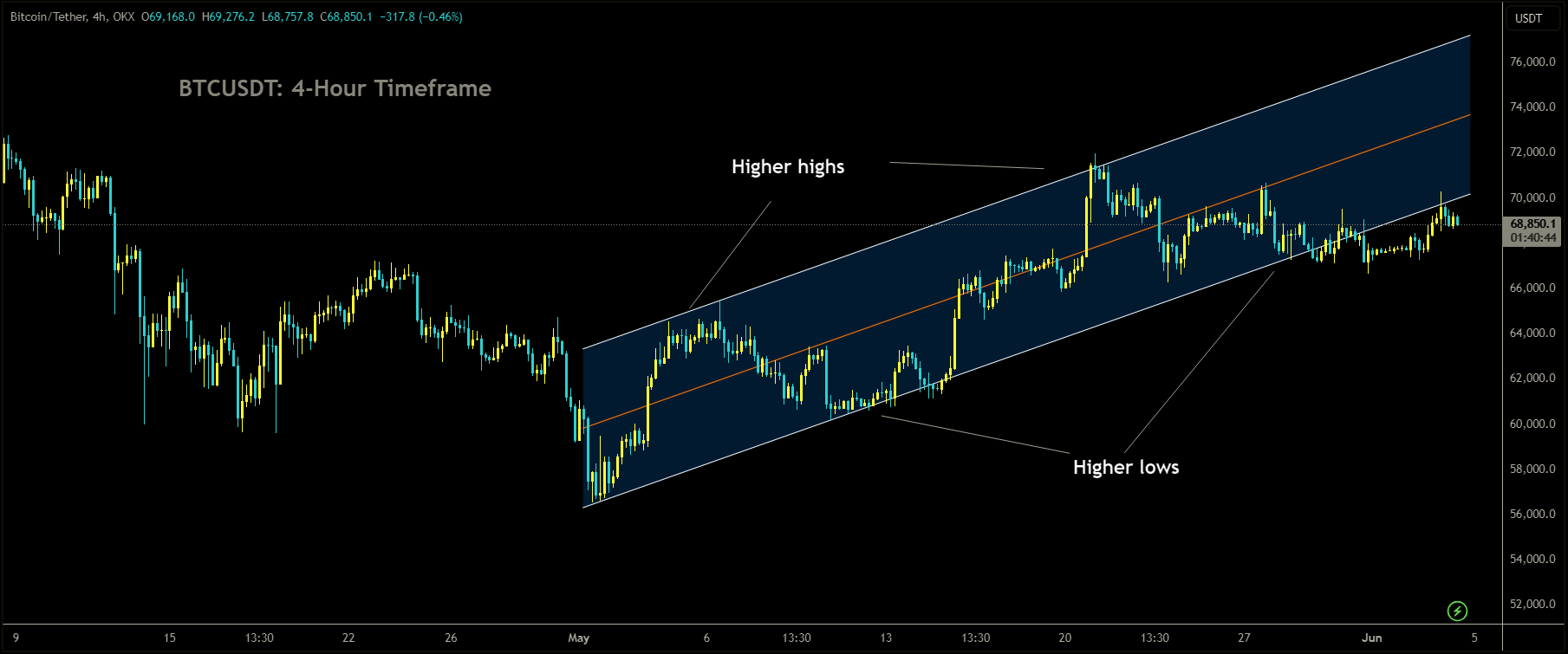

BTCUSDT is moving in Ascending channel and market has reached higher low area of the channel

According to Bitfinex’s analysis, there are indications that the selling pressure on Bitcoin has started to diminish, primarily due to the emergence of new buying contracts evident in the data. This suggests a changing sentiment among investors, with a notable uptick in accumulation activity over the past three months, as observed from the data reflecting the presence of new buyers in the market.

In essence, Bitfinex analysts are observing a trend wherein Bitcoin’s price surge beyond $70,000 is accompanied by a decline in selling pressure, indicating a potential shift towards a more bullish market sentiment.

On Monday, Bitcoin (BTC) experienced a brief surge, surpassing the $70,000 mark for the first time in a week, before retracing back to its usual trading range, thus maintaining its sideways price movement.

Bitcoin, the largest cryptocurrency by market capitalization, was recently trading around $69,200, marking a 2% increase over the past 24 hours. Meanwhile, Ethereum’s ether (ETH) saw little change, trading slightly below $3,800. The broader cryptocurrency market, as measured by the CoinDesk 20 Index, saw a 1.6% gain over the same 24-hour period.

Since March, Bitcoin and the broader crypto market have been consolidating for over two months. This consolidation began after BTC reached a record price above $73,000.

In a Monday market update, Bitfinex analysts expressed optimism, suggesting that the correction phase for Bitcoin appears to be drawing to a close. They noted that selling by long-term holders had contributed to Bitcoin’s correction from its all-time highs. However, blockchain data indicates that these holders have begun re-accumulating BTC for the first time since December 2023. Additionally, the number of new accumulation addresses for both Bitcoin and Ethereum has been increasing over the past month, signaling growing bullish sentiment despite the price stability.

According to Bitfinex analysts, CryptoQuant data shows a rise in new BTC and ETH accumulation addresses over the past month, indicating increasing confidence among investors.

Swissblock, a crypto analytics firm, highlighted significant resistance levels at $70,000 and $73,000, which have been capping BTC’s price movement. They noted that short-term pullbacks are viewed as buying opportunities, with $67,000 serving as a reliable support level.

Looking ahead, Joshua Lim, co-founder of crypto derivatives principal trader Arbelos Markets, suggested that the upcoming week could be interesting to watch. Key inflation data releases and the Federal Reserve meeting could introduce volatility in either direction for the cryptocurrency market.

BTCUSDT: Bitcoin Nears $70K; Bitfinex Optimistic Amid Market Correction

Bitfinex experts announced that Bitcoin has crossed the $70,000 mark this week for the first time since March 2024. They believe the recent selling pressure on Bitcoin is easing up because they see more people buying Bitcoin in the data. They’ve noticed a trend where new buyers are entering the market and accumulating Bitcoin over the past three months. This suggests that the Bitcoin market might be getting more positive overall.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

Bitcoin’s recent decline was triggered by long-term holders offloading their holdings, impacting market sentiment. However, according to Bitfinex, blockchain data indicates a slowdown in this trend, with investors starting to accumulate BTC. The shifting dynamics suggest a potential reversal in selling pressure, brightening the outlook for Bitcoin’s price performance in the near future.

The title, “Bitcoin Nears $70K Milestone; Bitfinex Optimistic on Easing Selling Pressure,” captures the essence of the expanded information provided.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/