BTCUSDT: Hong Kong Grants Initial Approval for Bitcoin and Ether ETFs, Issuers Confirm

The Hong Kong Government finally approved Bitcoin and Ether Spot ETF Funds last day. This is welcome thing for Investors to invest in Crypto assets in a safer way to invest like Financial markets.

Hong kong set to have collaboration with Singapore and Dubai for developments of this crypto hub channels in coming months.

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

Hong Kong Approves Bitcoin and Ether ETFs, Paving the Way for Digital Asset Integration

In a notable development for the cryptocurrency market, Hong Kong has granted initial approvals for asset managers to launch spot-Bitcoin and Ether exchange-traded funds (ETFs). Harvest Global Investments, along with a collaboration between HashKey Capital Ltd. and Bosera Asset Management (International) Co., announced these approvals on Monday.

Additionally, China Asset Management’s Hong Kong unit revealed approval from the city’s Securities & Futures Commission to provide virtual-asset management services, with plans underway to develop related products. OSL Digital Securities Ltd. expressed its intent to offer custodial services for Bitcoin and Ether products from both the China Asset Management unit and Harvest.

This move underscores Hong Kong’s ambition to establish itself as a competitive financial hub for digital-asset firms, particularly following the introduction of regulatory frameworks for virtual-asset service providers last year, as it seeks to rival other financial centers like Singapore and Dubai.

The approval of spot funds by authorities has injected momentum into the cryptocurrency market. Bitcoin surged by as much as 4.3% to approximately $66,629, while Ether saw a 6.1% increase, reaching $3,257.

From a technical perspective, the approval of Bitcoin and Ether ETFs in Hong Kong marks a significant milestone for the cryptocurrency market. ETFs offer investors a regulated and potentially more accessible means to invest in digital assets, which could attract more institutional capital into the market. Additionally, the provision of custodial services for these ETFs enhances their credibility and security, addressing concerns about the safety of holding cryptocurrencies.

This development is expected to have a positive impact on market sentiment, signaling growing acceptance and adoption of cryptocurrencies by traditional financial institutions and regulatory authorities. It also reflects a broader trend of increasing institutional interest in digital assets, driven by factors such as inflationary pressures, low interest rates, and the potential for portfolio diversification.

However, it’s important to acknowledge that regulatory approval does not eliminate all risks associated with investing in cryptocurrencies. Price volatility, security breaches, and regulatory uncertainty continue to pose challenges to market participants. Investors should conduct thorough research and exercise caution when considering exposure to digital assets.

Hong Kong’s approval of Bitcoin and Ether ETFs represents a significant step forward for the cryptocurrency market, providing investors with additional avenues for accessing these assets. This move underscores the increasing integration of cryptocurrencies into the mainstream financial system and is likely to contribute to further market growth and maturation.

BTCUSDT: Hong Kong Regulators Greenlight Spot Bitcoin and Ether ETF Launch

The Hong Kong Government finally approved Bitcoin and Ether Spot ETF Funds last day. This is welcome thing for Investors to invest in Crypto assets in a safer way to invest like Financial markets.

Hong kong set to have collaboration with Singapore and Dubai for developments of this crypto hub channels in coming months.

BTCUSDT is moving in box pattern and market has reached support area of the pattern

Hong Kong Regulators Give Nod to Spot Bitcoin and Ether ETF Launch

On Monday, asset managers announced that Hong Kong regulators have approved the launch of spot bitcoin and ether exchange-traded funds (ETFs), following similar moves in the United States earlier this year.

Bitcoin saw a roughly 3% increase in trading around 7:11 a.m. ET, rebounding from a weekend sell-off.

Three ETF providers have secured approval from Hong Kong’s Securities and Futures Commission (SFC). ChinaAMC disclosed regulatory clearance for the provision of “virtual asset management services” and is actively progressing in the development of spot bitcoin and ether ETFs. OSL Digital Securities is set to act as a custodian for ChinaAMC.

Harvest Global and Bosera International have also obtained SFC approval for bitcoin and ether ETFs, as confirmed by the respective companies. The Hong Kong SFC, however, was unavailable for immediate comment when approached by CNBC.

While these asset managers have received regulatory approval for the ETFs, they have yet to launch them.

Crypto trading is effectively banned in mainland China following a significant crackdown on the sector in 2021. However, Hong Kong has been gradually positioning itself as a regulated crypto hub to rival places like Dubai and Singapore. It remains uncertain whether mainland Chinese investors will be permitted to invest in cryptocurrencies via the ETFs.

Hong Kong’s regulatory steps come in the wake of U.S. securities regulators greenlighting the trade of spot bitcoin ETFs, attracting billions of dollars in inflows.

A bitcoin ETF enables investors to gain exposure to the asset’s price movement without needing to own the underlying cryptocurrency. Many analysts believe ETFs will pave the way for more traditional investors to enter the crypto market.

Hong Kong is poised to become one of the first jurisdictions globally to approve an ether ETF. The U.S. Securities and Exchange Commission has yet to approve such a product, and asset managers informed CNBC last week that they do not anticipate regulatory approval in the near term.

BTCUSDT: Hong Kong Grants Initial Approval for First Bitcoin and Ether Spot ETFs, Funds Report

The Hong Kong Government finally approved Bitcoin and Ether Spot ETF Funds last day. This is welcome thing for Investors to invest in Crypto assets in a safer way to invest like Financial markets.

Hong kong set to have collaboration with Singapore and Dubai for developments of this crypto hub channels in coming months.

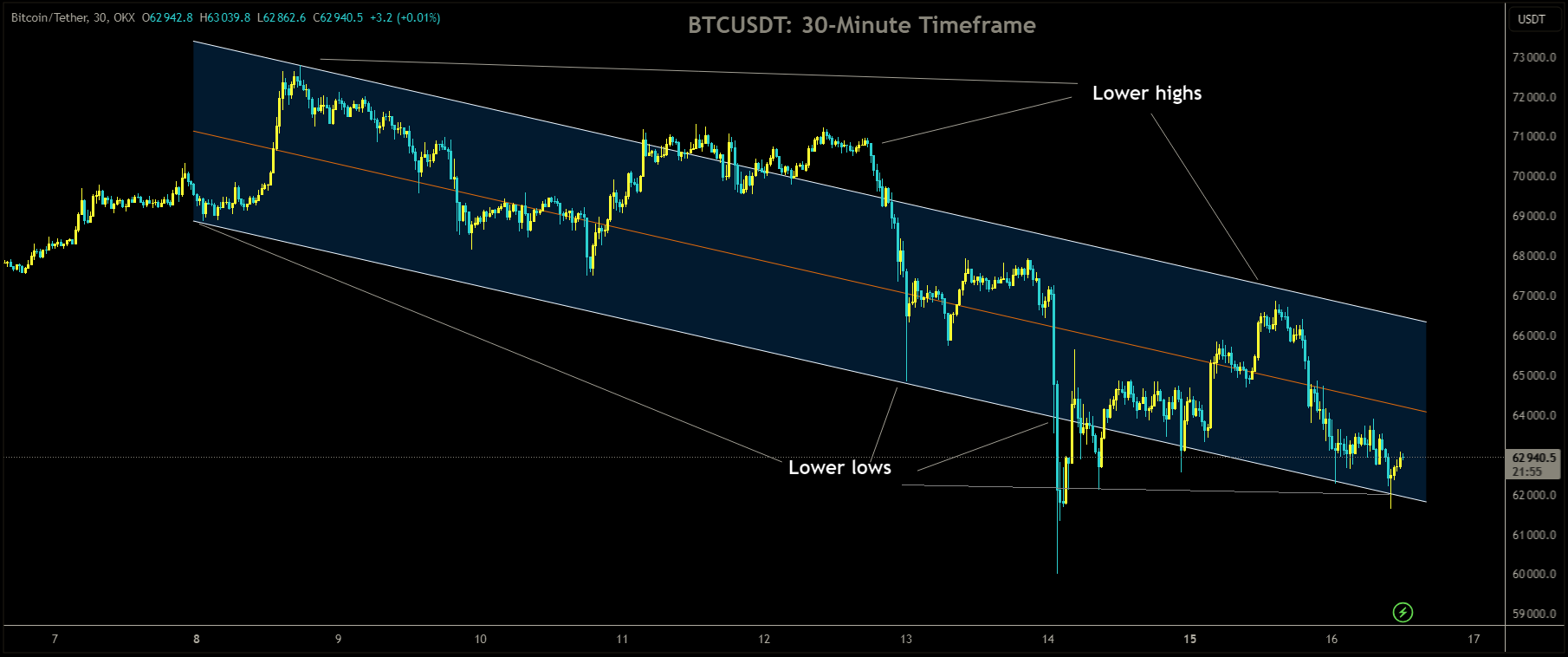

BTCUSDT is moving in Descending channel and market has rebounded from the lower low area of the channel

Hong Kong Conditionally Approves First Bitcoin and Ether Spot ETFs, Paving the Way for Mainstream Cryptocurrency Investment

On Monday, money managers announced that Hong Kong has conditionally approved its first spot bitcoin and ether exchange-traded funds (ETFs), signaling the city’s readiness to embrace cryptocurrencies as a mainstream investment avenue in Asia.

Several offshore Chinese asset managers are gearing up to launch the virtual asset spot ETFs imminently.

The Hong Kong units of Harvest Fund Management and Bosera Asset Management disclosed in separate statements that they have secured conditional approvals from the Hong Kong Securities and Futures Commission (SFC) to introduce the ETFs.

Meanwhile, China Asset Management’s Hong Kong unit, ChinaAMC (HK), revealed that it obtained regulatory clearance on Monday to offer virtual asset management services and is actively developing spot ETFs for bitcoin and ether.

In response to queries from Reuters, the SFC explained that it issues a conditional authorization letter for an ETF application if it generally meets its requirements, subject to various conditions such as fee payments, document filings, and approval from the Hong Kong Stock Exchange (HKEX) for listing.

The regulator refrained from commenting on the specifics of virtual asset spot ETFs.

This development comes just three months after the United States launched its first ETFs to track spot bitcoin, which have already attracted approximately $12 billion in net inflows.

While mainland China has banned cryptocurrency, Hong Kong has been positioning itself as a global digital asset hub to enhance its appeal as a financial center.

Bosera Asset Management (International) emphasized in its statement, The introduction of the virtual asset spot ETFs not only provides investors with new asset allocation opportunities but also reinforces Hong Kong’s status as an international financial center and a hub for virtual assets.

Bosera will collaborate with Hong Kong-based HashKey Capital to launch its product. Virtual asset spot ETFs in Hong Kong will introduce an “in-kind” subscription mechanism, enabling investors to purchase ETF shares directly using bitcoin or ether, Bosera added.

Chinese financial institutions, grappling with underperforming Chinese equity markets in recent years, have shown keen interest in participating in crypto asset development in Hong Kong.

The conditional approval aligns with Harvest Global’s objective of fostering industry innovation and meeting diverse investor demand, stated Harvest Global Investments CEO Han Tongli.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/