BTCUSDT: McHenry: Bill on Crypto Market Structure to Receive Floor Vote

The US House of Legislatives and Senate is going to conduct the Floor vote today inorder to regulate the crypto markets in the US. This is the Historical event if the Bill passed and Signed by US President Joe Biden for Crypto regulations as per said by US Chairman of House of representative Patrick Mchenry. US be the First country to approve the New form of Financial assets handling by Digital assets with proper regulations and protection of Investors if the Bill is passed by US Government.

BTCUSDT is moving in box pattern and market has reached support area of the pattern

Representative Patrick McHenry (R-N.C.), chairman of the House Financial Services Committee, disclosed that the most extensive cryptocurrency legislation to have successfully passed through a congressional committee will advance even further, with the entire House of Representatives slated to vote on its approval soon.

The Financial Innovation and Technology for the 21st Century Act, known as FIT21, was cleared by McHenry’s panel last year in a bipartisan vote. Despite opposition from their ranking member, Representative Maxine Waters (D-Calif.), a few Democrat supporters endorsed the bill. Now, the House Rules Committee has scheduled a vote next month, propelling FIT21 on a trajectory to become the first significant regulatory legislation for digital assets to clear one of Congress’s chambers.

The bill, also approved by the House Agriculture Committee, represents the culmination of years of bipartisan endeavors aimed at providing clarity in digital asset markets, as noted by McHenry, who has prioritized crypto legislation in his final term in Congress before retirement.

“With the floor vote announced today, Congress will take a historic step to provide a clear regulatory framework for digital asset markets,” stated McHenry, emphasizing the legislation’s significance in solidifying American leadership in the global financial system and enhancing the nation’s role as a hub for innovation.

Despite the progress achieved in the House, it’s unlikely that the bill will garner similar traction in the Senate, where parallel action is necessary for full congressional approval and subsequent enactment into law. While high-level efforts in the Senate remain scarce, there have been indications of willingness among lawmakers to explore regulatory measures, notably in the form of a bill aimed at regulating issuers of stablecoins.

BTCUSDT: US Congress Fast-Tracks Crypto Regulation

The United States House of Representatives and Senate are poised to conduct a floor vote today to enact legislation aimed at regulating the cryptocurrency markets within the country. This event holds historical significance, as noted by Patrick McHenry, Chairman of the House of Representatives. If the bill is successfully passed and signed into law by US President Joe Biden, it would mark a pivotal moment in the realm of crypto regulations.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

McHenry emphasized that the United States would be at the forefront globally by approving a new framework for managing financial assets in the form of digital assets, underpinned by comprehensive regulations and investor protections. Should the bill receive approval from the US government, it would establish a landmark precedent for other nations to follow suit in implementing regulatory measures to govern the burgeoning cryptocurrency sector.

The process of legal regulation within the cryptocurrency sector is undergoing significant developments. The US House Financial Services Committee recently echoed billionaire Mark Cuban’s criticism of the Securities and Exchange Commission (SEC), particularly its approach to regulating the crypto industry. Cuban, in a social media post on May 11, expressed concerns about how the SEC’s stance on cryptocurrencies might impact President Joe Biden’s re-election prospects. He argued that the SEC, under the leadership of Chairman Gary Gensler, is inadvertently impeding the growth of the crypto industry by making compliance overly burdensome and complex.

Cuban emphasized the industry’s desire for a streamlined registration and compliance process to exclude speculative ventures and ensure investor protection. He lamented that the current regulatory environment allows inferior tokens to coexist with legitimate companies, creating confusion for investors.

In response to Cuban’s remarks, the US House Financial Services Committee acknowledged the validity of his concerns and highlighted the impediments posed by the SEC’s regulatory approach. To address these challenges, the Committee is advocating for the passage of the Financial Innovation and Technology (FIT21) Act for the 21st Century. This proposed legislation aims to fill regulatory gaps, provide clarity, and enhance consumer protection within the crypto industry.

One key aspect of the FIT21 Act is the delineation of regulatory responsibilities between the Commodity Futures Trading Commission (CFTC) and the SEC. The bill seeks to expand the CFTC’s oversight to encompass crypto commodities while clarifying the SEC’s jurisdiction over cryptocurrencies categorized as investment contracts.

Chairman Patrick McHenry underscored the bipartisan efforts behind the FIT21 Act, emphasizing its importance in bolstering America’s leadership in the global financial system and fostering innovation domestically.

Efforts to advance the FIT21 Act have been ongoing since its committee approval in July 2023, with a floor vote anticipated in the near future. Notably, the proposed legislation has garnered support from prominent stakeholders within the crypto industry. Grayscale, a leading issuer of Bitcoin ETFs, welcomed the bill as a crucial step towards providing regulatory clarity for the crypto ecosystem.

BTCUSDT: US House Committee Echoes Mark Cuban’s SEC Critique, Pushes for Regulatory Reform

Today marks a significant moment as the United States House of Representatives and Senate prepare to vote on legislation aimed at regulating the country’s cryptocurrency markets. This legislative endeavor, if successful, could usher in a new era of crypto regulations, as emphasized by Patrick McHenry, Chairman of the House of Representatives. He underscored the importance of adopting a comprehensive regulatory framework to govern digital assets, positioning the US as a global leader in this rapidly evolving industry. Should the bill pass and be signed into law by President Joe Biden, it would set a precedent for other nations to follow suit in implementing similar regulatory measures to ensure investor protection and foster innovation in the cryptocurrency sector.

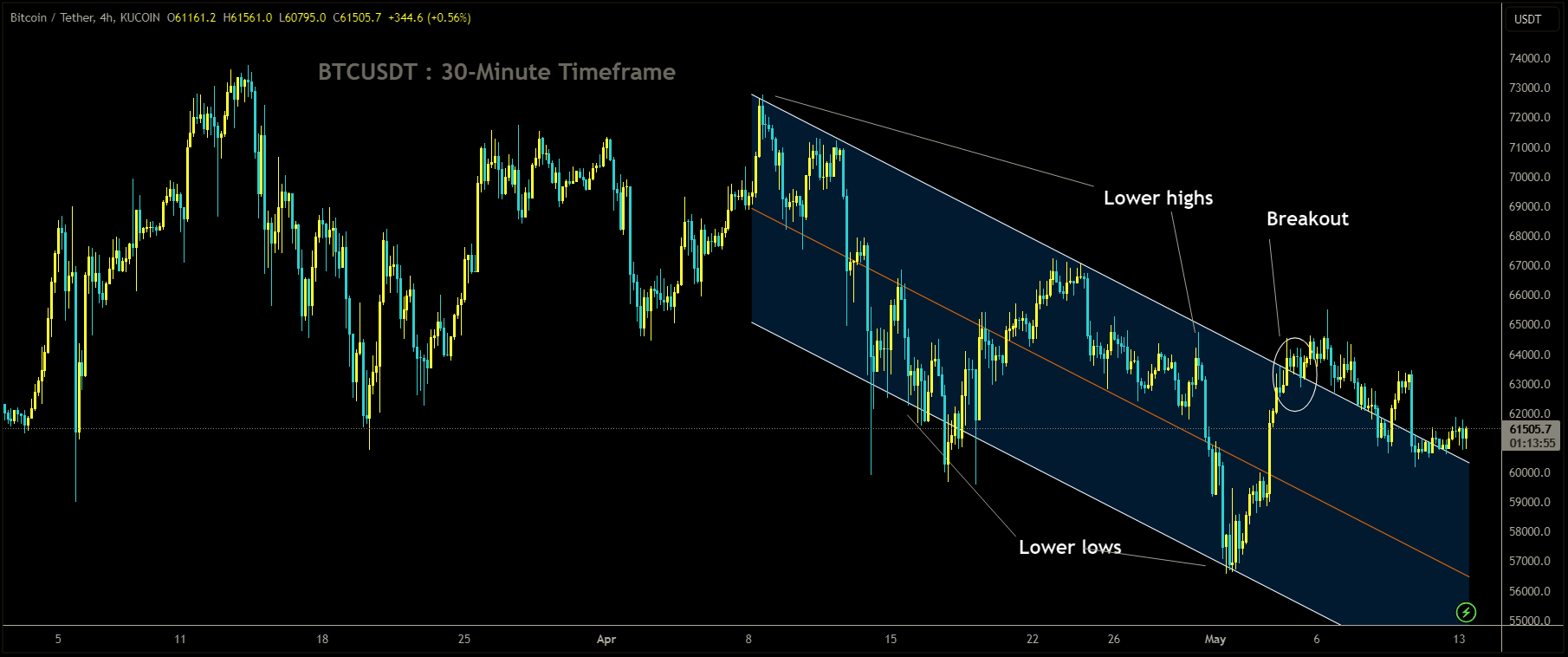

BTCUSDT has broken descending channel in upside

The US House Financial Committee has aligned itself with billionaire Mark Cuban’s critique of the Securities and Exchange Commission’s (SEC) handling of the cryptocurrency industry. Cuban, a prominent investor, voiced his concerns over the regulatory hurdles faced by crypto firms, highlighting the challenges they encounter in complying with current regulations.

In response to Cuban’s remarks, the Committee is advocating for the passage of the Financial Innovation and Technology for the 21st Century (FIT21) Act. This proposed legislation aims to address the regulatory gaps within the crypto industry and provide much-needed clarity and consumer protections.

Cuban’s criticism underscores the frustration felt by many within the crypto community regarding the SEC’s regulatory approach, which is perceived as hindering innovation and growth in the industry. He emphasized the importance of establishing a regulatory framework that facilitates compliance while distinguishing between legitimate projects and fraudulent tokens.

The FIT21 Act seeks to delineate the regulatory responsibilities of both the Commodity Futures Trading Commission (CFTC) and the SEC. It aims to expand the CFTC’s oversight to include crypto commodities and clarify the SEC’s jurisdiction over cryptocurrencies categorized as investment contracts.

House Financial Services Committee Chairman Patrick McHenry emphasized the bipartisan efforts behind the FIT21 Act and its potential to solidify America’s leadership in the global financial system while fostering innovation domestically.

Efforts to advance the FIT21 Act have been ongoing since its committee approval in July 2023, with a push for a floor vote expected in the coming weeks. The bill has garnered support from major crypto stakeholders, including Bitcoin ETF issuer Grayscale, who view it as a crucial step towards achieving regulatory clarity for the crypto ecosystem.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/