BTCUSDT: Bloomberg: Spot Bit coin and Ether ETF Approval Expected in Hong Kong by Monday

The Honkong is going to Approve Bitcoin and Etheream ETFs on Exchange soon this week. If Approval comes then China investors has easy to participate in Crypto assets.

Reports from Bloomberg suggest that anticipation is growing in Hong Kong, where the approval of ETF products could mark a significant milestone with potential repercussions for crypto currency markets.

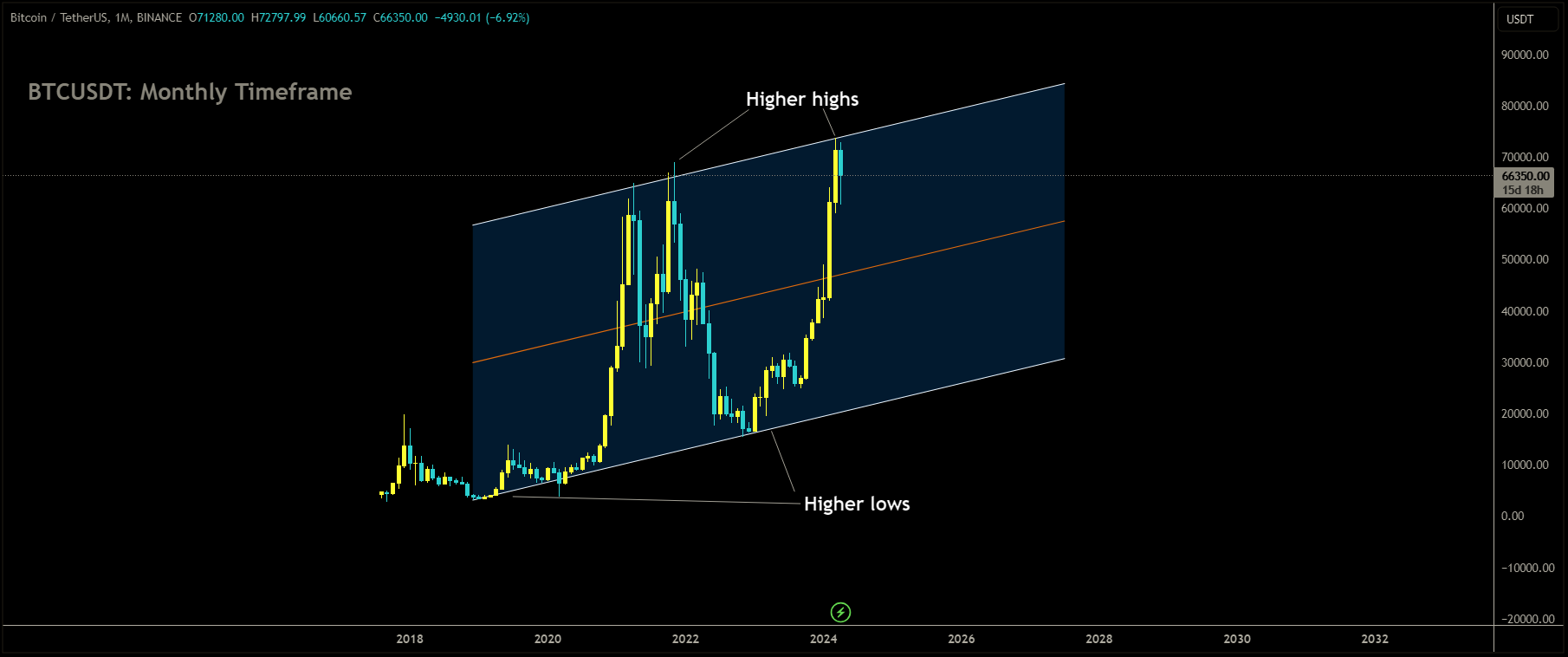

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

Citing sources familiar with the matter, Bloomberg indicates that as early as Friday, Hong Kong may give the green light for spot Bitcoin and Ether ETFs. Trading of these ETFs could commence by the end of the month, although the approval timeline remains subject to potential adjustments.

The spotlight is on spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds, which could receive approval in Hong Kong as soon as Monday. Pending finalization of listing details with Hong Kong Exchanges & Clearing (HKEX), these ETFs could be available for trading by the month’s end. Harvest Global Investments, Bosera Asset Management (International) Co., and HashKey Capital are prominent contenders vying for approval.

It’s essential to note the fluidity of the approval timeline, which could undergo revisions. The anticipated approval of ETF products in Hong Kong is expected to be a pivotal catalyst for cryptocurrency markets and could position the city as a key digital asset hub in Asia.

In contrast, while the U.S. approved spot Bitcoin ETFs in January, fueling a significant price surge that drove Bitcoin to $73,000, Ether ETFs are yet to receive approval. Expectations for spot Ether ETF approval in the U.S. remain muted.The Securities and Futures Commission (SFC), Hong Kong’s market regulator, has refrained from commenting on the matter. Requests for comments from Harvest Global Investments, Bosera Asset Management, HashKey, and HKEX were unanswered as of Friday’s business hours.

BTCUSDT: Bitcoin Rebounds Ahead of Hong Kong’s Spot ETF Decision

The Hong Kong is going to Approve Bit coin and Etheream ETFs on Exchange soon this week. If Approval comes then China investors has easy to participate in Crypto assets.

Exploring Bitcoin’s Rally Amid Global Tensions

In the wake of recent geopolitical turbulence, Bitcoin has surged past $65,000, signaling a robust resurgence in investor confidence. This upward momentum is mirrored by Ethereum, which has also seen a notable recovery, now trading above $3,100. The financial world is abuzz with anticipation as Hong Kong nears the introduction of Bitcoin ETFs, a move poised to redefine digital asset accessibility for regional investors.

BTCUSDT is moving in Descending channel and market has rebounded from the lower low area of the channel

Cryptocurrency’s Resilience During Conflict

Over the weekend, the cryptocurrency market faced a downturn, with Bitcoin briefly dipping below $62,000 in response to escalating geopolitical tensions. Iran’s significant drone and missile offensive against Israel triggered market volatility, though the situation de-escalated thanks to effective air defenses. The United States’ decision not to participate in an Israeli counteroffensive further eased investor concerns, reducing the likelihood of immediate military engagement.

The Allure of Digital Gold

Following Iran’s attack, the crypto markets witnessed a flight to security, notably towards PAXG—a digital asset backed by gold and created by Paxos—which traded at a significant premium. This shift underscores digital assets’ unique role in modern investors’ portfolios, offering a safe haven during times of uncertainty.

External Pressures and Cryptocurrency Market Dynamics

Before the geopolitical events, the digital asset sector faced significant selling pressure, exacerbated by the U.S. tax season. This period typically tightens dollar liquidity, a scenario that Arthur Hayes believes could trigger a severe crypto sell-off, particularly coinciding with the halving event that traditionally impacts market dynamics.

A Pivotal Moment: Anticipation of ETFs in Hong Kong

The spotlight, however, is on Hong Kong’s potential approval of Bitcoin and possibly Ethereum ETFs. This development is eagerly anticipated, with Matrixport projecting these financial instruments could generate up to $25 billion in new demand. Such an influx promises to broaden the investor base and offer a streamlined avenue for digital asset exposure, particularly in the Chinese market.

In Conclusion

As Bitcoin and Ethereum navigate through geopolitical and economic uncertainties, their resilience and Hong Kong’s evolving regulatory landscape signal a potentially transformative phase for digital assets. The market’s response underscores the intricate interplay between global events and cryptocurrency dynamics, highlighting the sector’s growing maturity and expanding horizons for investors.

BTCUSDT: Hong Kong Drives Crypto Growth with New Bitcoin ETFs

The Hong Kong is going to Approve Bit coin and Etheream ETFs on Exchange soon this week. If Approval comes then China investors has easy to participate in Crypto assets.

Hong Kong Paves the Way for Crypto Market Growth with New Bitcoin ETFs

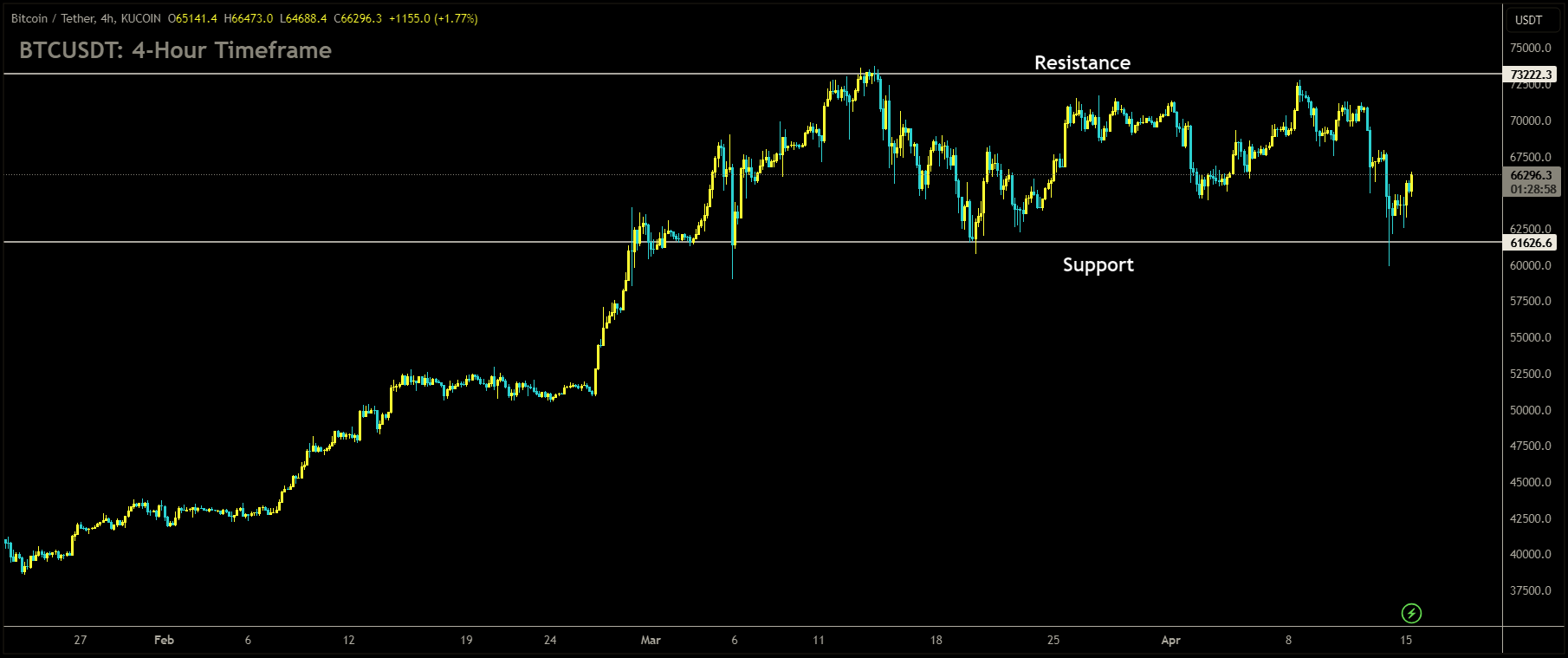

BTCUSDT is moving in box pattern and market has rebounded from the support area of the pattern

Hong Kong is gearing up for a significant uptick in the cryptocurrency market with the imminent introduction of spot Bitcoin exchange-traded funds (ETFs).

Regulators in the city are fast-tracking approvals, with Reuters reporting that announcements could come as early as next week. This move is poised to elevate Hong Kong’s stature as a financial powerhouse by enticing traditional financial institutions and investors into the rapidly expanding crypto sector. Bitcoin’s value has surged by approximately 60% this year, surpassing $70,000, adding to the allure of these ETFs.

Leading the charge to launch these ETFs are several Chinese asset management firms. Value Partners, based in Hong Kong, announced in January their partnership with Venture Smart Financial Holdings to introduce a Bitcoin ETF. Similarly, Bosera Asset Management from Shenzhen and HashKey Capital have formed a collaboration focused on virtual asset spot ETFs. Additionally, China Asset Management and Harvest Fund Management have secured regulatory approval to manage portfolios with substantial virtual asset investments.

Major banks are also jumping on board to support the distribution of crypto ETFs in Hong Kong. HSBC was the first to include crypto ETFs in its offerings in June 2023, followed by UBS in November, enabling clients to invest in Bitcoin and Ether-related ETFs. Notable crypto-related products already available on the Hong Kong stock exchange include the CSOP Bitcoin Futures ETF and the Samsung Bitcoin Futures Active ETF.

The launch of spot ETFs is part of Hong Kong’s broader strategy to establish itself as a hub for digital assets. This effort was bolstered by the implementation of a virtual asset licensing regime in June 2023. The city aims to rival the United States, which approved its first 11 spot Bitcoin ETFs in January. Gerald Goh, co-founder of Sygnum, emphasizes the importance of adapting traditional financial structures to facilitate crypto investments, enabling broader investment through funds rather than direct purchases by individuals.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/