NZDUSD is moving in the Rising wedge pattern and the market has fallen from the higher high area of the pattern

New Zealand finds itself at a critical juncture in its economic journey as the central bank contemplates maintaining its overnight cash rate at 5.50%. This decision, expected to mark the fourth consecutive meeting without a rate adjustment, comes in the wake of evolving economic indicators and a backdrop of potential central bank reforms. This comprehensive analysis explores the multifaceted aspects of New Zealand’s current monetary policy landscape, the government’s proposed reforms, and the intricate interplay between economic forces and policy decisions.

Current Monetary Policy Landscape

Inflation Trends and RBNZ’s Response

Inflation, a key determinant of monetary policy, has experienced a slowdown to a two-year low of 5.6% in the third quarter. Despite this deceleration from the previous 6.0%, it remains well above the Reserve Bank of New Zealand’s (RBNZ) target range of 1-3%. This persistent and sticky inflation has provided a compelling rationale for the RBNZ to maintain its current stance and keep the overnight cash rate at 5.50%.

The hawkish bias exhibited by the RBNZ since its decision to tighten monetary policy in October 2021 positions it as a frontrunner among global central banks. The 1-3% target range has become a touchstone for the bank, reinforcing its commitment to price stability. Sharon Zollner, Chief Economist at ANZ, emphasizes the RBNZ’s cautious approach, stating that they are likely to keep all options open, stressing that the next move in rates could be in either direction, and remain in data-dependent mode.

Economic Outlook and Analyst Predictions

A Reuters poll conducted from Nov. 20-23 indicates a unanimous forecast among 28 economists that the RBNZ will hold its official cash rate at 5.50% during the Nov. 29 meeting. ANZ and ASB, two of the largest banks in New Zealand, anticipate this status quo to persist through the end of 2024, echoing a cautious long-term approach. Contrary to this, Westpac forecasts a potential hike in February 2024, but recent fall in headline inflation has prompted a reassessment.

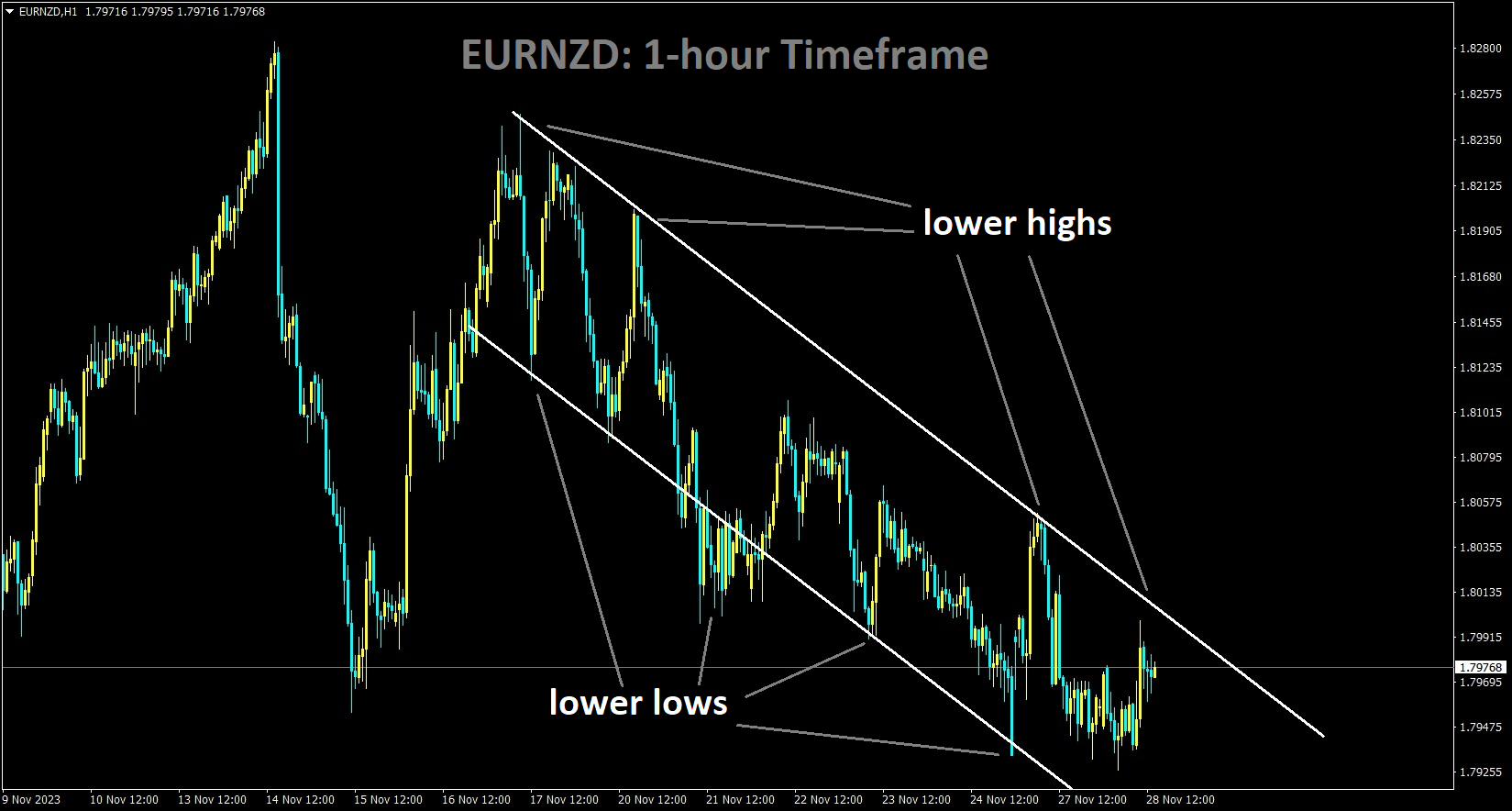

EURNZD is moving in the Descending channel and the market has reached the lower high area of the channel

The median forecast from the poll suggests a possible 25 basis point rate cut to 5.25% in the third quarter, indicative of a nuanced shift in the trajectory. While this adjustment is one quarter later than previously predicted, interest rate futures are pricing in the first cut in July. Notably, the U.S. Federal Reserve is expected to cut rates in the second quarter of 2024, underlining the distinctive approach of the RBNZ in the global context.

Government’s Role in Shaping Monetary Policy

In addition to monitoring economic indicators, attention is turning towards the government’s role in shaping monetary policy. The government, as part of coalition agreements, plans to amend the Reserve Bank of New Zealand Act. The proposed amendments involve removing the existing dual mandate, which includes employment considerations, and potentially introducing time targets for monetary policy. The decision to seek advice on these reforms underscores a potential shift in the dynamics of the central bank-government relationship.

Central Bank Reforms: An In-Depth Analysis

Historical Context and Dual Mandate

To understand the proposed reforms, it is crucial to delve into the historical context. The dual mandate, introduced in 2018 by the Labour Party-led administration, expanded the Reserve Bank’s responsibilities beyond a sole focus on inflation. Employment considerations were integrated into the mandate, necessitating a more comprehensive approach to monetary policy. This shift marked a departure from the previous model where interest rate decisions rested solely with the governor.

Additional Reforms and Political Landscape

The current government, led by the center-right National Party, campaigned on returning the RBNZ to a single mandate, emphasizing the importance of curbing inflation. Additional reforms have emerged from coalition negotiations with the ACT Party and New Zealand First. The proposed changes include potential time targets for monetary policy, revisiting the presence of the Treasury Dept. observer on the Monetary Policy Committee, and a return to a single decision-maker model.

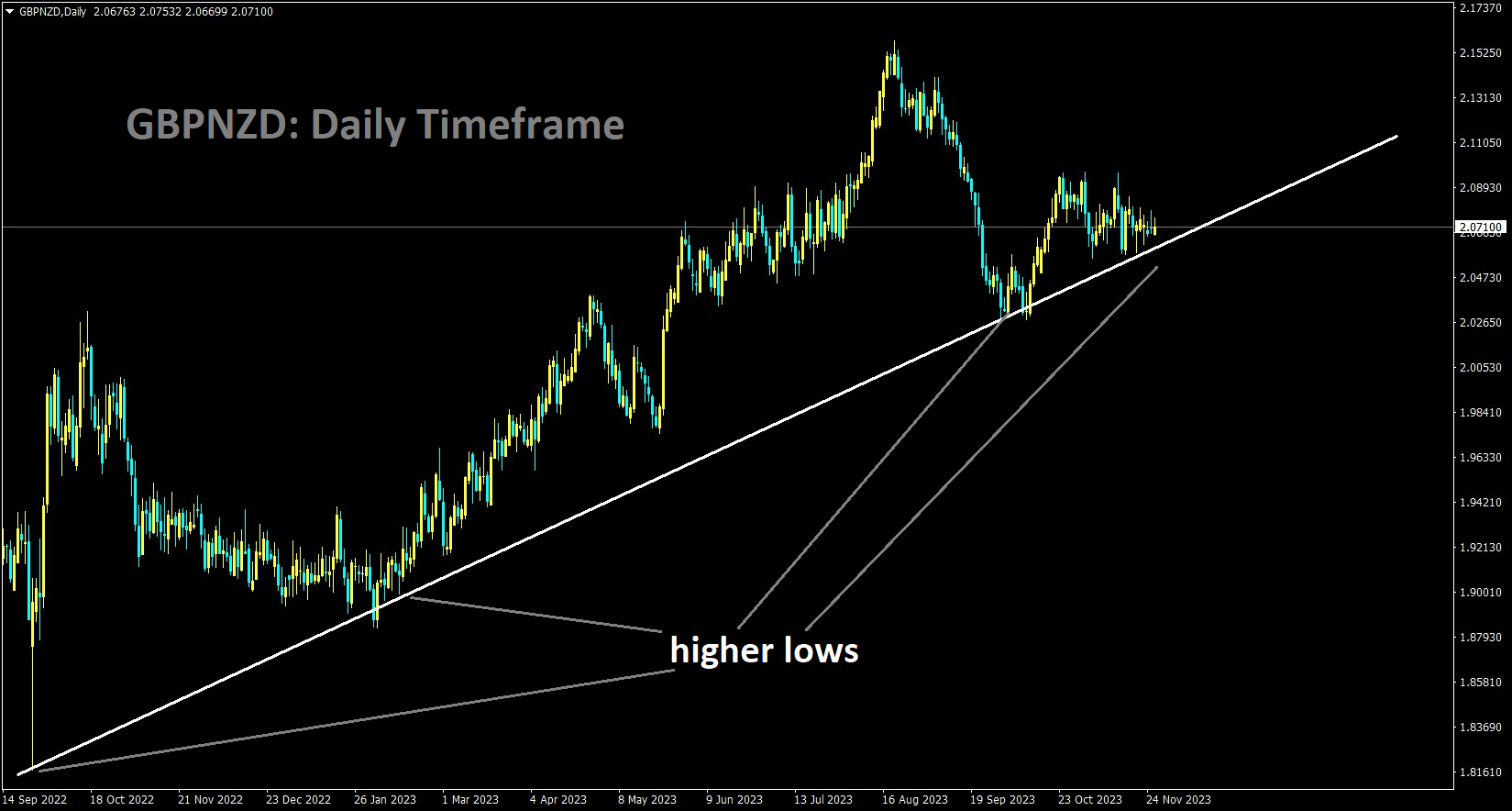

GBPNZD is moving in the Up trend line and the market has reached the higher low area of the trend line

The urgency expressed by the ACT Party leader, David Seymour, suggests a swift legislative process. These proposed reforms challenge the changes implemented by the previous Labour Party-led administration. The Reserve Bank’s autonomy is evident in its reluctance to support changes that specify a time-frame for achieving inflation targets, reinforcing its commitment to maintaining flexibility in policy decisions.

Market Reaction and RBNZ’s Stance on Reforms

Market sentiment reflects a consensus that the RBNZ will maintain its cash rate at 5.50%. However, the potential reforms introduce an element of uncertainty. The RBNZ, as an independent institution, has expressed its stance on not providing comments on current or hypothetical government policies. It remains steadfast in its commitment to a flexible approach to achieving and maintaining the inflation target, underscoring the delicate balance between government directives and central bank autonomy.

Economic Indicators and Retail Spending

Retail Spending Trends and Monetary Policy Implications

Real retail sales in New Zealand, a key economic indicator, showed stability in the September quarter. When adjusted for price movements, retail spending remained unchanged, a notable improvement from the prior quarter’s 1% decline.

NZDCAD is moving in an Ascending channel and the market has reached the higher low area of the channel

This stabilization aligns with the prevailing belief that the RBNZ will maintain its rates during its November monetary policy decision.

Population Growth and Per-Capita Spending Analysis

While real retail sales demonstrate stability, a closer examination reveals the impact of population growth. New Zealand’s population grew by 3% over the past year, indicating that per-capita spending has been weak. This weakness is attributed to the RBNZ’s decision to implement restrictive monetary measures, aiming to temper demand and bring inflation within the annual target band of 1-3%.

Despite the RBNZ’s history of surprising markets, economists and markets are unified in their belief that the November meeting will see no adjustment to the cash rate. The consensus among economists extends to a projection of rate stability until the third quarter of 2024, indicating a cautious optimism for the future.

Market Response and External Factors

The NZDUSD currency pair’s muted response to the latest retail spending data indicates a stable market environment. This stability is attributed to the quiet conditions surrounding the US Thanksgiving holiday and the understanding that domestic interest rates are unlikely to undergo significant changes. The focus remains on external factors determining the currency pair’s direction, emphasizing the intricate interplay between global and domestic forces.

Conclusion

In conclusion, New Zealand stands at the crossroads of economic decision-making, with the RBNZ navigating a landscape defined by inflationary pressures and potential central bank reforms.

AUDNZD is moving in the Box pattern and the market has rebounded from the support area of the pattern

The commitment to maintaining the overnight cash rate at 5.50% reflects a cautious approach, rooted in the persistent and sticky nature of inflation. Simultaneously, the government’s proposed reforms introduce a layer of complexity, challenging the existing dual mandate and advocating for a return to a singular focus on inflation.

As New Zealand charts its course in the coming months, the delicate balance between government directives and central bank autonomy will shape the trajectory of monetary policy. The proposed reforms, if enacted, could redefine the dynamics of the central bank’s role. With economic indicators, retail spending trends, and external factors in play, the landscape is dynamic, and careful navigation is essential to foster sustainable economic growth while addressing inflation concerns.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/