GOLD Analysis:

XAUUSD has broken Ascending channel in downside

Recent geopolitical tensions have increased the appeal of safe-haven assets among market participants. However, despite lackluster US data leading up to the Christmas break, the US Dollar failed to find support. The low trading volume and liquidity this week could benefit Gold bears by limiting any potential upside moves. The renewed weakness in the US Dollar is attributed to several data misses in the week before Christmas, which has led market participants to maintain a dovish outlook on US interest rates in 2024, thereby weighing on the currency.

Looking ahead, this week lacks significant catalysts, and with subdued trading volume expected, the possibility of rangebound trading is substantial. Interestingly, US Equities have continued their rally after the Christmas break, in contrast to the safe-haven demand for Gold. This divergence is not entirely surprising, as US Equities have often defied consensus views by market participants, as observed in 2023. US Treasury Yields are also on a downward trajectory, with both the 2-year and 10-year yields decreasing as expectations of rate cuts gain momentum.

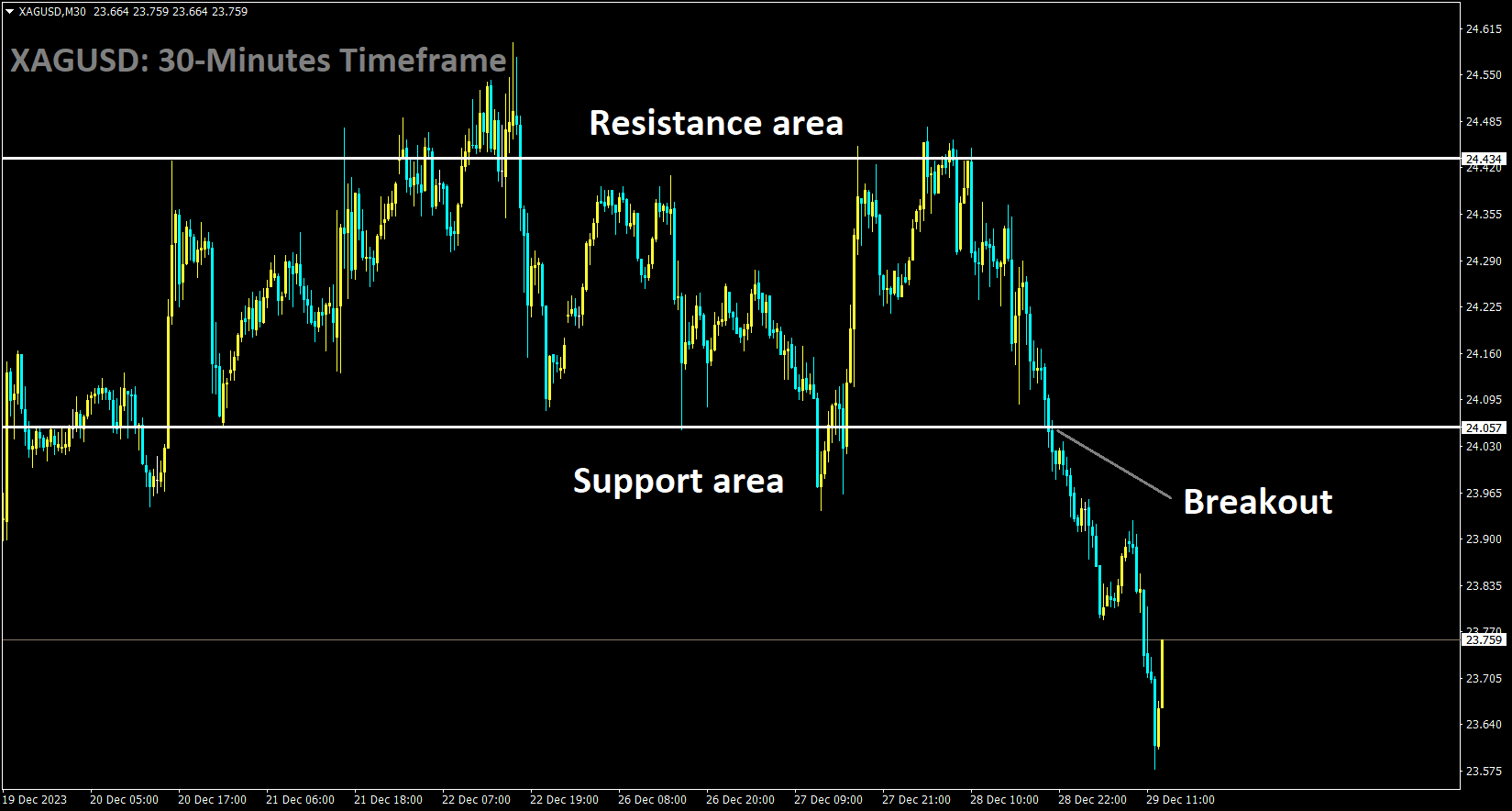

SILVER Analysis:

XAGUSD has broken the Box pattern in downside

In the United States, recent data showed that Initial Jobless Claims increased by 12,000 in the week ending December 23, surpassing the market consensus of 210,000 with a total of 218,000 claims. Additionally, Continuing Claims rose to 1.875 million, marking a four-week high. Meanwhile, Pending Home Sales remained unchanged in November, failing to meet expectations of a 1% increase. Looking forward, the release of the Chicago PMI is scheduled for Friday, but the primary focus is on next week’s employment reports.

The US Dollar Index hit its lowest point since July before rebounding sharply, partly due to rising US Treasury yields, which reached 3.85% after the auction of the 7-year note. This surge in yields provided support to the US Dollar, allowing it to recover some of its weekly losses. While the overall trend for the USD remains bearish, there is potential for further corrections.

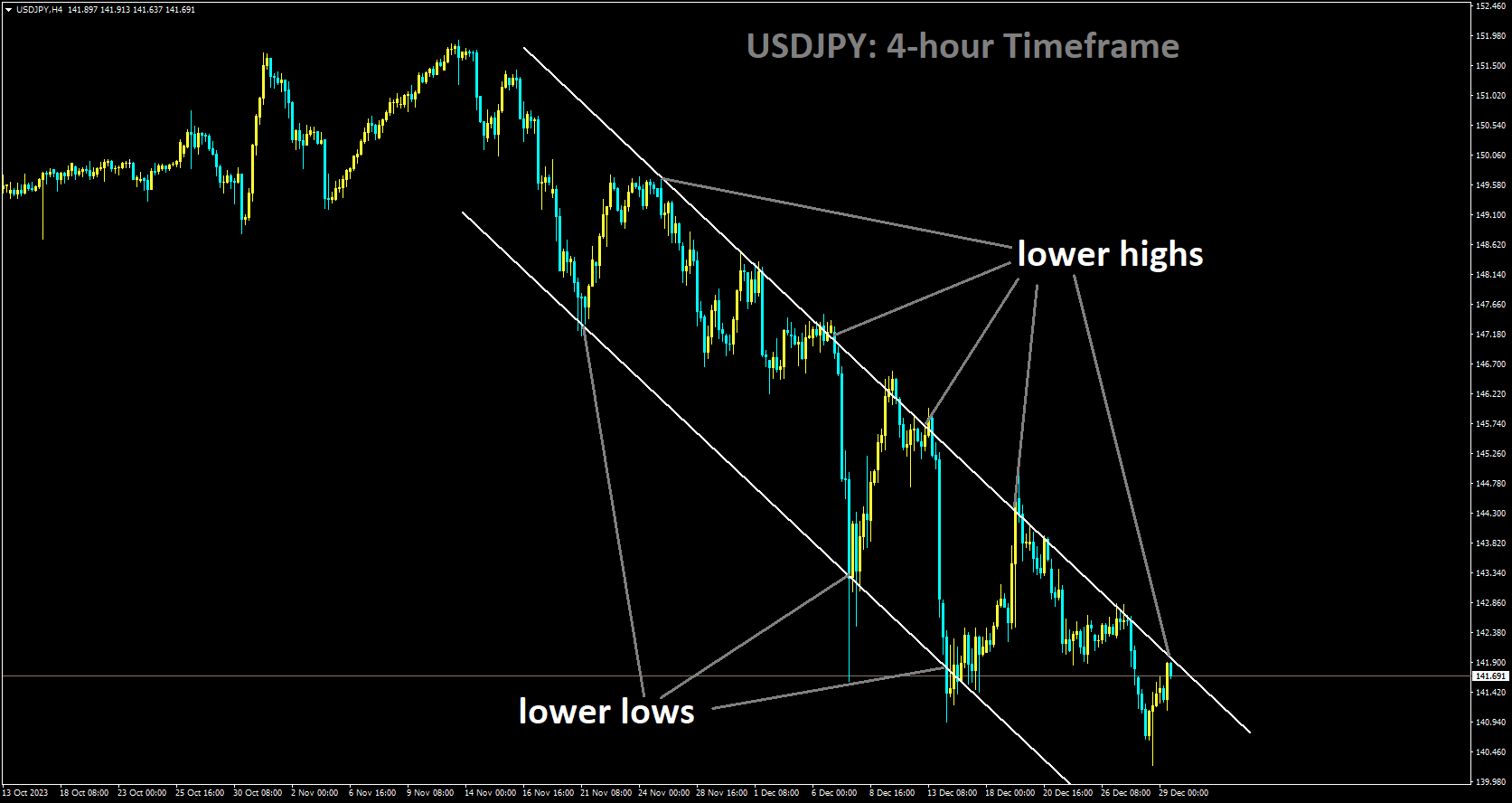

USDJPY Analysis:

USDJPY is moving in Descending channel and market has reached lower high area of the channel

The Japanese Yen is currently the most significant mover in the foreign exchange market. Economists at MUFG Bank are assessing the outlook for USDJPY, noting that while the exact timing of the first interest rate hike remains uncertain, the overall direction is becoming clearer. The expectation is that the Bank of Japan will move away from its negative rate policy in the first half of the upcoming year, which should support the Yen’s recovery from its previously undervalued levels.

The recent resurgence of the Yen can be attributed to the anticipation that major central banks outside of Japan, including the Federal Reserve (Fed), will initiate interest rate cuts earlier and more significantly in the coming year. This expectation is likely to narrow the policy disparities between these central banks and the Bank of Japan.

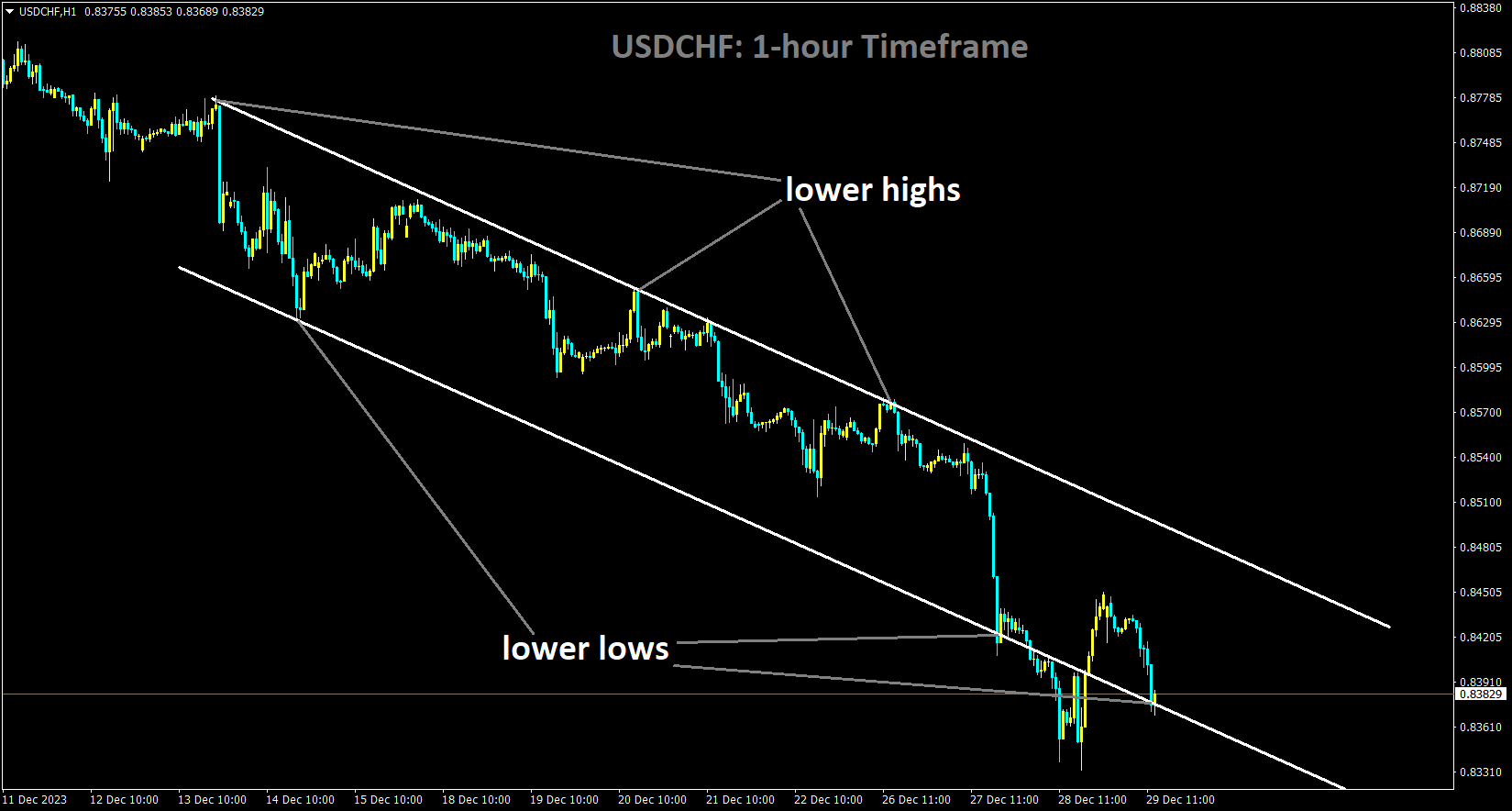

USDCHF Analysis:

USDCHF is moving in the Descending channel and the market has reached the lower low area of the channel

The US Dollar Index is currently trading near 101.10, with the yields on 2-year and 10-year US Treasury notes at 4.26% and 3.84%, respectively. Weaker economic data from the United States may have contributed to the Greenback’s decline, reinforcing market expectations of a dovish stance from the Federal Reserve in upcoming policy meetings. Notably, US Initial Jobless Claims for the week ending December 23 increased to 218,000, surpassing the market’s projection of 210,000. Additionally, November’s Pending Home Sales remained flat at 0.0%, missing the expected 1.0% growth. The upcoming release of the Chicago Purchasing Managers’ Index for December is anticipated to show a reading of 51, down from the previous figure of 55.8.

Heightened risk aversion due to ongoing geopolitical conflicts in the Middle East has increased demand for the safe-haven Swiss Franc . Concerns persist regarding the potential closure of the Gibraltar Strait by Iran, adding an element of caution to the situation. However, the return of major shipping companies to the Red Sea suggests a tentative step toward normalization. In terms of economic indicators, the ZEW Survey Expectations decreased by 23.7 points in December, compared to a decline of 29.6 in November. The KOF Leading Indicator, scheduled for release on Friday, is expected to improve from 96.7 to 97.0. The Swiss National Bank has indicated its readiness to actively intervene in the foreign exchange market to support the Swiss Franc.

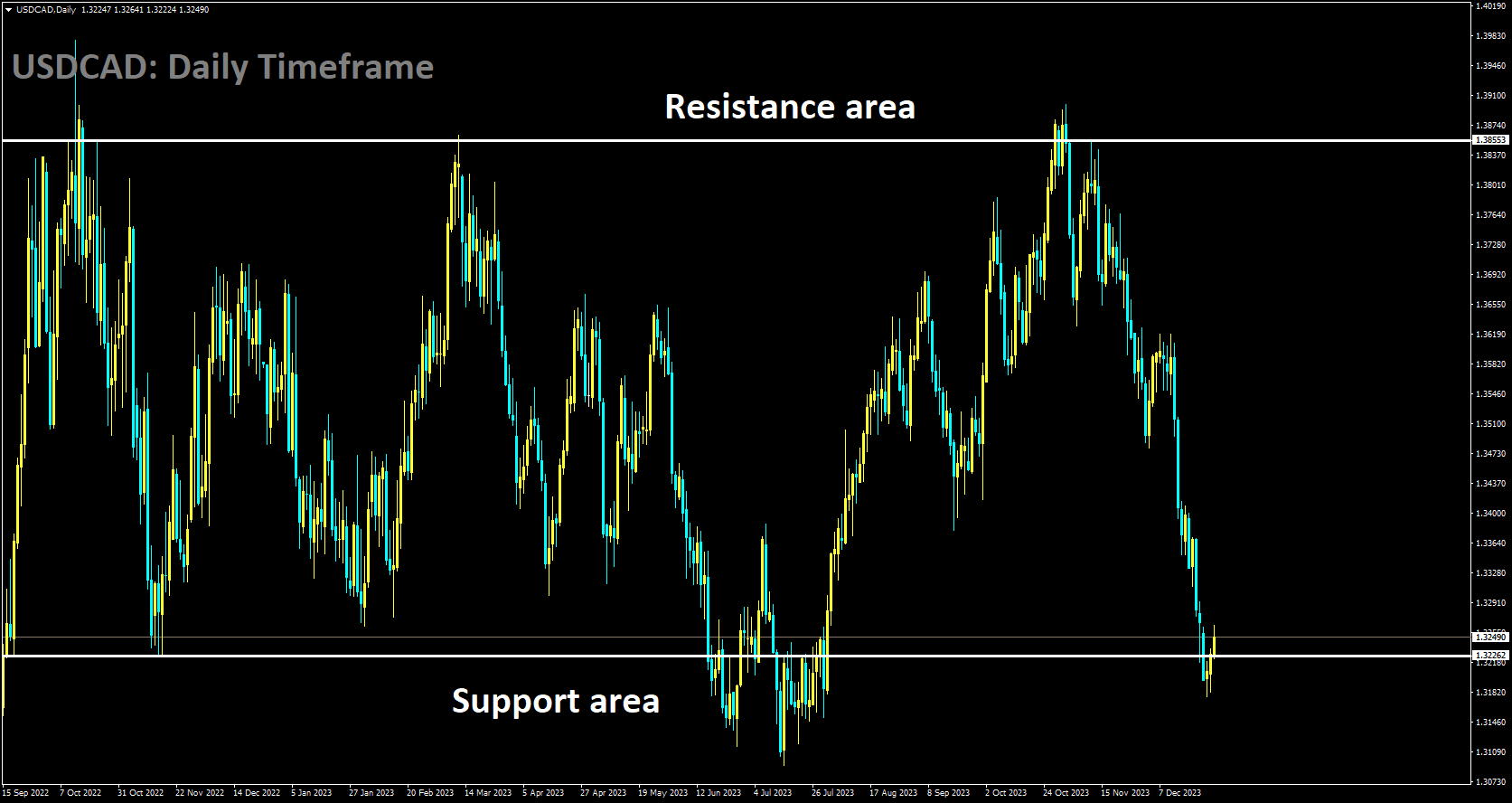

USDCAD Analysis:

USDCAD is moving in Ascending channel and market has reached support area of the pattern

Oil prices continued their descent on Friday, putting pressure on the Canadian Dollar due to concerns about potential supply disruptions. While the Bank of Canada expressed increased optimism about inflation in its December meeting statement, the November Consumer Price Index did not show signs of slowing down, raising questions about further rate hikes. On the other hand, investors are anticipating interest rate cuts in the United States in the coming year. During its last meeting, the Federal Reserve kept rates unchanged at 5.25%-5.50%, with Chair Jerome Powell hinting at the timing of rate cuts as the next question for the Fed. This shift towards a dovish stance by the Fed has led to a broad decline in the US Dollar and a drop in bond yields.

The US Department of Labor reported that weekly Initial Jobless Claims reached 218,000 for the week ending December 23, surpassing expectations. Pending Home Sales in the United States remained stagnant at 0.0% in November, falling short of the expected 1.0% growth. As the year comes to a close, the market is experiencing a relatively quiet session, with traders preparing for the transition into 2024.

EURUSD Analysis:

EURUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

The European Central Bank (ECB) is expected to implement easing measures in March 2024. It’s worth noting that interest rate cuts may not necessarily have a negative impact on the Euro, as the gap in real yield between the United States and the Eurozone narrows. This could potentially bolster the EURUSD exchange rate.

Analysts at Natixis emphasize the enduring relevance of the US Dollar as a reserve currency and preferred currency for trade and financial transactions, despite the United States’ decreasing share of the global economy. This resilience highlights the effectiveness of having a single reserve currency in the international monetary system.

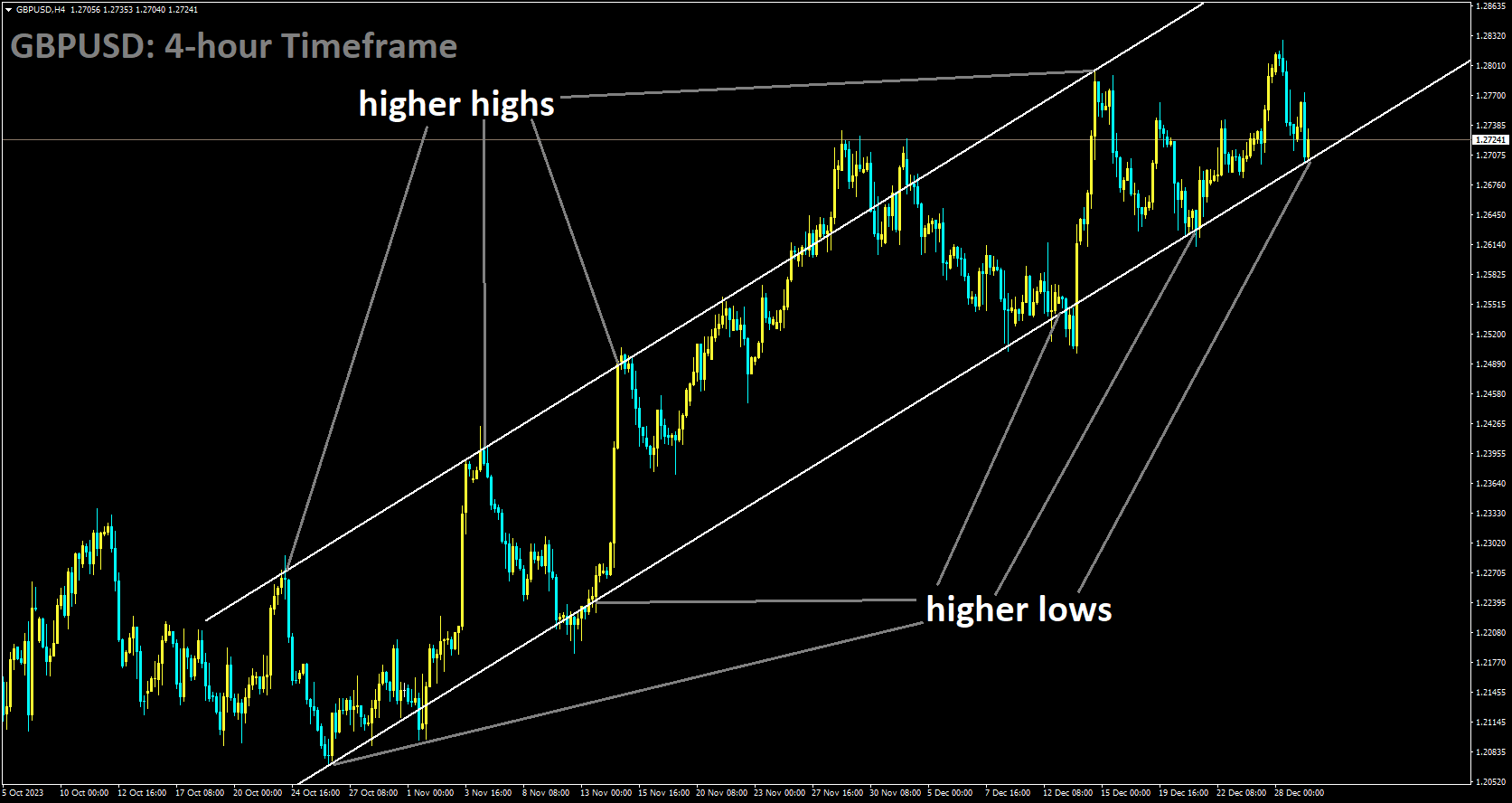

GBPUSD Analysis:

GBPUSD is moving in Ascending channel and market has reached higher low area of the channel

US Treasury yields have declined following gains in Thursday’s trading session, which has exerted downward pressure on the US Dollar. Investors are anticipating interest rate cuts in the US. The 2-year and 10-year yields, while previously higher, have retreated slightly. Additionally, discouraging US economic data, including higher-than-expected Initial Jobless Claims and flat Pending Home Sales in November, may have contributed to the Greenback’s decline. This data supports the likelihood of the US Federal Reserve adopting a more accommodative monetary policy stance in upcoming meetings.

The Pound Sterling has been showing signs of recovery, driven by market expectations that the Bank of England may maintain its restrictive monetary policy stance. Despite having the highest inflation among G7 economies, BoE policymakers face challenges in addressing high price pressures while avoiding a domestic market recession due to deteriorating demand. These dynamics contribute to volatility and uncertainty in currency markets, affecting the performance of the British Pound. Traders will closely monitor seasonally adjusted UK Nationwide Housing Prices data for December, with expectations of no change month-over-month and a slight improvement in yearly figures.

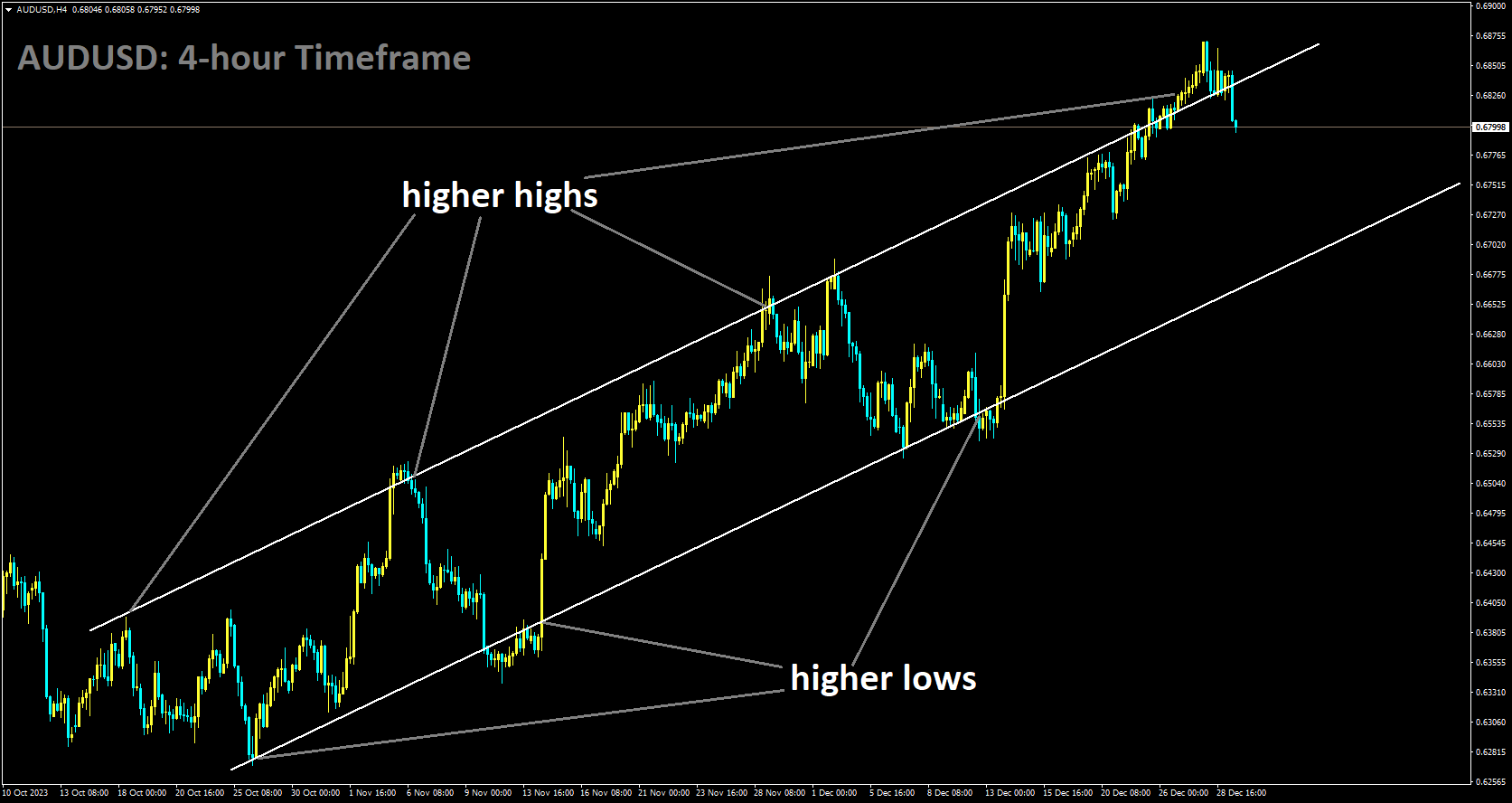

AUDUSD Analysis:

AUDUSD is moving in Ascending channel and market has reached higher high area of the channel

The Australian Dollar has strengthened in recent months due to the weakening US Dollar, driven by expectations of the Federal Reserve implementing more lenient monetary policies. Investors anticipate the Fed will cut interest rates by approximately 155 basis points throughout 2024, contributing to the positive momentum of the Australian Dollar, known for its pro-growth characteristics. The Reserve Bank of Australia is expected to begin rate cuts around May or June 2024, with the timing and direction dependent on incoming economic data.

China, a significant trade partner for Australia, is in focus due to the impending release of the NBS manufacturing and non-manufacturing PMI report on December 31, 2023. China has implemented stimulus measures to revive its economy following the lifting of COVID restrictions, and positive data could benefit the Australian Dollar. US data, particularly Initial Jobless Claims, is closely monitored. Non-Farm Payrolls in the first week of 2024 will be a critical economic indicator.

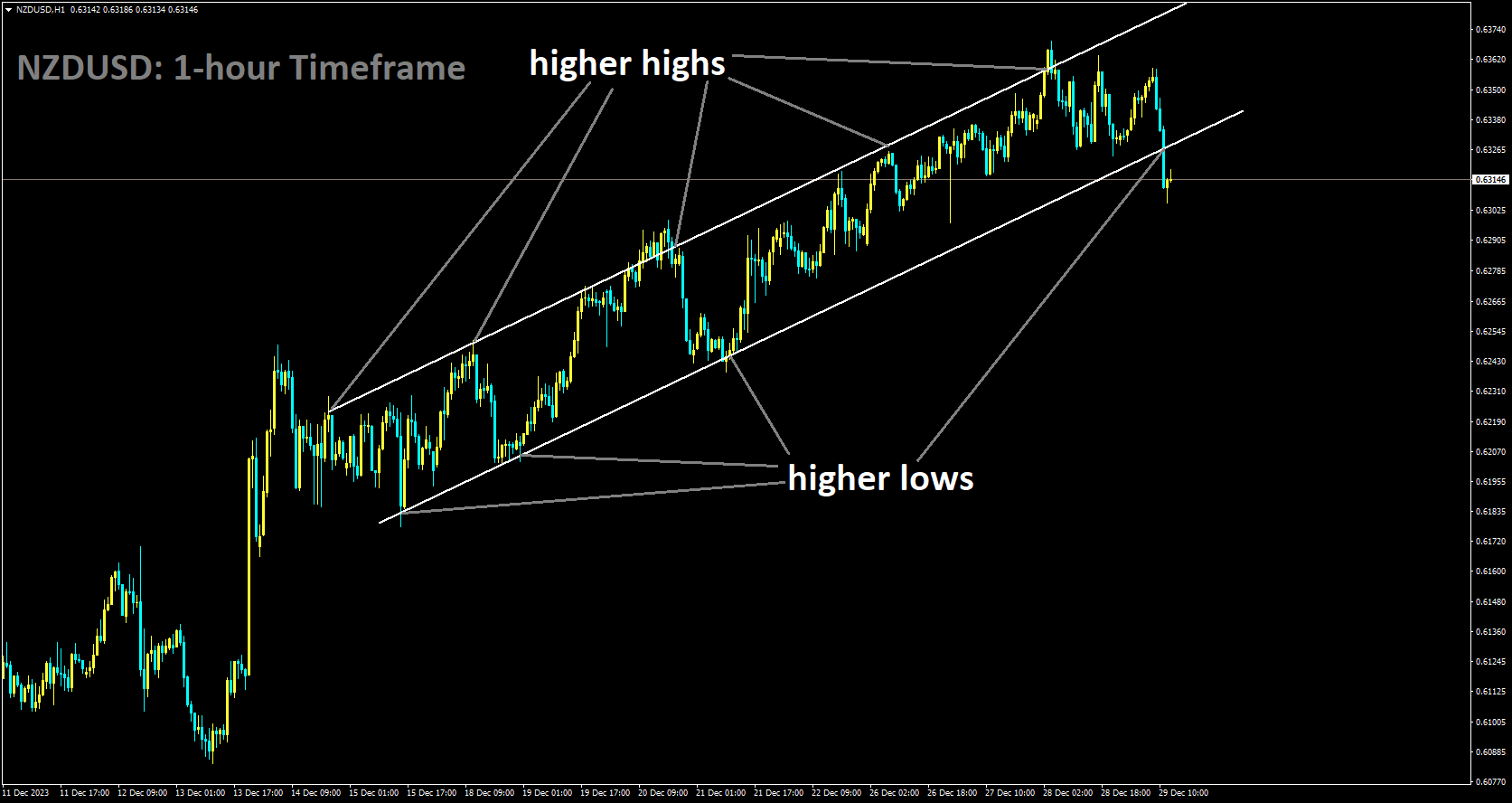

NZDUSD Analysis:

NZDUSD is moving in Ascending channel and market has reached higher low area of the channel

The New Zealand Dollar is showing strength, driven by expectations that the Reserve Bank of New Zealand may delay policy easing. Improved Consumer Confidence and Business Confidence data for November have further boosted sentiment. Despite New Zealand’s GDP data indicating a contraction in the third quarter due to the RBNZ’s higher policy rates, Governor Adrian Orr’s cautious approach and recognition of challenges, including high inflation, add complexity to navigating the economic landscape. ANZ analysts expect a global resurgence in risk appetite and a favorable interest rate differential to support the NZD into 2024. The US Dollar faces headwinds against the Kiwi Dollar as softer economic data from the United States increases the likelihood of a more accommodative stance by the US Federal Reserve in early 2024.

The US Dollar may encounter resistance as Initial Jobless Claims unexpectedly rose above expectations to 218,000 for the week ending December 23. Pending Home Sales for November remained stagnant at 0.0%, falling short of the expected 1.0% increase. The upcoming release of the Chicago Purchasing Managers’ Index for December will provide additional insights into the US economy. With no significant events on the Kiwi’s calendar for the next week, attention will turn to China’s Caixin Manufacturing PMI for December, given China’s importance as New Zealand’s trade partner.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/