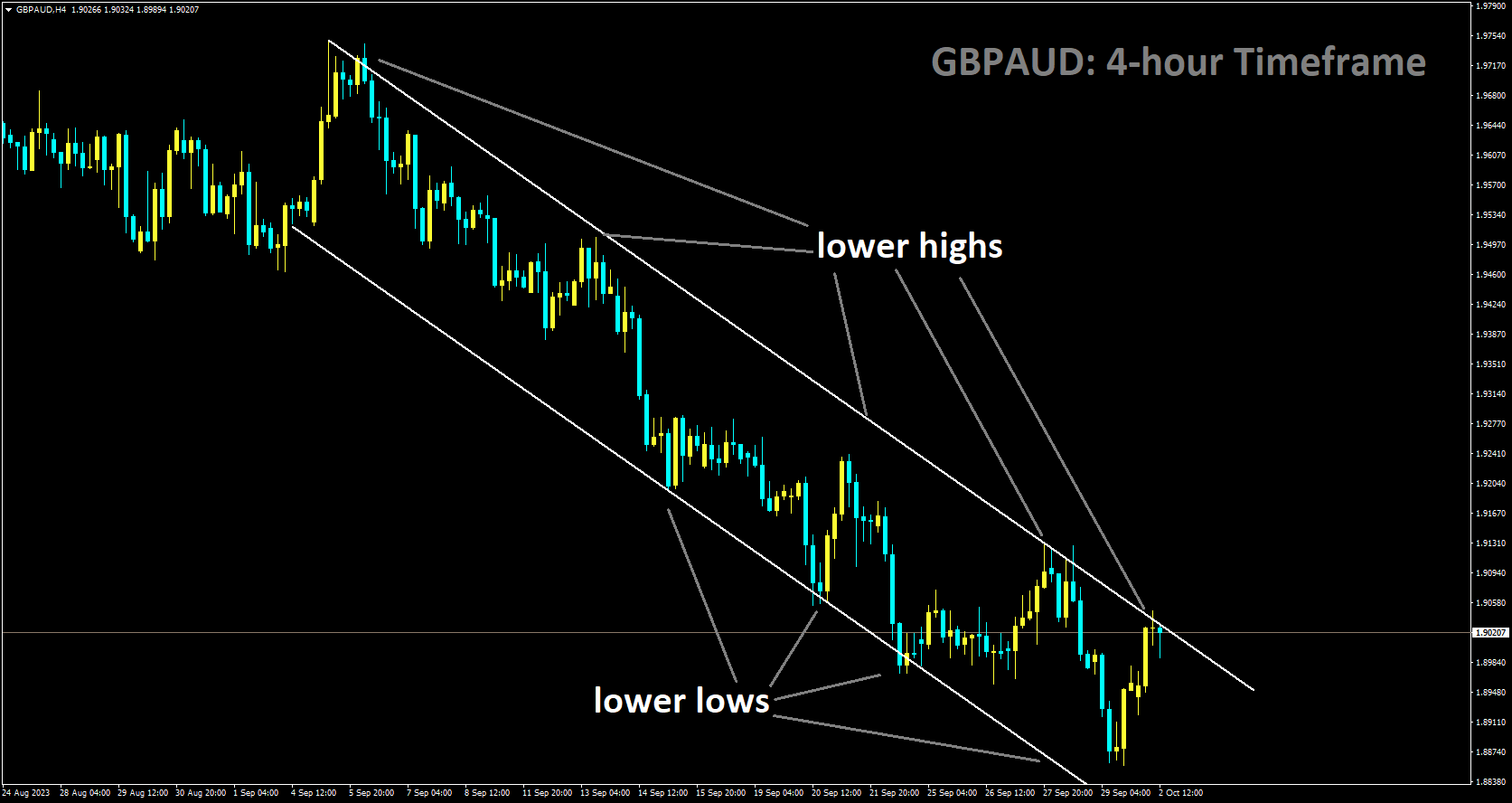

GBPAUD is moving in Descending channel and market has reached lower high area of the channel

The Reserve Bank of Australia faces a critical juncture as it grapples with the challenge of managing interest rates in the midst of rising inflationary pressures and surging global oil prices. This in-depth analysis explores the multifaceted aspects of the RBA’s upcoming rate decision, delving into the context, implications, and expert opinions surrounding this crucial event.

Inflationary Pressures and Oil Prices

Inflation Hits 5.2% in August

Inflation has emerged as a significant concern for the Australian economy, with the latest data revealing a sharp uptick. In August, the inflation rate surged to 5.2%, marking a substantial increase from the previous month’s figure of 4.9%. This acceleration in inflation can be attributed to a range of factors, including rising costs in key sectors such as housing, transportation, and services.

Australia’s inflation rate, which had previously been relatively subdued, has now surpassed the upper bound of the RBA’s target range of 2% to 3%. Such elevated inflation levels raise questions about the central bank’s response and its ability to steer the economy towards its mandated target.

Rising Oil Prices and Global Impact

One of the critical drivers of inflation and a significant concern for the RBA is the surge in global oil prices. Brent crude oil prices have climbed steadily and approached the $100 per barrel mark, registering a remarkable 26% increase over the past quarter. The primary contributors to this price escalation are supply cuts implemented by OPEC+ oil producers and a resurgence in global demand.

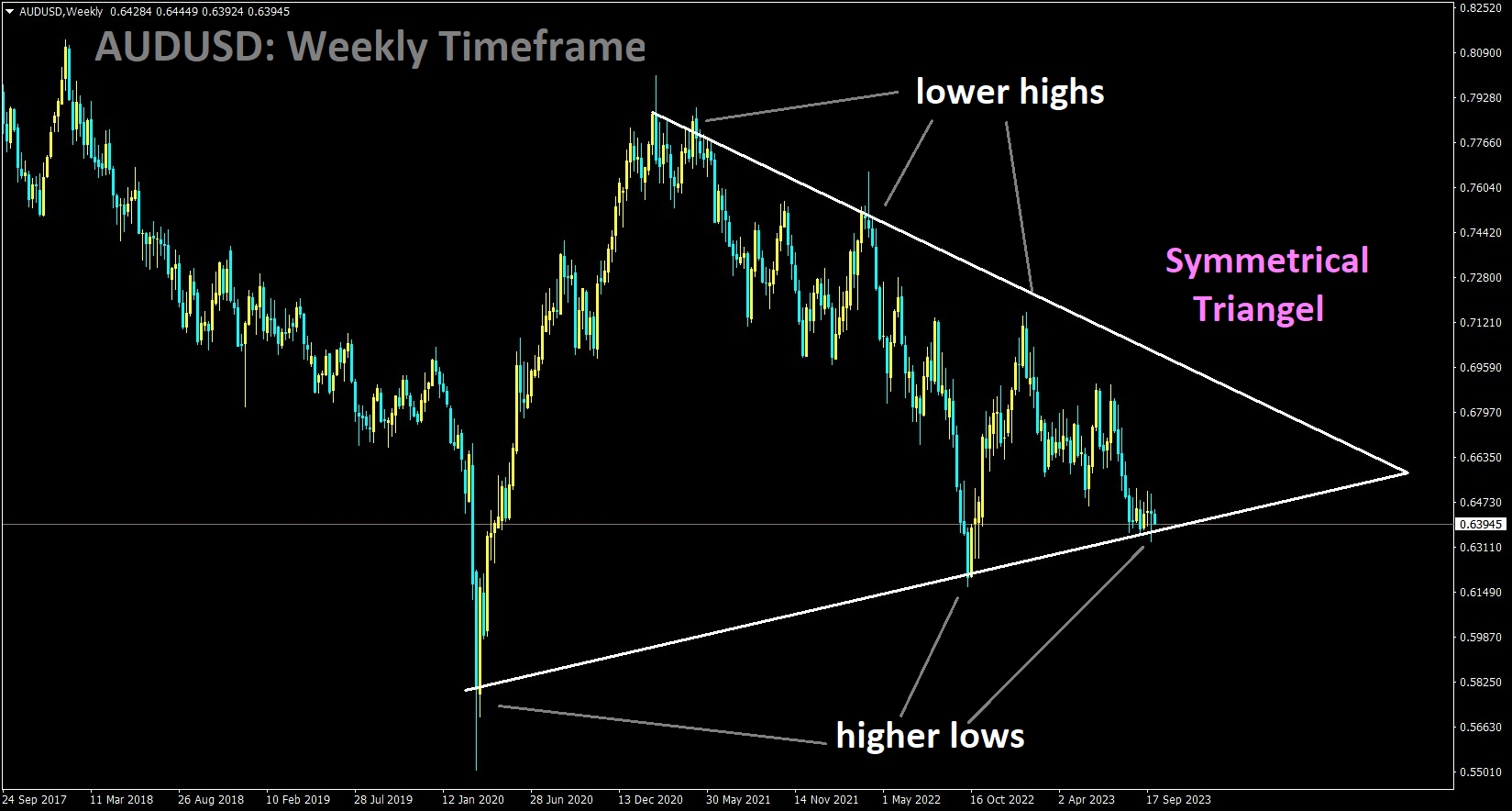

AUDUSD is moving in the Symmetrical triangle pattern and the market has reached the bottom area of the pattern

The significance of higher oil prices extends far beyond the fuel pump. It has a cascading effect throughout the economy, impacting industries ranging from transportation to manufacturing. These cost increases can result in higher production expenses, which, in turn, may lead to inflationary expectations across the board. This complicates the RBA’s task of managing inflation while maintaining economic stability.

The RBA’s Response: Balancing Act in Uncertain Times

Rate Hikes and Their Delayed Impact

The RBA has already embarked on a series of 12 interest rate hikes since May of the previous year, aimed at taming inflationary pressures and stabilizing the economy. However, it’s crucial to understand that changes in interest rates typically take a considerable amount of time, usually 12 to 18 months, to fully permeate through the economy, affecting households, businesses, and financial markets.

This time lag between policy action and its effects presents a challenge for central banks like the RBA. It necessitates a forward-looking approach, where policymakers must anticipate future economic conditions and make adjustments accordingly.

Expert Opinions: Divergent Views

Economists and financial experts offer diverse perspectives on the RBA’s future course of action:

Judo Bank Chief Economist’s Perspective: Warren Hogan suggests that the RBA might need to implement another 0.25 percentage point rate hike to exert control over mounting price pressures. This viewpoint aligns with the need to stay ahead of inflation and meet the central bank’s target.

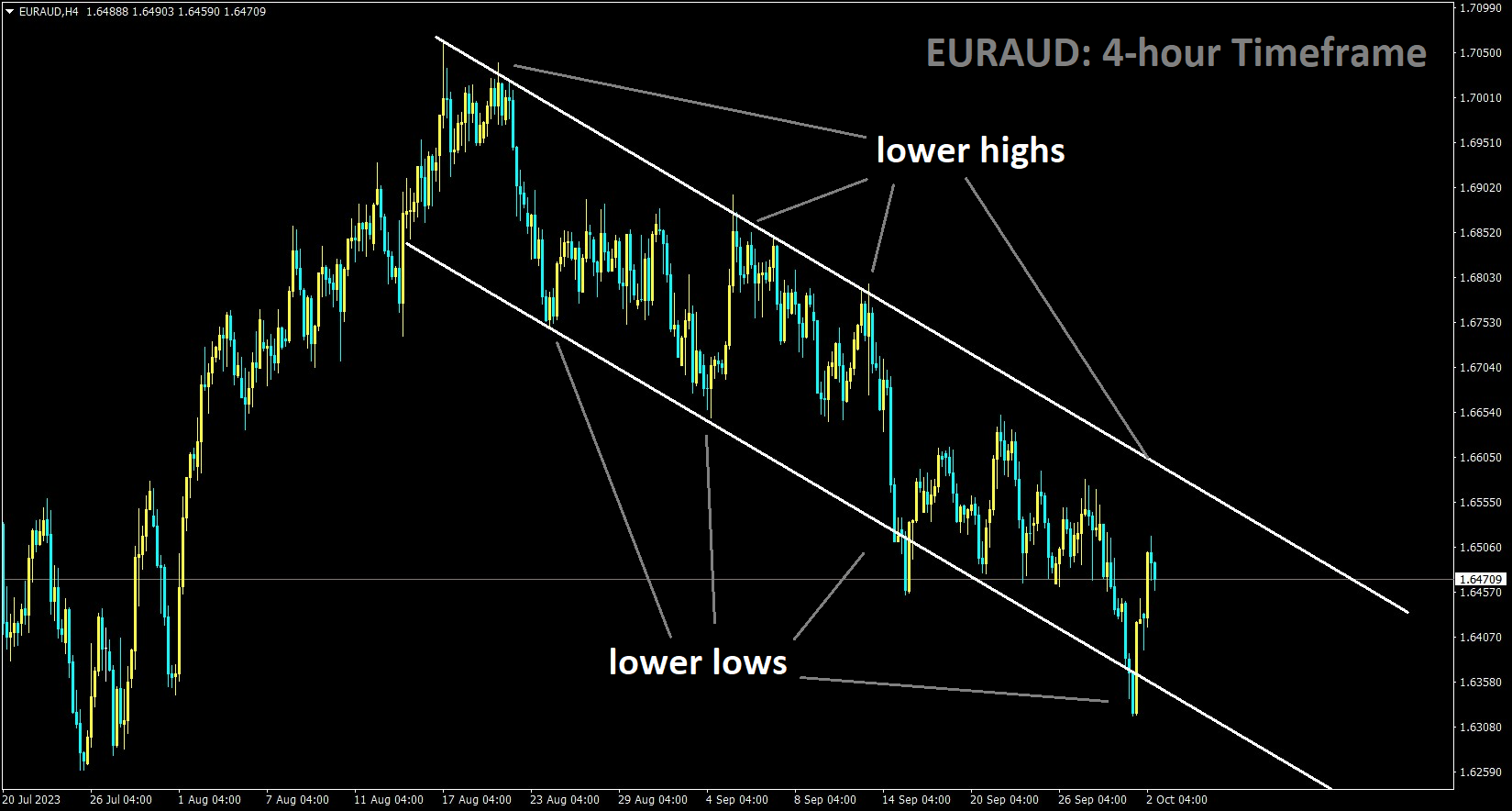

EURAUD is moving in the Descending channel and the market has rebounded from the lower low area of the channel

Financial Markets’ Anticipation: Financial markets both in Australia and internationally are increasingly factoring in an extended period of elevated interest rates. The Commonwealth Bank, for instance, has revised its forecast, pushing back the anticipated timing for the RBA’s first rate cut to May 2024.

Treasurer’s Caution: Jim Chalmers, Australia’s Treasurer, underscores the impact of the already implemented 400 basis points of rate hikes. He emphasizes that the RBA’s decision should not be solely influenced by the August inflation data but should consider broader economic implications.

These divergent views reflect the complexity of the situation and the uncertainty surrounding the future path of interest rates in Australia.

Governor Michele Bullock’s Influence: A New Era

This upcoming RBA meeting holds particular significance as it marks the first board meeting under the leadership of Michele Bullock, who has recently been appointed as the governor of the RBA. Governor Bullock’s approach to managing inflation, her stance on interest rates, and her strategies to navigate the current economic challenges will be closely scrutinized.

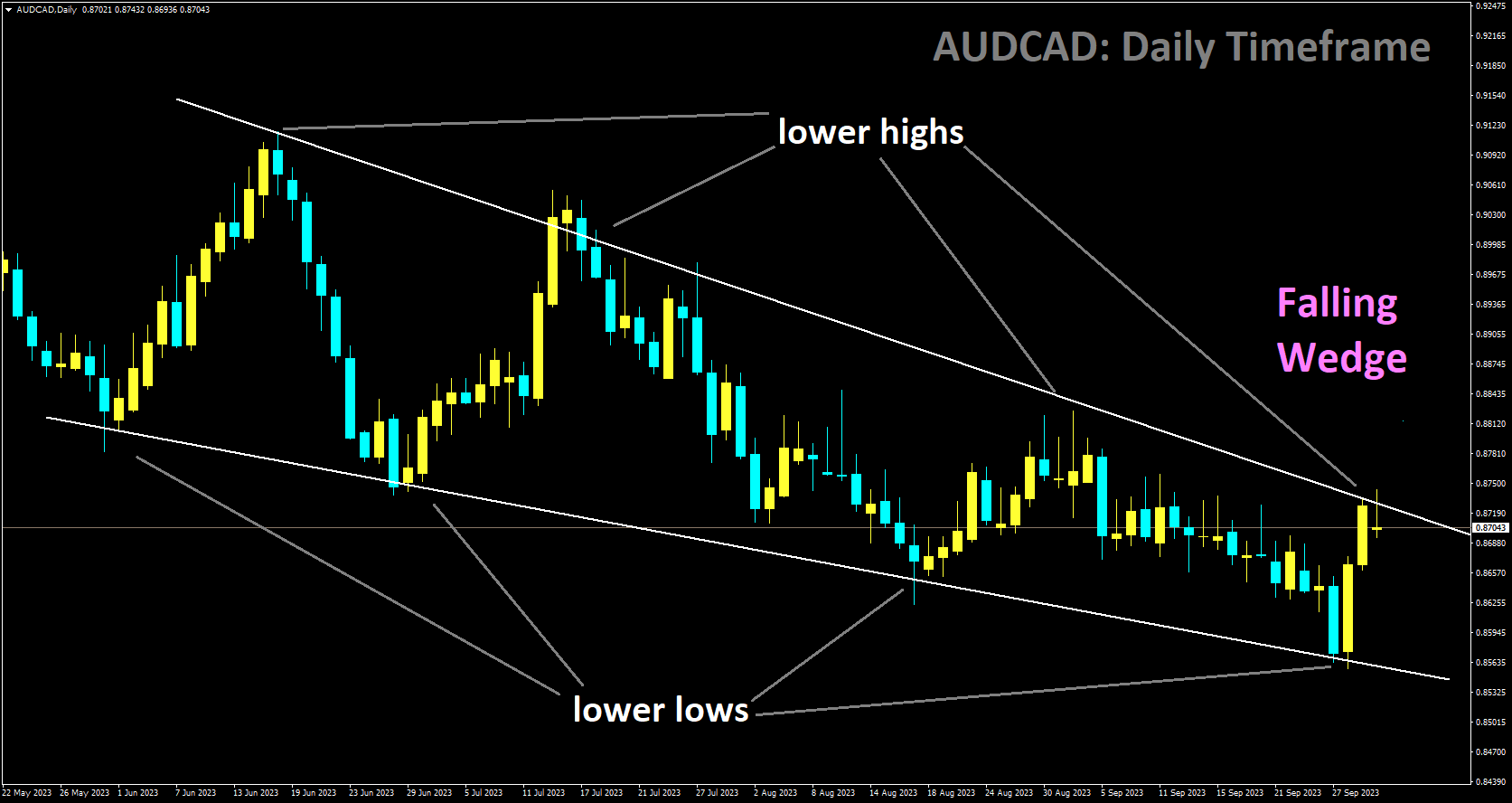

AUDCAD is moving in falling wedge and market has reached lower high area of the pattern

Governor Bullock inherits a challenging economic landscape characterized by rising inflation, global uncertainties, and the need for prudent monetary policy. Her leadership and decision-making will play a pivotal role in shaping Australia’s economic trajectory in the coming months.

Balancing Act for the RBA: Competing Forces and Complex Decisions

The RBA finds itself in a precarious position, where it must carefully balance several competing forces and considerations:

Decelerating but Sticky Inflation: The central bank must address the challenge of decelerating inflation while recognizing that certain inflationary pressures, particularly those in labor-intensive sectors, remain stubbornly high. These sticky price increases often accompany wage growth.

Delayed Impact of Previous Rate Hikes: The RBA’s decision-making is also influenced by the fact that the effects of the 12 previous rate hikes are still in the process of flowing through the economy. The bank must gauge the full extent of these impacts before making further adjustments.

Fixed-Rate Mortgage Cliff: Another factor that warrants consideration is the current landscape of fixed-rate mortgages. The RBA needs to evaluate how these fixed-rate mortgages, along with rising house prices, affect the broader economy.

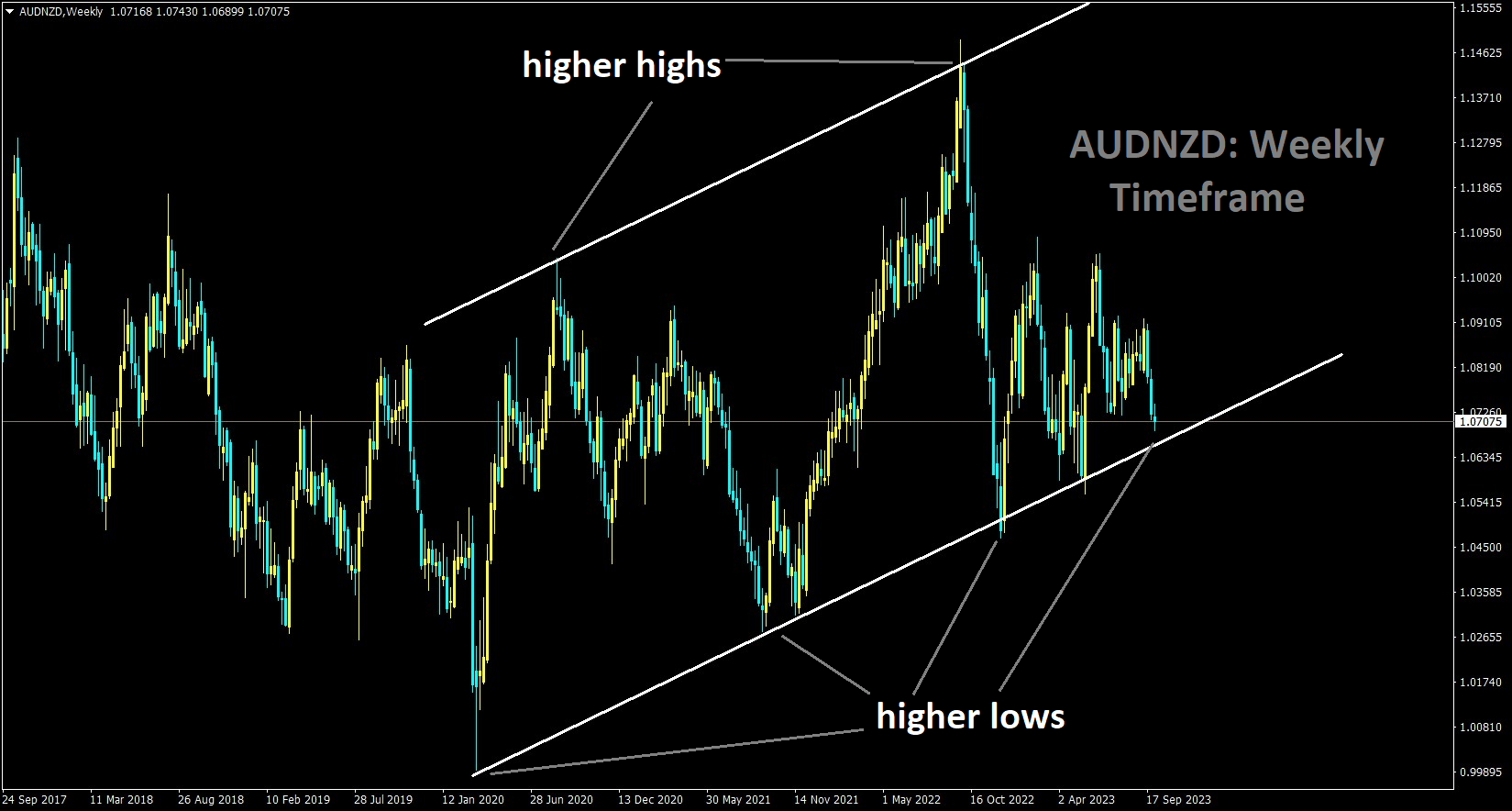

AUDNZD is moving in an Ascending channel and the market has reached the higher low area of the channel

External Economic Risks: The RBA must also monitor external economic factors, including the state of China’s economy, Australia’s largest trading partner. Economic developments in China can have a direct impact on Australia’s economic outlook.

Conclusion: Implications and Outlook

As Australia grapples with the challenge of rising inflation and escalating global oil prices, the Reserve Bank of Australia faces a pivotal moment in its monetary policy decisions. Economists and experts are divided on the timing and necessity of further rate hikes, reflecting the complexity of the economic landscape.

The decision taken by Governor Michele Bullock and the RBA in this critical juncture will have far-reaching implications for households, businesses, and the broader Australian economy. The central bank’s ability to strike a balance between taming inflation and ensuring economic stability will shape the nation’s economic trajectory for the foreseeable future.

It is essential to remain vigilant and closely monitor the RBA’s decisions and their repercussions as the Australian economy navigates these challenging and uncertain times. The central bank’s actions will undoubtedly play a pivotal role in shaping the nation’s economic path in the coming months and years.

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/