BTCUSDT: Wisconsin State Invests $100M in BlackRock’s Bitcoin ETF

The state of Wisconsin bought $ 100M Worth of Bitcoin ETFs from Black Rock in the Financial quarter of 2024 and send the report to US SEC for Financial Filings. Already this state investment Board bought $64 million in the Gray Scale Bitcoin Trust. This investment firms are welcomes to invest in the Digital assets like this more in the Future and public has to aware of regulated the Bitcoin market by ETFs.

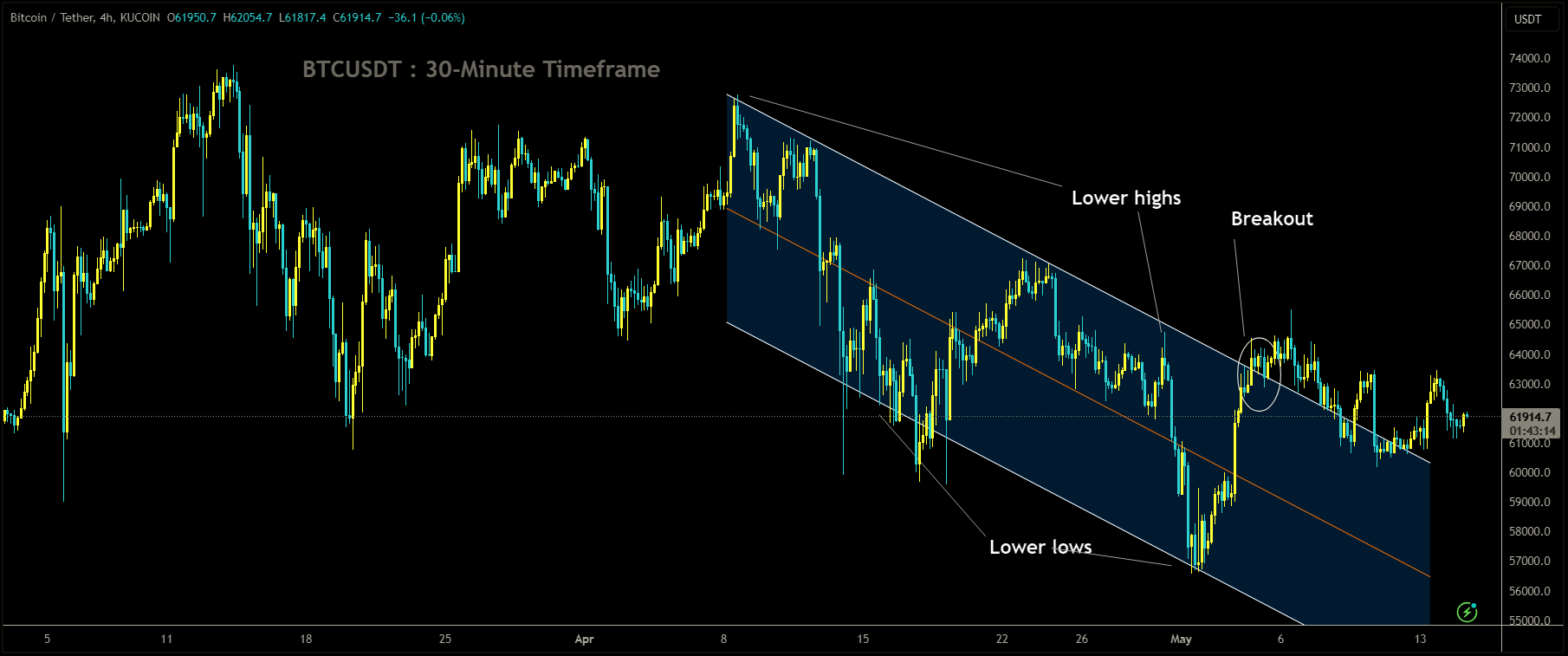

BTCUSDT Market price has broken descending channel in upside

In the first quarter of the year, the state of Wisconsin made a notable investment move by purchasing 94,562 shares of BlackRock’s iShares Bitcoin Trust (IBIT), as revealed in a filing. The total value of these shares amounts to nearly $100 million.

Upon this announcement, Bitcoin experienced a 1% increase in its value, currently trading at $61,957. However, it is down 1.7% over the past 24 hours, possibly influenced by new inflation data that emerged during U.S. morning hours.

Wisconsin’s investment in the iShares Bitcoin Trust is particularly significant as it marks the state’s entry into the cryptocurrency market. The disclosure was made through the quarterly 13F report filed with the Securities and Exchange Commission (SEC) on Tuesday. Notably, Wisconsin also acquired shares of Grayscale’s Bitcoin Trust (GBTC), valued at approximately $64 million.

The Wisconsin Investment Board (SWIB), responsible for managing the state’s assets, including those of the Wisconsin Retirement System (WRS) and the State Investment Fund (SIF), executed these investments. Established in 1951, SWIB currently oversees assets exceeding $156 billion.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, noted the significance of Wisconsin’s move, highlighting that institutional investors typically wait for ETFs to gain liquidity before making significant investments. He anticipates that more institutions may follow suit, given the recent momentum.

With the March 15 deadline for institutional investment managers to file quarterly holdings approaching, market observers are keenly monitoring these disclosures. They seek insights into whether large traditional financial (TradFi) funds have invested in Bitcoin ETFs since their launch earlier this year.

BTCUSDT: Wisconsin Invests $100M in BlackRock’s Bitcoin ETF

In the financial quarter of 2024, the State of Wisconsin made a substantial purchase of Bitcoin Exchange-Traded Funds (ETFs) from BlackRock, amounting to approximately $100 million. This significant investment was reported to the U.S. Securities and Exchange Commission (SEC) as part of the state’s regular financial filings.

Prior to this, the State Investment Board of Wisconsin had already allocated funds towards digital assets, having invested approximately $64 million in the Grayscale Bitcoin Trust. These strategic investment decisions signify a growing interest and confidence in digital assets within institutional investment portfolios.

BTCUSDT is moving in box pattern and market has reached support area of the pattern

The move by investment firms, such as the State of Wisconsin’s Investment Board, to embrace digital assets through ETFs underscores a shifting landscape in the financial industry. With increasing recognition of the potential of cryptocurrencies and blockchain technology, institutional investors are exploring avenues to participate in this emerging asset class.

Moreover, these developments emphasize the importance of regulatory oversight and investor education in the cryptocurrency market. As more institutional capital flows into digital assets through regulated ETFs, it becomes imperative for investors to be well-informed about the risks and regulations governing the Bitcoin market. Regulatory frameworks surrounding ETFs offer a structured approach to investing in digital assets, providing investors with a degree of security and transparency in an otherwise volatile market.

The State of Wisconsin Investment Board (SWIB), based in Madison, disclosed its significant investment of nearly $100 million in BlackRock’s spot bitcoin ETF, the iShares Bitcoin Trust. This revelation came through SWIB’s latest 13F holdings report, filed on May 14.

According to the report, SWIB held approximately 2.45 million shares of the iShares Bitcoin Trust, with a total value of $99.2 million. This ETF, with assets totaling $17.3 billion, is recognized by its ticker symbol IBIT.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, commented on the significance of this investment move by SWIB. He likened the involvement of pensions in such investments to a challenging endeavor, comparing it to “landing a sailfish.” Balchunas noted that pensions typically exhibit discerning investment behavior, requiring time before making significant decisions.

The swift response from SWIB to invest in the iShares Bitcoin Trust reflects positively on the ETF’s liquidity and market acceptance. Balchunas highlighted the importance of liquidity in attracting institutional investors, emphasizing that the ETF’s rapid liquidity expansion made it appealing to a broad spectrum of investors, including pensions.

Moreover, Balchunas emphasized that SWIB’s utilization of this ETF marks a notable milestone for the broader ETF industry. The fact that a pension plan opted for this investment underscores the growing acceptance and utilization of ETFs within institutional investment strategies.

BTCUSDT: Wisconsin Investment Board Leads in Bitcoin ETF Investment, Holds $162 Million

In the financial quarter of 2024, the State of Wisconsin invested $100 million in Bitcoin ETFs from BlackRock and submitted the report to the US Securities and Exchange Commission (SEC) for financial filings. Additionally, the state investment board had previously purchased $64 million worth of shares in the Grayscale Bitcoin Trust.

These investments reflect a growing interest among institutional investors in digital assets. Furthermore, they highlight the importance of regulating the Bitcoin market through ETFs. As investment firms continue to explore opportunities in digital assets, it is essential for the public to remain informed about the regulatory framework surrounding Bitcoin ETFs.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

Today, the State of Wisconsin Investment Board (SWIB) made a significant revelation regarding its investments in Bitcoin Exchange-Traded Funds (ETFs) through a recent filing with the Securities and Exchange Commission (SEC). According to the filing, SWIB holds nearly $100 million worth of BlackRock’s spot Bitcoin ETF (IBIT).

This disclosure positions SWIB as the first state-level institution to publicly announce its holdings in spot Bitcoin ETFs, marking a significant step in the integration of Bitcoin into traditional investment portfolios.

Bloomberg Senior ETF Analyst Eric Balchunas expressed his surprise and optimism about the news, stating, “Wow, a state pension bought $IBIT in the first quarter. Normally you don’t get these big fish institutions in the 13Fs for a year or so (when the ETF gets more liquidity) but as we’ve seen these are no ordinary launches. Good sign, expect more, as institutions tend to move in herds.”

In addition to its investment in BlackRock’s IBIT, SWIB also disclosed in the filing that it holds over $63 million worth of Grayscale’s spot Bitcoin ETF (GBTC), totaling over $162 million between these two holdings.

The recent wave of 13F filings by institutions disclosing their Bitcoin ETF holdings underscores the increasing institutional interest in Bitcoin. These filings include prominent institutional investors like SWIB and major traditional firms such as the largest bank in America, JPMorgan Chase, which has disclosed its spot Bitcoin ETF holdings as it serves as a market maker for these ETFs.

Market researcher and analyst, MacroScope, emphasized the significance of SWIB’s investment, stating, “This is a small part of a massive public investment fund (total value of all positions in the 13F filing is $37.8 billion). But the long-term importance cannot be overstated. Wisconsin is now the second-largest reporting holder of IBIT globally. This will be closely analyzed and widely discussed by other state investment boards. Watch for others to follow in coming quarters.”

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/