EURO: German Industrial Production Falls 0.1% MoM in April, Missing 0.3% Expected

The German Industrial Production came at -0.10% in the April month from -0.40% Drop in the March month and 0.30% rise is expected. The Annual Rate of drop is -3.9% in the April month from -3.3% printed in the March month. Euro currency weaker after the data came.

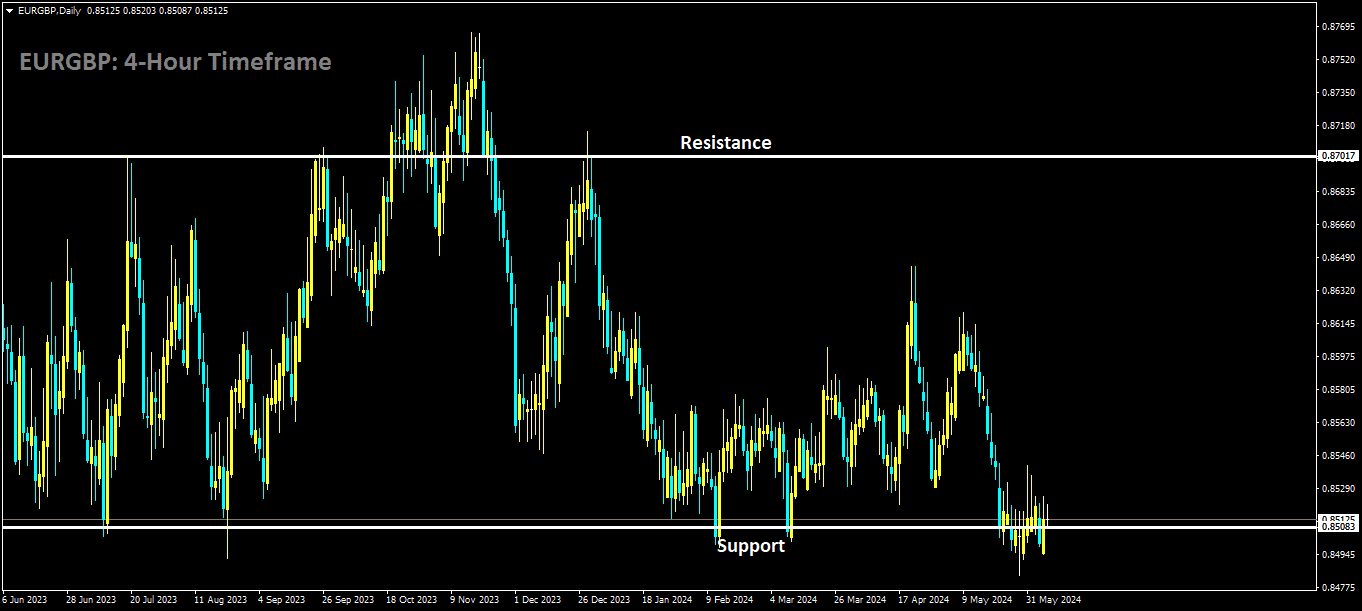

EURGBP is moving in box pattern and market has reached support area of the pattern

Germany’s industrial sector continued to contract in April, according to the latest data published by Destatis on Friday. The industrial output in Germany, the leading economy in the Eurozone, decreased by 0.1% month-over-month (MoM) after adjustments for seasonal and calendar effects. This decline was smaller than the anticipated 0.3% but followed a 0.4% drop in March.

On an annual basis, German Industrial Production fell by 3.9% in April, which was a steeper decline compared to the 3.3% drop recorded in March. This data highlights ongoing challenges within Germany’s industrial sector, indicating a persistent contraction.

EURO: German Industrial Production Falls 0.1% MoM in April, Missing 0.3% Expected

German industrial production registered a 0.1% decline in April, following a 0.4% drop in March. Analysts had expected a 0.3% increase. On an annual basis, industrial production fell by 3.9% in April, compared to a 3.3% drop in March. This disappointing data has led to a weakening of the Euro currency.

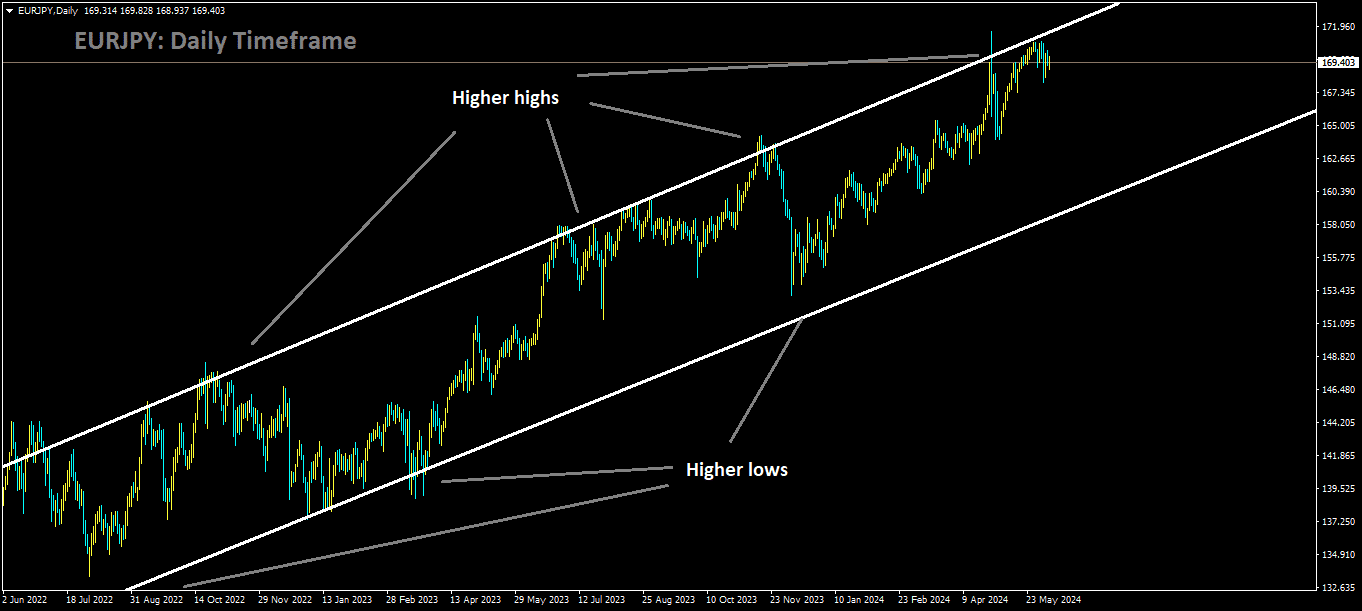

EURJPY is moving in Ascending channel and market has reached higher high area of the channel

Key Points:

Monthly Industrial Production: -0.1% in April, improving from -0.4% in March but missing the expected 0.3% rise.

Annual Rate of Decline: -3.9% in April, worsening from -3.3% in March.

Euro Impact: The weaker-than-expected industrial production data has led to a decline in the Euro’s value.

The weaker industrial production figures indicate ongoing challenges in Germany’s industrial sector, contributing to a weaker Euro in response to the economic data.

German industrial production fell by 0.1% in April compared to the previous month, hindered by a decline in the construction sector, according to the Federal Statistics Office. Analysts polled by Reuters had predicted a 0.3% increase.

The construction sector experienced a significant drop of 2.1% in output, while the automotive industry showed robust growth, increasing by 4.2% month-on-month. Over a less volatile three-month comparison, production rose by 1% in the February-April period compared to the previous three months.

Thomas Gitzel, chief economist at VP Bank, commented that the data heightens concerns about overall economic growth being weak in the second quarter. He noted that higher output in the industry would initially require stronger growth in incoming orders.

Moreover, industrial orders unexpectedly fell in April, marking the fourth consecutive month of declines due to a significantly smaller number of large-scale orders. Carsten Brzeski, global head of macro at ING, pointed out that the drop in new orders and persistently high inventories indicate that any rebound in industrial activity will likely be subdued.

EURO: German Industrial Production Declines Again, Signaling Poor Start to Quarter

The statistical revelations pertaining to German industrial production for the month of April delineate an unforeseen diminution, with the index registering a decrement of 0.1%, following a more substantial contraction of 0.4% observed in March. This figure starkly contravenes the anticipated ascension of 0.3% posited by economic prognosticators. On an annualized metric, the industrial production index experienced an exacerbated decline of 3.9% in April, intensifying from the 3.3% regression recorded in the antecedent month.

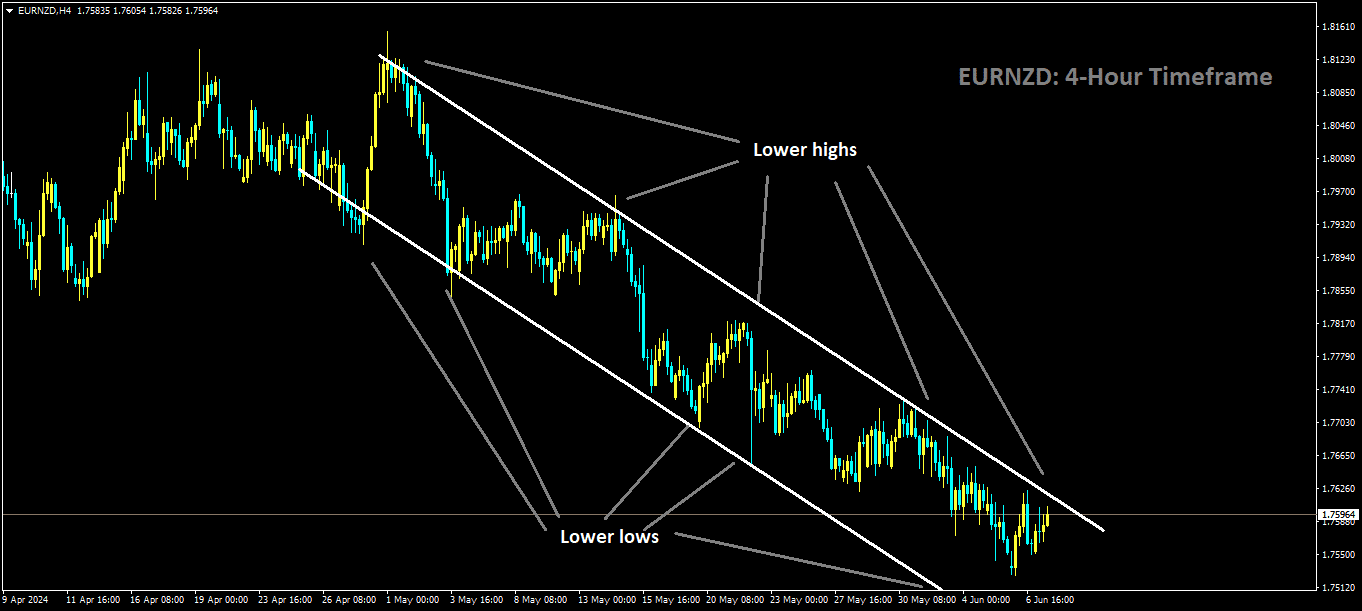

EURNZD is moving in Descending channel and market has reached lower high area of the channel

The deleterious nature of this data precipitated a depreciation in the Euro, manifesting the persistent vulnerabilities within Germany’s industrial domain.

Salient Points:

Monthly Industrial Production: Contracted by 0.1% in April, an amelioration from the 0.4% contraction in March, yet divergent from the anticipated 0.3% increment.

Annual Decline Rate: Intensified to a 3.9% downturn in April, from a 3.3% decline in March.

Euro Depreciation: The suboptimal industrial production metrics have engendered a devaluation of the Euro.

The underperformance of the German industrial sector, as elucidated by these metrics, has precipitated an adverse market response, contributing to the depreciation of the Euro amidst escalating apprehensions regarding the sector’s sustained frailty and the broader economic ramifications.

German industrial output unexpectedly fell for the second consecutive month in April, indicating a weak start to the quarter for Europe’s largest economy. Production decreased by 0.1% following a 0.4% drop in the previous month, according to the statistics office. Analysts in a Bloomberg poll had anticipated an increase.

This decline follows another negative report on Thursday, which showed factory orders unexpectedly dropped by 0.2% in April. Despite these setbacks, Germany’s economy, after two years of near-stagnation, expanded more than anticipated at the start of 2024 and is expected to rebound gradually throughout the year. This recovery is projected to be driven mainly by consumption and services, with manufacturing also showing signs of gradual improvement.

Private-sector activity in Germany grew at its fastest pace in a year in May, as indicated by the S&P Global’s purchasing managers’ index. Additionally, the Ifo institute’s expectations gauge rose last month, although a measure of current conditions fell. The Bundesbank expects economic output to rise slightly in the second quarter, suggesting that the underlying cyclical trend is gradually gaining momentum.

The recovery may also benefit from lower interest rates. On Thursday, the European Central Bank cut borrowing costs and hinted at further reductions without committing to a specific timeline. This move could provide additional support for Germany’s economic rebound.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/