EURO: ECB’s Nagel: June Rate Cut May Stand Alone

The ECB Policy maker and Bundesbank Chief Joachim Nagel said June month rate cut is not necessary and services inflation still higher in the Euro zone, Wage growth is also higher. We do not pre-commit to rate cuts based on the incoming datas, we wait for inflation to move to the target of 2% then only we do rate cuts. Hawkish remarks from Chief Nagel makes Euro stronger against counter pairs.

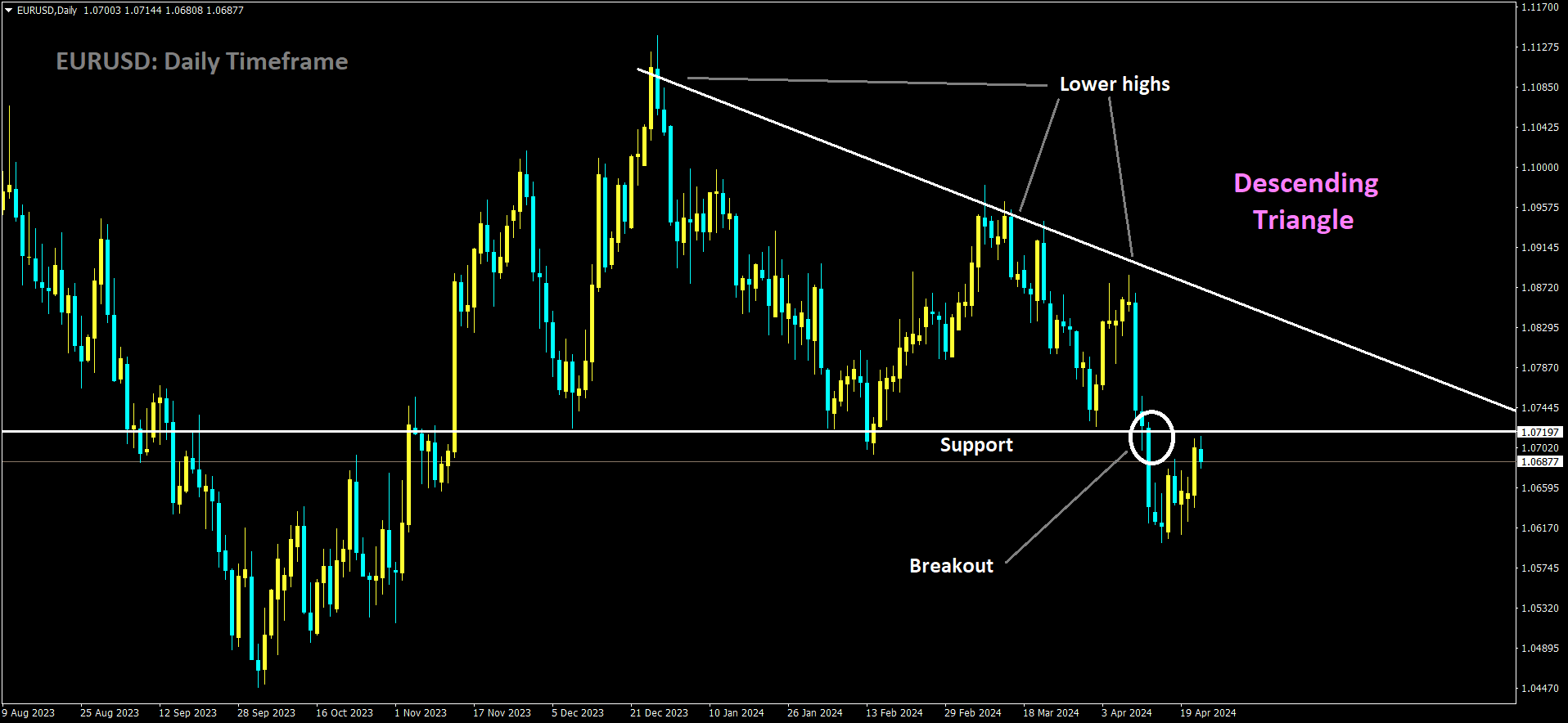

EURUSD has broken Descending Triangle in downside

Bundesbank President Joachim Nagel emphasized on Wednesday that despite the European Central Bank’s (ECB) anticipated rate cut in June, the trajectory of monetary policy easing might not extend beyond that. Nagel expressed concerns over the persistent nature of euro zone inflation and the uncertainty surrounding the U.S Federal Reserve’s stance on potential rate cuts, which complicates the policy outlook further.

While the ECB has hinted at a rate cut during its upcoming policy meeting in June, the discussion among policymakers remains focused on the path of interest rates beyond that point. Nagel acknowledged the likelihood of a rate cut in June, noting that it has been widely anticipated, but cautioned against assuming a series of rate cuts thereafter. He emphasized that the current economic uncertainty prevents policymakers from committing to a specific rate trajectory.

Nagel’s remarks reflect a cautious approach compared to some policymakers who lean towards further easing measures. Despite acknowledging the possibility of additional policy easing, many policymakers are hesitant to outline a definitive timeline for such actions.

Nagel highlighted his concerns regarding services inflation, which continues to be driven by robust wage growth. He expressed skepticism about inflation returning to the ECB’s target level in a timely and sustained manner, indicating the persistence of inflationary pressures in the euro zone economy.

EURO: ECB’s Nagel: Single June rate cut doesn’t imply consecutive cuts

The ECB Policy maker and Bundesbank Chief Joachim Nagel said June month rate cut is not necessary and services inflation still higher in the Euro zone, Wage growth is also higher. We do not pre-commit to rate cuts based on the incoming datas, we wait for inflation to move to the target of 2% then only we do rate cuts. Hawkish remarks from Chief Nagel makes Euro stronger against counter pairs.

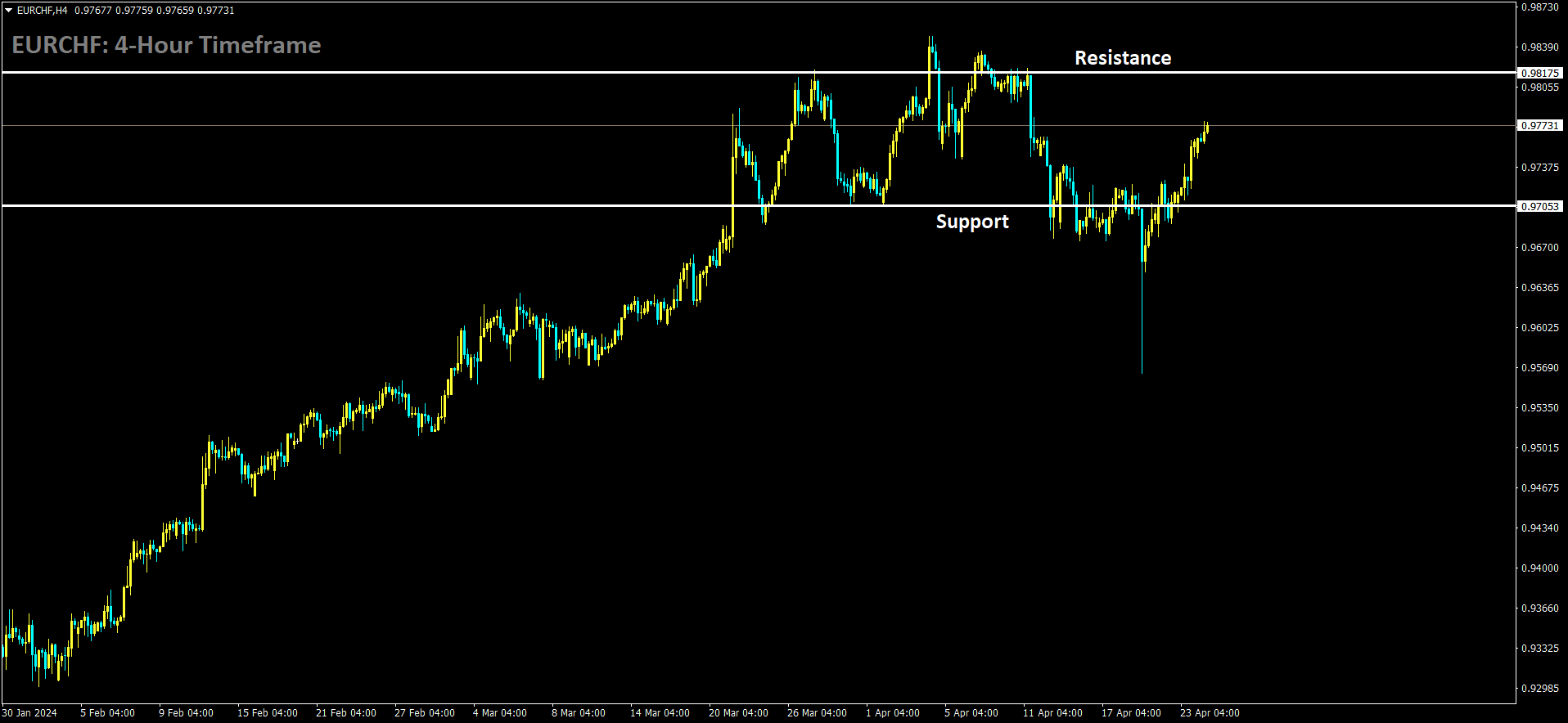

EURCHF is moving in box pattern and market has rebounded from the support area of the pattern

European Central Bank (ECB) policymaker and Bundesbank Chief Joachim Nagel addressed on Wednesday the potential for a June interest rate cut, emphasizing that such a move might not automatically lead to a sequence of subsequent rate reductions.

Nagel also noted that services inflation continues to stay elevated, primarily due to ongoing robust wage increases. However, he expressed reservations about whether inflation would indeed return to the target level in a timely and sustained manner.

Highlighting the prevailing uncertainty, Nagel emphasized the ECB’s stance of not committing in advance to a specific path for interest rates.

EURO: Nagel: June ECB Rate Cut May Not Lead to More

The ECB Policy maker and Bundesbank Chief Joachim Nagel said June month rate cut is not necessary and services inflation still higher in the Euro zone, Wage growth is also higher. We do not pre-commit to rate cuts based on the incoming datas, we wait for inflation to move to the target of 2% then only we do rate cuts. Hawkish remarks from Chief Nagel make Euro stronger against counter pairs.

Joachim Nagel, the President of the Deutsche Bundesbank, addressed an audience on April 24, expressing his cautious stance on the current state of inflation and the potential for a rate cut in June. He highlighted his reservations about the return of inflation to the target of 2 percent, particularly noting the persistent nature of services sector inflation driven by robust wage growth. Nagel emphasized the importance of upcoming data, such as wage growth figures for the first quarter, which will inform new projections.

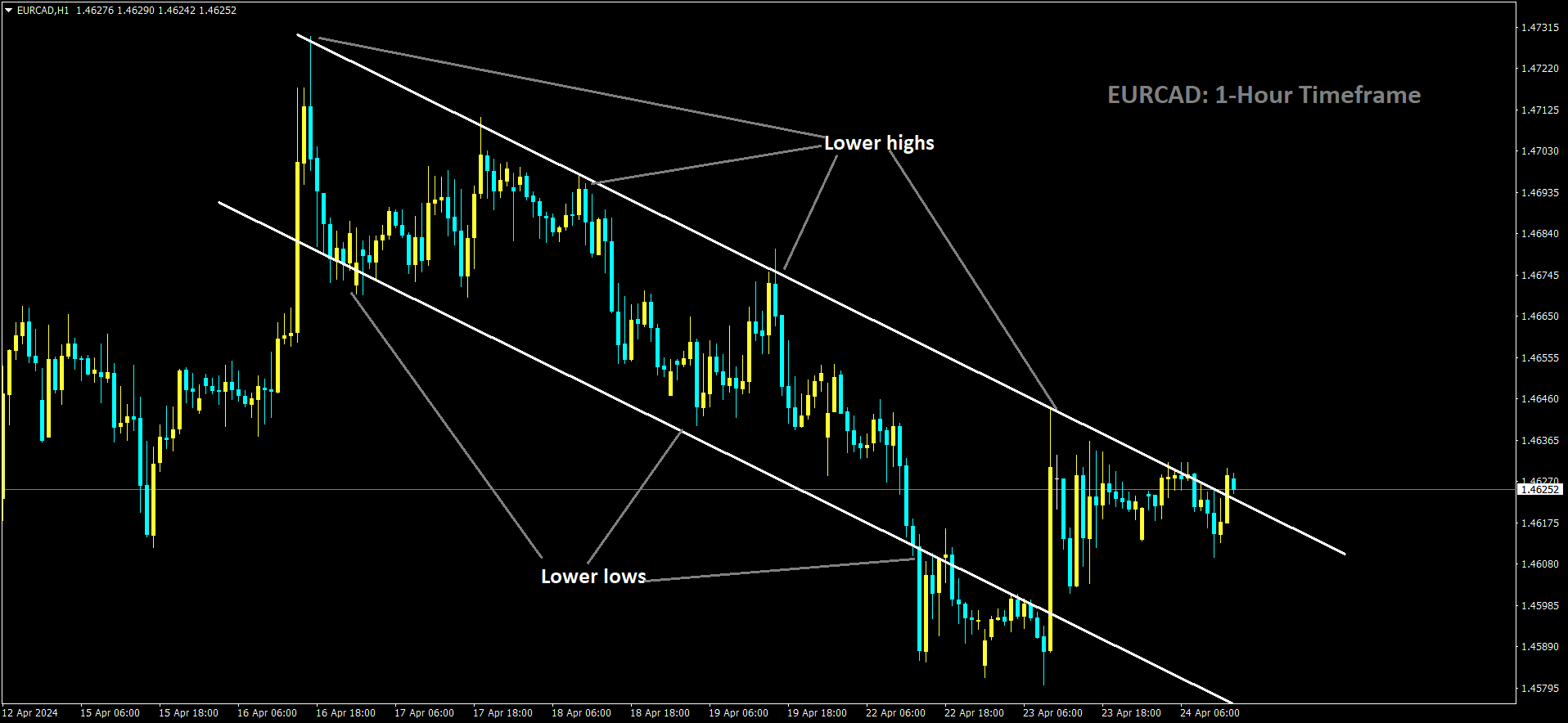

EURCAD is moving in Descending channel and market has reached lower high area of the channel

While he acknowledged the possibility of a rate cut in June if the data supports confidence in reaching the inflation target, Nagel stressed that such a move would not automatically lead to a series of rate cuts. He underscored the prevailing uncertainty and the need to remain flexible in determining the future path of interest rates. The Governing Council will continue to assess incoming data and make decisions on a meeting-by-meeting basis.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/