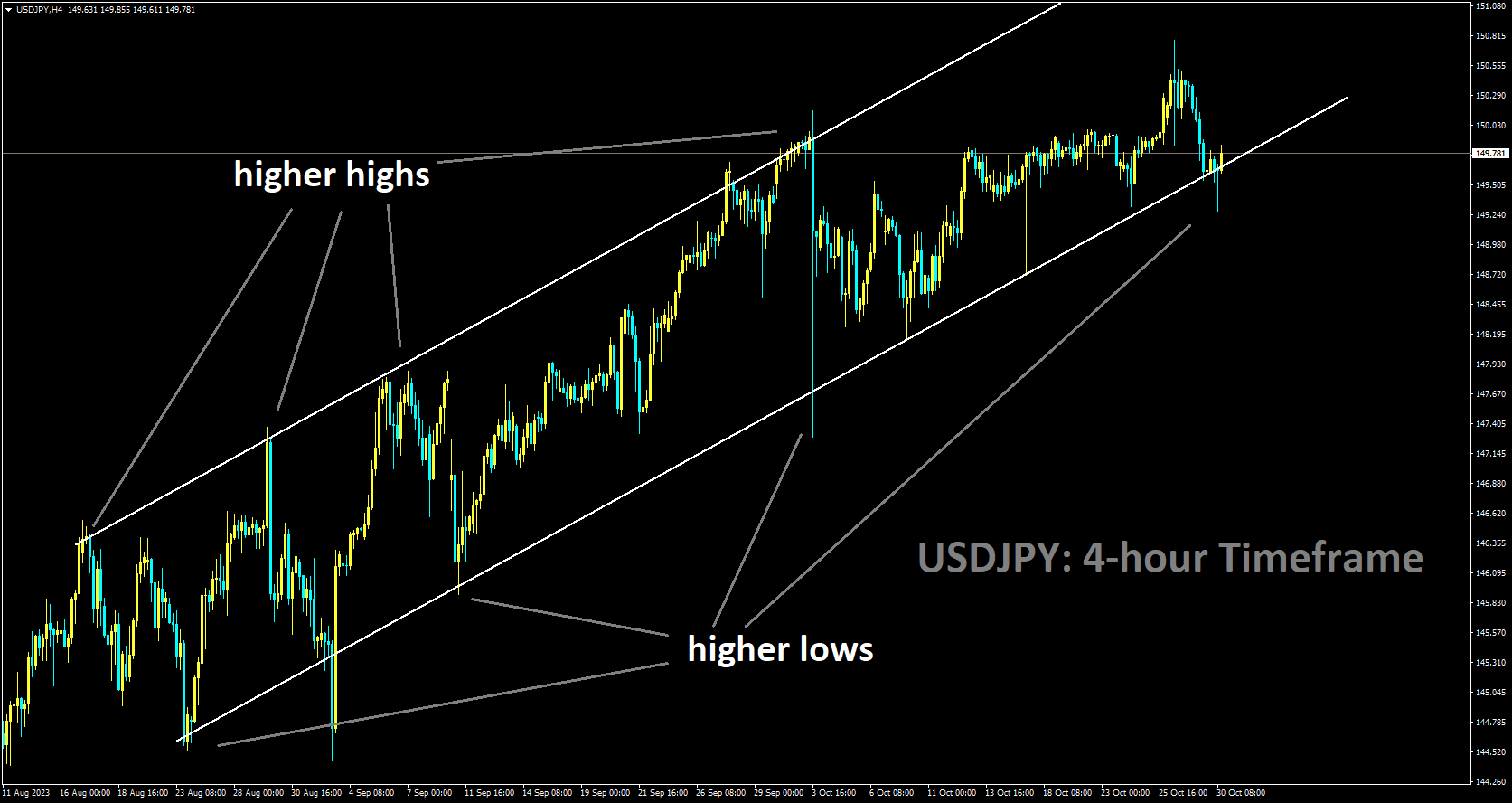

USDJPY moving in Ascending channel and the market has reached the higher low area of the channel

It is widely anticipated by economists that the Bank of Japan (BoJ) will raise the Yield Curve Control (YCC) rate from 1.0% to 1.5% during this meeting, while maintaining the current interest rates at -0.10%. However, there is even greater expectation that the YCC rate may indeed be increased.

As the Bank of Japan (BOJ) convenes for its two-day meeting, it grapples with a multifaceted monetary policy challenge of immense importance to Japan’s economic landscape. This decision carries significant weight, as it influences various facets of the nation’s economy, encompassing currency exchange rates, inflation management, and overall economic stability. In this comprehensive analysis, we delve into the intricate challenges that confront the BOJ, examining the precarious position of the yen, the intricate dance between yield control and economic fundamentals, the shadow cast by global economic uncertainties, and the interplay of political considerations. Additionally, we scrutinize potential policy alternatives and their potential ramifications.

The Yen’s Precarious Position

The primary focus of the BOJ’s deliberations centers on the yen’s stability, which holds a pivotal role in Japan’s economic framework. The currency’s value hovers around the psychologically significant threshold of 150 against the U.S. dollar, reflecting the anticipation of market participants regarding the BOJ’s stance. The yen’s volatility largely stems from expectations and speculative movements, as investors closely scrutinize BOJ’s actions, seeking insights into its monetary policy. Any deviation from these market expectations can trigger abrupt fluctuations in the yen’s value, affecting export-driven industries and overall economic equilibrium.

Divergent Easing Policies

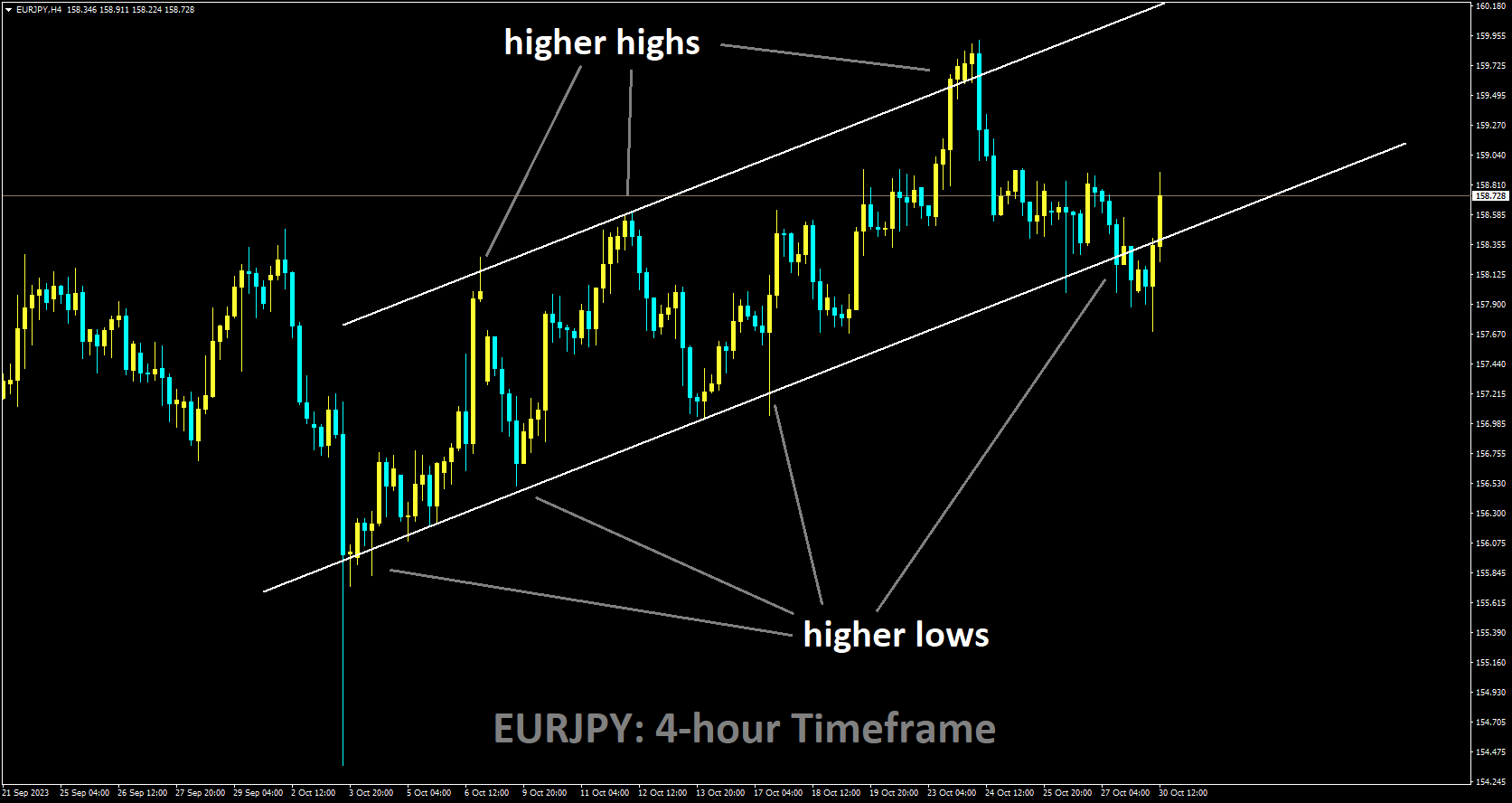

A crucial factor contributing to the yen’s fluctuations is the stark contrast between the BOJ’s easing policy and the monetary policies adopted by its global counterparts. While the BOJ maintains ultralow interest rates and pursues yield curve control (YCC), the U.S. Federal Reserve and other central banks are on a path of aggressive tightening.

This divergence places pressure on the yen’s value, as rising interest rates in other nations entice investors seeking higher returns, often leading to yen depreciation. This divergence has persisted, contributing to the yen’s ongoing depreciation trend.

Balancing Yield Control and Economic Fundamentals

Underpinning the BOJ’s strategy is the unique yield curve control (YCC) program, designed to manage interest rates and ensure economic stability. This program targets short-term interest rates at minus 0.1 percent and endeavors to maintain 10-year yields around zero percent, offering the BOJ a distinctive means to influence borrowing costs and stabilize financial markets. Nevertheless, the BOJ has recently incorporated more flexibility into its YCC program, allowing 10-year yields to better reflect economic conditions, permitting them to rise while remaining below 1.0 percent. This adaptation underscores the BOJ’s recognition of the necessity to align policies with evolving economic dynamics.

EURJPY moving in Ascending channel and the market has reached the higher low area of the channel

The BOJ’s steadfast commitment to ultralow rates and YCC is grounded in its unattained 2 percent inflation target. Governor Kazuo Ueda has emphasized the significance of wage growth in reaching this target, viewing sustainable wage increases as a prerequisite for attaining the desired inflation levels. Despite indications of progress, the BOJ remains cautious about declaring victory on the inflation front, as some board members express confidence in future price hikes, while others, including Prime Minister Fumio Kishida, voice concerns about inflation outpacing wage growth.

Economic Uncertainty and Global Factors

The backdrop of economic uncertainty stemming from the Israel war adds complexity to the BOJ’s policy decision. Geopolitical events, such as Middle East conflicts, can disrupt supply chains, influence energy prices, and induce financial market volatility. The BOJ must carefully evaluate how these external factors may impact Japan’s economic prospects and tailor its monetary policy accordingly, acknowledging the interconnectedness of global economies and the potential far-reaching consequences of events on the global stage.

The BOJ’s monetary policy decisions are not made in isolation but within the context of global monetary trends. The recent decision by the European Central Bank to refrain from raising interest rates and the expected pause in monetary tightening by the U.S. Federal Reserve create a challenging environment for the BOJ. This divergence in monetary policies among major central banks influences currency exchange rates and capital flows. As the BOJ navigates its monetary course, it must be mindful of how its decisions may affect not only Japan’s economy but also its global position and financial stability.

Political Considerations and Relief Measures

Prime Minister Fumio Kishida faces a delicate dilemma as the BOJ grapples with monetary policy. The yen’s weakness, partly a result of BOJ’s easing measures, has raised concerns about rising consumer prices, impacting household purchasing power. Kishida’s government is contemplating relief measures to assist households coping with inflation’s impact, a challenge that involves balancing support for Japan’s export-oriented industries, which benefit from a weaker yen, with addressing the concerns of ordinary citizens experiencing rising living costs.

Adding complexity to the BOJ’s policy decisions are the demands of labor unions. The Japanese Trade Union Confederation’s request for a 5 percent or higher pay hike in annual wage negotiations for fiscal 2024 aligns with their goal of ensuring that wage growth keeps pace with inflation. The BOJ must consider how labor market dynamics and wage negotiations will impact the inflation trajectory, assessing whether rising wages contribute to sustainable inflation or if other factors may pose challenges to achieving its inflation target.

Policy Alternatives and Speculation

The BOJ possesses various policy alternatives, each with its implications. One potential course of action involves adjusting the YCC settings, particularly the 10-year yield cap. Raising the cap could narrow the interest rate differential between Japan and the U.S., potentially relieving pressure on the yen’s exchange rate. However, such a move could weaken the effectiveness of the BOJ’s stimulus measures and signal to market speculators that the central bank is on the defensive, carrying its own set of risks.

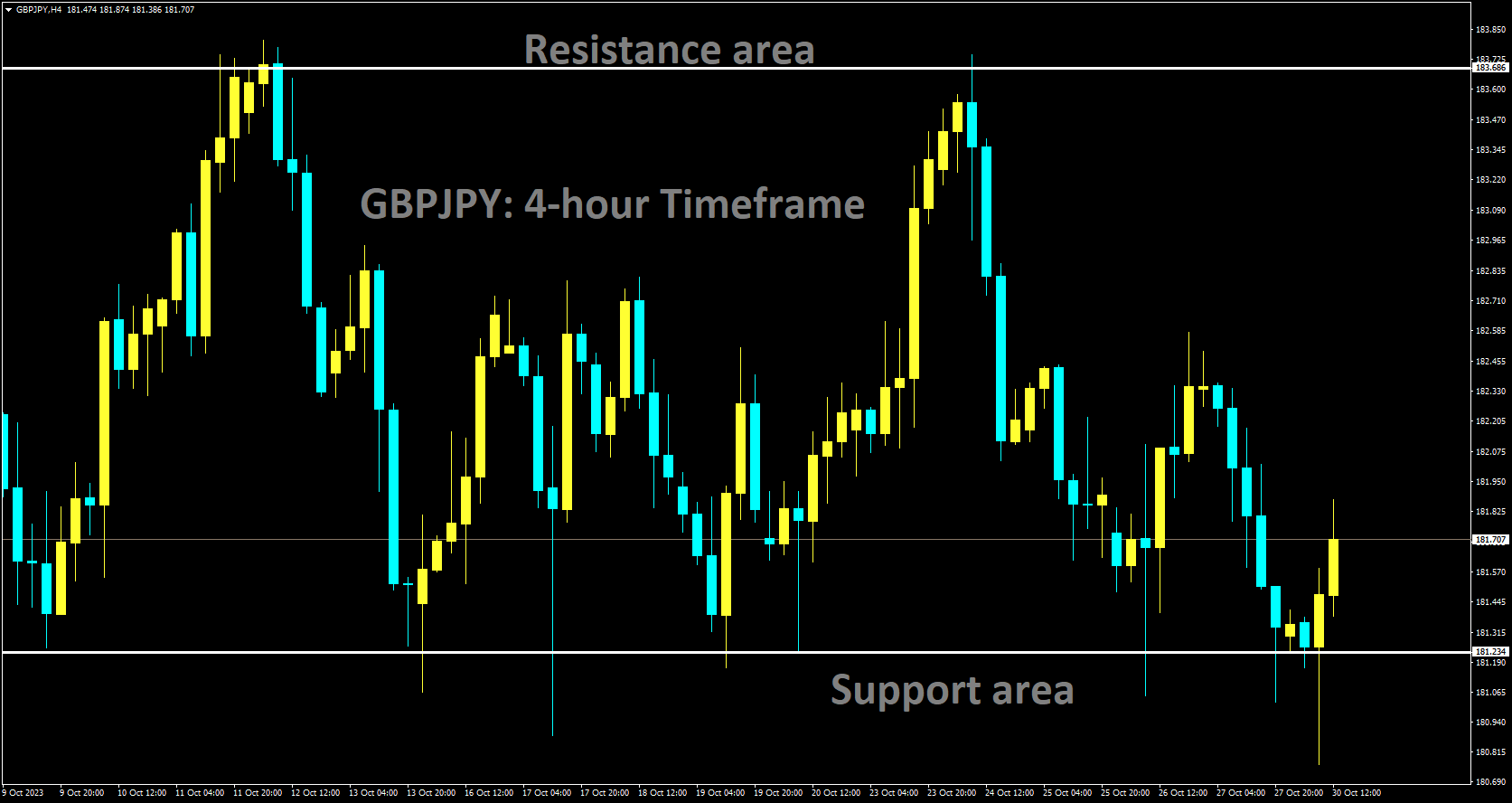

GBPJPY moving in Box Pattern and the market has reached the support area of the pattern

Market analysts hold divergent opinions regarding BOJ Governor Kazuo Ueda’s likely course of action. While some expect the BOJ to maintain its current policy settings without immediate adjustments, others argue that some policy shift is necessary to navigate the challenging economic landscape. The BOJ’s decision will not only impact currency markets but also financial market stability, as investors closely watch for any signs of policy shifts that could influence their investment strategies.

The Impact on the Yen and Global Markets

The BOJ’s monetary policy decision significantly affects the yen’s exchange rate, with potential outcomes ranging from further depreciation to a sudden rally, depending on the central bank’s actions. Currency market participants are closely monitoring the BOJ’s decisions, and any surprises could lead to abrupt movements in the yen’s value.

CADJPY moving in Ascending channel and the market has reached the higher low area of the channel

Moreover, the repercussions of the BOJ’s policy decisions extend beyond Japan’s borders, reverberating throughout global financial markets. The interconnected nature of economies means that changes in Japan’s monetary policy can influence capital flows, risk sentiment, and investment strategies worldwide, capturing the attention of global investors and central banks as they assess potential spillover effects on their own economies and currencies.

Government and Corporate Responses

The Japanese Ministry of Finance plays a crucial role in maintaining economic stability, particularly in currency markets. If the yen’s depreciation reaches a critical point, the Ministry may intervene to support the currency and prevent further weakness. Government intervention in currency markets is a strategic maneuver that aims to strike a balance between supporting export-oriented industries and addressing concerns about inflation’s impact on everyday goods.

The BOJ’s monetary policies have diverse effects on different sectors of the economy. Export-oriented corporations benefit from a weaker yen, which enhances their competitiveness in global markets. However, the same currency weakness exacerbates inflation, impacting consumers and wage growth. As the BOJ navigates its policy decisions, it must consider the interests of both corporations and consumers while managing the broader economic landscape.

Inflation Expectations and Future Projections

Inflation dynamics play a central role in the BOJ’s policy considerations. Rising costs have begun to impact consumer prices, leading to concerns about the sustainability of inflation. Over time, price levels in Japan are expected to converge with those in other countries, signaling a period of sustained inflation. The BOJ monitors inflation expectations among investors through measures like break-even inflation rates, which indicate the expected average inflation rate over the next decade.

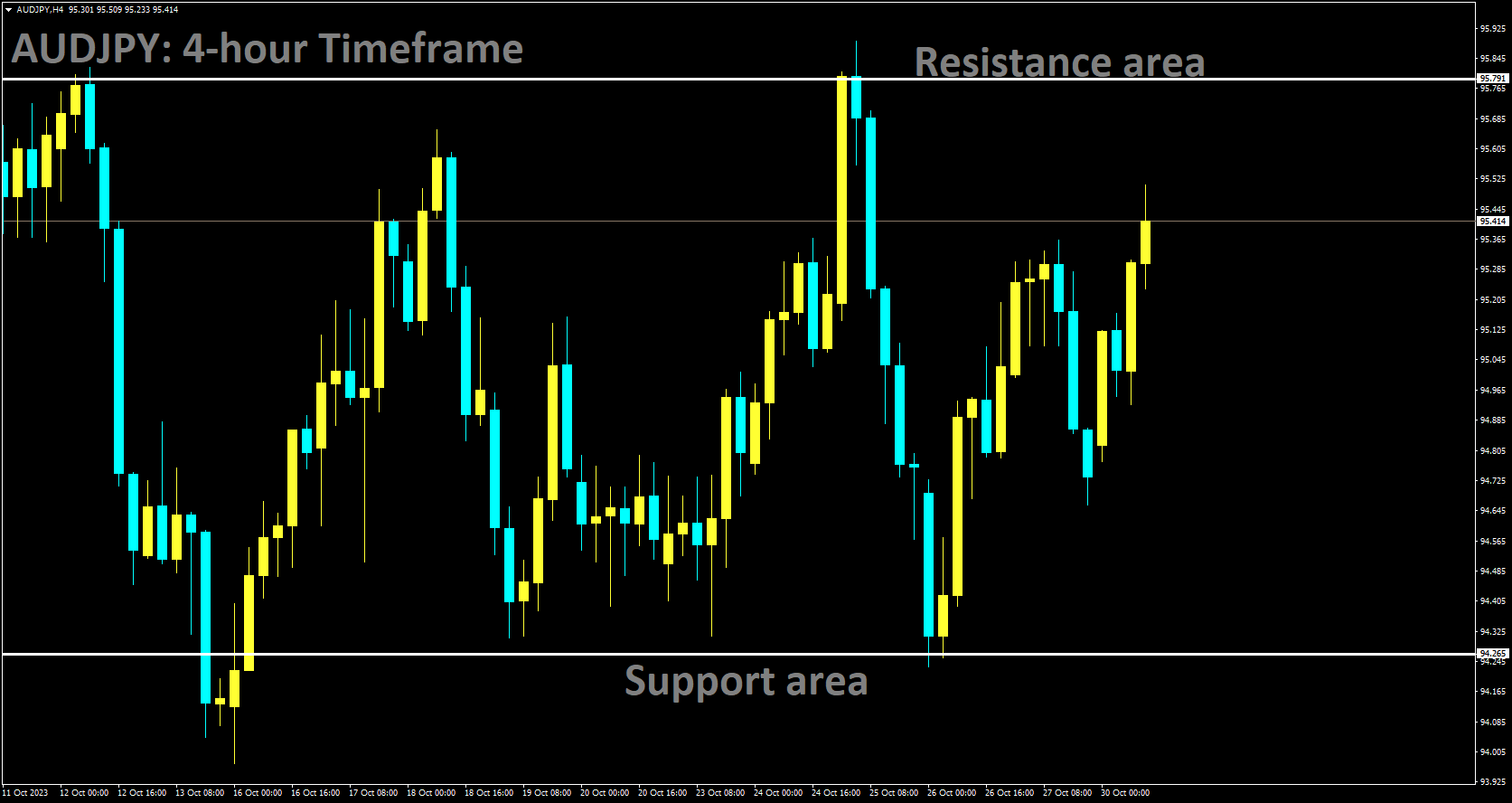

AUDJPY moving in Box Pattern and the market has reached the Resistance area of the pattern

Differing views exist among market players and central bankers regarding the prospects for sustained inflation and the need for monetary policy adjustments. The BOJ must carefully assess these views as it formulates its policy decisions. A critical aspect is the central bank’s economic projections, which provide insights into its views on inflation’s durability.

Conclusion

The Bank of Japan confronts a multifaceted and challenging monetary policy decision, one with far-reaching implications for Japan’s economy and its global financial standing. Striking a balance between managing the yen’s exchange rate, navigating yield curve control, and addressing inflation pressures while considering global uncertainties and domestic political concerns is a complex and delicate task. The BOJ’s policy decisions are closely scrutinized by market participants, central banks, and governments worldwide, highlighting the extensive impact of Japan’s monetary choices on the global economy.

💹 500 USD turned into 13,000 USD in last 7 days – Check the REAL Live Trading account of our signal follower here: fxblue.com/users/forexfib76/stats

🔥 Stop Trading all the time, trade markets only at the best setups with Premium or VIP plan

🎃 60% HALLOWEEN OFFER 🎁 for Trading Signals 😍 GOING TO END – Get now: forexfib.com/offer/