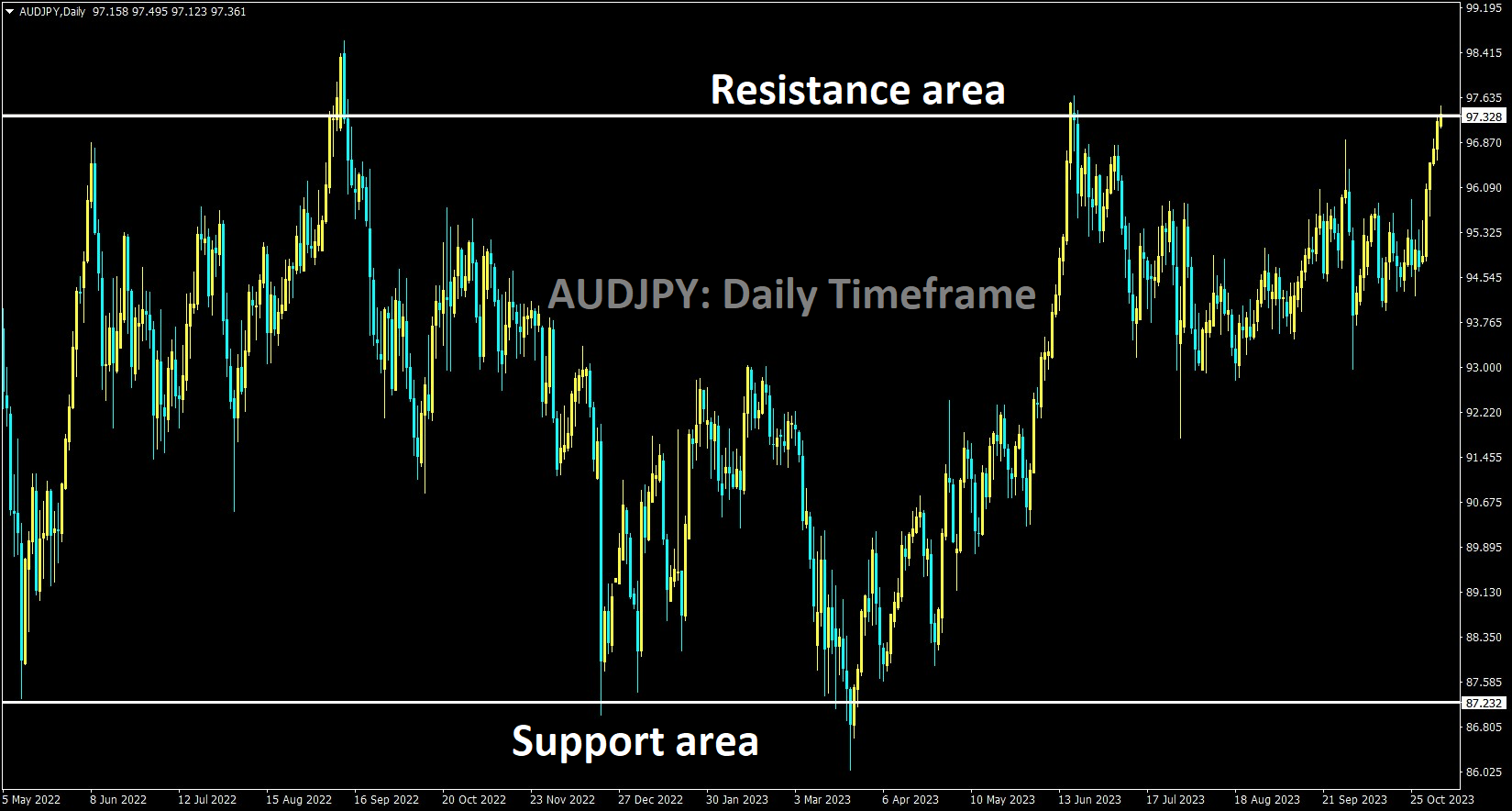

AUDJPY is moving in the Box pattern and the market has reached the resistance area of the pattern

The Reserve Bank of Australia (RBA) is on the brink of a significant policy decision. After keeping its key policy rate steady at record-low levels for an extended period, there is a growing consensus that the RBA is poised to raise interest rates by 25 basis points to 4.35% in the near future. This decision comes in response to unexpected inflationary pressures that have caught policymakers off guard, setting the stage for a potential shift in Australia’s monetary policy landscape. In this comprehensive analysis, we will delve into the factors leading to this anticipated rate hike, its potential impact on the economy, and the broader implications for borrowers, consumers, and investors.

Inflation Surprises and Policy Response

Inflation Catching Policymakers Off Guard

Inflation is a critical economic indicator that central banks closely monitor to maintain price stability and support economic growth. In Australia, inflation had been relatively subdued for an extended period, prompting the RBA to maintain historically low interest rates to stimulate economic activity. However, recent inflation data has taken policymakers by surprise. In the last quarter, inflation surpassed expectations, creating a complex challenge for the RBA.

The unexpected surge in inflation can be attributed to various factors, including rising global commodity prices, supply chain disruptions, and increased consumer demand. These inflationary pressures have created a dilemma for the RBA, as it must balance its mandate to maintain inflation within the target range of 2% to 3% while avoiding actions that could harm economic growth.

Market Expectations for a Rate Hike

As inflationary pressures became more pronounced, financial markets began to price in the likelihood of an RBA rate hike. Market participants started anticipating that the central bank would shift its stance from accommodative to more restrictive monetary policy. This shift in market sentiment led to increased speculation about the timing and magnitude of a potential rate increase.

Governor Michele Bullock’s Stance

Michele Bullock, the governor of the RBA, has made it clear that the central bank is closely monitoring inflation dynamics and is prepared to take action if necessary. Governor Bullock emphasized that the RBA would not hesitate to raise interest rates further if there is a material upward revision to the inflation outlook. This statement signaled the RBA’s willingness to respond decisively to inflationary pressures, setting the stage for potential rate hikes.

Near-Unanimous Expectation for a Rate Hike

Economist Consensus on Rate Increase

While economists had been anticipating a single rate hike in the near future since August, the consensus around a rate increase solidified further during the October 30 to November 2 Reuters poll.

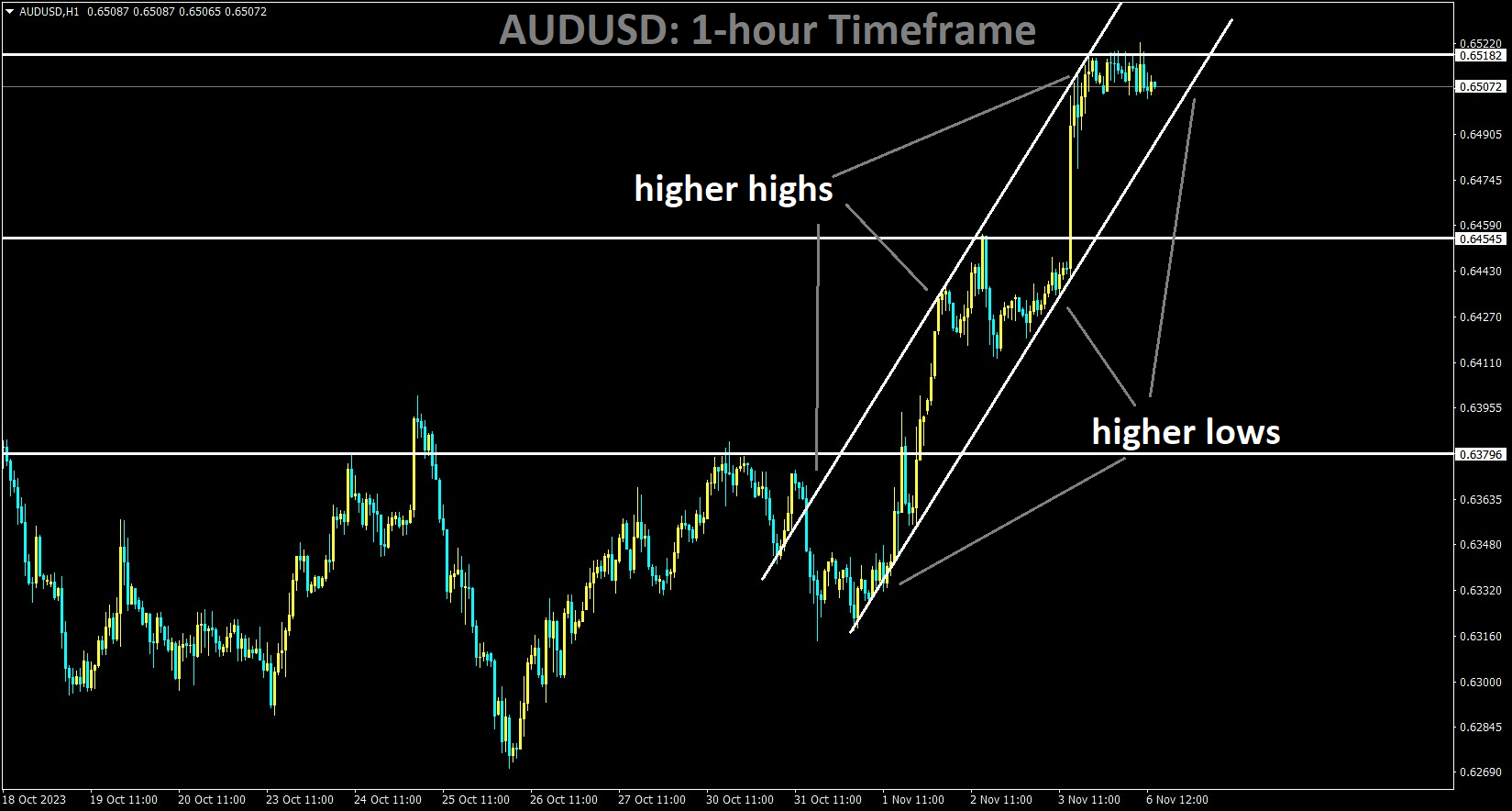

AUDUSD is moving in an Ascending channel and the market has reached the higher high area of the channel

For the first time in several months, there was near unanimity among participants in the poll that the RBA would raise its official cash rate by 25 basis points to 4.35% on November 7. This near-consensus among economists underscored the market’s growing conviction in the inevitability of a rate hike.

Differing Predictions Among Economists

Despite the consensus on a rate hike, there were differing predictions among economists regarding the extent of the increase and the terminal rate. Nearly 90% of economists in the poll believed that the RBA would raise the cash rate by 5 basis points to 4.35%. However, among the remaining five economists, one predicted a 15 basis points hike, while four expected the terminal rate to be 4.10%.

RBA’s Optimistic Inflation Forecast

One of the reasons behind the expectation of a rate hike was skepticism about the RBA’s inflation forecasts. Economists questioned the central bank’s optimism regarding inflation projections for the second half of the year. Taylor Nugent, a senior economist at NAB, pointed out that the RBA’s forecast appeared overly optimistic, leading to the anticipation of a rate hike to address the potential upward risks to inflation.

Australia’s Unique Monetary Policy Landscape

Contrasting RBA’s Move with Global Peers

Australia’s central bank’s readiness to raise interest rates stands in contrast to many of its global peers. While the RBA is preparing for a rate hike to combat inflation, several other central banks around the world have adopted a wait-and-watch approach. Notably, the Reserve Bank of New Zealand and other major central banks have refrained from tightening monetary policy, citing different economic conditions and priorities.

Major Local Banks’ Consensus on Rate Hike

All major local banks in Australia, including ANZ, CBA, NAB, and Westpac, share the expectation that the RBA will raise rates by 25 basis points in the near term. Their consensus reflects the collective assessment of the country’s leading financial institutions that a rate hike is imminent. This alignment among major banks underscores the market’s expectations regarding the RBA’s policy shift.

Long-Term Rate Forecasts

Looking beyond the immediate rate hike, a strong majority of economists anticipate that interest rates will remain at 4.35% or higher by the end of 2023. Among the remaining economists, some predict a slightly lower rate, while others believe there will be no change from the current level of 4.10%. The prevailing sentiment is that the RBA is likely to maintain a higher interest rate environment for the foreseeable future.

Impact of Rising House Prices

Property Market Resilience

One of the intriguing aspects of the RBA’s rate hike preparations is the resilience of Australia’s property market. Despite the central bank’s policy tightening, house prices in Australia have rebounded to near previous peaks. This phenomenon raises questions about the effectiveness of the RBA’s 400-basis-point tightening and its limited impact on the red-hot property market.

Potential Consequences of Further Rate Hikes

While rising house prices may suggest a robust property market, further rate hikes could have adverse consequences. Higher interest rates would add to the cost of necessities without necessarily reducing inflation. This scenario could place additional financial strain on households that are already grappling with a 70% increase in mortgage costs. The cost of living figures highlight the potential economic challenges posed by another rate hike.

Speculation and Market Reaction

Market’s Changing Perception

In recent weeks, the likelihood of the RBA raising the cash rate to 4.35% has increased significantly. Prior to the release of inflation figures, this probability was around 20%. However, the unexpected inflation data and subsequent market reactions have led to a shift in expectations, with many now considering a rate hike as an even-money bet.

Drivers Behind Speculation

The primary drivers behind this speculation are market participants, including those trading on futures and bond markets, who are responding to economic data and signals from the RBA.

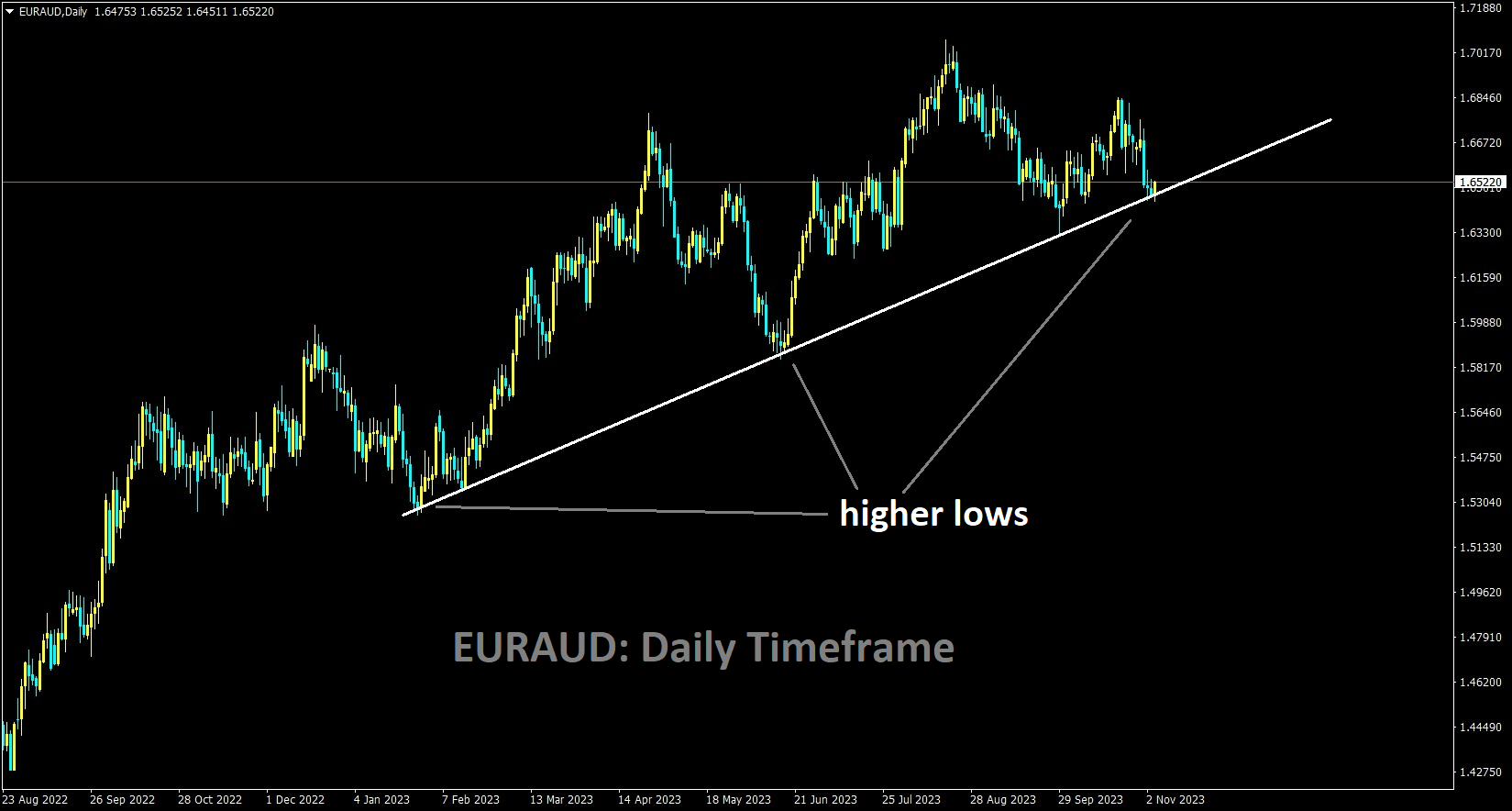

EURAUD is moving in an Ascending trendline and the market has reached the higher low area of the trendline

The 1.2% growth in the Consumer Price Index (CPI) for the September quarter played a pivotal role in reshaping market sentiment. This surge in inflation fueled expectations of a rate hike.

Impact on Borrowers and Investors

The anticipation of a rate hike has significant implications for borrowers and investors. Borrowers may face higher mortgage costs and increased financial pressure if interest rates rise. Meanwhile, investors must carefully assess their portfolios and strategies in response to changing market conditions. The uncertainty surrounding the timing and magnitude of rate hikes adds an additional layer of complexity to investment decisions.

Factors Influencing Rate Hike Decision

Economic Indicators and Inflation Trends

The RBA’s decision to raise interest rates is influenced by a combination of economic indicators and inflation trends. While the quarterly CPI figures showed a decline from 6.0% in June to 5.4% in September, the monthly CPI exhibited an increase from 5.2% annually in August to 5.6% in September. These fluctuations highlight the dynamic nature of inflation data and its impact on policy decisions.

RBA’s Strategy and Communication

The RBA’s strategy and communication play a pivotal role in shaping market expectations. Governor Michele Bullock and other central bank officials have conveyed a clear message regarding their willingness to act decisively if inflation continues to pose risks. The central bank’s communication strategy helps guide market participants and the broader public in understanding its policy intentions.

Balancing Act: Economic Stability vs. Inflation Control

The RBA faces a delicate balancing act as it navigates the path between maintaining economic stability and controlling inflation. While raising interest rates can help curb inflationary pressures, it also carries the risk of dampening economic growth and potentially triggering adverse consequences such as higher unemployment and reduced consumer spending.

Potential Ripple Effects

Impact on Mortgage Rates

A rate hike by the RBA would have a direct impact on mortgage rates, leading to higher borrowing costs for homeowners and property buyers. As interest rates rise, borrowers with variable-rate mortgages would see an increase in their monthly mortgage payments. This could place financial stress on households that are already stretched due to rising living expenses.

Mortgage Stress and Household Budgets

The potential for mortgage stress is a growing concern as interest rates move higher. Many households allocate a significant portion of their income to mortgage repayments, making them vulnerable to rate hikes. The latest ABS data revealed that the cost of living for employee households rose by 2.0% in the September quarter and by 9.0% over the past year. These figures underscore the financial challenges facing many Australian households.

Effects on Retail and Consumer Spending

Higher interest rates can have a broader impact on the economy by influencing consumer spending patterns. When essential expenses such as mortgage payments, petrol, electricity, and rents increase due to rate hikes, consumers may reduce discretionary spending on goods and services. This shift in consumer behavior can affect retail businesses and economic growth.

IMF’s Assessment and Recommendations

IMF’s Evaluation of Australia’s Economy

The International Monetary Fund (IMF) has provided an external assessment of Australia’s economic conditions.

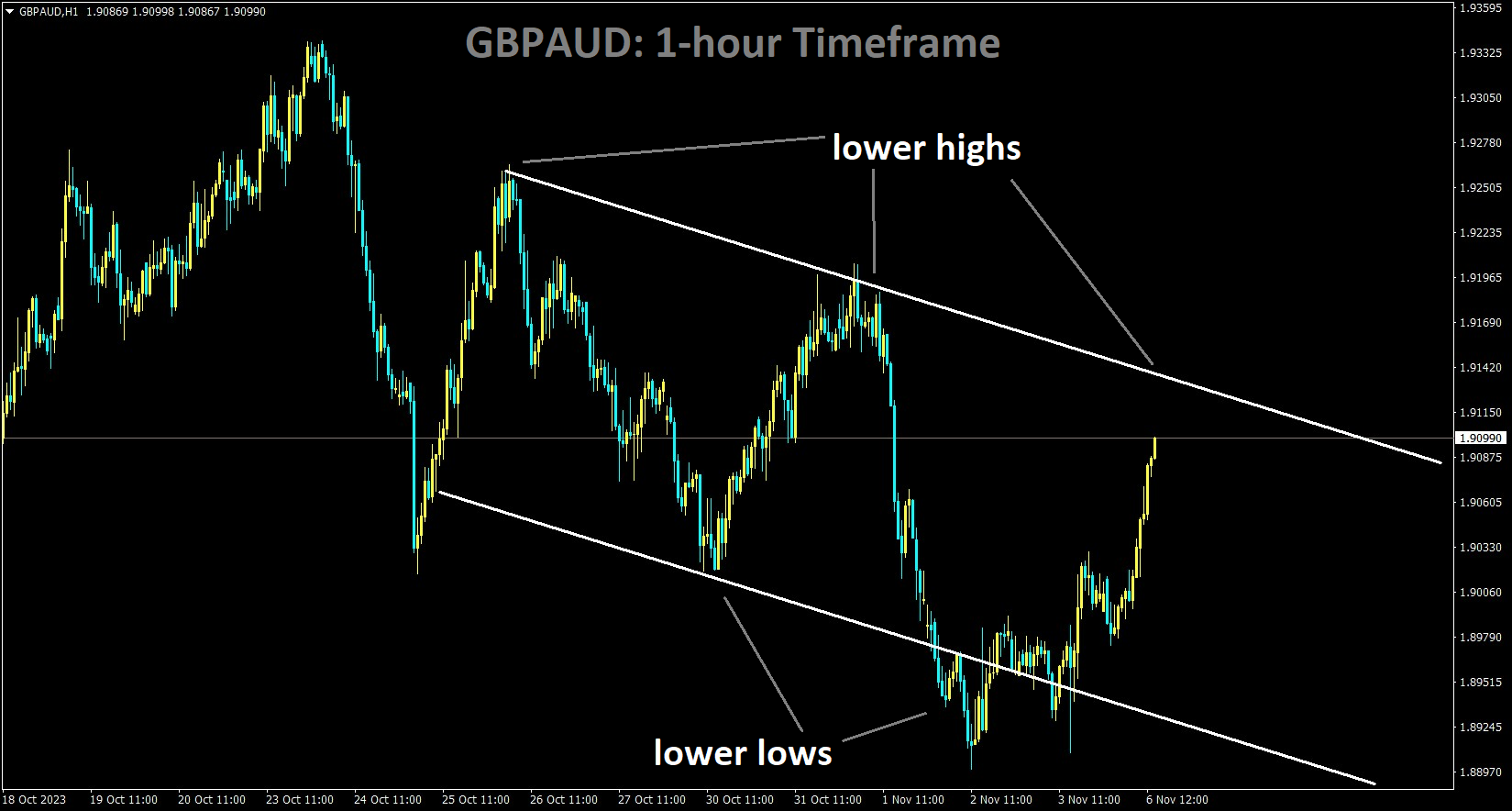

GBPAUD is moving in the Descending channel and the market has reached the lower high area of the channel

According to the IMF’s latest assessment, the country’s inflation rate remains too high, despite 12 interest rate hikes by the RBA. The rising costs of services have contributed to this persistence of inflation, creating challenges for policymakers.

Recommendations for Policy Measures

To address the inflationary pressures and bring inflation within the RBA’s target range by 2025, the IMF recommended further monetary policy tightening in the form of higher interest rates. The IMF’s advice reflects the need to anchor inflation expectations and maintain price stability. However, the size of the rate hikes required would depend on factors beyond economic models, including psychological effects on market participants.

The Challenge of Achieving a Soft Landing

The RBA faces the challenging task of achieving a “soft landing” for the economy, where inflation subsides without causing a recession. This delicate balancing act involves managing the impacts of rising oil prices, which can both increase headline inflation and reduce growth by limiting consumer spending. Additionally, the central bank must consider the effects of rising costs for non-discretionary items on households’ ability to spend elsewhere.

Banking Sector Response

ANZ and ING’s Preemptive Rate Hikes

In anticipation of the RBA’s rate hike, two prominent banks in Australia, ANZ and ING, took preemptive measures to increase interest rates. ANZ, the country’s fourth-largest bank, raised its fixed rates by up to 0.35 percentage points for both owner-occupiers and investors. ING followed suit by hiking new customer variable rates up to 0.08 percentage points and fixed home loan rates by up to 0.40 percentage points for owner-occupiers.

Implications for Borrowers and Competition

The decisions by ANZ and ING to raise rates highlight the broader impact of the RBA’s monetary policy on the banking sector. While these rate hikes are a response to changes in funding costs and market dynamics, they also have implications for borrowers. ANZ’s rate increase, for example, has positioned it as one of the less competitive options among the big four banks’ lowest advertised fixed rates.

Fixed vs. Variable Rates

The rate hikes by ANZ and ING raise questions about the choice between fixed and variable mortgage rates for borrowers. Fixed rates can provide stability and protection against future rate hikes, but they may come at a slightly higher initial cost. Borrowers must weigh the benefits of locking in rates against the potential for future reductions in variable rates.

Rate Hike Prospects and Economic Outlook

The RBA’s Stance on Rate Increases

Despite the market consensus on a near-term rate hike, the RBA’s stance remains contingent on economic data and inflation developments.

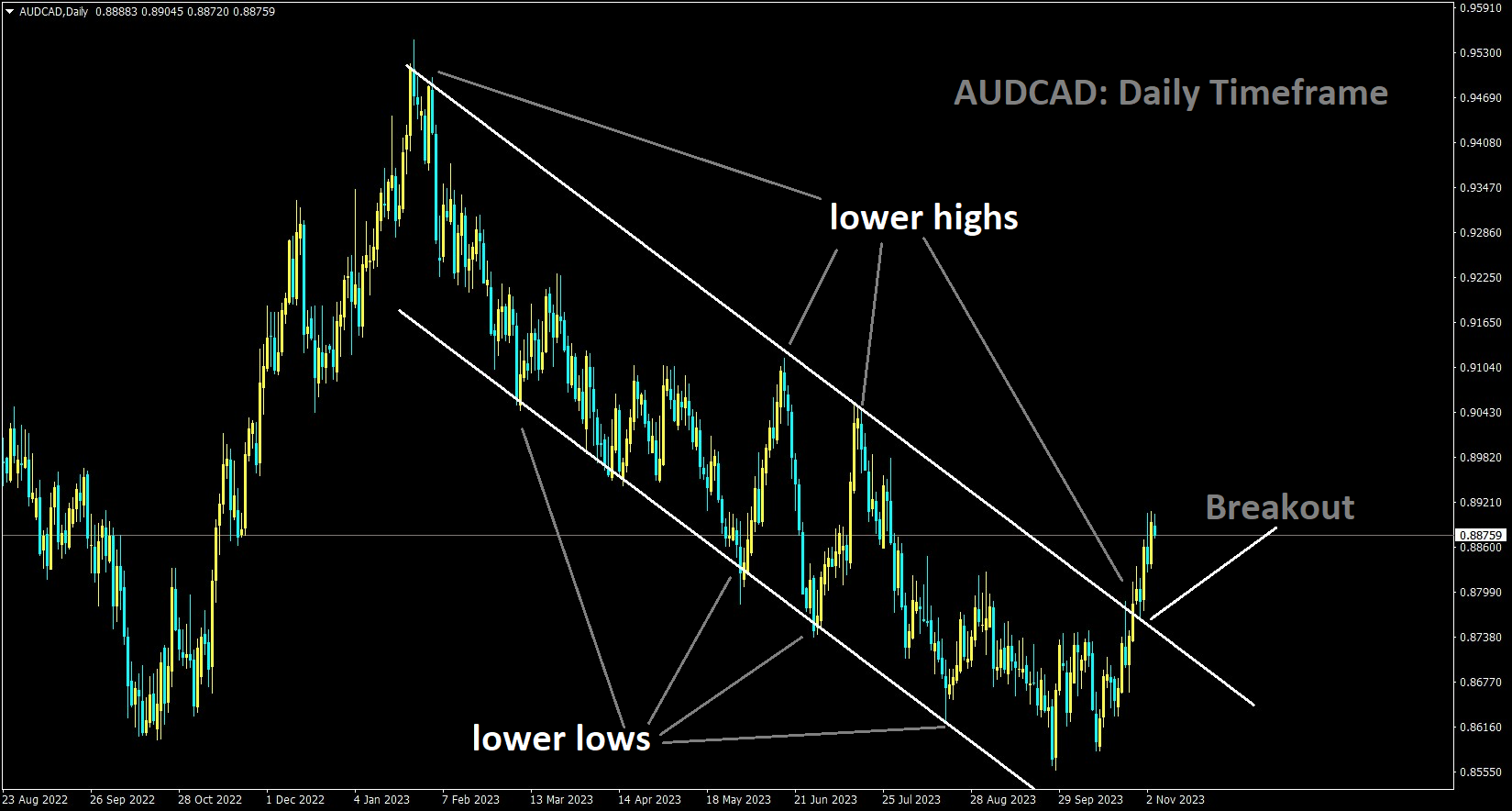

AUDCAD has broken the Descending channel in upside

The central bank will base its decision on an update of its forecasts, with the full quarterly statement on monetary policy due out on November 10. The RBA’s August forecast anticipated inflation falling within the bank’s target range by mid-2025.

Predictions from Major Banks

The major banks in Australia, including Commonwealth Bank, Westpac, ANZ, and NAB, have provided their predictions regarding the RBA’s rate decisions. While they collectively anticipate a rate hike in the near future, they also acknowledge the potential for a finely balanced decision in November. The RBA’s messaging and response to economic conditions will play a critical role in shaping the outcome.

The Timing of Rate Hikes

The timing of rate hikes is a crucial aspect of the RBA’s strategy. Some experts argue that a November rate hike allows for more time to assess the impacts of previous rate increases. Delaying until December could face criticism for potentially affecting Christmas spending and causing economic disruption. However, the RBA must carefully weigh the timing against the need to address inflationary pressures promptly.

Uncertainties and the Road Ahead

Balancing Inflation and Economic Growth

The RBA’s decision-making process is fraught with uncertainties, as it seeks to balance the need to control inflation with the imperative of supporting economic growth. Striking the right balance is challenging, given the potential consequences of rate hikes, including higher unemployment and reduced consumer spending. The central bank must carefully navigate the road ahead to achieve its dual mandate of price stability and sustainable economic growth.

Managing the Impact on Borrowers

As the RBA contemplates rate hikes, borrowers face the prospect of higher mortgage costs. Managing the impact on borrowers’ financial well-being is a critical consideration for policymakers.

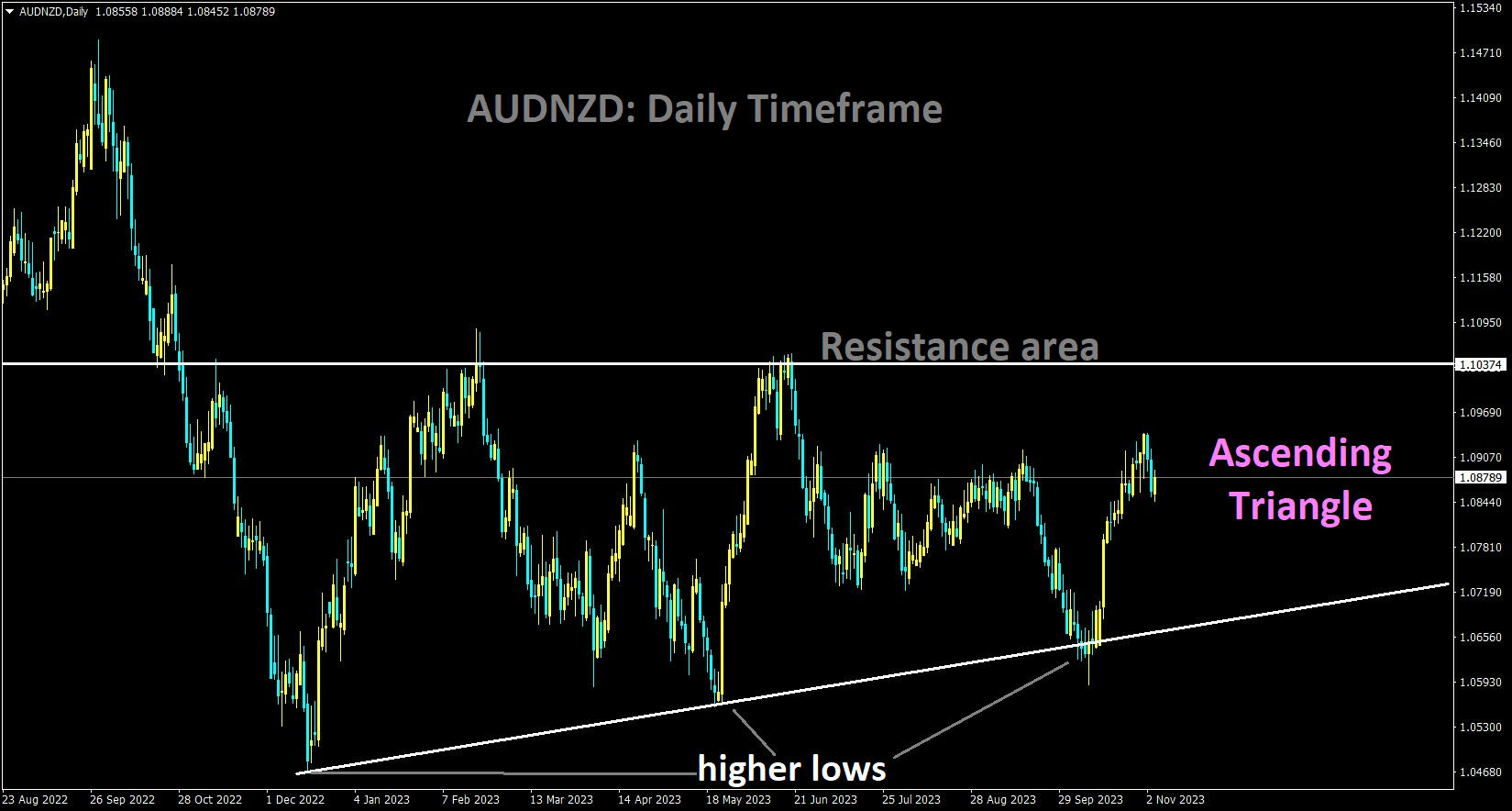

AUDNZD is moving in an Ascending triangle pattern and the market has rebounded from the higher low area of the pattern

Mortgage stress, where a significant portion of income goes toward mortgage repayments, is a growing concern. Addressing this issue will be essential to prevent widespread financial hardship.

Long-Term Prospects and Potential Rate Cuts

Looking beyond the immediate rate hikes, there are long-term prospects for the Australian economy. Some experts anticipate that inflation will peak and gradually subside, allowing the RBA to consider rate cuts to support economic recovery. NAB and Westpac have laid out timelines for potential interest rate reductions, offering hope to borrowers for relief in the future.

Conclusion

Australia’s central bank finds itself at a pivotal juncture, preparing to raise interest rates in response to unexpected inflationary pressures. The RBA’s actions will have far-reaching implications for borrowers, consumers, investors, and the broader economy. As it navigates the complexities of achieving a “soft landing,” the central bank must carefully balance its dual mandate of controlling inflation and fostering economic growth. The road ahead is uncertain, but the decisions.\

🔥Stop trying to catch all movements in the market, trade only at the best confirmation trade setups

🎁 60% FLAT OFFER for Signals 😍 GOING TO END – Get now: forexfib.com/discount/