EURUSD – Rebounds post-final Eurozone inflation data

The Euro CPI Data for the month of March came at 2.4% inline with expectations and 2.6% printed in the last month. Core CPI came at 2.9% from 3.1% in the previous reading. Euro pairs slight up move after the data printed. ECB hopes for June month rate cuts is very bright now due to CPI is closer to the ECB target of 2%.

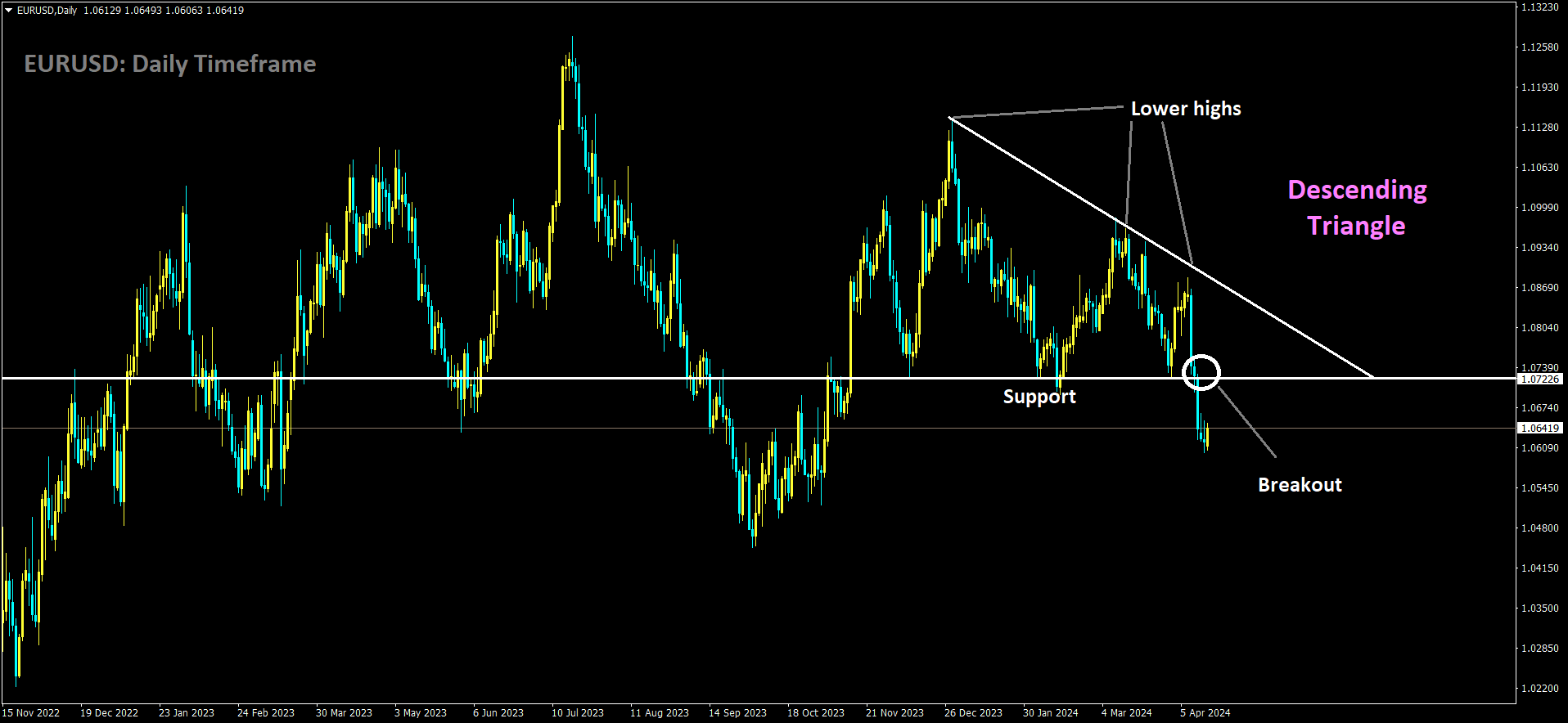

EURUSD has broken Descending Triangle in downside

After the final Eurozone inflation reading, the EUR/USD pair displays signs of recovery. This movement follows the release of key data that impacts the economic landscape of the Eurozone. The final estimates for Eurozone inflation data are crucial indicators for the European Central Bank (ECB) in making decisions regarding interest rates, which, in turn, influence currency markets.

The flash estimates for March showed a slight decline in inflation compared to previous figures. However, the final estimates are awaited to confirm these trends. Any deviation from these estimates could trigger fluctuations in the EUR/USD pair, affecting market sentiment.

A lower-than-expected final estimate might reinforce expectations of an interest rate cut by the ECB, potentially weakening the Euro against the US Dollar. Conversely, if the final estimate exceeds expectations, it could raise doubts about the necessity of an immediate rate cut, potentially strengthening the Euro and driving up the EUR/USD pair.

In addition to the inflation data, speeches by key ECB members, including ECB Executive Board Member Piero Cipollone, ECB Executive Board Member Isabel Schnabel, and ECB President Christine Lagarde, could influence market volatility. These speeches provide insights into the ECB’s policy outlook and can impact investor sentiment towards the Euro.

Overall, the EUR/USD pair’s recovery after the final Eurozone inflation reading reflects the market’s reaction to the latest economic data and central bank communications, highlighting the importance of fundamental factors in currency trading.

Eurozone inflation sticks to estimated 2.4% slowdown

The Euro CPI Data for the month of March came at 2.4% inline with expectations and 2.6% printed in the last month. Core CPI came at 2.9% from 3.1% in the previous reading. Euro pairs slight up move after the data printed. ECB hopes for June month rate cuts is very bright now due to CPI is closer to the ECB target of 2%.

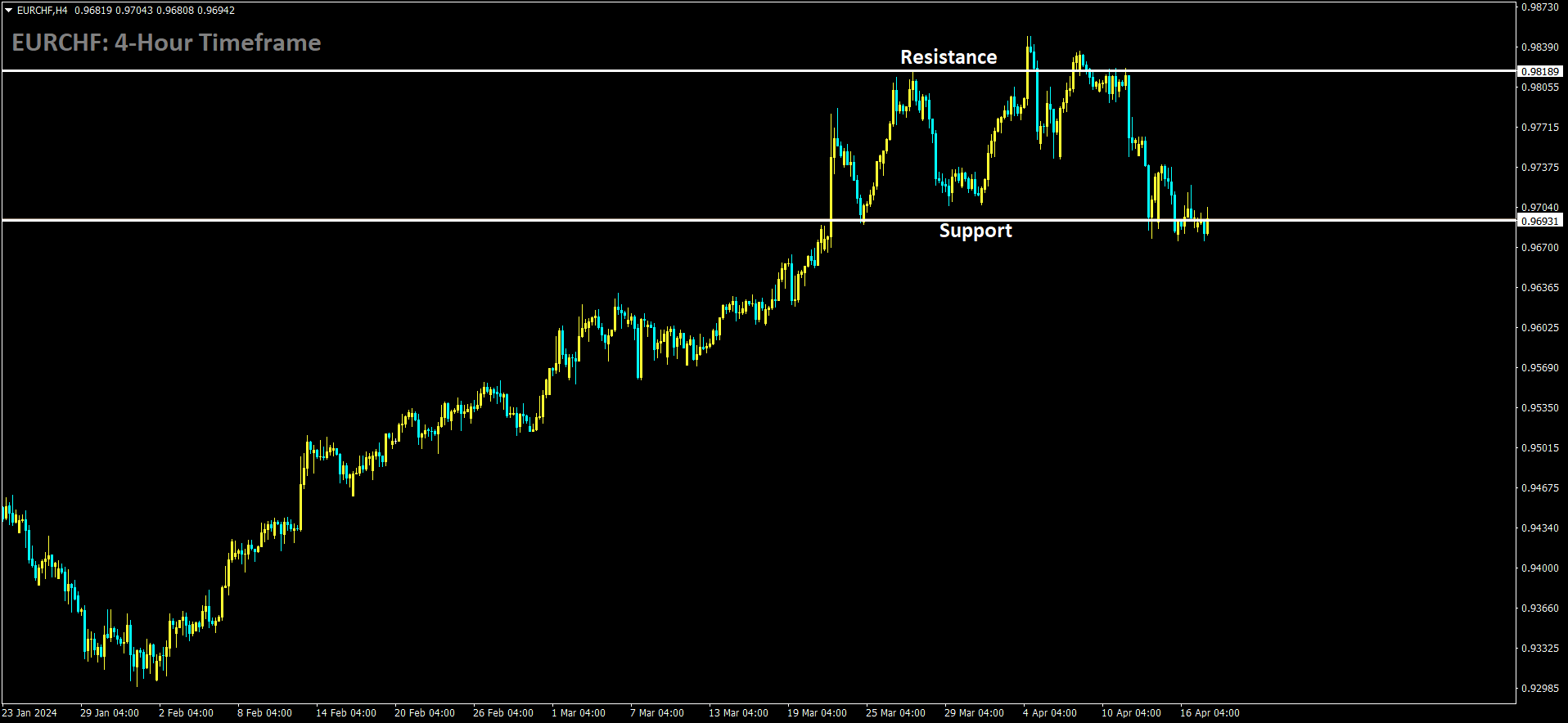

EURCHF is moving in box pattern and market has reached support area of the pattern

In March, Eurozone inflation continued to moderate as initially projected, driven primarily by a deceleration in food price growth, according to the final data released by Eurostat on Wednesday.

The Harmonized Index of Consumer Prices (HICP) showed a year-on-year increase of 2.4 percent, marking a slowdown from the 2.6 percent rise observed in February. Similarly, core inflation, which excludes the volatile components of food and energy prices, eased to 2.9 percent in March from 3.1 percent in the previous month.

Both the overall and core inflation rates were in line with the estimates published on April 3, affirming the accuracy of earlier projections.

The Survey of Professional Forecasters, conducted by the European Central Bank, predicts a decline in headline inflation to 2.0 percent in both 2025 and 2026, down from 2.4 percent in 2024.

Examining specific components, Eurostat noted that the cost of food, alcohol, and tobacco rose at a slower pace of 2.6 percent, following a 3.9 percent increase previously. Meanwhile, the rate of decline in energy prices moderated to 1.8 percent from 3.7 percent.

Non-energy industrial goods prices recorded a modest increase of 1.1 percent, compared to a 1.6 percent rise in February. Services cost inflation remained unchanged at 4.0 percent.

On a monthly basis, the Harmonized Index of Consumer Prices showed a 0.8 percent increase.

Eurozone Inflation at 2.4% in March Confirmed

The Euro CPI Data for the month of March came at 2.4% inline with expectations and 2.6% printed in the last month. Core CPI came at 2.9% from 3.1% in the previous reading. Euro pairs slight up move after the data printed. ECB hopes for June month rate cuts is very bright now due to CPI is closer to the ECB target of 2%.

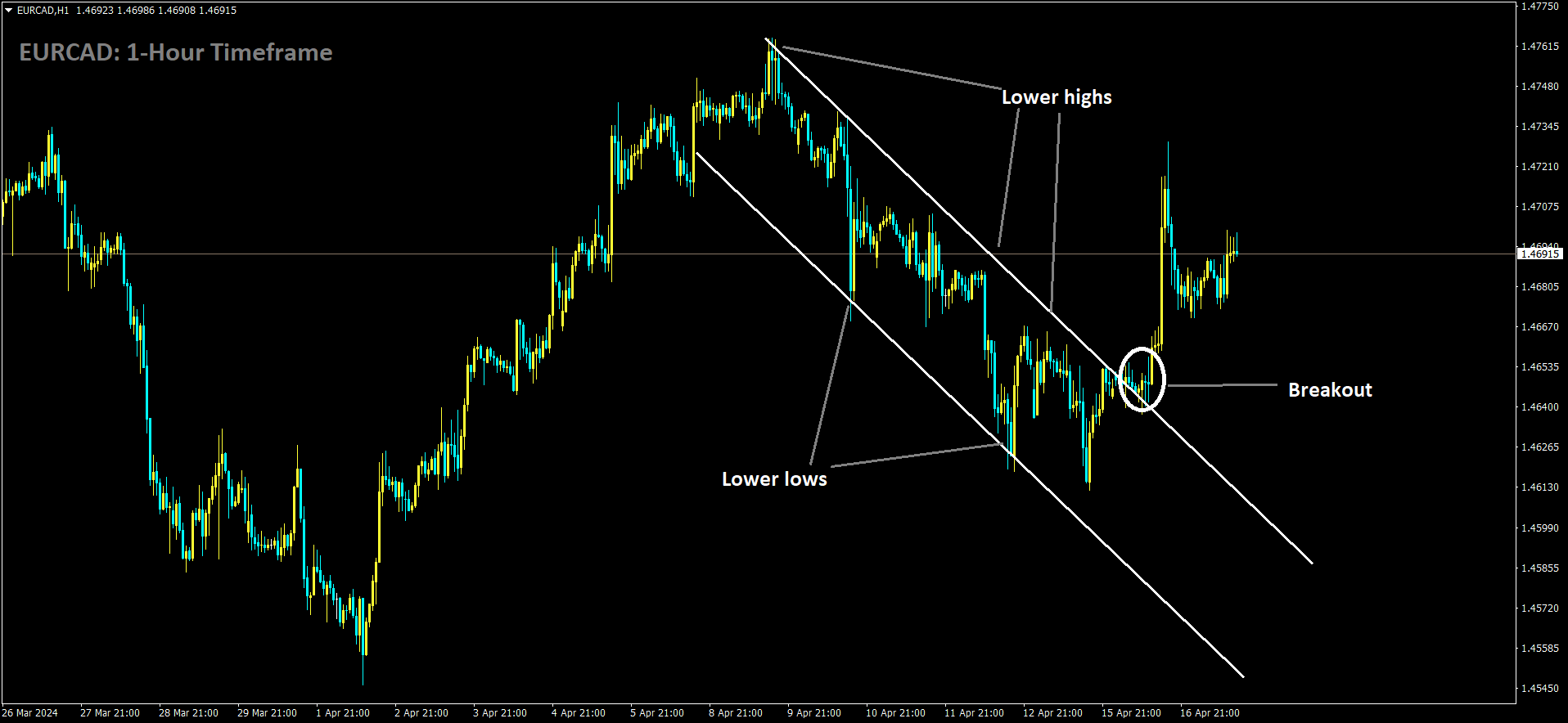

EURCAD has broken Descending channel in upside

On Wednesday, Eurostat confirmed the deceleration of eurozone inflation in March, validating earlier indications of a slowdown in consumer price growth, reaching a level comparable to the 28-month low recorded in November.

The final assessment of the eurozone’s harmonized index of consumer prices revealed that the annual inflation rate dipped to 2.4% in March. This figure aligns precisely with the initial estimate disclosed two weeks ago and conforms to market consensus forecasts.

This marks a decline from the 2.6% recorded in February and represents the lowest inflation rate observed in four months. The last time inflation figures fell below this threshold was in July 2021.

Core inflation, a metric that excludes volatile components such as food and energy prices, was reaffirmed at 2.9% for March. This rate reflects a decrease from the 3.1% reported in February and represents the lowest level observed since February 2022.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/