BTCUSDT: Crypto survey: Less consumer scepticism, but third anticipate bitcoin price drop.

According to Deutsche bank survey Bitcoin is the important asset class for payments and US people said Bitcoin will drop to $20K by year end of 2024. People giving less interest on buying Bitcoin at this value according to the survey of 3600 people .

A recent survey conducted by Deutsche Bank, published on Monday, reveals that consumers are showing a slight reduction in scepticism towards bitcoin. However, the survey indicates that just under one-third of the respondents anticipate a significant decline in its price by the end of 2024.

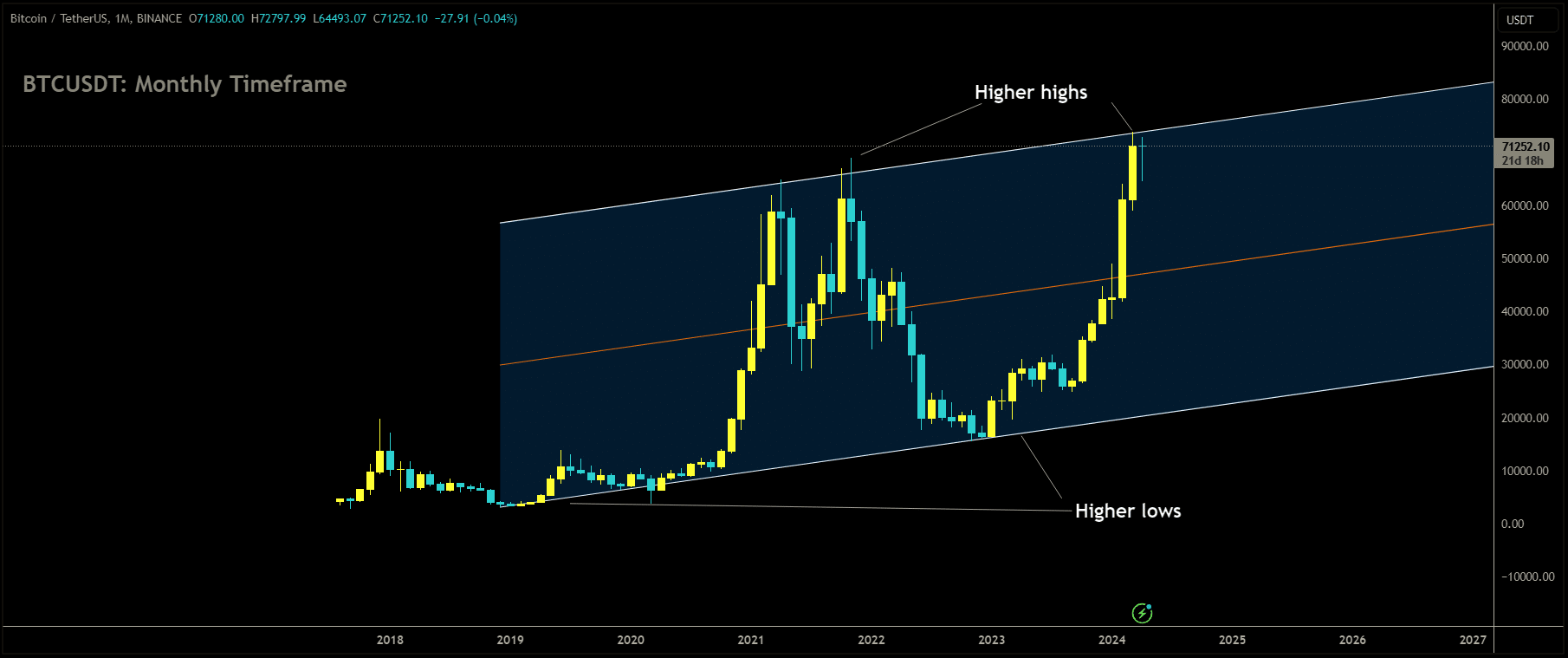

BTCUSDT Market Price is moving in Ascending channel and market has reached higher high area of the channel

The significance of this survey lies in the fact that despite substantial investments in bitcoin with hopes of capitalizing on price surges, top regulators have emphasized that bitcoin lacks inherent value and poses risks.

Deutsche Bank’s survey encompassed over 3,600 consumers, among whom 52% expressed belief that cryptocurrencies will emerge as an “important asset class and method of payment transactions” in the future. This marks an increase from less than 40% reported in September 2023.

In terms of specific expectations, a third of respondents from the United States anticipate bitcoin’s price falling below $20,000 by the end of 2024. Notably, this percentage has marginally decreased from 35% in February and 36% in January.

Furthermore, the survey indicates a significant decline in the proportion of individuals who view cryptocurrencies as merely a passing fad, dropping to less than 1%.

Despite the growing optimism, only 10% of the surveyed individuals expect bitcoin to surpass $75,000 by the end of the year.

In context, bitcoin recently reached a three-week high, having achieved an all-time peak of $73,803.25 in March, following a tumultuous decline in 2022. Analysts attribute this recent resurgence to excitement surrounding spot bitcoin ETFs and expectations of forthcoming rate cut

Looking ahead, some analysts interpret bitcoin’s recovery above $70,000 as a sign that investors are disregarding previous warnings. Deutsche Bank analysts foresee bitcoin’s price being bolstered by factors such as the upcoming “bitcoin halving”, regulatory developments, central bank rate adjustments, and the potential approval of spot ethereum ETFs by the Securities and Exchange Commission (SEC).

BTCUSDT: Reduced Bitcoin scepticism: Will the euphoria endure?

According to Deutsche bank survey Bit coin is the important asset class for payments and US people said Bit coin will drop to $20K by year end of 2024. People giving less interest on buying Bitcoin at this value according to the survey of 3600 people .

A recently released survey by Deutsche Bank revealed a diminishing level of skepticism among consumers regarding Bitcoin, following a notable resurgence of the cryptocurrency this year. However, despite this shift, a majority of respondents anticipate a significant decline in the price of the most prominent cryptocurrency by the conclusion of 2024.

BTCUSDT is moving in Ascending channel and market has fallen from the higher high area of the channel

The survey’s findings, as reported by Reuters, underscored the substantial investments made by individuals in Bitcoin, driven by expectations of lucrative returns. Nevertheless, it emphasized that prominent regulators have cautioned against such investments, citing Bitcoin’s lack of intrinsic value and associated risks.

The Deutsche Bank survey encompassed more than 3,600 consumers, revealing that 52% of respondents perceive cryptocurrencies as an “important asset class and method of payment transactions” for the future. This marks a significant increase compared to less than 40% recorded in September 2023.

In terms of Bitcoin’s price outlook, a third of US respondents anticipate its value to dip below $20,000 by the conclusion of 2024. However, this group is gradually shrinking, with figures dropping from 35% in February to 36% in January, as per the survey findings.

The survey also indicated a notable decline in the proportion of individuals dismissing cryptocurrencies as a passing trend, dropping to less than 1%. Despite this, only 10% of respondents anticipate Bitcoin’s price to surpass $75,000 by year-end.

Regarding Bitcoin’s recent performance, the cryptocurrency reached a peak on Monday, marking its highest point in three weeks. In March, Bitcoin achieved an all-time high of $73,803.25, rebounding from a significant decline experienced in 2022.

Analysts cited by news agency Reuters attribute Bitcoin’s recent surge to growing excitement surrounding new investment avenues, such as spot bitcoin ETFs, which have captured the interest of investors. Additionally, they suggest that potential cuts in interest rates may further contribute to Bitcoin’s upward trajectory.

Furthermore, some analysts interpret Bitcoin’s price surpassing $70,000 as an indication that investors are relatively unconcerned about associated risks, despite previous warnings.

Deutsche Bank analysts offer additional insights, predicting that Bitcoin’s price will remain elevated due to several factors. They highlight the upcoming “Bitcoin halving,” an event where the rate of new Bitcoin creation is halved, as a significant factor in supporting Bitcoin’s price. Additionally, they anticipate that regulatory measures, alongside potential interest rate cuts by central banks, will serve to sustain Bitcoin’s price. Furthermore, the potential approval of spot Ethereum ETFs by the Securities and Exchange Commission (SEC) is seen as another factor that could bolster Bitcoin’s price in the future.

BTCUSDT: Crypto survey: Reduced scepticism, but one-third anticipate bitcoin price drop.

According to Deutsche bank survey Bitcoin is the important asset class for payments and US people said Bitcoin will drop to $20K by year end of 2024. People giving less interest on buying Bitcoin at this value according to the survey of 3600 people .

A recent Deutsche Bank survey, published on Monday, reveals a slight decrease in consumer scepticism towards bitcoin, although nearly one-third of respondents still anticipate a significant drop in its price by the end of 2024.

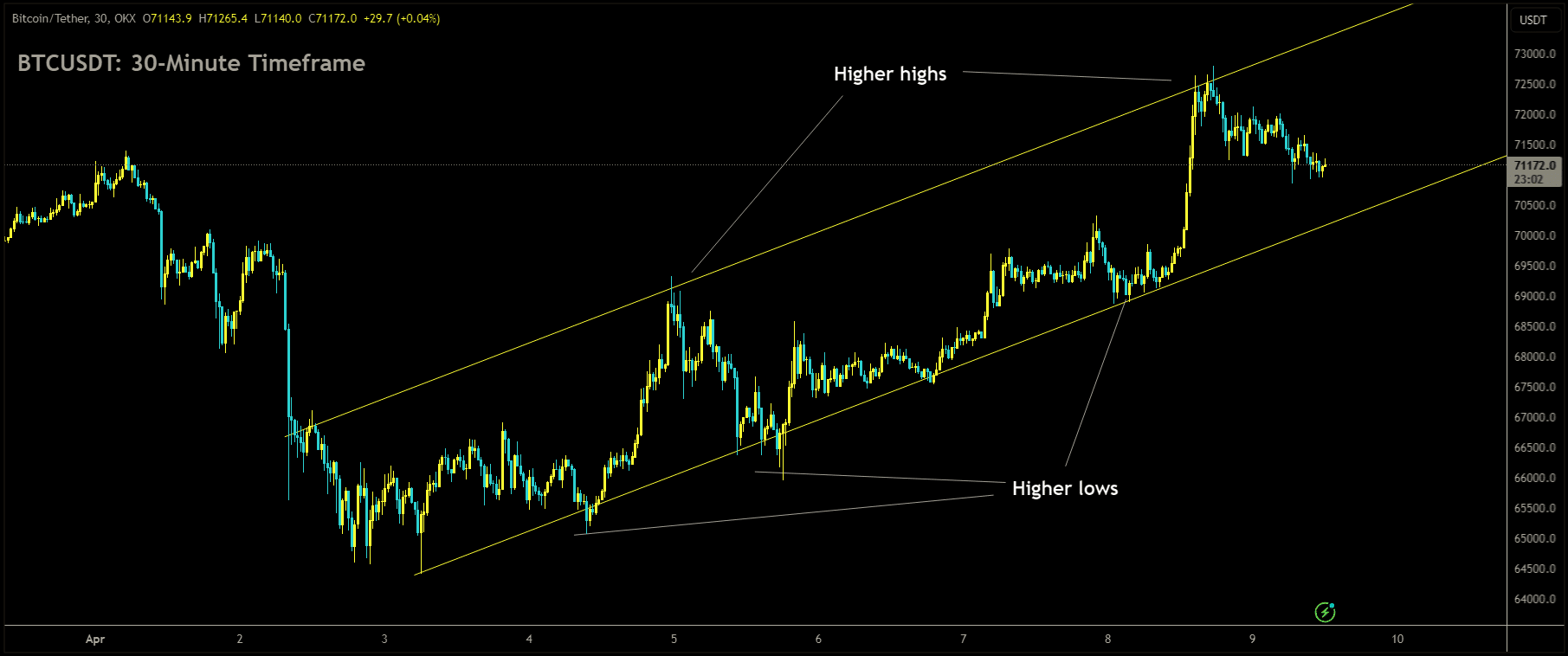

BTCUSDT is moving in uptrend line and market has rebounded from the higher low area of the pattern

Importance:

Despite significant investments in bitcoin, with hopes of capitalizing on potential price surges, leading regulators have cautioned against its perceived lack of intrinsic value and associated risks.

By the Numbers:

Deutsche Bank conducted the survey among over 3,600 consumers, with 52% expressing the belief that cryptocurrencies will evolve into an essential asset class and payment method in the future. This marks an increase from the less than 40% recorded in September 2023.

One-third of U.S. respondents foresee bitcoin plummeting below $20,000 by the close of 2024, with this group exhibiting a gradual decline from 35% in February to 36% in January.

The proportion of individuals viewing cryptocurrencies as a transient fad has decreased to less than 1%.

However, only 10% of respondents anticipate bitcoin’s price to exceed $75,000 by year-end.

Context:

Bitcoin recently attained a three-week peak and reached an all-time high of $73,803.25 in March, rebounding from a significant downturn in 2022.

Analysts attribute this resurgence to growing excitement surrounding spot bitcoin ETFs and expectations of impending interest rate reductions.

What’s Next:

Some analysts interpret bitcoin’s recent surge above $70,000 as a signal that investors are overlooking previous warnings.

Deutsche Bank analysts anticipate ongoing support for bitcoin’s price, driven by factors such as the forthcoming “bitcoin halving,” regulatory measures, central bank interest rate adjustments, and potential approval of spot ethereum ETFs by the Securities and Exchange Commission (SEC).

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/