JPY: BOJ’s Ueda hints at easing stimulus

The BoJ Governor Kazhao Ueda said inflation to Wage cycle is expected to increase in the coming months, we projected inflation will go above 2% in the next 1.5-2 Years. Wage hike from Firms has to watch in the real market, whether real wage hike driven the inflation trending to higher, then only we reduce stimulus in the faster pace, if wage hike does not reflected in the inflation rate then we keep monetary policy changes to lower at more time. Current policy stance did not change for some time until proper conclusion seen in the market trend.

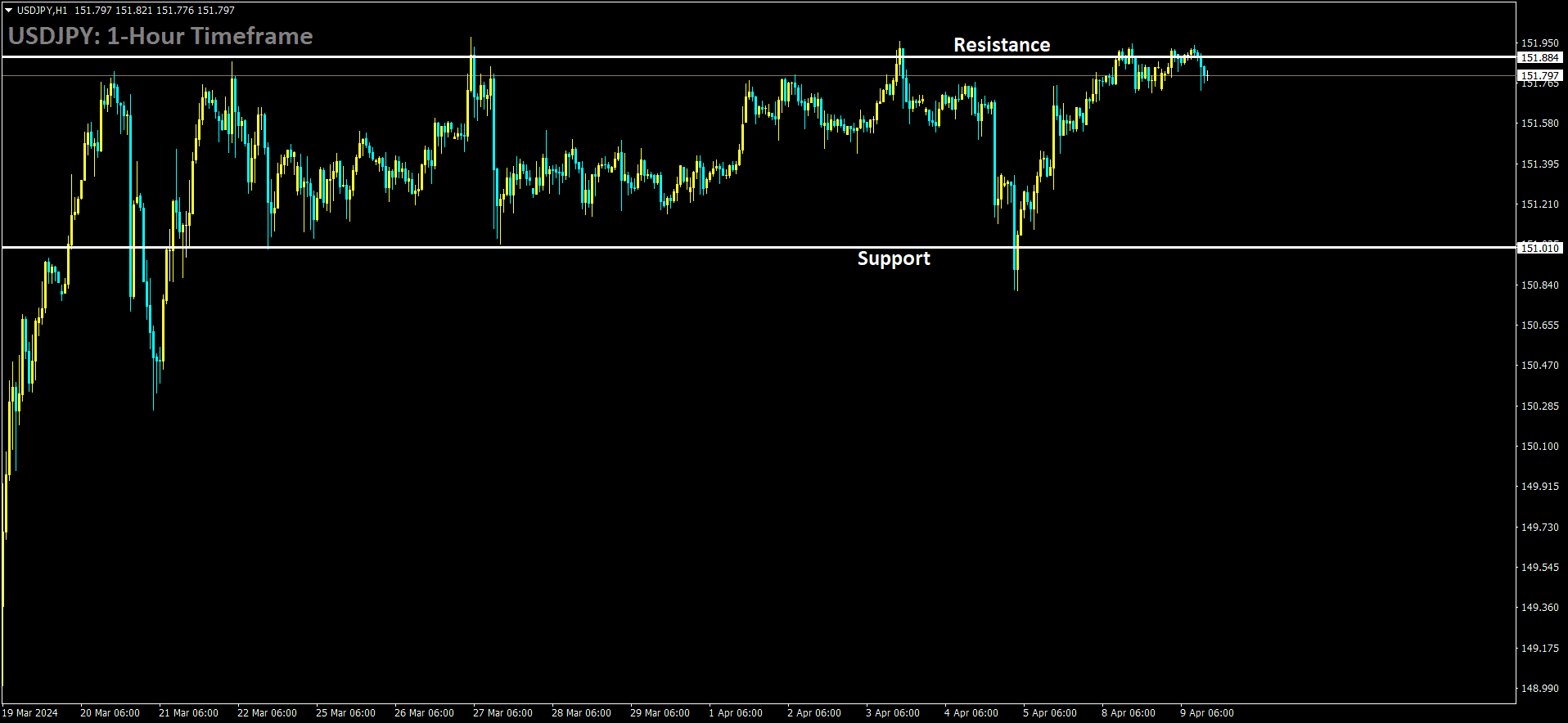

USDJPY is moving in box pattern and market has reached resistance area of the pattern

Bank of Japan Governor Kazuo Ueda emphasized that the central bank would need to assess the possibility of further reducing monetary stimulus if inflation continues to rise. This suggests the potential for another interest rate increase later this year, aligning with market expectations.

During his address to parliament, Ueda underscored the importance of maintaining an accommodative monetary policy in the short term, given that underlying inflation has yet to reach the targeted 2%. However, he expressed optimism regarding the economic outlook, citing substantial wage increases from ongoing negotiations and their potential to stimulate household spending.

Ueda outlined the BOJ’s baseline scenario, projecting a gradual convergence of trend inflation towards 2% over the next 1-1/2 to two years. He indicated that if economic and price developments align with these projections, the central bank would consider scaling back stimulus measures.

The BOJ’s forecasts, as outlined in January, anticipate inflation (excluding volatile food and fuel prices) reaching 1.9% in both fiscal years 2024 and 2025. These projections will be revisited during the next BOJ meeting scheduled for April 25-26.

In March, the BOJ made a significant policy shift by ending its eight-year-long negative interest rates and other unconventional measures, signaling a departure from its previous focus on stimulating growth and combating deflation.

Market analysts are eagerly awaiting indications from Ueda regarding the timing of the next interest rate hike. A Reuters poll conducted post-March policy change indicated that a majority of economists anticipate another rate hike this year, with the October-December period being the most favored timeframe.

Ueda also mentioned potential scenarios that could influence the pace of stimulus reduction. If wage growth remains sluggish or if external shocks impact Japan’s economy, the BOJ may opt for a slower withdrawal of stimulus or postpone monetary tightening measures. Conversely, if wages and inflation exceed forecasts, the central bank might expedite the reduction of stimulus.

Ueda emphasized the importance of monitoring actual wage data and its impact on service prices in shaping future policy decisions.

JPY: BOJ’s Ueda Open to More Stimulus Reduction

The BoJ Governor Kazhao Ueda said inflation to Wage cycle is expected to increase in the coming months, we projected inflation will go above 2% in the next 1.5-2 Years. Wage hike from Firms has to watch in the real market, whether real wage hike driven the inflation trending to higher, then only we reduce stimulus in the faster pace, if wage hike does not reflected in the inflation rate then we keep monetary policy changes to lower at more time. Current policy stance did not change for some time until proper conclusion seen in the market trend.

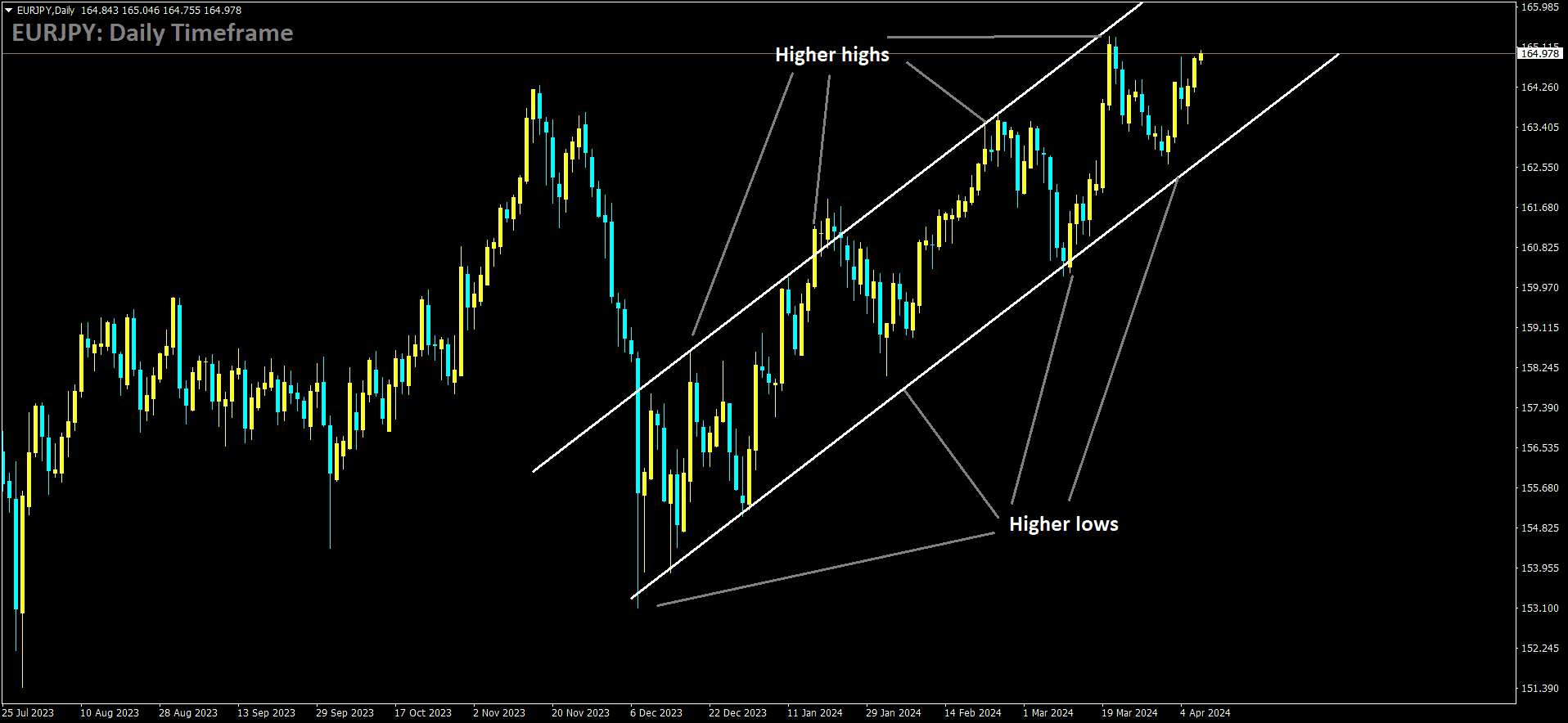

EURJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

Bank of Japan Governor Kazuo Ueda maintained flexibility regarding the potential for further scaling back of monetary easing, refraining from adopting a definitively dovish stance amidst the yen’s proximity to a 34-year low.

Ueda emphasized the need to assess the trajectory of underlying price trends in conjunction with the economic outlook when considering adjustments to monetary policy. He conveyed this sentiment during his parliamentary appearance on Tuesday, stating that such considerations would be thoroughly evaluated at each policy meeting, contingent upon incoming data.

These remarks from Ueda coincide with heightened vigilance among yen traders amid concerns over potential currency intervention by Japan. The upcoming release of US Consumer Price Index (CPI) data on Wednesday holds significance, with the possibility of stronger-than-expected results potentially exerting additional pressure on the yen, potentially surpassing the 152 mark against the dollar, a level perceived by some investors as a potential intervention threshold.

The yen has remained subdued, hovering near its lowest level in over three decades following an unexpected depreciation subsequent to the Bank of Japan’s first interest rate hike in 17 years last month. The persistent weakness in the yen suggests skepticism among investors regarding the central bank’s commitment to maintaining accommodative financial conditions.

In his semi-annual report to parliament, Governor Ueda highlighted the potential risks associated with both a hastened and a slowed pace of stimulus reduction. He noted that in the event of an economic shock, the bank may need to moderate its pace of adjustment, whereas if a positive feedback loop between wages and inflation were to strengthen rapidly, the bank might need to take swifter action.

JPY: BOJ’s Ueda Suggests Potential Stimulus Reduction

The BoJ Governor Kazhao Ueda said inflation to Wage cycle is expected to increase in the coming months, we projected inflation will go above 2% in the next 1.5-2 Years. Wage hike from Firms has to watch in the real market, whether real wage hike driven the inflation trending to higher, then only we reduce stimulus in the faster pace, if wage hike does not reflected in the inflation rate then we keep monetary policy changes to lower at more time. Current policy stance did not change for some time until proper conclusion seen in the market trend.

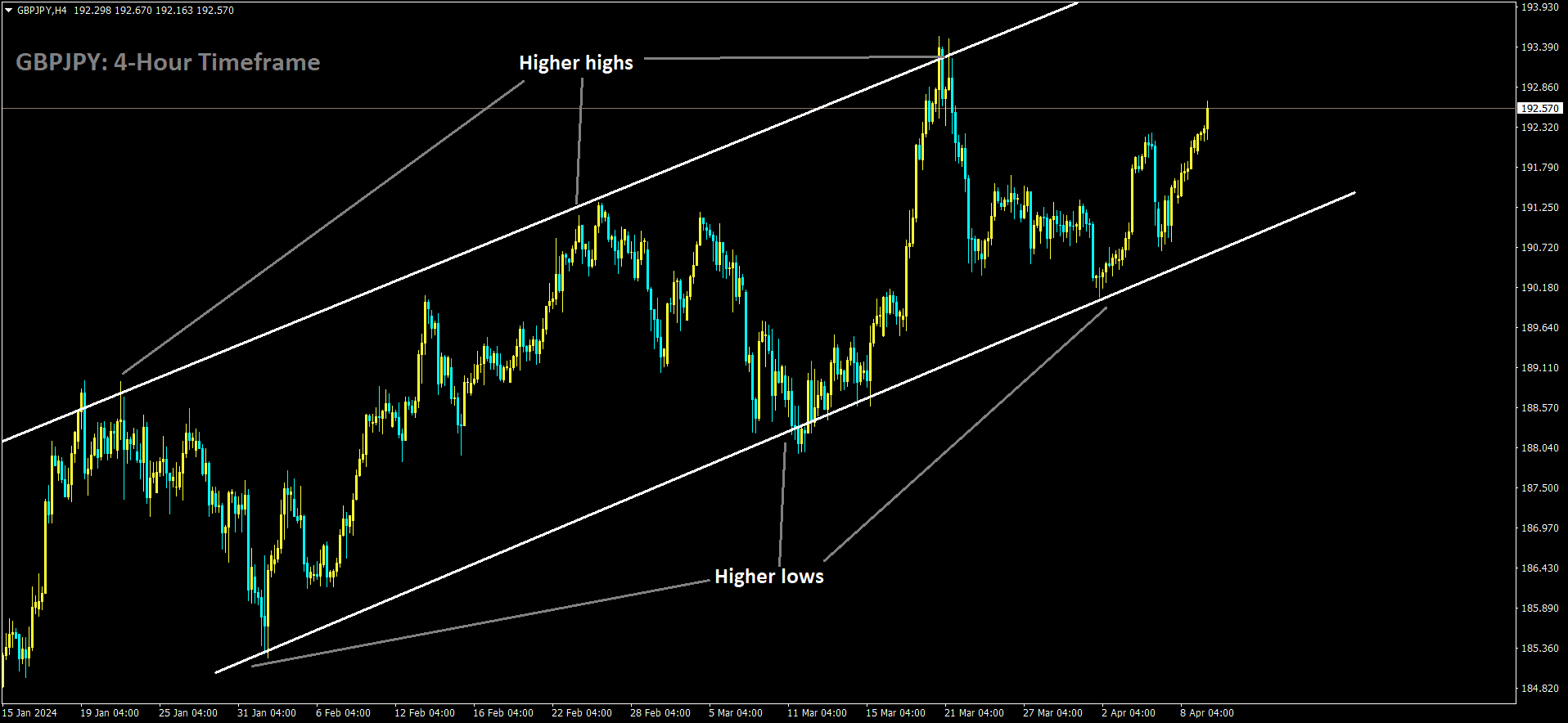

GBPJPY is moving in Ascending channel and market has rebounded from the higher low area of the channel

During his remarks on Tuesday, Bank of Japan Governor Kazuo Ueda emphasized the importance of considering a reduction in monetary stimulus measures should trend inflation exhibit signs of acceleration.

Ueda underscored the fact that despite ongoing efforts, trend inflation has yet to reach the central bank’s targeted rate of 2%. Consequently, he stressed the necessity of maintaining accommodative monetary conditions in the interim.

He elaborated that if economic and price indicators align with current projections, trend inflation is expected to gradually pick up pace. In such a scenario, Ueda emphasized the need for the bank to contemplate scaling back stimulus measures. However, he cautioned that the decision would ultimately hinge upon forthcoming data.

Ueda further emphasized that the BOJ currently lacks any predetermined plans regarding the timing or method of adjusting short-term interest rates.

In March, the BOJ initiated a significant policy shift by terminating eight years of negative interest rates and other unconventional measures. This marked a historic departure from the central bank’s previous focus on stimulating economic growth and combating deflation through extensive monetary stimulus measures.

Given these developments, financial markets are closely monitoring indications regarding the potential timing of the next interest rate hike by the central bank.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/