BTCUSDT: Mt.Gox’s $7B Bitcoin Transfer Triggers Price Plunge

MT. Gox World Famous Bitcoin exchange was closed in 2014 due to hacking of more Bitcoins from their customer Wallet. Now This exchange said holding Bitcoin of Creditors will recieve as Bitcoin in the Wallet by October 31, 2024. This Value of Bitcoin is $7Billion and 107000 Bitcoins is going to transfer from MT. Gox exchange to New Address and there from Customer Wallets instead of Selling in the Open Market. Due to this news Bitcoin shed 1.7% for caution at the all time high of $70K. Incase Customers sell in the Open market it created small drop in the Bitcoin Market.

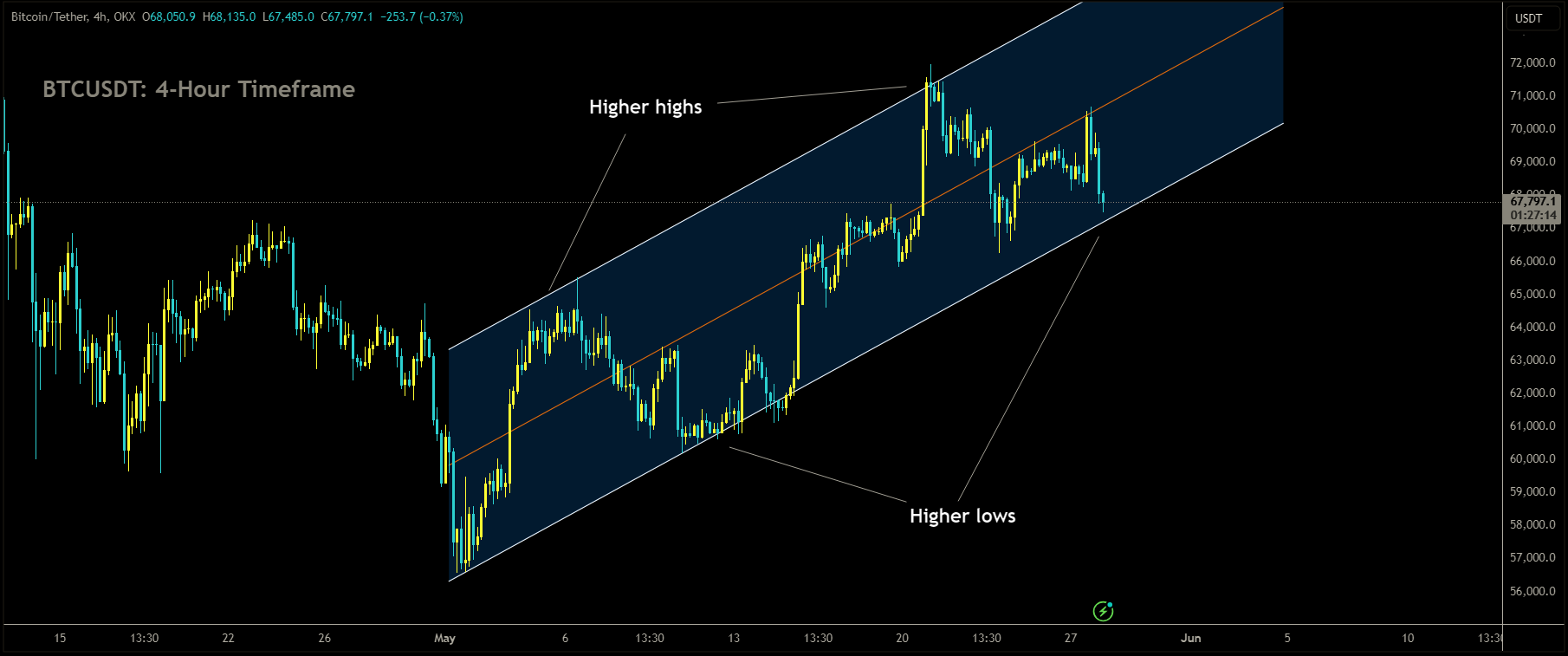

BTCUSDT is moving in Ascending channel and market has reached higher high area of the channel

Over 107,000 Bitcoin (BTC), valued at approximately $7 billion, were moved from wallets associated with Mt. Gox to an undisclosed address in thirteen separate transactions. This significant transfer has raised speculation that it could be part of a larger plan to repay creditors by October 31, 2024.

Mt. Gox, once the largest Bitcoin exchange globally, shuttered its operations in 2014 following a massive hack that resulted in the loss of hundreds of thousands of bitcoins. Since then, creditors have awaited the repayment of their holdings, a process that is widely expected to exert selling pressure on Bitcoin markets.

The transactions were conducted over thirteen separate movements, starting early on Tuesday during Asian trading hours. Notably, the first transaction, worth only $3, occurred on May 20 as a likely test. Another smaller transaction of $160 was executed early on Tuesday, with the remaining transactions varying in size from $1.2 million to $2.2 billion worth of Bitcoin.

This movement marks the first transfer of assets from Mt. Gox’s cold wallets in over five years and is perceived to be part of a broader strategy to redistribute the assets back to creditors before the October 31 deadline. All coins have been relocated to a new address, “1JbezDVd9VsK9o1Ga9UqLydeuEvhKLAPs6,” according to Julio Moreno, head of research at CryptoQuant.

Alex Thorn, head of research at Galaxy, suggested that most of the transferred bitcoins are likely to be held by creditors rather than being immediately sold on the open market.

Despite this expectation, market sentiment turned bearish following the movements, with Bitcoin shedding 1.4% since the commencement of Asian trading hours. The price dropped to as low as $67,680 after reaching a high of over $70,000 on Monday.

BTCUSDT: Mt. Gox shifts $2.9B Bitcoin after five years

In 2014, Mt. Gox, a globally renowned Bitcoin exchange, was forced to close its operations following a significant hacking incident that resulted in the loss of a substantial amount of Bitcoins from its customers’ wallets. Fast forward to the present, Mt. Gox has announced plans to distribute the Bitcoin holdings to its creditors by October 31, 2024. This amounts to a staggering $7 billion worth of Bitcoin, totaling around 107,000 Bitcoins.

BTCUSDT is moving in Ascending channel and market has reached higher low area of the channel

Rather than opting to sell these Bitcoins on the open market, Mt. Gox has decided to transfer them to a new address. This move aims to ensure that creditors receive their entitled Bitcoin directly from the exchange’s wallets. The decision not to flood the market with these Bitcoins has been made to mitigate any potential negative impact on Bitcoin’s price.

However, news of this transfer has still stirred some caution among investors. Bitcoin experienced a 1.7% drop from its all-time high of $70,000, indicating a degree of apprehension in the market. Should creditors decide to sell their allocated Bitcoins in the open market, it could potentially lead to a slight downturn in Bitcoin’s overall market value.

On Tuesday morning in Asia, Mt. Gox seemingly initiated a transfer of at least 42,830 BTC to an undisclosed address, as reported by data from Arkham Intelligence. This transaction signifies the first movement of assets from Mt. Gox’s wallets in five years.

The value of the transferred BTC is estimated to be around $2.9 billion, sourced from Mt. Gox’s cold wallets, according to Arkham Intelligence. The defunct bitcoin exchange, which infamously collapsed in 2014, executed these transfers in several transactions to an address of unknown ownership by 11:00 am Hong Kong time on Tuesday, according to the data.

This action marks the initial instance in half a decade that Mt. Gox has shifted assets from its wallets. Currently, Mt. Gox retains approximately $9.42 billion worth of bitcoin in wallets identified and monitored by Arkham.

In September 2023, the trustee overseeing Mt. Gox’s affairs announced a 12-month extension of the repayment deadline to October 31, 2024.

Despite these developments, The Block’s request for comment from the Mt. Gox trustee remains unanswered.

Launched in 2010, the Tokyo-based platform rapidly ascended to become the world’s largest bitcoin exchange by 2013, handling 70% of global bitcoin trades. However, in early 2014, it halted all withdrawals and trading operations, ultimately leading to bankruptcy after the loss of over 800,000 bitcoins.

BTCUSDT: Mt. Gox shifts $840M Bitcoin to new wallet

Back in 2014, Mt. Gox, a big Bitcoin exchange, got hacked, and many customers lost their Bitcoins. Now, they’re saying they’ll give back the lost Bitcoins to their customers by October 31, 2024. These Bitcoins are worth a whopping $7 billion, about 107,000 Bitcoins in total.

BTCUSDT is moving in box pattern and market has fallen from the resistance area of the pattern

Instead of selling these Bitcoins, Mt. Gox is moving them to a new place so they can directly give them to the customers. They’re doing this to avoid causing any problems in the Bitcoin market.

But, even though they’re trying to be careful, the news made some people worried. Bitcoin’s price dropped by 1.7% from its highest point of $70,000. People are concerned that if the customers start selling their Bitcoins, it might cause Bitcoin’s price to go down even more.

According to data from Arkham Intelligence, the defunct cryptocurrency exchange Mt. Gox has recently made a significant transfer. They moved 12,240 BTC, which is roughly valued at $840 million, to a new wallet within the last hour. This transfer coincided with a slight drop in Bitcoin’s price, dipping below $68,500 after hitting $70,600 earlier on Monday, as reported by CoinGecko.

This move precedes the repayment deadline set for October 31, with Mt. Gox planning to repay creditors with 142,000 BTC, 143,000 BCH, and 69 billion Japanese yen. Despite this substantial transfer, there remains a considerable balance of around $9.7 billion in the wallet.

Speculation within market circles suggests that such a large release of Bitcoin could prompt a sell-off, potentially affecting Bitcoin’s price negatively. However, experts believe that staunch Bitcoin supporters, known as Bitcoin maximalists, may mitigate the impact of any sell-off.

Established in 2010, Mt. Gox once dominated the cryptocurrency landscape, handling 70% of global Bitcoin transactions. However, its fortunes changed drastically in 2014 when it suffered a severe cyberattack, resulting in significant losses of Bitcoin for both the exchange and its users.

Reports indicated that around 750,000 BTC belonging to customers, along with an additional 100,000 from the exchange’s own holdings, were lost in the attack. While efforts led to the recovery of 200,000 BTC later on, legal complexities in Japan have hindered the restitution process for affected users.

In 2018, the Tokyo District Court approved a rehabilitation petition for Mt. Gox, with trustees voting on a rehabilitation plan in 2021. The plan garnered overwhelming support, with 99% of creditors voting in favor of its implementation.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% OFFER for Trading Signals 😍 GOING TO END – Get now: https://forexfib.com/offer/